Justin Paget/DigitalVision through Getty Photographs

The NXG NextGen Infrastructure Earnings Fund (NYSE:NXG) is a closed-end fund that permits buyers to place cash into the renewable vitality sector and the vitality transition with out the necessity to sacrifice revenue. As we are all nicely conscious, except for just a few yieldcos corresponding to NextEra Vitality Companions (NEP), there are only a few renewable vitality corporations that pay a lot of a dividend or distribution. That is evident after we contemplate that the World X Renewable Vitality Producers ETF (RNRG) solely yields 1.43% as of the time of writing. That is considerably decrease than the yields that may be obtained by investing in conventional vitality:

|

Index/ETF |

TTM Yield |

|

World X Renewable Vitality Producers ETF |

1.43% |

|

The Vitality Sector Choose SPDR Fund ETF (XLE) |

3.23% |

|

iShares World Vitality ETF (IXC) |

3.68% |

|

iShares S&P World Clear Vitality ETF (ICLN) |

1.54% |

|

Alerian MLP ETF (AMLP) |

7.77% |

Clearly, the index funds that embody oil and fuel corporations have considerably greater yields. Certainly, the 2 “inexperienced” vitality funds would have had considerably decrease yields if it was not for the extremely poor efficiency of the renewable vitality sector out there over the previous few years. Thus, conventional oil and fuel has traditionally been a a lot better alternative for income-focused buyers. Nevertheless, governments all over the world appear decided to pressure the vitality transition to happen and are keen to direct huge sums of cash into making that occur. As such, it could be a good suggestion to have at the least just a little publicity to the sector. The NXG NextGen Infrastructure Earnings Fund is a method to do this, and it boasts an extremely enticing 16.80% yield. That’s a lot greater than the yields possessed by nearly another closed-end fund out there, and positively greater than a lot of the fund’s friends:

|

Fund Title |

Morningstar Classification |

Present Yield |

|

NXG NextGen Infrastructure Earnings Fund |

Fairness-Sector Fairness |

16.80% |

|

BlackRock Utilities, Infrastructure & Energy Alternatives Belief (BUI) |

Fairness-Sector Fairness |

6.38% |

|

Cohen & Steers Infrastructure Fund (UTF) |

Fairness-Sector Fairness |

7.69% |

|

DNP Choose Earnings Fund (DNP) |

Fairness-Sector Fairness |

8.65% |

|

EcoFin Sustainable and Social Affect Fund (TEAF) |

Fairness-Sector Fairness |

8.84% |

|

Tortoise Vitality Independence Fund (NDP) |

Fairness-Sector Fairness |

6.51% |

It is very important word that few of those funds focus completely on the renewable vitality sector. There was once a number of such funds, however lots of them both shut down or merged over the previous few years because the early 2021 bubble burst and worn out a lot of the capital of the pure renewable infrastructure funds. We are able to see this bursting bubble by wanting on the value of the 2 renewable sector exchange-traded funds because the begin of 2021:

Looking for Alpha

As we noticed in 2015 and in 2020 with the midstream closed-end funds, any time a complete sector declines so severely in a brief time period, it tends to considerably impair the capital of any leveraged closed-end fund that invests within the sector. The one possible way for the funds to rebuild at the moment is to both merge with comparable funds or do a reverse inventory cut up after which challenge extra shares. Many renewable funds, corresponding to the previous Kayne Anderson NextGen Vitality & Infrastructure Fund, opted to merge with different funds. The NXG NextGen Infrastructure Fund has to this point been the exception, however the truth that the fund’s yield is so excessive means that the market has doubts about its capability to outlive for for much longer. We’ll wish to you should definitely examine this extra totally in our evaluation at this time.

As common readers may bear in mind, we beforehand mentioned the NXG NextGen Infrastructure Fund in mid-October of 2023. The fairness markets typically have been extremely sturdy since that point, however renewable companies largely missed out on the rally. That is at the least partly resulting from the truth that renewable vitality tasks are usually not viable when financing prices are above negligible ranges, which Reuters identified earlier this 12 months. In accordance with Wooden Mackenzie:

A two percentage-point improve within the rate of interest pushes up the levelized value of electrical energy – the estimated income required to construct and function a generator over a specified value restoration interval – by as a lot as 20% for renewables.

Clearly, rates of interest have elevated by much more than 2% because the begin of 2021, so the scenario has been even worse for these corporations. These difficulties have resulted out there usually excluding renewable vitality corporations from the rally this 12 months. As such, we will most likely assume that the NXG NextGen Infrastructure Earnings Fund has not delivered a very spectacular efficiency since our final dialogue.

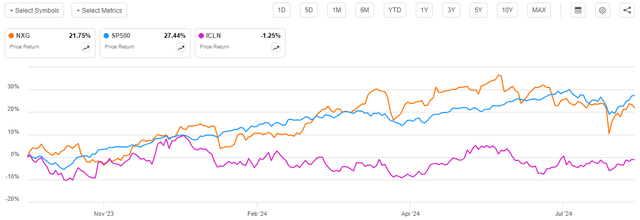

Nevertheless, this has not been the case. Actually, shares of the NXG NextGen Infrastructure Earnings Fund have risen by 21.75% over the interval. This considerably beat the iShares Clear Vitality ETF, and was truly considerably near the broader S&P 500 Index (SP500) over the interval:

Looking for Alpha

Whereas the fund did underperform the S&P 500 Index over the interval, that is nonetheless a much more spectacular efficiency than we actually anticipated from it. It’s doable that the fund’s excessive yield has contributed to this efficiency energy, although, because the market has these days been valuing something with a high-yield fairly extremely. We must always examine the fund additional, although, because it does probably not make a lot sense for it to be outperforming the renewable vitality sector by such a considerable margin.

Actually, although, the fund’s efficiency has been even higher than the chart above suggests. As I said in a latest article:

A easy take a look at a closed-end fund’s value efficiency doesn’t essentially present an correct image of how buyers within the fund did throughout a given interval. It is because these funds are likely to pay out all of their internet funding earnings to the shareholders, slightly than counting on the capital appreciation of their share value to supply a return. That is the rationale why the yields of those funds are typically a lot greater than the yield of index funds or most different market property.

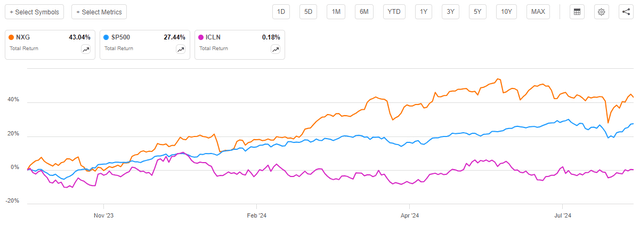

After we embody the distributions that the NXG NextGen Infrastructure Earnings Fund paid out over the interval from October 10, 2023, till at this time, we get this various chart:

Looking for Alpha

This clearly exhibits that buyers on this fund did handsomely since my earlier article on it was revealed. Roughly ten months have handed since our prior dialogue, and buyers on this fund have realized a really enticing 43.04% whole return. That beats the S&P 500 Index in addition to the renewable vitality sector in mixture. Anybody is more likely to be pleased with this kind of efficiency.

As is all the time the case, although, we must always remember the fact that previous efficiency isn’t any assure of future outcomes. As such, we must always check out this fund’s positioning at this time in addition to the basics surrounding its holdings to be able to make a practical estimate of the place it will likely be sooner or later. The rest of this text will deal with this job.

About The Fund

In accordance with the fund’s web site, the NXG NextGen Infrastructure Earnings Fund has the first goal of reaching a really excessive stage of whole return. This makes loads of sense given the fund’s technique, which is defined on the web site:

The Fund’s goal is to hunt excessive whole return with an emphasis on present revenue. There may be no assurance that the Fund’s funding goal shall be achieved. Beneath regular market circumstances, the Fund will make investments at the least 80% of its internet property, plus any borrowings for funding functions, in a portfolio of fairness and debt securities of infrastructure corporations, together with (i) vitality infrastructure corporations, (ii) industrial infrastructure corporations, (iii) sustainable infrastructure corporations, and (iv) know-how and communication infrastructure corporations. The Fund will make investments not more than 25% of its Managed Belongings in securities of vitality grasp restricted partnerships.

The truth that the fund is investing in each debt and fairness securities makes the entire return goal affordable. In any case, as I’ve identified prior to now, fairness securities are whole return autos resulting from the truth that they ship funding returns within the type of each dividends or distributions and capital appreciation. Debt securities are primarily revenue autos, however revenue is a element of whole return, so the target continues to be affordable.

As we noticed within the introduction, although, the latest efficiency of the NXG NextGen Infrastructure Earnings Fund has correlated fairly extremely with that of the S&P 500 Index. As such, we will assume that the fund is usually invested in widespread equities proper now. The fund’s most up-to-date semi-annual report verifies this. In accordance with this doc, as of Could 31, 2024, the NXG NextGen Infrastructure Earnings Fund was holding the next asset allocation:

|

Safety Kind |

% of Internet Belongings |

|

Widespread Inventory |

103.2% |

|

Grasp Restricted Partnerships |

26.1% |

|

Most popular Inventory |

0.9% |

|

Actual Property Funding Trusts |

1.0% |

|

Fastened Earnings |

0.0% |

|

Cash Market Funds |

1.3% |

The grasp restricted partnership allocation consists completely of widespread equities. Whereas many grasp restricted partnerships do challenge most popular inventory and bonds, this fund doesn’t embody any of these securities. We are able to see that just by wanting on the listing of grasp restricted partnerships held by the fund:

Plains GP Holdings (PAGP), Vitality Switch (ET), Enterprise Merchandise Companions (EPD), MPLX (MPLX), TXO Companions (TXO), NextEra Vitality Companions.

Thus, it seems that the fund is nearly completely invested in widespread equities proper now, except for a single most popular inventory challenge from Algonquin Energy & Utilities (AQN) and an actual property funding belief, HA Sustainable Infrastructure Capital (HASI), that features as an investor in renewable vitality tasks.

As we will see from the grasp restricted partnerships within the listing above, the fund doesn’t make investments completely in renewable vitality. NextEra Vitality Companions is the one renewable partnership in its portfolio, for instance. A take a look at the widespread shares held by the fund reveals a lot the identical factor, as there are a selection of corporations within the portfolio that aren’t renewables-focused. Certainly, the portfolio consists of quite a lot of midstream firms in each the USA and Canada:

|

Subsector |

% of Internet Belongings |

|

Pembina Pipeline (PBA) |

0.2% |

|

Cloud Companies |

2.2% |

|

Cloud Software program |

1.4% |

|

Crude Oil & Refined Product Pipelines |

1.5% |

|

Cryptocurrency Miners |

0.6% |

|

Cybersecurity |

3.3% |

|

Exploration & Manufacturing |

3.7% |

|

Vitality Metering and Administration |

2.1% |

|

Engineering and Development |

6.5% |

|

Built-in Oil and Gasoline |

1.5% |

|

Massive-Cap Diversified C-Cap Midstream |

19.9% |

|

Mineral Royalties |

1.7% |

|

Pure Gasoline Gathering & Processing |

16.4% |

|

Pure Gasoline Transportation & Storage |

12.9% |

|

Refiners |

4.1% |

|

Photo voltaic Tools |

5.2% |

|

Utilities |

16.4% |

|

Waste |

1.4% |

|

Wi-fi Connectivity |

2.2% |

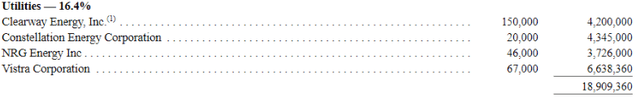

That is actually way more diversified than we might anticipate for a fund that I characterised as a “renewable vitality fund.” Nevertheless, a more in-depth take a look at the portfolio does reveal just a few issues that make my statements not completely inaccurate. First, we discover a major weighting to each utilities and photo voltaic gear producers. These two subsectors mixed account for 21.6% of the fund’s internet property, which is sort of as a lot as the entire weight of all the grasp restricted partnerships within the portfolio. As well as, the utilities are ones which are usually well-known for being pretty huge gamers within the deployment of renewable vitality:

Fund Semi-Annual Report

Clearway Vitality (CWEN) is likely one of the largest house owners of renewable vitality technology services in the USA. The corporate’s personal web site explicitly states that it’s targeted on creating renewable vitality tasks across the nation. The identical can largely be stated for NRG Vitality (NRG), which I identified in a earlier article. NRG doesn’t focus completely on renewable vitality, however it’s nonetheless a serious presence within the business. Constellation Vitality (CEG) is a serious producer of nuclear energy, which truly has a decrease carbon footprint than solar energy and is usually thought of to be a very good possibility for baseline energy to assist keep the electrical grid in a future world powered by unreliable wind and photo voltaic vitality. Vistra is a diversified energy producer, however it consists of each nuclear and renewable vitality in its portfolio, so my feedback concerning the different corporations listed below are related to this one as nicely.

The vast majority of the remainder of the fund’s holdings are positioned to learn from development in pure fuel demand, and that has been taking place over the previous a number of years. This is because of the truth that pure fuel is often used as a backup supply of electrical energy for wind and solar energy. As everyone knows, wind and photo voltaic don’t generate electrical energy constantly. Photo voltaic vitality doesn’t work at night time, and wind energy doesn’t work when the wind isn’t blowing. Reuters eloquently illustrated this downside in a late-July article:

Wind energy within the Decrease 48 states produced about 335,753 megawatt-hours on July 22, the bottom since October 4, 2021, in keeping with preliminary information from the U.S. Vitality Data Administration.

The quantity of wind-generated electrical energy produced in 2023 was 425.Zero billion kilowatt-hours. That’s lower than the 434.Zero billion kilowatt-hours produced in 2022. It’s price noting that there was a complete of 53.Three gigawatts of wind farms constructed over the 2019 to 2023 interval. Thus, extra farms have been constructed but the quantity of electrical energy produced truly declined. This illustrates the issue with any vitality resolution that depends upon the climate, and it exhibits why to be able to have a dependable electrical grid, one thing must be used along with wind and photo voltaic. Whereas nuclear energy is the lowest-polluting possibility, utilities have usually opted for pure fuel resulting from the truth that it’s a lot simpler to get permits (and pure fuel doesn’t invoke public worry to the identical extent as nuclear energy).

In 2023, pure fuel consumption in the USA set a document at 89.1 billion cubic toes per day. The consumption of the compound set a brand new document in each single month from March 2023 to November 2023, earlier than air conditioners and different summer season attracts lowered electrical consumption sufficiently to permit electrical producers to cut back their output. Most indications are although that it’s going to proceed to extend going ahead as electrical autos, information facilities, electrical residence heating, and different issues pressure the flexibility of intermittent wind and photo voltaic to maintain up.

That is the place the midstream corporations that represent a major proportion of the fund’s portfolio are available. As subscribers to Vitality Income in Dividends are nicely conscious, almost each midstream firm noticed vital year-over-year development in pure fuel volumes through the second quarter of 2024. These corporations are carrying the pure fuel to the utilities that then burn it to generate electrical energy. As volumes correlate with money circulate for these corporations, this development has allowed them to ship not insignificant money circulate development over the previous 12 months. For instance, contemplate the next:

|

Firm |

YOY Adjusted EBITDA Development |

|

Pembina Pipeline |

32.56% |

|

Enterprise Merchandise Companions |

10.04% |

|

MPLX |

7.97% |

|

The Williams Firms (WMB) |

3.48% |

The vast majority of these corporations additionally pay out pretty enticing dividend yields that present the fund with a supply of revenue that it will probably use to help its personal very excessive yield. Thus, the fund is mainly positioned in a method that permits it to revenue totally from the vitality transition, versus profiting on just one facet like a pure renewable vitality fund. That is most likely one of the simplest ways to revenue from the increasing presence of “inexperienced vitality” and comparable issues in our societal infrastructure and future.

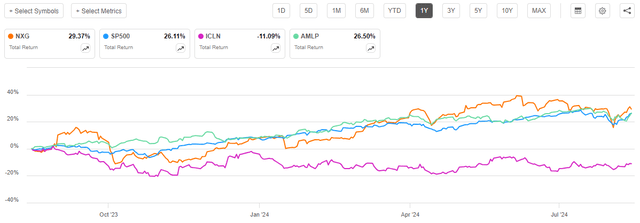

The truth that the fund consists of each midstream corporations and renewable vitality turbines helps to elucidate its efficiency in comparison with renewable vitality index funds. The Alerian MLP Index has barely overwhelmed the S&P 500 Index on a complete return foundation over the previous 12 months:

Looking for Alpha

As most readers are nicely conscious, the Alerian MLP Index tracks these midstream corporations which are structured as grasp restricted partnerships. It particularly excludes the pipeline firms. Nevertheless, it nonetheless works as a degree of comparability because the pipeline firms won’t actually ship a radically completely different efficiency than the partnerships, at the least when it comes to whole return (they may ship higher capital positive factors however decrease yields). As we will see, the NXG NextGen Infrastructure Earnings Fund has usually delivered comparable efficiency to the Alerian MLP Index however with extra volatility. The presence of the pipeline corporations within the fund explains this.

Leverage

As is the case with most closed-end funds, the NXG NextGen Infrastructure Earnings Fund employs leverage as a technique of boosting the efficient yield of its portfolio. I defined how this works in my earlier article on this fund:

Mainly, the fund borrows cash after which makes use of that borrowed cash to buy the widespread fairness of grasp restricted partnerships and infrastructure firms. So long as the bought property have greater whole returns than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly nicely to spice up the efficient yield and total return of the portfolio. As this fund is able to borrowing at institutional charges, that are significantly decrease than retail charges, it will normally be the case. It is very important word although that this technique isn’t almost as efficient at this time with rates of interest at 6% because it was two years in the past when rates of interest had been at 0%.

Nevertheless, using debt on this trend is a double-edged sword. It is because leverage boosts each positive factors and losses. As such, we wish to be sure that the fund isn’t utilizing an excessive amount of leverage since this might expose us to an excessive amount of danger. I usually don’t wish to see a fund’s leverage exceed a 3rd as a share of its whole property for that reason.

As of the time of writing, the NXG NextGen Infrastructure Earnings Fund has leveraged property comprising 29.44% of its portfolio. This represents a rise over the 25.49% leverage that the fund had the final time that we mentioned it, which is slightly curious. In any case, the share value has appreciated by 21.75% over the interval in query. That ought to have precipitated the fund’s leverage to say no.

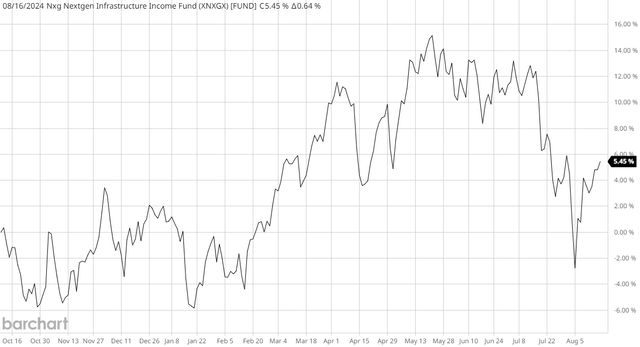

The fund’s internet asset worth is up over the interval too, however not almost to the identical extent because the share value:

Barchart

As we will see, the fund’s internet asset worth has solely elevated by 5.45% over the interval. This tells us fairly clearly that the fund is way more costly than it was beforehand. That may have an effect on the valuation, which we’ll talk about later. For now, although, we will see that the fund’s leverage ratio elevated together with its internet asset worth. The one method that this might be the case is that if the fund borrowed extra cash through the interval. Thus, this seems to be the case.

With that stated, the fund’s leverage continues to be beneath the one-third of property ranges that we might ordinarily deem acceptable, however that doesn’t imply that it’s applicable for the fund’s technique. Right here is the way it compares with its friends:

|

Fund Title |

Leverage Ratio |

|

NXG NextGen Infrastructure Earnings Fund |

29.44% |

|

BlackRock Utilities, Infrastructure & Energy Alternatives Belief |

0.00% |

|

Cohen & Steers Infrastructure Fund |

30.30% |

|

DNP Choose Earnings Fund |

28.05% |

|

EcoFin Sustainable and Social Affect Fund |

8.90% |

|

Tortoise Vitality Independence Fund |

13.70% |

(all figures from CEF Information)

This means that the fund’s leverage ratio could also be just a little excessive, however it most likely isn’t too dangerous. The Cohen & Steers Infrastructure Fund and the DNP Choose Earnings Fund each make investments closely in utilities, and every of them is comparatively in step with this fund. The EcoFin Sustainable and Social Affect Fund is way more targeted on renewable vitality, so it wants a decrease stage of leverage given the poor efficiency of that sector lately.

Total, the present stage of leverage for the NXG NextGen Infrastructure Earnings Fund might be nothing to lose sleep over. Nevertheless, risk-averse buyers could desire to see it drop just a little bit.

Distribution Evaluation

The first goal of the NXG NextGen Infrastructure Earnings Fund is to supply its buyers with a excessive stage of whole return. Nevertheless, like all closed-end funds, this one primarily goals to do this via the fee of normal distributions to its shareholders. To this finish, the fund pays a month-to-month distribution of $0.5400 per share ($6.48 per share yearly), which supplies the fund a whopping 16.80% yield on the present share value. This is likely one of the highest yields obtainable from any closed-end fund.

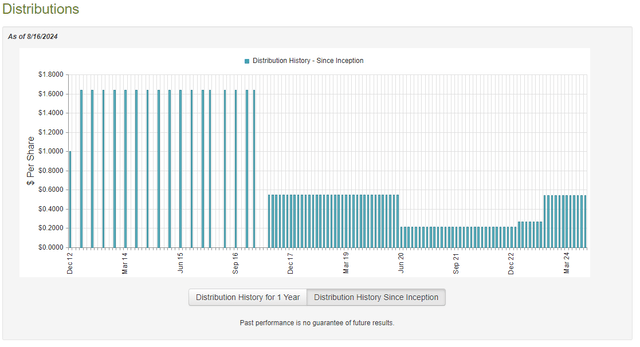

Sadly, the NXG NextGen Infrastructure Fund has not been significantly dependable with its distribution. It has performed higher than many funds that make investments closely on this sector, although:

CEF Join

As said beforehand:

This distribution historical past could cut back the fund’s enchantment within the eyes of these buyers who’re in search of a secure and safe supply of revenue to make use of to pay payments or finance bills. Nevertheless, we will see that the fund did fairly nicely previous to 2020, which was a 12 months by which almost all closed-end funds that put money into vitality infrastructure needed to cut back their payouts. This was as a result of market promoting off something associated to the fossil gasoline business in enormous quantities and a few midstream corporations chopping their distributions in order that they might turn into completely self-sufficient and never must care concerning the market anymore. It’s good to see that this fund has began to revive its distribution to its prior stage now that the business has recovered, though this one was a lot slower to take action than lots of its friends.

The fund raised its distribution to the present stage in September 2023, and the brand new stage is barely beneath the $0.5468 per share that the fund was paying out previous to the pandemic. Thus, now we have not but had a full restoration of the distribution, however this fund has gotten shut and that’s higher than many different funds on this sector.

As is all the time the case, although, we wish to be sure that the distribution is sustainable by reviewing the fund’s funds. The latest monetary report as of the time of writing is the semi-annual report for the six-month interval that ended on Could 31, 2024. A hyperlink to this doc was supplied earlier on this article. Clearly, this can be a a lot newer report than the one which we had obtainable to us again in October, so it ought to work fairly nicely as an replace.

For the six-month interval that ended on Could 31, 2024, the NXG NextGen Infrastructure Earnings Fund acquired $4,208,587 in dividends and distributions together with $115,594 in curiosity from the property in its portfolio. Nevertheless, a few of this cash got here from grasp restricted partnerships, so it’s not thought of to be funding revenue for tax or accounting functions. As such, the fund solely reported a complete funding revenue of $1,802,768 for the interval. This was not ample to cowl the fund’s bills, and it ended up reporting a internet funding lack of $634,345 for the interval. Clearly, that was not sufficient to cowl the $8,429,555 that the fund paid out in distributions through the interval.

Happily, the fund was in a position to make up for the dearth of internet funding revenue via capital positive factors. For the six-month interval, the fund reported internet realized positive factors of $1,156,133 together with internet unrealized positive factors of $19,709,293. Total, the fund’s internet property elevated by $11,801,526 after accounting for all inflows and outflows over the interval. Thus, the fund managed to completely cowl its distributions through the interval.

This was a pleasant change over the full-year interval that ended on November 30, 2023, throughout which period the fund’s internet property declined by $38,752,680 resulting from massive realized losses.

For now, the fund’s distribution appears to be secure. The property that it’s at the moment invested in appear unlikely to say no considerably except we get a extreme market shock (corresponding to from a shock rate of interest hike). That appears unlikely, so we most likely do not need to fret about it proper now.

Valuation

Shares of the NXG NextGen Infrastructure Earnings Fund are at the moment buying and selling at a 6.34% low cost to internet asset worth. That is barely higher than the 5.70% low cost that the fund’s shares have had on common over the previous month. As such, the present value seems first rate as an entry level.

Conclusion

In conclusion, the NXG NextGen Infrastructure Fund seems like a reasonably great way for buyers to acquire some publicity to renewable vitality and different corporations which are more likely to profit from the political push towards electrification. Not like some comparable funds, this one consists of publicity to pure gas-focused midstream corporations, which have been beneficiaries of rising pure fuel consumption as a result of must complement renewable fuels. Maybe most surprisingly, this fund seems to be totally overlaying its whopping yield. It could possibly be price buying for diversification functions, as many revenue buyers have very restricted renewable publicity.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.