filo

Rithm Capital Company (NYSE:RITM) continued to earn its $0.25 per share per quarter dividend simply with distributable earnings within the second quarter.

Rithm Capital additionally grew its ebook worth and disclosed strong monetary outcomes, pushed by positive factors within the Mortgage Servicing Rights portfolio. I anticipate Rithm Capital to do extra acquisitions transferring ahead, significantly within the asset administration enterprise, to be able to diversify its mortgage-heavy funding portfolio and create new earnings streams.

From a dividend security angle, Rithm Capital gives up some of the safe 9% yields which might be obtainable out there, in my opinion.

My Ranking Historical past

A low dividend pay-out ratio and a higher-for-longer charge atmosphere led me to guage Rithm Capital as a Sturdy Purchase in Could. Rithm Capital is a well-diversified and increasing its enterprise within the asset administration enterprise which might assist the belief obtain decrease earnings volatility transferring ahead.

With the dividend additionally being fairly well-covered with distributable earnings, I feel RITM stays a purchase for passive earnings traders.

Portfolio Assessment

Rithm Capital is a mortgage-focused funding firm, nevertheless it has began to vary and broaden its funding scope.

Final 12 months, Rithm Capital acquired Sculptor Capital in 2023, an asset administration enterprise with $32 billion in belongings, to be able to diversify its portfolio and earnings streams.

The core funding for Rithm Capital remains to be Mortgage Servicing Rights that are distinctive mortgage belongings within the trade. They provide traders upside in a rising-rate atmosphere as a result of they develop into extra useful because the lifetime of the price stream will get prolonged. As such, they’re pro-cyclical investments and have been key to Rithm Capital’s mortgage-based funding technique in recent times.

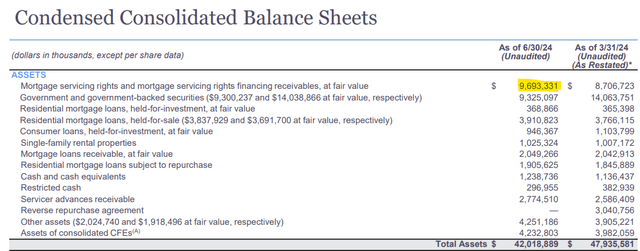

Mortgage Servicing Rights remained the most important pillar in Rithm Capital’s funding portfolio and accounted for $9.7 billion of funding belongings, reflecting 11% QoQ progress. Different investments within the mortgage belief’s portfolio included Shopper Loans, Single Household Leases, Residential Mortgage Loans and different mortgage investments.

Condensed Consolidated Steadiness Sheets (Rithm Capital Company)

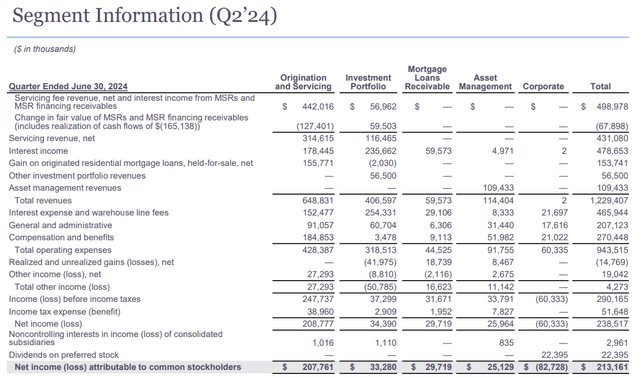

Mortgage Servicing Rights are paying servicing charges for Rithm Capital and within the second quarter, the mortgage belief’s MSRs produced $431.1 million in servicing revenues, which was the second-highest gross sales stream. Solely curiosity earnings, which captures earnings from the belief’s residential mortgage and shopper mortgage portfolio, had greater revenues of $478.7 million.

The breakdown for the second quarter additionally confirmed that the asset administration is beginning to produce some respectable outcomes: The brand new asset administration service line produced $109.four million in revenues in 2Q24, up 44% YoY.

Section Info (Rithm Capital Company)

In June, Rithm Capital turned the exterior supervisor of Nice Ajax, an funding firm that’s reworking into an opportunistic business actual property REIT.

I anticipate Rithm Capital to do extra acquisitions within the asset administration trade and develop the scope of its investments. Transferring ahead, Rithm Capital is poised to develop into a diversified asset administration firm with distinct service traces in credit score, actual property and asset administration. The growing diversification of the funding portfolio ought to result in a good greater high quality and extra diversified earnings stream for shareholders.

Dividend Protection

Rithm Capital is a well-managed mortgage actual property funding belief, although the corporate is turning into extra of an all-round funding supervisor that has moved past its core mortgage investments.

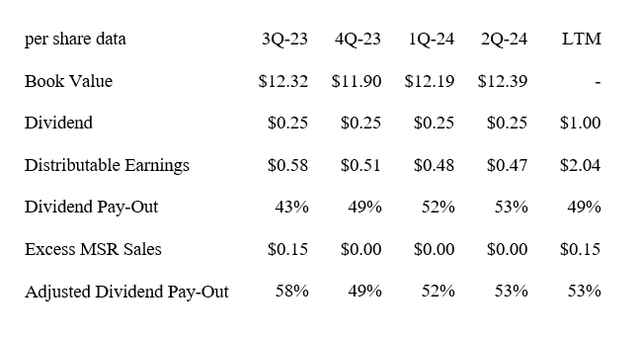

Within the second quarter, Rithm Capital earned $0.47 per share in distributable earnings which equates to a dividend pay-out ratio of solely 53%. Within the final twelve months the mortgage actual property funding belief paid out even lower than that, solely 49% of its cumulative distributable earnings which interprets into a really excessive margin of security.

Annaly Capital Administration, Inc. (NLY) paid out 98% of its distributable earnings. Although Annaly Capital Administration has little bit of a unique focus within the mortgage trade (the mortgage belief primarily invests in mortgage-backed securities) than Rithm Capital, it does have some publicity to Mortgage Servicing Rights as effectively.

From a margin of security angle, Rithm Capital is likely one of the finest offers that passive earnings traders can get within the REIT trade, in my opinion.

Dividend (Writer Created Desk Utilizing Belief Info)

Low cost To E-book Worth

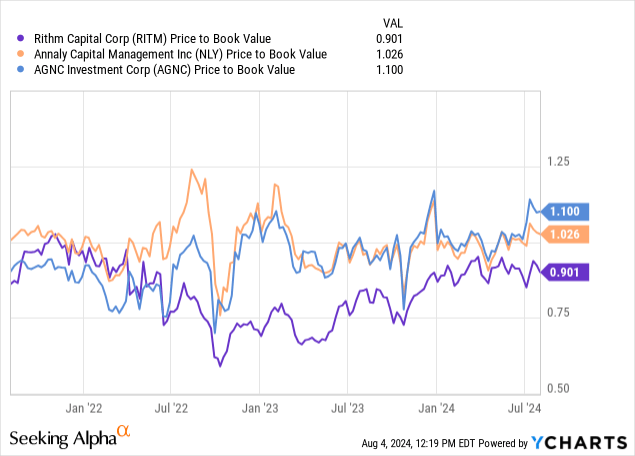

Rithm Capital’s ebook worth grew 1.6% within the final quarter and the mortgage actual property belief had a ebook worth of $12.39 as of June 30, 2024. Sturdy Mortgage Servicing Rights outcomes added to the QoQ achieve in ebook worth. With a inventory worth of $11.35, the inventory of Rithm Capital sells for an 10% low cost to ebook worth.

Company MBS-focused mortgage trusts like Annaly Capital Administration and AGNC Funding Corp. (AGNC) are promoting for 3% and 10% premiums to their ebook values, respectively.

Bearing in mind that Rithm Capital is providing investments into a number of completely different and uncorrelated mortgage investments, I feel that Rithm Capital on the very least might rerate to ebook worth which means an intrinsic worth of $12.39 per share.

Why The Funding Thesis May Not Play Out

Rithm Capital is chubby Mortgage Servicing Rights which have gotten much less interesting investments in a low-rate atmosphere. MSR values have a tendency to extend in periods of rising charges and fall in periods of falling charges which makes them directional charge investments.

With the central financial institution closing in on its first charge reduce (anticipated for September 2024), I feel that MSRs have gotten much less compelling funding decisions for passive earnings traders.

I anticipate Rithm Capital to strategically cut back its MSR investments within the subsequent couple of quarters, nevertheless, to be able to take away a supply of potential valuation threat from its steadiness sheet.

Since Rithm Capital can be turning into extra diversified via its funding in Sculptor Capital, I feel that the long-term asset combine will shift away from Mortgage Servicing Rights.

My Conclusion

Rithm Capital grew its ebook worth within the second quarter, the Mortgage Servicing Rights Portfolio for now’s performing effectively and the mortgage actual property funding belief as soon as once more lined its dividend with distributable earnings within the second quarter.

It needs to be famous that Rithm Capital continued to realize a considerable quantity of extra dividend protection in 2Q24 with the belief paying out solely 53% of its distributable earnings.

The worth proposition stays compelling, in my opinion, as a result of Rithm Capital is promoting at a reduction to ebook worth and the 10% ebook worth low cost on high of a major dividend margin of security makes the belief’s inventory a purchase for passive earnings traders.