mariusFM77

Altria Group, Inc. (NYSE:MO), by way of its subsidiaries, manufactures and sells smokable and oral tobacco merchandise in america. Its most iconic and recognisable model is Marlboro.

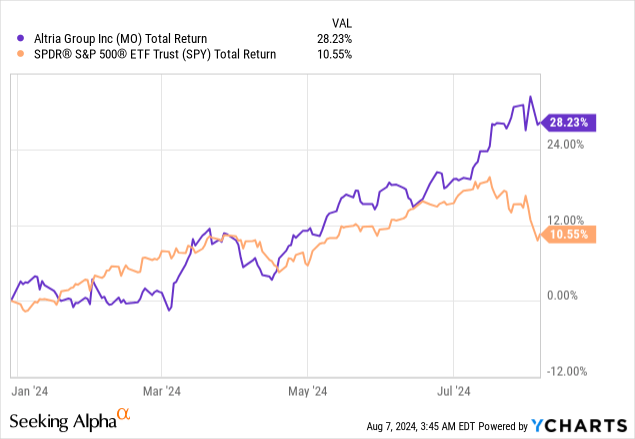

Because the begin of the 12 months, MO has generated a complete return of 28.2% for its shareholders, considerably outperforming the broader market, which has returned roughly 11% in the identical interval.

The purpose of our article at the moment is to evaluate whether or not there’s any upside potential left after this worth run up. To reply this query, we are going to first have a look at the important thing takeaways from the agency’s most up-to-date quarterly earnings report, after which attempt to estimate MO’s honest worth utilizing a dividend low cost mannequin. To validate our analysis, we will even check out a set of conventional worth multiples.

Quarterly earnings

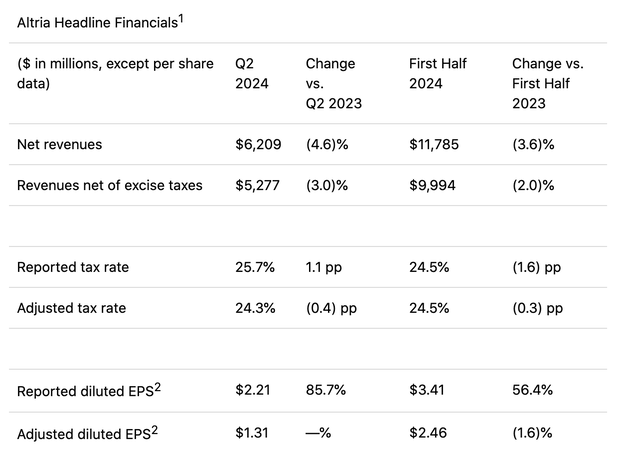

MO has missed analyst estimates, each prime and backside line, in the newest quarter. Income got here in at $5.28 billion, roughly 3% decrease than within the prior 12 months, and $115 million beneath analyst expectations. EPS totalled in $1.31 or $0.03 beneath what was initially forecasted.

Highlights (SA)

To know, nevertheless, what components have been driving these gross sales dynamics, we have now to grasp the composition of the gross sales and the main segments of the enterprise.

Smokable product section

The smokable product section is the section the place we see and count on the least development going ahead. This section is all about conventional cigarettes.

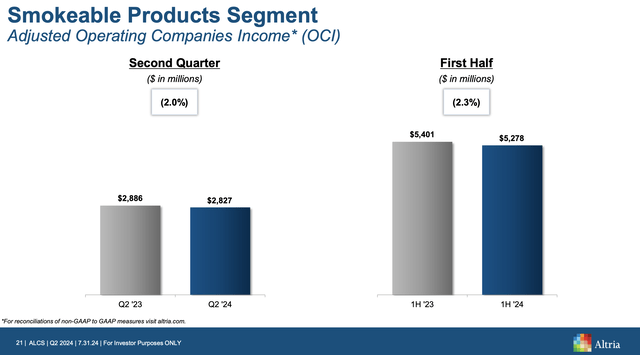

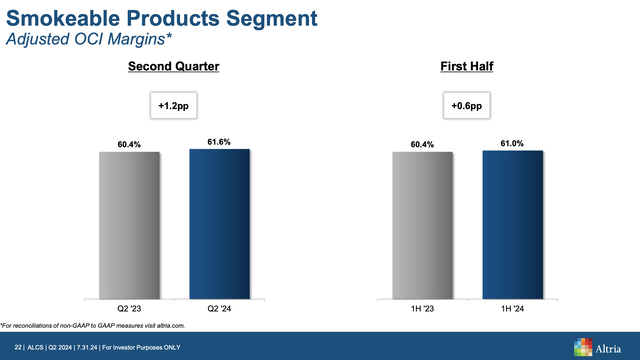

We are able to see from the next slide that each within the earlier quarter and likewise within the first half of 2024, working earnings has been declining.

Smokable product section (MO)

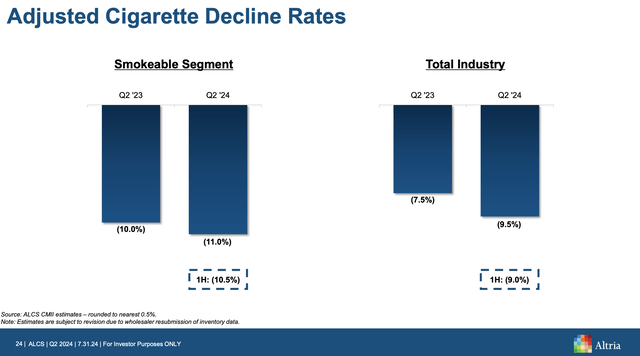

Apparent that this section will not be prone to be the expansion story behind the corporate within the years to return. The decline of cigarettes, particularly after we are speaking in regards to the smokable section, has even accelerated in comparison with the prior 12 months.

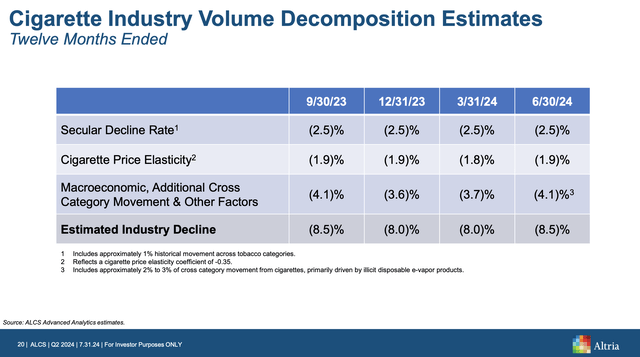

Decline charges (MO)

Quantity decomposition (MO)

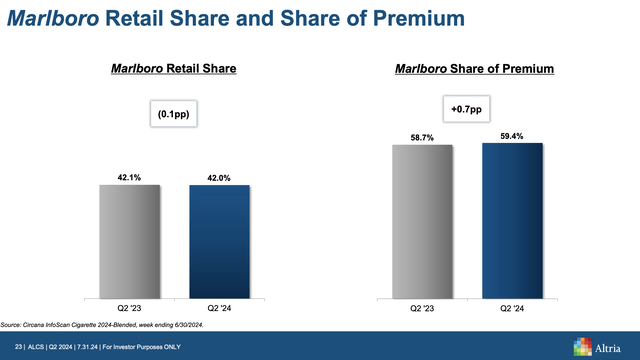

However, necessary to focus on that regardless of the decrease working earnings, the agency has managed to broaden its margins and achieve market share within the premium section.

Margins (MO)

Market share (MO)

Smoke-free merchandise

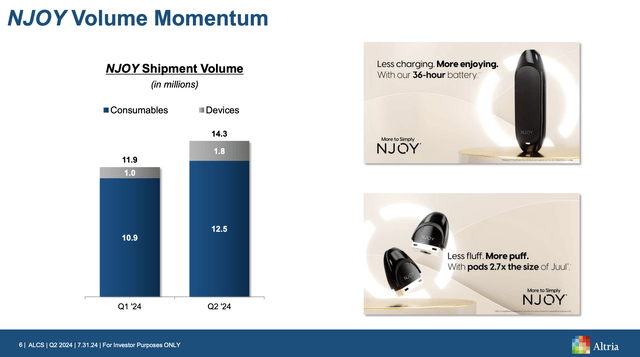

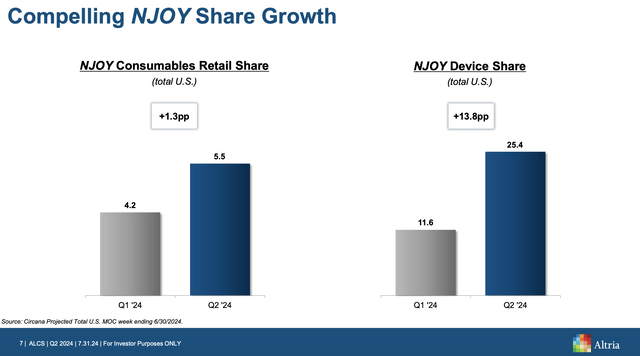

When speaking about smoke-free merchandise, we have now to begin our dialogue with considered one of MO’s fast-growing merchandise, the NJOY. MO has managed to develop the demand for this product considerably quarter over quarter. Each by way of consumables and gadgets.

Quantity momentum (MO)

Not solely the quantity grew, but in addition the market share has expanded considerably. When speaking in regards to the gadgets, NJOY share in america has elevated by 13.8pp QoQ.

Share development (MO)

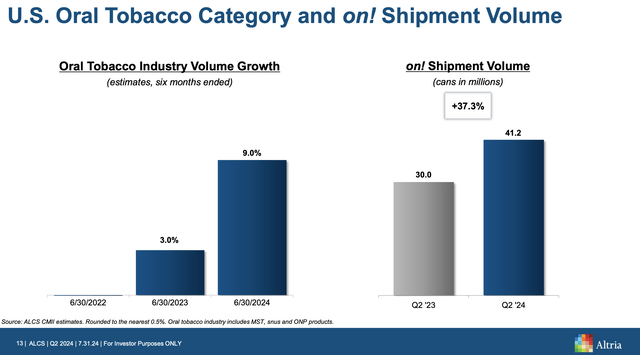

One other kind of product class that’s exhibiting spectacular development is the oral tobacco class. The oral tobacco as an business has grown quickly over the previous two years, and this development has been benefitting MO’s on! merchandise. Volumes have elevated by greater than 37% 12 months over 12 months.

Oral tobacco (MO)

All in all, we will clearly see that the tobacco business is reworking. smokables have gotten much less in style, and smoke-free merchandise are beginning to achieve traction and have gotten extra extensively accepted. We imagine that primarily based on the most recent quarterly figures, MO is efficiently positioning itself for this transition, and it’s poised for development within the coming years. Regardless of the current decline in income, we imagine that the corporate can as soon as once more get on a development trajectory, fuelled by its new and revolutionary merchandise.

Valuation

MO obtained the eye of many traders primarily due to its distinctive dividend. The agency presently pays dividends quarterly, totalling in an annual payout of $3.92 a share – equal to a yield of about 8%. A yield of 8% is troublesome to disregard. However there are three inquiries to ask at this level:

1.) Is the dividend sustainable?

2.) Is the dividend prone to develop and if sure, at what charge?

3.) Is it price paying the present share worth for this dividend/dividend development?

So allow us to attempt to reply these questions one after the other.

Dividend sustainability

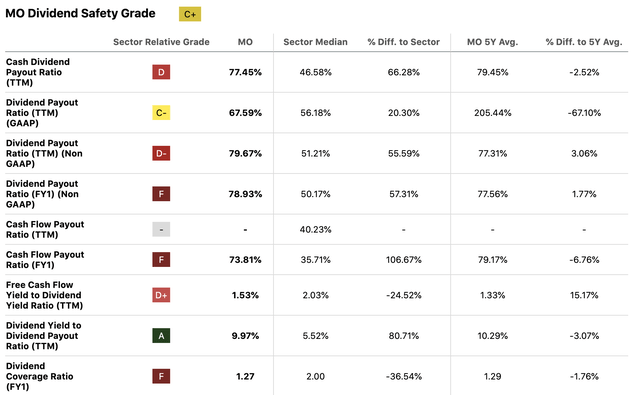

Based mostly on numerous dividend payout ratios, MO’s present dividend seems to be protected and sustainable. Whereas MO’s metrics could also be greater than the patron staples sector median, when evaluating them to these of different companies within the tobacco business, they look like regular.

Dividend security (SA)

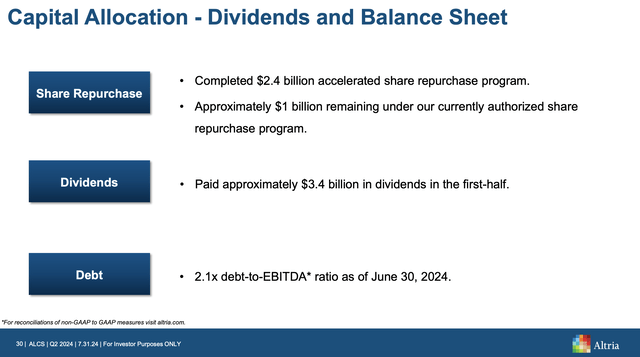

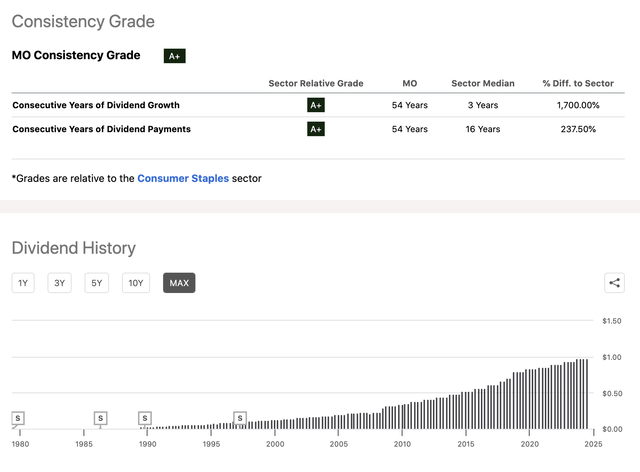

Additional, from the most recent earnings report, it’s clear that MO is dedicated to return worth to its shareholders each within the type of dividends and share buybacks. Actually, it’s not solely evident from the final quarter, but in addition from the final 54 years. MO has paid and elevated its dividends annually within the final greater than 5 many years.

Capital allocation (MO)

Dividend development (SA)

And this takes us to our subsequent part: Dividend development.

Dividend development

To estimate the honest worth of MO’s inventory utilizing a dividend low cost mannequin, we have to outline two fundamental parameters. Dividend development charge and required charge of return.

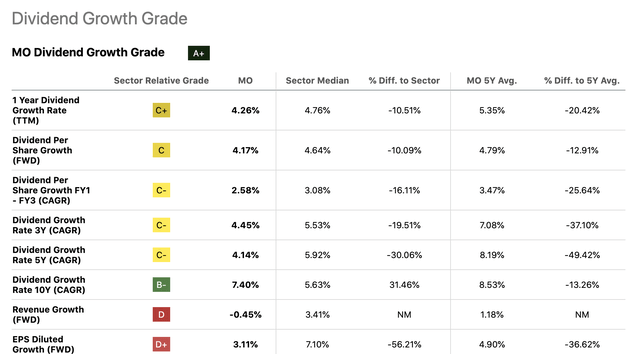

For such calculations, we usually prefer to assume the long run historic dividend charge of the agency. In MO’s case, this could be 7.4%. We, nevertheless, imagine that assuming a dividend development charge of seven.4% in perpetuity could be too aggressive an assumption and would end in an unrealistically excessive honest worth. For that reason, we are going to select the 5Y dividend development charge of the corporate, which is 4.1% CAGR, till 2030, and use a perpetual development charge of two.5% past.

Dividend development (SA)

Dividend low cost mannequin

Now that we have now assumed a dividend development charge in perpetuity, we have to outline a required charge of return in an effort to estimate MO’s honest worth.

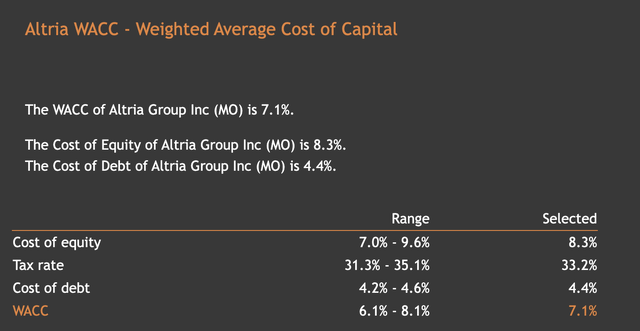

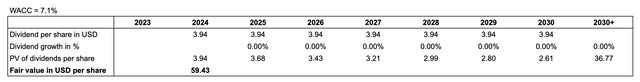

For the required charge of return, usually we like to make use of the agency’s weighted common price of capital (WACC). In accordance with the most recent estimates, MO’s WACC is 7.1%.

WACC (valueinvesting.io)

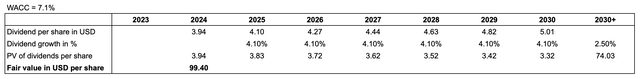

Plugging these values into the dividend low cost mannequin, we get a good worth of $99 per share. This worth is twice the present share worth, indicating a major upside.

Outcomes (Creator)

Now, some might say that as a result of altering regulatory atmosphere due to the altering smoking habits, and the altering notion of smoking, as a result of want for steady innovation to remain aggressive, a dividend enhance might not be warranted within the close to time period. However even when so, assuming a 0% dividend development charge in our mannequin nonetheless yields us a good worth, which is 20% greater than the present share worth.

Outcomes (Creator)

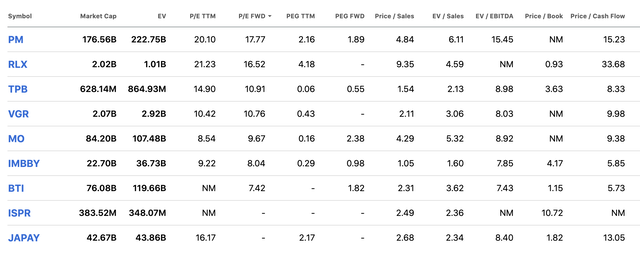

a set of conventional worth multiples and evaluating these throughout the tobacco business additionally signifies that MO could also be undervalued in comparison with the opposite companies.

Comparability (SA)

All in all, primarily based on our evaluation, MO seems to be a horny funding for dividend and dividend development traders. Even when assuming no dividend development, the upside nonetheless seems to be 20%. Based mostly on different companies within the business, the valuation multiples additionally recommend {that a} 20% growth of the multiples could also be real looking.

Conclusions

Regardless of lacking analyst estimates, we imagine that MO has delivered robust leads to the smoke-free product classes. Each its NJOY model and its oral tobacco merchandise have been performing properly.

The agency seems to be undervalued primarily based on its dividends and likewise primarily based on a set of conventional worth multiples.

For these causes, we imagine that an funding in MO on the present worth degree may very well be engaging for dividend- and dividend development traders.