Waldencast plc. (NASDAQ:WALD) Q2 2024 Earnings Convention Name August 28, 2024 8:30 AM ET

Firm Contributors

Allison Malkin – Investor Relations, ICR

Michel Brousset – Founder & Chief Govt Officer

Manuel Manfredi – Chief Monetary Officer

Convention Name Contributors

Olivia Tong – Raymond James

Linda Bolton Weiser – DA Davidson

Dana Telsey – Telsey Advisory Group

Operator

Greetings. Welcome to Waldencast’s Second Quarter and First Half 2024 Earnings Name. At the moment, all members are in a listen-only mode. An issue-and-answer session will comply with the formal presentation. [Operator Instructions] Please notice this convention is being recorded.

I’ll now flip the convention over to Allison Malkin of ICR. Allison, it’s possible you’ll start.

Allison Malkin

Thanks, and welcome to the Waldencast plc second quarter fiscal 2024 earnings name. With me at present are Michel Brousset, Founder and Chief Govt Officer; and Manuel Manfredi, Chief Monetary Officer. For at present’s name, Michel will start with an replace on our enterprise and imaginative and prescient and focus on the corporate’s efficiency inside the context of the sweetness market. Manuel will comply with with a evaluation of the second quarter and first half efficiency and supply our fiscal 2024 outlook. Following this, Michel will share the strategic progress initiatives for our Milk Make-up and Obagi Medical model. After the ready remarks, the operator will open the decision to take questions.

Earlier than we begin, I wish to remind you that administration will make sure statements at present, that are forward-looking, together with statements in regards to the outlook of Waldencast enterprise and different issues referenced within the firm’s earnings launch issued at present. Every forward-looking assertion is topic to dangers and uncertainties that might trigger precise outcomes to vary materially from these projected in or implied by such statements.

Further data concerning these assertion seems underneath the heading, “Cautionary Word” concerning Ahead-Trying Statements, within the firm’s earnings launch and within the firm’s filings that it makes with the Securities and Alternate Fee which are obtainable at www.sec.gov and on the Investor Relations part of the corporate’s web site at ir.waldencast.com and ought to be learn together with the part untitled danger issue within the firm’s annual report on Kind 20-F filed with the Securities and Alternate Fee on April 30, 2024. The forward-looking statements on this name converse solely as of the unique date of this name, and we undertake no obligation to replace or revise any of those statements.

Additionally, throughout this name, administration will focus on sure non-GAAP monetary measures, which administration believes might be helpful in evaluating the corporate’s efficiency. The presentation of non-GAAP measures shouldn’t be thought of in isolation or as an alternative to outcomes ready in accordance with GAAP. One can find extra data concerning the definition of those non-GAAP monetary measures and a reconciliation of those non-GAAP to probably the most straight comparable GAAP measures within the firm’s earnings launch.

A reside broadcast of this name can also be obtainable on the Investor Relations part of the corporate’s web site at ir.waldencast.com, which is able to stay obtainable till the corporate’s subsequent earnings name.

I’ll now flip the decision over to Michel Brousset.

Michel Brousset

Thanks, Allison, and good morning everybody. I’m happy to talk to you at present and share our robust second quarter efficiency that noticed accelerated comparable progress of 25.7% versus our first quarter enhance of 21% and capped a really profitable first half of the 12 months. Our efficiency demonstrates the facility of our multi-run platform and the progress we’re making to attain our imaginative and prescient for Waldencast. This imaginative and prescient is to construct a world best-in-class magnificence and wellness platform that creates, acquires, accelerates and scales the following technology of high-growth, extremely worthwhile, purpose-driven manufacturers.

As you’ve got heard me say earlier than, we’re a magnificence pure participant as a result of magnificence is probably the most lovely of industries, one which has proven impressively constant progress, robust profitability and resilience. The U.S. marketplace for Status Magnificence stays robust, up 8% for the primary half. This follows important progress over the previous two years because the class continues to normalize following unprecedented progress.

For the primary half, Status Skincare grew 7% and Status Make-up grew 5%. Circana notes that this progress displays an accelerated bifurcation rising within the magnificence trade, highlighted by the continued progress in Status relative to mass and is indicative of the continued premiumization of the sweetness class with customers on the lookout for greater ranges of efficacy and efficiency. Our progress has far exceeded the class as our manufacturers, Milk Make-up and Obagi Medical, are solely in the beginning of their ambition to be market-leading manufacturers of their respective classes and are very well-positioned to ship constant progress over time.

We have now two of probably the most thrilling manufacturers within the two greatest magnificence classes, Make-up No. 1 and Skincare No. 2 within the U.S. Status Magnificence market. Our manufacturers play within the fastest-growing sub-segments of those two classes, Status Clear make-up {and professional} science-led skincare.

Obagi Medical outperformed the U.S. Status skincare market by an element of 5X within the first half and continues its clear benefit of the No. 1 physician-recommended medical-grade skincare model for top-ranked sufferers’ wants, main in probably the most engaging fast-growing sub-segment of premium skincare.

With its breakthrough patented know-how and transformative clinically confirmed outcomes, it unlocks excessive loyalty from each customers and physicians and it’s completely positioned to reply the rising client wants for high-performance efficient skincare whereas additionally paving the way in which for growth to different classes. Milk Make-up grew 3 times sooner than the U.S. Status make-up market within the first half. The model, a cult-favorite Gen Z model advantages organically from an engaged and various group attributable to its cultural relevance and iconic merchandise.

It’s a main clear make-up model, the No. 2 clear model at Sephora U.S. and is rapidly constructing a world following with management positions in a number of worldwide markets. Milk Make-up has completed this by way of its related promise of cool, clear make-up that works. However we’re simply in the beginning of our journey to constructing a best-in-class international multi-brand portfolio.

Immediately, we possess two highly effective manufacturers which have garnered vital mass whereas nonetheless having substantial runway for progress. With Milk Make-up and Obagi Medical, now we have a strong basis in Status pores and skin and shade with a core enterprise within the U.S. and a rising presence in Europe and the Asia-Pac area.

We’re reaching a powerful progress in engaging channels and anticipate this momentum to proceed as we drive consciousness of each manufacturers past its core communities, proceed to introduce extra blockbuster improvements, and increase into different areas and classes. Our growing success with each manufacturers and the facility of our distinctive pure play magnificence ecosystem provides us a definite aggressive power in attracting different manufacturers and founders to our platform. Our platform constructed for scale and pace will solely get higher as we create and purchase extra manufacturers and scale them profitably and effectively.

And now I’ll flip the decision over to Manuel to evaluation our financials and outlooks.

Manuel Manfredi

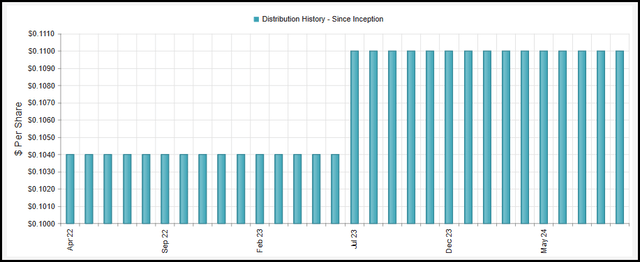

Thanks, Michel, and good morning everybody. I am happy to share our robust second quarter and first half outcomes for 2024 with you at present. These outcomes spotlight the continued success of our strategic initiatives and our dedication to delivering shareholder worth. Immediately I will deal with our adjusted monetary measures. You’ll find a reconciliation to GAAP monetary measures in our press launch from yesterday and within the appendix of this morning’s presentation.

Let’s dive into the highlights of our second quarter efficiency. We noticed a strong 25.7% year-over-year comparable progress, which exceeded the 21% progress we achieved in Q1, aligning with our prior steering. We proceed to see important year-over-year growth in our adjusted gross revenue margin, and we maintained a double-digit adjusted EBITDA margin, positioning us effectively to fulfill our annual profitability objectives.

A key level to notice is that, as now we have indicated prior to now, whereas we monitor our enterprise each day, we plan on it on an annual foundation. This annual planning strategy permits us to navigate quarterly fluctuations with out compromising our strategic targets. We’re happy to attain this consequence although in each manufacturers we skilled out-of-stocks in a few of our key merchandise, notably a few of our key launches, as robust client demand outstripped our expectations.

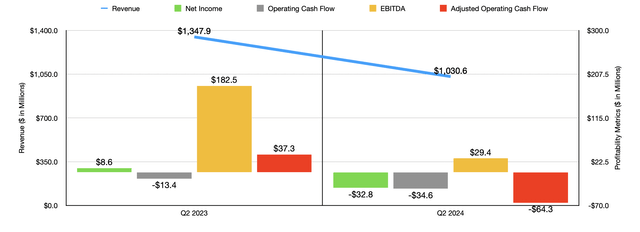

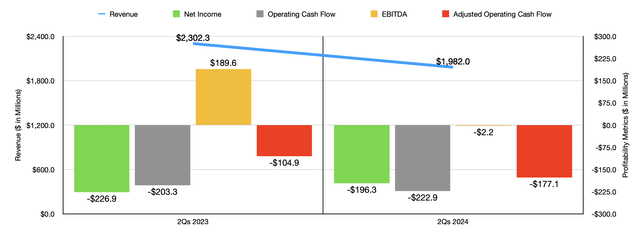

Particularly for the second quarter, internet income was $63.Three million, reflecting 25.7% comparable progress for Q2 2023. Obagi Medical and Milk Make-up achieved 30.9% and 20% progress respectively. Adjusted gross revenue got here in at $47.5 million, with an adjusted gross margin of 75.0%, a notable 650 foundation level enhance from Q2 2023.

Adjusted EBITDA was $6.Three million, up $2.Four million from Q2 2023. As robust income progress and gross margin growth greater than offset essential investments to assist our group, advertising and gross sales enterprise drivers. Constructing on our robust second quarter, our first half of 2024 has been glorious.

For the primary half of 2024, internet income was $131.6 million, marking a 23.1% enhance from the primary half of 2023. Adjusted gross revenue elevated by 36.4% to $99.5 million, with the adjusted gross margin increasing considerably by 890 foundation factors to 75.6%. Adjusted EBITDA rose by 27.2% to $17.7 million, reflecting robust gross sales progress and improved gross margins, which greater than offset our funding spending. This led to an adjusted EBITDA margin of 13.4% for the primary half, up from 12.7% in the identical interval final 12 months.

Now, trying forward, our robust first half efficiency, the continued success of our progress technique and the operational efficiencies that now we have carried out positioned us effectively to take care of our optimistic momentum all year long and past. For the complete 12 months 2024, we anticipate comparable income progress will proceed to speed up, past the 25.7% enhance we noticed in Q2, elevating our steering communicated in Q1. Adjusted EBITDA margin is anticipated to land within the mid-teens, aligned with our prior steering, and considerably greater than the 11.2% achieved in 2023.

This enchancment comes whilst we proceed to put money into our gross sales and advertising progress drivers. We anticipate second-half adjusted EBITDA to exceed first-half outcomes, each in absolute phrases and as a share of income.

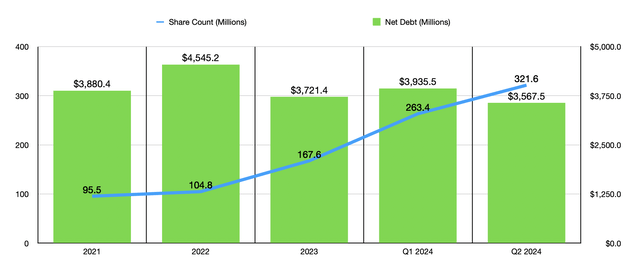

Turning now to our steadiness sheet and money circulate, we ended the primary half of 2024 with a strong monetary place, with no near-term maturities and ample liquidity to fund our asset-light enterprise mannequin.

As of June 30, 2024, money and money equivalents have been $19.7 million. We even have $30 million obtainable on our revolving credit score facility, and internet debt whole $155 million. We achieved optimistic working money circulate, excluding non-recurring prices related to authorized and advisory charges. As of August 15, 2024, share excellent have been $122.7 million, in comparison with $122.2 million as of April 15, 2024.

And now I’ll flip the decision over to Michel.

Michel Brousset

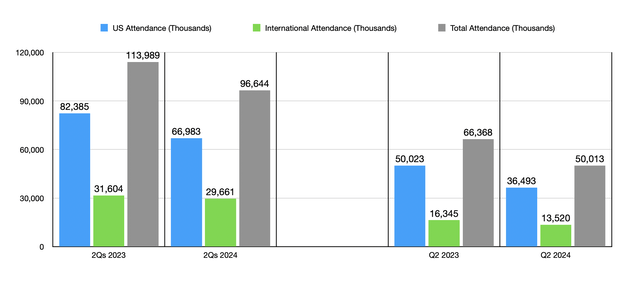

Thanks, Manuel. Now, let’s take a look at the efficiency by manufacturers beginning with Milk Make-up. As Manuel shared with you, within the second quarter, Milk Make-up generated a internet income of $28.7 million, a rise of 20% versus a 12 months in the past. Progress was pushed by the elevated buzz and consciousness of the model, the success of our innovation, and the continued power in worldwide markets.

Unprecedented demand, and specifically the incredible success of our Cooling Water Jelly Tint launched led to some out-of-stocks, which dampened the expansion potential within the early a part of the quarter. That stated, income accelerated towards the top of the quarter throughout geographies as we elevated stock ranges to assist the upper degree of demand.

Adjusted gross revenue margin of 69.7% drew a powerful 360 foundation factors versus Q2 final 12 months, as we continued to deploy our operational effectivity playbook and benefited from elevated efficiencies in sources and distribution, in addition to higher administration of our stock.

Adjusted EBITDA rose 48% to $5.7 million, whereas adjusted EBITDA margin of 19.8% expanded 370 foundation factors from the second quarter of 2023, as robust income and gross margin growth was mitigated by elevated gross sales and advertising funding in assist of key launches that may set us up for acceleration within the second half.

Now, for the primary half, Milk Make-up generated internet income of $63.2 million, growing 20.8% from the primary half of 2023. Adjusted gross revenue rose 29.2% to $44.6 million, with gross revenue margin growth of 460 foundation factors to 70.6%. And adjusted EBITDA rose 23.4% to $15.7 million from $12.7 million within the first half of 2023, with adjusted EBITDA margin increasing to 24.9% of internet income.

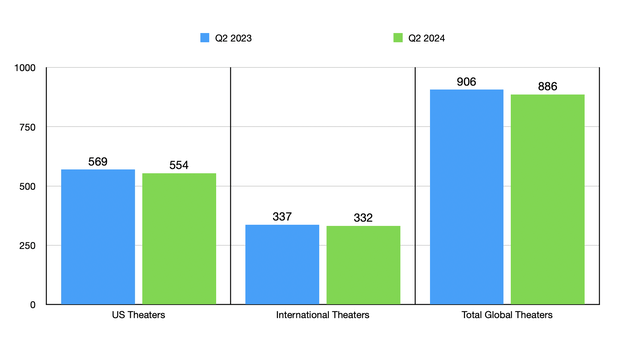

Milk Make-up is rapidly turning into a real international powerhouse, with customers all over the world embracing what we stand for and our constant capability to ship sought-after innovation. The model noticed spectacular progress throughout geographies throughout the first half of the 12 months, with income up 15.5% in North America and 33.3% internationally. Our imaginative and prescient for Milk Make-up is to be the primary selection of the following technology, uniquely connecting with our wants, values, and aspirations.

Our mission is to create an area in magnificence for all, all the time fearless in innovation, agility, and self-expression. Our path is evident, guided by our imaginative and prescient and anchored by our mission to create magnificence for all. Primary, construct a model that’s related to our viewers at present and tomorrow. Two, nurture a world group of extremely engaged customers and companions. Three, delight with merchandise which are famously distinctive and tangibly higher. Milk merchandise are like nobody else’s.

4, increase our presence by way of distribution that’s all the time brand-building and community-connecting. 5, proceed to gasoline the model to ship robust worthwhile progress. And lastly, carry our tradition of creativity in and out.

Our North Star is our group of creatives, listening to them, seeing them, understanding them, feeling their creativity and self-expression, serving to them reside their look. We’re the instruments and they’re the artists. We encourage, we by no means prescribe. Our connection to our group and celebration of their self-expression led Milk Make-up to double its earned media worth year-on-year and climb seven ranks since January 2023. A real measure of its rising desirability and consciousness and an essential predictor of a model’s future progress. Consciousness pushed by excellent social outcomes throughout the 2 most important metrics, bigger group and better engagement.

Our new followers grew by 538,000 within the entrance half of 2024, which is a powerful 254% acceleration year-on-year. Most video views virtually doubled at 95%, up from 89 million views with engagement leaping by 286%. This group social field is amplified by robust editorial protection with 5.Four billion press protection impression within the entrance half of 2024, of which 1.Four billion is new merchandise alone, rising 60% year-on-year, that includes specifically our viral Cooling Water Jelly Tint and our different launches in all main publications.

An illustration of the facility of merchandise which are famously distinctive, extremely fascinating and efficiency that delivers on client wants. The key sauce of our product innovation is a single-minded deal with merchandise that ship on our easy but highly effective client proposition of fresh, cool, magnificence that works. We ship never-before-seen innovation in codecs that ship strongly on the efficiency profit and keep true to our model and group values. All the time vegan, clear and cruelty-free.

Our merchandise feel and appear like nobody else’s and are extremely recognizable within the class that at occasions is a sea of sameness. Over time, now we have constructed robust cult icons and award-winning franchises in Prime and Set and sticks, and we’ll proceed fueling these strongholds.

And once we’re speaking about award-winning, our group was set alight with the 11th Olympic medal winner and the best gymnast of all time, Simone Biles, utilizing our best-selling Hydro Grip Primer as a primary step on her get-ready-with-me routine forward of her spectacular efficiency on the Paris Olympics final month. The best of all-time gymnasts carrying the best of all-time primers.

Along with our stronghold in our core classes, no pun meant, we’re additionally delighting our group by increasing into new excessive replenishment segments resembling Eye with the launch of Kush Eye Curler Mascara and Forehead Tints, in addition to in Lip with the newest shade extension of our Odyssey Lip Gloss franchise.

Furthermore, we’re nonetheless on the very starting of our Viral, many occasions offered out, as soon as offered each 30 seconds, multi-award-winning Cooling Water Jelly Tint, driving a document boss, document group constructing, and document gross sales. Extra thrilling issues to return on this franchise within the second half.

Now, this franchise has been showered in editorial awards, which strongly contributed to 22 awards the model has gained year-to-date, and we’re nonetheless counting. It was additionally notably thrilling to all of us at Waldencast to have Milk Make-up named by WWD as one of the highly effective magnificence manufacturers fueling the trade’s progress. Our most up-to-date market expansions proceed to substantiate the worldwide attraction and desirability of our Milk Make-up model. The standard of our merchandise and our model values resonate universally.

Our launches within the U.Okay., Scandinavia, and Latin America are performing forward of our expectations, as evidenced by the compelling stats you see on the display. Now, from the world of Milk Make-up, let’s go to the world of high-performance skincare with Obagi Medical.

Obagi Medical delivered one other excellent quarter of progress, with income of $34.6 million, representing comparable progress of 30.9% from the prior 12 months. This robust progress was pushed by the progress made on our strategic priorities that target growing digital channel gross sales, constructing our worldwide enterprise, and accelerating our innovation with the introduction of extremely efficient blockbuster merchandise. Much like Milk Make-up, a few of this progress was dampened by out-of-stocks on key merchandise and robust demand outstripped provide, which notably impacted our U.S. doctor dispensary channel. Stock ranges on key out-of-stock objects at the moment are considerably improved and we anticipate acceleration in Q3.

Adjusted gross revenue totaled $27.Four million, with adjusted gross margin increasing 850 foundation factors to 79.3% from 70.8% within the second quarter of fiscal 2023. And robust gross sales progress mixed with important growth in adjusted gross margin greater than offset the elevated funding in enterprise drivers, resulting in adjusted EBITDA of $6.5 million, a 55.4% enhance versus Q2 2023. Adjusted EBITDA margin expanded 230 foundation factors to 18.6% from 16.3% within the second quarter of Q2 2023.

Now trying on the first half, Obagi Medical delivered internet income of $68.Four million, representing appropriate progress of 25.4% from the primary half of 2023. Adjusted gross revenue rose to $54.9 million, or 80.3% of internet income versus $38.5 million, or 67.4% of internet income within the first half of 2023. This progress led to adjusted EBITDA of $13.2 million, a 37.1% enhance from the primary half of fiscal 2023, with adjusted EBITDA margin increasing to 19.3% from 16.9% within the fiscal 2023 first half.

Throughout geographies, Obagi Medical noticed balanced progress with a 37.6% enhance in North America and a 35.2% enhance internationally within the first half of 2024 in comparison with the prior 12 months first half. Within the U.S, we noticed exterior progress from our digital channels and a powerful efficiency from our innovation. Internationally, we’re very happy to proceed to re-establish Obagi Medical’s presence in Southeast Asia and anticipate to construct on this this 12 months.

Our imaginative and prescient for Obagi Medical is to be the primary physician-dispensed dermatological model on the earth, offering focused options to professionals and customers that ship transformative, seen outcomes. We’re proud to be a number one U.S. physician-recommended model for the highest three pores and skin issues for our physicians and sufferers — hyperpigmentation, wonderful strains, wrinkles and sagging pores and skin lack of elasticity. These situations account for roughly two-thirds of the physician-dispensed class.

Our progress technique follows three pillars. First, strengthen our skilled dermatological skincare model’s DNA. Second, speed up cutting-edge, science-backed innovation that delivers transformative outcomes. And third, develop model consciousness and footprint to succeed in extra customers domestically and internationally. Once we acquired the model, certainly one of our clearly said progress alternatives was to modernize the model and usher it into a brand new space of dermatological skincare that may delight each our physicians and our customers. I’m happy with the progress now we have made and excited to share with you small slides of what we’re rolling onto the market.

Our Obagi Medical model positioning is anchored in 4 core pillars which are additionally the 4 cornerstones of our iconic Obagi Medical Sq.. First, science is the reply. At Obagi Medical, science has all the time been the inspiration of our model. Our science and scientific outcomes have been trusted by physicians for greater than 35 years. However science is rarely settled and neither are we. All the time pushing to innovate, take a look at and analysis past our greatest to find higher methods to remodel our pores and skin.

Second, greater requirements are our requirements. We all know our merchandise are transformative as a result of we maintain ourselves to greater requirements the place clinically confirmed is simply a place to begin. We transcend scientific with our rigorous testing and data-backed outcomes to show the transformative energy of each certainly one of our merchandise.

Three, we’re various by design. An essential worth, we pioneered scientific testing in opposition to your complete Fitzpatrick pores and skin spectrum and proceed to develop merchandise systematically examined on each pores and skin tone and kind. And fourth, belief is all the time on development.

Merely put, our merchandise simply work and that is why generations of customers and physicians all over the world have trusted us with their pores and skin and their popularity for 35 years. That’s how we ship clinically confirmed, science-backed, seen transformative outcomes on all pores and skin tones. Due to our cutting-edge science and medical-grade components, growing partnership with 39 analysis and growth companions and leveraging Waldencast’s open growth ecosystem.

With a number one scientific testing program having carried out 329 research, 100 product checks and as much as 10 completely different checks carried out per innovation. A lot of you’ve got spoken to us over time in regards to the numerous parts of the model combine that we’re in want of a refresh. And we’re blissful to current to you past a refresh, a leapfrog that we imagine is the power of our biomedical management place.

The power of our biomedical place dropped at life with our iconic brand and sq. tailored to all contact factors to speak science, efficiency and the way we stand as uniquely of worth. Be it in our typography, pictures or product and packaging. Carry our new model universe in an immersive method out and in of a doctor’s workplace for an elevated expertise that displays the authority and efficiency we’re recognized for.

An id anchored in our medical blue as we enhance extra client media contact factors out and in of the doctor’s workplace to make it uniquely memorable, related and compelling. A brand new elevated model that’s each like the center of our model, science and efficiency whereas educating our group on the efficiency and superiority of our vary and make it extra accessible to professionals and customers alike. One of many first improvements that’s totally benefiting from the brand new model positioning and imagery is our new launches in our strategic ELASTIderm franchise.

Launching certainly one of our best improvements up to now, bringing medical grade lifting to new heights. We will probably be extending our best-selling ELASTIderm franchise with the launch of ELASTIderm Carry Up and Sculpt Facial Moisturizer. Clinically confirmed to visibly carry and sculpt facial contours in solely six weeks. And its companion ELASTIderm Superior Filler Focus. Clinically confirmed to visibly scale back the looks of wonderful strains with a single utility. Two broad posture improvements taking part in in one of many high skincare segments of the doctor channel delivering seen, clinically confirmed outcomes.

The brand new ELASTIderm Carry Up and Sculpt Moisturizer expands our portfolio within the heartland of anti-aging and day cream class. A format the place we at the moment under-index comes supercharged with a scientific file displaying product efficacy in as little as three weeks of use and visual transformations with earlier than and after. The right launch pad to speak our medical authority out and in of our practitioner’s workplace.

New ELASTIderm Superior Filler Focus is a non-injectable prompt wonderful line filler with spectacular scientific outcomes after a single utility and additional enchancment after eight weeks displaying a 19% discount within the look of wonderful strains and brow strains.

And lastly we’ll proceed the momentum by elevating model consciousness with Obagi Medical. We’re excited as a result of we’re simply in the beginning. Obagi Medical is at present the quantity three quickest rising earned media worth magnificence model. We anticipate additional acceleration with investing progress drivers and deploy the brand new branding, packaging and naturally medical grade innovation.

As you may see, we’re extra excited than ever about our enterprise and our progress prospects. We have now two highly effective excessive progress, compelling manufacturers completely positioned in probably the most engaging segments of the sweetness enterprise. We’re now centered on stepping up our funding in our manufacturers and the event of our communities. This mixture of a powerful group engagement and seductive excessive efficiency merchandise is driving elevated international demand for our manufacturers, which, couple with the facility of our golden forged platform and gifted groups, have us effectively positioned to drive long-term worthwhile progress. I am all the time grateful for the continued assist of our customers, traders, companions and workers and everybody who shares our dream of constructing a world best-in-class magnificence and wellness working platform. General, we proceed to anticipate our efforts to result in long-term worth creation for all Waldencast’s stakeholders.

And with that, I’ll flip the decision over to the operator to start the Q&A portion of the decision.

Query-and-Reply Session

Operator

Thanks. [Operator Instructions] Our first questions come from the road of Ashley Helgans with Jefferies. Please proceed together with your questions.

Unidentified Analyst

Hello. That is Sydney [ph] on for Ashley. I used to be simply questioning when you can discuss a bit of bit in regards to the promotional surroundings and sort of what you’ve got seen and expect going ahead after which additionally simply any shade you may share on the innovation pipeline in 2H. Thanks.

Michel Brousset

Hello Sydney, thanks. Thanks for the decision. I’ll break the query in two components. Our manufacturers are comparatively unexposed to promotional fluctuations within the case of doctor expense, Obagi Medical, if we run, and the market runs comparatively standardized promotions, is comparatively value rigid. And within the case of Milk, the phase of the market has been comparatively flat when it comes to promotion. We do not see any important or substantial quantity of enhance of promotion or internet value erosion as a consequence of that. From an innovation pattern, which is what’s driving our manufacturers. We’re, as you noticed, now we have an unimaginable half certainly one of innovation on each manufacturers, and albeit, we’re tremendous excited what’s coming in half two. So we proceed to speed up the innovation on each manufacturers. It is a key a part of our technique, and I believe innovation up to now has been delivering very effectively.

Operator

Thanks. Our subsequent questions come from the road of Olivia Tong with Raymond James. Please proceed together with your questions.

Olivia Tong

[Indiscernible] useful to grasp what you view as type of a income progress, and in addition how you consider the EBITDA margin growth alternative, recognizing, after all, the expectations for an improved second half on each these lineups.

Michel Brousset

Olivia, sorry, you are breaking apart. May you please repeat your query?

Olivia Tong

Sorry. Certain. I will be a bit of louder, too. I hoped you can discuss a bit of bit about what you consider as a gentle state income progress and the way you consider the EBITDA margin growth alternative from right here. Recognizing, after all, that you simply talked about second half doing higher than Q2 or second half doing higher than first half. Relating to EBITDA, notably given the volatility prior to now, it could be useful to try this. In order that’s the primary query.

Second query is round, only a competitors in your classes. We have clearly seen some deceleration within the class after a really robust interval of progress. So when you might simply speak about aggressive surroundings, each for Milk and in addition for Obagi within the derm skincare space. After which lastly, simply what your, the outer shares that you have been, that you have been coping with. Thanks.

Michel Brousset

Sure. Thanks, Olivia. So on the primary a part of your query, sort of regular state income progress as you may. We supplied steering for the 12 months. We have not supplied steering past that. However I believe what we’re seeing is an acceleration, as we talk an acceleration on the again half from the Q2 quantity. I believe we anticipate an algorithm of an organization that’s excessive progress and definitely effectively forward of market progress and EBITDA, as you noticed, we proceed to construct EBITDA to what our vacation spot and structural economics. So we anticipate, and I communicated this prior to now, we anticipate on a long-term foundation, on a gentle state foundation. We have already got structural economics within the firm which are comparable and in lots of instances superior to best-in-class magnificence from a gross margin perspective, which is just going to assist us construct our EBITDA.

As we proceed to develop our manufacturers. Ours, very merely is a progress story. We proceed to develop the manufacturers, as you may see, at a really accelerated tempo, which what’s already the engine of the corporate, which is the gross margin degree that may be very, very engaging. In order we develop the corporate, we’ll proceed to execute what’s our virtuous cycle, which is income progress, translated to very robust gross margin progress, reinvested into enterprise drivers of promoting and gross sales that additional drive progress and dilute G&A to ship will increase in EBITDA.

When it comes to competitors on the class, I imply, magnificence has all the time been a really aggressive market. It’s a market of competitors. However frankly, as I stated earlier than, we don’t suppose an excessive amount of about competitors. We’re such a small firm in the entire scheme of issues within the magnificence market that our limitation to develop is just our personal capability to create nice client propositions which are attention-grabbing and compelling to customers, mixed with our personal capability to execute. So the sweetness market has all the time been aggressive. It’s a aggressive market, but it surely’s not a winner-takes-all market.

It is an expandable consumption class, and whereas competitors is some extent of knowledge, frankly, we do not suppose an excessive amount of of competitors. We predict extra of how will we create nice breakthrough propositions, like, for instance, what we have performed with Milk Make-up jellies, which is we invented a totally new product that’s extremely seductive and attention-grabbing for customers that basically has no competitors. And as a consequence, we benefited from an amazing impression on our top-line progress, our gross sales, and our social and group metrics.

And lastly, in out-of-stocks, out-of-stocks was a little bit of a headwind in Q2. Frankly, in some methods, we have been victims of our personal success. Issues notably like make-up or issues like jellies are notably tough to forecast if you end up making a new-to-the-world proposition, and we might have grown considerably extra on the idea of these out-of-stocks.

Similar factor at Obagi. Our innovation was carried out higher than we anticipated, however in equity, we additionally have been managing our base stock a bit tighter than maybe we must always have with hindsight 2020.

When it comes to on a go-forward foundation, I believe many of the out-of-stock points are behind. We inventory on jellies, and when you have been to go at present to a Sephora or to certainly one of our others, you do not have to struggle for one of many jellies that you simply needed to struggle a bit of bit earlier than. You’ll see stock and customers shopping for this stock at a speedy tempo. However we nonetheless have a bit of little bit of an impact on out-of-stocks, notably within the Obagi enterprise in Q3, however considerably lower than we noticed in Q2. Thanks for the query, Olivia.

Operator

Thanks. [Operator Instructions] Our subsequent query has come from the road of Linda Bolton Weiser with DA Davidson. Please proceed together with your query.

Linda Bolton Weiser

Sure, hello. Congratulations on the nice progress. So I used to be curious, I did not catch when you have been sort of speaking in regards to the promoting and promo ratios in every of the manufacturers. Possibly you do not need to disclose these, however perhaps you can provide us a way for when you really feel the spending ranges as a ratio are sort of the place you need it to be for every of the 2 manufacturers, or do you envision even additional enhance in A&P sort of sooner or later years?

Michel Brousset

Thanks, Linda. Thanks for the query. So we expect that since we began this journey two years in the past, as you already know, Linda, we have accelerated fairly considerably the extent of promoting funding as we construct our manufacturers. We actually anticipate half to proceed to speculate even additional than we invested in half one, which was already a considerable enhance versus final 12 months. However what we comply with is a really robust ROI mindset behind that advertising expense.

In a long-term foundation, are we on the degree of promoting funding long-term? No, we imagine that I believe there may be nonetheless substantial room to develop and assist each when it comes to a p.c of gross sales in addition to absolute worth as we proceed to construct a enterprise. However that’s a part of our sort of digital circle. And what we do is we make investments, we drive operational effectivity, which we put money into enterprise drivers to drive the highest line progress and dilute our G&A.

So in each instances, in each manufacturers, we anticipate to proceed to extend our advertising assist and gross sales assist on each manufacturers. That with ensuing, as I stated, in will increase in our EBITDA contribution.

Linda Bolton Weiser

Okay. And only one follow-up. When it comes to Obagi, perhaps you can remind us simply is Obagi utilizing distributors just about in all of its worldwide markets or simply a few of them? And may you simply clarify to us, like, do we have to fear about like an excessive amount of stock within the distributor channel? Or how ought to we take into consideration simply the way you execute there internationally on Obagi? Thanks.

Michel Brousset

Thanks. So our worldwide construction at present is comparatively easy. As you already know, we internalize the distribution of Obagi in Southeast Asia. So in Southeast Asia, what we use is our personal subsidiary now, transferring from an previous distributor mannequin that now we have in Southeast Asia for all of the challenges and trials and tribulations we had with that distributor in 2022 that’s now totally behind us. And now now we have our personal subsidiary in Southeast Asia. In each different worldwide market, we use distributors.

And what we do is now we have a really strict monitoring in these distributors from a sell-in, sell-through, and sell-out foundation. For many distributors, we do not have sell-out for all distributors when it comes to all the key distributors. We have now a really robust monitoring sell-in, sell-through, and sell-out in locations the place we are able to have sell-out.

So we would not have any issues about an excessive amount of stock on distributors at a world degree. The worldwide footprint, simply to finalize, is we’re on a journey on that, on the older distributors, the skin of Southeast Asia distributors. And simply frankly, now we have some glorious distributor companions, and there are some distributors the place we have to execute a little bit of a change on go-to-market construction, which we’ll be doing over the following couple of years or in order we transition that right into a extra environment friendly distributor mannequin. However general, now we have no issues in regards to the stock invoice in anyway on worldwide distribution.

Linda Bolton Weiser

Okay. Thanks lots.

Michel Brousset

Thanks, Linda.

Operator

Thanks. Our subsequent questions come from the road of Dana Telsey with Telsey Advisory Group. Please proceed together with your questions. Dana, might you verify when you’re self-muted, please?

Dana Telsey

Sure. Hello. Good morning, everybody. As you consider the drivers of the robust gross margin growth that you simply had within the worldwide growth that Milk and Obagi are seeing, what’s driving that? How do you consider the expansion going ahead and what it might imply for the enterprise? Thanks.

Michel Brousset

Thanks, Dana. On gross margin, the story stays the identical, and it is a bit of bit completely different by model, however the story stays the identical. Within the case of Obagi, it is essentially pushed by two issues. One is a really robust and favorable channel combine as we develop our digital channels on Obagi, and the second is operational effectivity that we proceed to construct on these companies.

As you already know, we’re already at a really excessive gross margin degree. I believe we’re about on the vacation spot degree of Obagi when it comes to gross margin. I believe any future effectivity, whether or not it is a still-to-half as a part of that operational effectivity, we plan to reinvest it into product and formulation and purchase high quality providing to our clients.

So, we anticipate Obagi to be roughly at its vacation spot. Milk, as you noticed, is a enterprise that was gross margin within the 40s once we purchased it, and now it is approximating the place we would like it when it comes to vacation spot. It is pushed primarily by way of operational effectivity. So, we proceed to construct that operational effectivity, a little bit of combine, all of the sort of element of the way you construct a terrific working margin. Thanks for highlighting the purpose of gross margin as a result of that, on the finish of the day, is the engine of the corporate. As we develop the enterprise at that very engaging degree of gross margin, it permits us a considerable quantity of gasoline to reinvest in constructing our manufacturers and ship profitability over time.

Within the case of worldwide, a bit of bit completely different, once more, by model as a result of the fashions are completely different. We have now some substantial progress approaching Milk, as you noticed from the outcomes. Most of it’s actually productivity-driven. It is productiveness out of our personal companies, however now we have some modest distribution growth. As you already know, we entered the U.Okay. market not way back, but it surely’s nonetheless comparatively modest within the variety of shops the place we’re, and it is doing very effectively and exceeding our expectations of the way it’s performing within the U.Okay. We additionally expanded our distribution footprint in Scandinavia with Leco, and it has been a incredible success.

We talked in regards to the final quarter of strains and features and features of customers ready to purchase Milk as we expanded, and in addition a small however essential growth into Latin America, notably in Chile, Colombia, and Mexico with Blush Bar. That has been an amazing success during which, as we noticed within the presentation we noticed earlier than, we’re the primary or two model within the retailer for these markets, which is validating only a common attraction of the Milk model internationally, and there is way more to return sooner or later.

Within the case of Obagi, as I stated, now we have a little bit of a bifurcated mannequin. One is our distributor enterprise exterior of the U.S., which is in all places exterior the U.S. apart from South East Asia, which continues to construct from power to power. We put money into the model, professionalize, and we’re managing these distributors, realigning a few of these distributors. There’s nonetheless a bit of labor to try this we have to do over the following two or three years at strengthening that distribution community, search for internalization the place acceptable, etcetera. Then now we have South East Asia the place, as you already know, we’re rebuilding our enterprise in South East Asia after the collapse, if you need, of our former distributor, and we’re very happy with that progress. We launched initially in Vietnam in November of final 12 months, and now we have expanded into Thailand, Singapore, and most not too long ago India, and the enterprise is performing very effectively. We have now now an internalized mannequin that permits us to have a a lot better profitability on a going foundation as we seize all of the margin on that provide chain.

Operator

Thanks. We have now reached the top of our question-and-answer session. I’d now like handy the decision again over to Michel Brousset for any closing feedback.

Michel Brousset

Thanks very a lot. Effectively, thanks, all people, for becoming a member of us at present. We’re very excited in regards to the Q2 outcomes and the closing of half 1, and as we communicated on the earnings launch, we’re very, very assured about our outlook for the 12 months. And thanks very a lot for being right here and on your assist. Have a very good day.

Operator

Thanks. This does conclude at present’s teleconference. We recognize your participation. Chances are you’ll disconnect your strains right now.