Olga Druzhchenko

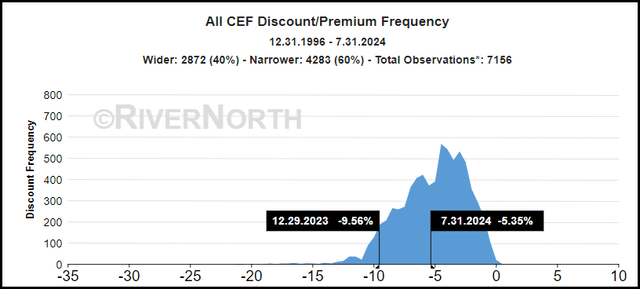

The primary half of the yr is over, and it has been some time since I’ve shared my high ten holdings in my closed-end fund portfolio. The ‘offers’ within the closed-end fund area aren’t fairly like they have been final yr, however there are nonetheless alternatives in sure areas of the market. Reductions have narrowed fairly materially because the begin of the yr.

All CEF Low cost/Premium Common (RiverNorth)

That mentioned, 2022 and 2023 did see closed-end funds go to traditionally vast low cost ranges. Additional, with market volatility beginning to warmth up with the mega-cap tech names beginning to take a breather, we may see some low cost widening as has typically occurred traditionally.

As a reminder, a CEF isn’t an asset class or a sector; it’s merely a construction—a wrapper for different underlying securities unfold throughout varied asset courses and sectors. Meaning that there’s probably some CEF or two that may slot in nearly any sort of investor portfolio, whether or not they’re revenue or growth-focused buyers. Whereas they typically pay out excessive distributions to buyers, month-to-month or quarterly, there are a number of tech-focused funds that some progress buyers may discover interesting. The distribution may merely be reinvested if progress is the actual goal.

Prime 10

General, I maintain 42 positions (not counting money) in my CEF portfolio. That’s up from the 41 positions I held on the final replace and goes in the wrong way of me wanting to chop again the variety of holdings a bit. The brand new place was abrdn Healthcare Traders (HQH), which I added very shortly after my prior high 10 updates. Nevertheless, I did not take a large place, so it will not seem as a high place on this listing.

With my fundamental CEF portfolio, I are usually a long-term investor and can maintain some positions for years. I do somewhat restricted buying and selling/swapping, however when there is a chance, I’ll benefit from it. In any case, the low cost/premium mechanic of the CEF construction is without doubt one of the fundamental benefits that may be exploited, particularly between swap pairs. Apparently, we now have every one in all these three actions that befell since my earlier replace to the touch on.

That features making strikes based mostly on company actions, equivalent to sidestepping rights choices and collaborating in tender presents. So, it isn’t a very passive portfolio, however I may in all probability greatest describe it as semi-passive.

With that, that is how I ended up with so many positions; if there is not a transparent purpose to promote when it comes to the low cost/premium or a swap alternative, then I typically simply keep invested. I do not thoughts holding related funds throughout totally different fund sponsors, as which means totally different managers which will outperform for some time however then underperform for quite a few years and vice versa.

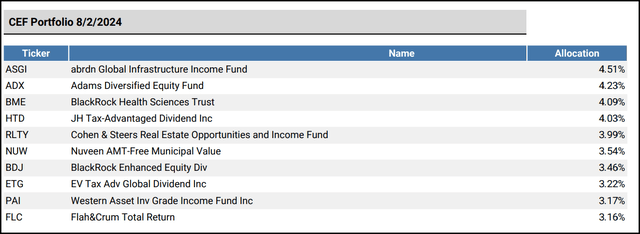

Whereas I maintain fairly a couple of positions, my high ten make up 37.40%—up from the 36.52% beforehand.

With that, here’s a take a look at my newest high ten.

Prime Ten Holdings (Portfolio Visualizer)

The primary place right here, #1 abrdn World Infrastructure Earnings Fund (ASGI), stays my largest place. The weighting elevated to 4.51% from 4.27%. I’ve even added to it when promoting NXG NextGen Infrastructure Earnings Fund (NXG) in anticipation of the rights providing being introduced. After promoting NXG and placing a few of that capital to work in ASGI, NXG did announce a rights providing.

I added again put up providing, as I discussed in my newest month-to-month closed-end fund shopping for collection. Nevertheless, I solely began again with a somewhat small place in NXG—which is why it does not seem as a top-ten holding anymore. Beforehand, NXG was the ninth largest place. That is an instance of sidestepping the rights providing and being extra of an energetic investor on this portfolio.

As ASGI’s low cost has narrowed materially because of a rise within the managed distribution coverage to a rolling 12% of NAV, it nonetheless stays a decently engaging choice within the infrastructure area, in my view.

#2 Adams Diversified Fairness Fund (ADX) is a brand new high ten identify, however not a brand new identify to this portfolio. I’ve held it for quite a few years. Nevertheless, the opposite frequent company motion that occurs to CEFs is tender presents, which was what this fund introduced together with a change in their very own managed distribution coverage as effectively.

As I lately touched on, once more, in my newest month-to-month CEF shopping for collection, I used to be rising this place to take part on this supply because the fund nonetheless traded at a sizeable low cost to permit for some low cost realization via this 10% tender supply at 98% of NAV. I really had plans to go extra aggressive, however with the market seemingly solely rising greater and better via most of this era, I in the reduction of my ambitions.

With that mentioned, that tender supply expired the day I wrote this, and I participated with 100% of my place. Whereas the tender supply was for 10% of excellent shares, as normal, not all buyers participated. The proration ended up being practically 30%. That meant, at the very least briefly, it stopped being my second largest place, however I purchased all of the shares again after. The TO buy value ended up being $22.47, and I repurchased at $20.31—a reasonably whole lot.

#three BlackRock Well being Sciences Belief (BME) was a high ten holding earlier than as my fourth largest place. I added to this identify in April when it was plunging to a traditionally massive low cost. I have been effectively rewarded within the brief time period and plan to proceed to hold this fund for the long run.

#Four John Hancock Tax-Advantaged Dividend Earnings Fund (HTD) is the swap alternative that I discussed above. Final yr, I swapped HTD to John Hancock Premium Dividend Fund (PDT) as a result of they minimize their distribution, and the low cost widened meaningfully relative to HTD, which is definitely fairly uncommon within the historical past of those two funds. It has tended to be PDT that trades at premiums whereas HTD trades at reductions repeatedly. That is how I ended up with PDT as a high ten place once we final gave my high ten a glance. Nevertheless, the chance to swap again introduced itself, and I took it—thus, HTD is again in my portfolio.

Together with ASGI and BME, different names which have remained high ten positions: #5 Cohen & Steers Actual Property Alternatives & Earnings Fund (RLTY), #7 BlackRock Enhanced Fairness Dividend Fund (BDJ), #8 Eaton Vance Tax-Advantaged World Dividend Earnings Fund (ETG) and #9 Western Asset Funding Grade Earnings Fund (PAI).

#6 Nuveen AMT-Free Municipal Worth Fund (NUW) has turn out to be a big place in my portfolio together with PAI as a result of I have been including steadily now since going again to April 2023. As I’ve talked about beforehand, the primary concept of including NUW and PAI to my portfolio was to de-risk but additionally take part in potential future charge cuts. I had began constructing these positions some time again, and it really ended up being too quickly, as I assumed charges could be minimize sooner. That mentioned, we ought to be getting nearer to these elusive charge cuts because the financial system begins to decelerate and with inflation persevering with to development in the appropriate route.

#10 Flaherty & Crumrine Whole Return Fund (FLC) can also be a brand new top-ten identify and a brand new identify to my portfolio. Nevertheless, it is not actually that new when it comes to holding an analogous F&C fund beforehand. It was additionally the results of having a swap alternative in January of this yr. I had held Flaherty & Crumrine Dynamic Most well-liked and Earnings Fund (DFP) and was wanting so as to add publicity to those high-leveraged F&C most popular performs. Whereas I might have been pleased so as to add DFP, the low cost for FLC was meaningfully deeper on the time. That prompted me to make the swap commerce however then additionally add extra to FLC. Additional, I lately added a bit extra to my FLC place in June as effectively, serving to to push the allocation greater.

That leaves Cohen & Steers High quality Earnings Realty Fund (RQI) and Cohen & Steers Tax-Advantaged Most well-liked Securities and Earnings Fund (PTA) not accounted for, as they have been earlier high ten positions. I did not promote these positions and even trim them; they merely slipped to positions #11 and #12 with weightings of three.14% and three.10%, respectively. Together with holding RQI on this portfolio and one other account, it stays my single largest CEF publicity total.

Conclusion

Over the primary half and one month of 2024, I made two swap trades from PDT again to HTD and DFP in favor of FLC. I additionally sidestepped a rights providing from NXG however added again to the place promptly after the RO expired. When promoting out of NXG, I put some more money to work in ASGI, rising my already largest place.

ADX is my second largest place as of writing, however that may drop some after the tender supply wraps up, and we’ll see the place that shakes out. I am leaning in direction of including the shares again post-tender, and I am hoping for a post-tender droop that we regularly see. Nevertheless, a change within the distribution coverage may mitigate a few of that occasion. The general market beginning to choose up in volatility can also be placing stress on shares of ADX, which, at this juncture, with the thought of shopping for shares as soon as once more, can also be a constructive.