ewastudio/iStock through Getty Pictures

The GSPY technique

Gotham Enhanced 500 ETF (NYSEARCA:GSPY) is an actively managed ETF launched on 12/28/2020. It has 501 holdings and a web expense ratio of 0.50%. As described within the prospectus by Gotham ETFs, GSPY invests within the constituents of the S&P 500 Index (SP500), reweighted primarily based on “a systematic, bottom-up, valuation method.” The methodology entails a scientific basic evaluation contemplating “recurring earnings, money flows, capital effectivity, capital construction, and valuation.” Firms that don’t conform to the methodology or have questionable monetary reporting could also be excluded. The fund is rebalanced each day to replicate earnings releases, worth motion, and “different new info.” The portfolio turnover charge was 134% in the newest fiscal 12 months. This text will use as a benchmark the mum or dad index S&P 500, represented by SPDR S&P 500 ETF Belief (SPY).

The GSPY portfolio

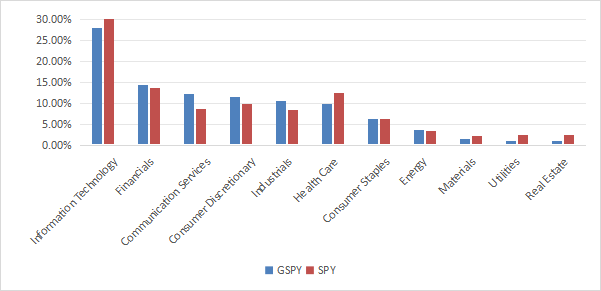

About 85% of asset worth is invested in giant and mega-cap firms. Expertise is the heaviest sector, with 28.1% of property. Then, come financials (14.4%), communication companies (12.3%) and shopper discretionary (11.5%). The sector breakdown just isn’t a lot totally different from the benchmark, as plotted on the subsequent chart. In comparison with SPY, GSPY reasonably overweights communication, and to a lesser extent, a number of different sectors. It nearly ignores low-weight sectors: supplies, utilities and actual property.

GSPY sector breakdown (chart: writer; knowledge: Constancy, iShares)

The highest 10 holdings, listed under with basic ratios, signify 37.3% of asset worth, whereas SPY has 34.8% of property in its high 10 issuers (grouping the 2 share sequence of Alphabet, GOOGL and GOOG). The most important place weighs 7.38% in GSPY and 6.85% in SPY. Focus and dangers associated to particular person firms are related in each funds. The truth is, they share Eight of their high 10 issuers. The 2 high 10 firms of GSPY that aren’t in SPY’s high 10 are Visa and Johnson & Johnson. They weigh solely 2.9% in mixture. GSPY methodology doesn’t appear to revolutionize S&P 500 weights.

|

Ticker |

Identify |

Weight |

EPS progress %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

MSFT |

Microsoft Corp. |

7.38% |

21.86 |

34.65 |

30.96 |

0.73 |

|

AAPL |

Apple, Inc. |

6.84% |

10.38 |

33.63 |

32.95 |

0.45 |

|

NVDA |

NVIDIA Corp. |

4.78% |

414.59 |

49.87 |

37.63 |

0.04 |

|

AMZN |

Amazon.com, Inc. |

4.43% |

231.89 |

41.53 |

36.65 |

0 |

|

GOOGL |

Alphabet, Inc. |

4.31% |

47.48 |

22.44 |

20.48 |

0.51 |

|

META |

Meta Platforms, Inc. |

3.16% |

128.32 |

26.18 |

24.09 |

0.39 |

|

BRK.B |

Berkshire Hathaway, Inc. |

2.09% |

-21.04 |

15.22 |

23.75 |

0 |

|

V |

Visa, Inc. |

1.57% |

18.89 |

30.47 |

28.28 |

0.74 |

|

JPM |

JPMorgan Chase & Co. |

1.41% |

15.32 |

12.23 |

12.35 |

2.10 |

|

JNJ |

Johnson & Johnson |

1.28% |

40.15 |

24.19 |

16.75 |

2.96 |

Fundamentals

GSPY is barely cheaper than SPY relating to the worth/earnings, worth/gross sales and worth/money stream ratios, as reported within the subsequent desk. Value/e book ratios are nearly an identical. As a complete, progress charges aren’t considerably totally different. As soon as once more, GSPY traits don’t look very unique relative to its mum or dad index.

|

GSPY |

SPY |

|

|

Value/Earnings |

24.66 |

26.44 |

|

Value/Guide |

4.63 |

4.62 |

|

Value/Gross sales |

2.56 |

3.03 |

|

Value/Money Movement |

16.59 |

18.15 |

|

Earnings progress |

22.15% |

22.62% |

|

Gross sales progress |

8.75% |

8.79% |

|

Money Movement progress |

9.78% |

8.99% |

Supply: Constancy.

Historic efficiency

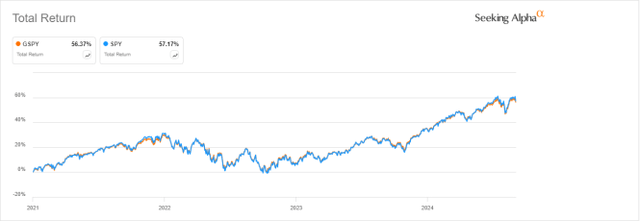

Since its inception, GSPY has adopted SPY very carefully, as proven by the subsequent chart. The 2 paths are practically an identical. Neither complete return, nor threat (drawdowns and volatility) are materially totally different on any interval of the chart.

GSPY vs. SPY, since 1/1/2021 (In search of Alpha)

Over the past 12 months, GSPY is 1.56% behind SPY:

GSPY vs. SPY, 12-month return (In search of Alpha)

Takeaway

Gotham Enhanced 500 ETF invests in S&P 500 constituents, reweighted primarily based on a proprietary valuation methodology. Nevertheless, a lot of its traits are very near the mum or dad index: sector breakdown, high holdings, fundamentals, worth motion. Probably the most notable variations are a better expense ratio and an astounding 134% turnover charge. That’s a lot ado about nothing. GSPY’s monitor document continues to be brief, and we must always give it an opportunity to make a distinction. In the meantime, there isn’t any cause to purchase a fund with a 0.50% web expense ratio and nearly the identical traits as capital-weighted S&P 500 ETFs, which begin at a 0.02% charge with SPDR Portfolio S&P 500 ETF (SPLG).