Feverpitched

There are a lot of dynamics within the present financial and inventory market surroundings. Inflation, rate of interest will increase, company gross sales/earnings, and geopolitical occasions are all elements shaping the outlook for 2023. The Federal Reserve has been targeted on driving down inflation with a sequence of curiosity charge will increase. The most up-to-date improve of 0.50 proportion factors introduced the first credit score charge to 4.5%.

It’s my opinion that these rate of interest will increase have not been totally mirrored within the financial system but. Certain, we now have seen mortgage charges improve from document low ranges of two.65% for a 30-year mortgage in January 2021 to the present degree of about 6.5%. There have additionally been mass layoff bulletins from Amazon (AMZN), Meta Platforms (META), Twitter (TWTR), Netflix (NFLX), Carvana (CVNA), Peloton (PTON), Goldman Sacs (GS), Micron (MU), and others. It’s seemingly that larger charges and layoffs may have a snowball impact within the broader financial system as demand for items/providers declines as customers and firms reduce on spending on account of larger borrowing prices and with extra folks out of labor.

Curiosity Price Outlook for 2023

The Federal Reserve usually has a aim of two% for the inflation charge over the long-term. The most recent inflation charge was 7.1% for November 2022. Whereas this was decrease than the 7.7% charge from October, the extent nonetheless stays stubbornly excessive. So, there may be nonetheless work for the Fed to do to drive down inflation.

The Fed hinted that it’s going to improve its goal rate of interest to five.1% in 2023. This means extra will increase that quantity to 0.75 proportion factors. So, the borrowing prices for properties, automobiles, and companies to broaden are prone to develop into costlier in 2023. That is prone to scale back demand for large-ticket gadgets and for enterprise enlargement. Subsequently, company gross sales/earnings are prone to decline and extra layoffs are prone to happen in 2023 because of this.

As borrowing turns into costlier, potential house consumers usually tend to postpone buying properties, customers could maintain off on buying new automobiles and different big-ticket gadgets, present house homeowners most likely will not refinance and should postpone massive house enchancment initiatives, companies could halt investments for enlargement, and many others.

Greater rates of interest usually result in recessions as part of the traditional enterprise cycles. We witnessed that within the monetary disaster of 2008, the dot com bubble burst in 2000, and in different recessions. Earlier recessions occurred after a sequence of rate of interest will increase. It’s prone to occur once more as financial exercise slows down.

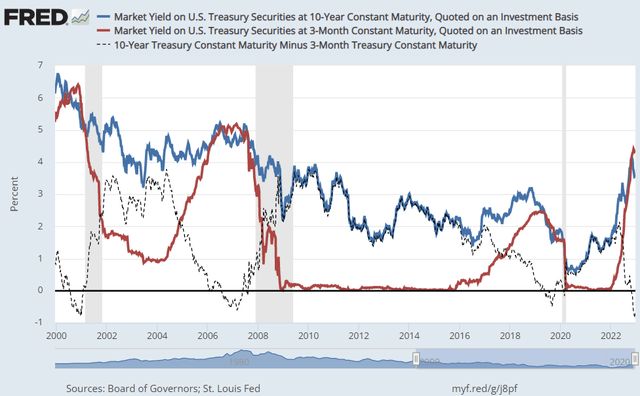

Yield Curve Inversion

One dependable recession indicator is the connection between the three month and 10-month treasury yields. When the 3-month treasury yield turns into larger than the 10-year treasury yield, the yield curve is alleged to be inverted. This prevalence predicted the final 10 recessions. The three-month treasury is presently yielding 4.28% whereas the 10-year treasury yields 3.75%. Usually, the longer-term treasuries may have larger yields. So, when the alternative happens, it signifies that financial circumstances are altering on account of short-term rate of interest will increase.

jobs.utah.gov

We are able to see within the chart above that the 3-month treasury yield (purple line) rose larger than the 10-year yield (blue line) previous to the final three recessions. It occurred earlier than the COVID-related recession in 2020, previous to the 2008 monetary disaster, and throughout the dot com bubble burst and recession that adopted. Whereas there isn’t any assure that the present inversion will end in a recession, this indicator has been dependable for the reason that 1980s. So, I do suppose it does improve the possibility of a recession occurring in 2023 considerably.

Company Earnings Declines

Analysts have been reducing EPS estimates for the S&P 500 (SP500) (SPY) firms for This autumn 2022 by a bigger margin than common. The EPS estimates had been lowered by 5.6% for This autumn. The typical decline for estimates over the previous 5 years has been 2.1%.

These bigger estimate declines are prone to proceed in 2023 for my part. The rationale for that’s inflation remains to be excessive and rates of interest are nonetheless rising. The price of most gadgets together with meals and vitality are nonetheless excessive which might scale back demand for different discretionary items/providers within the financial system. Many customers could need to put most of their cash into meals, shelter, and commuting prices and restrict spending on journey, leisure, eating out, and different discretionary items/providers.

Greater borrowing prices are prone to scale back demand for mortgages and residential purchases. This will result in much less demand for different large-ticket gadgets akin to home equipment, furnishings, and huge house enchancment initiatives. Greater borrowing prices may scale back demand for brand spanking new automobiles.

With all of this in thoughts, many firms are prone to see lowered demand resulting in decrease income and earnings as in comparison with when the financial system was more healthy. When demand decreases, then firms start shedding staff. That’s prone to result in an uptick in unemployment as many firms and companies are shedding staff.

Declining Financial Indicators

One financial indicator meaning so much for the well being of the financial system is the housing market. The rationale why housing is so vital is as a result of it includes about 15% to 18% of GDP. We’re experiencing important declines in actual property gross sales on account of larger mortgage charges.

Housing begins declined 16.4% in November 2022 over November 2021. Constructing permits declined 22.4% year-over-year with an 11.2% decline from October to November. Whereas new house gross sales elevated 5.3% from October 2022 to November 2022, they dropped 15.3% year-over-year in November 2022. Current house gross sales fell for 10 consecutive months. November present house gross sales declined 7.7% from October with a big 35.4% decline year-over-year.

Greater mortgage charges are having a detrimental impact on house gross sales. That is solely prone to worsen because the Fed continues to extend charges in 2023. Many potential consumers are prone to look ahead to decrease charges and/or decrease costs as they is likely to be priced out of the marketplace for the kind of home that they need to buy.

One other indicator that appears troublesome is the ISM Manufacturing report. Financial exercise within the manufacturing sector declined in November which marked the primary decline since Might 2020. The November Manufacturing PMI got here in at 49%. Percentages under 50% present contraction in manufacturing exercise. The Backlog of Orders Index got here in at 40% and was 5.3% decrease than the October studying. This could possibly be the beginning of a brand new downward pattern in manufacturing particularly with the backlog of orders declining.

One brilliant spot within the financial system has been the providers sector. The ISM Companies PMI got here in at 56.5% in November. This marked the 30th consecutive month of development for providers. Nevertheless, I believe it’s seemingly that some components of the providers sector are prone to decline in 2023. That features actual property which is prone to decline as larger mortgage charges scale back demand. Declines in 2023 might additionally happen in development, retail, wholesaling, transportation, and warehousing if slower financial exercise spreads on account of much less client and enterprise funding demand. Companies which are prone to maintain up properly embrace Agriculture, Healthcare, Utilities, and Meals Companies which will be thought-about non-discretionary spending.

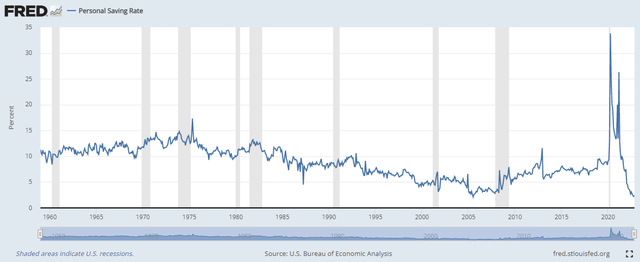

One other vital level for the 2023 outlook is that the private financial savings charge declined to a low degree.

fred.stlouisfed.org

The chart above exhibits that the private financial savings charge dropped under the place it was originally of 2008. The excessive financial savings charge in 2020 led to sturdy development because the financial system opened again up from the COVID lockdowns. Nevertheless, customers are actually starting 2023 with a lot much less saved up. That is prone to suppress demand as cash is extra prone to be spent on requirements akin to meals and vitality and fewer on main discretionary purchases akin to new properties, automobiles, journey, and leisure.

Technical Perspective

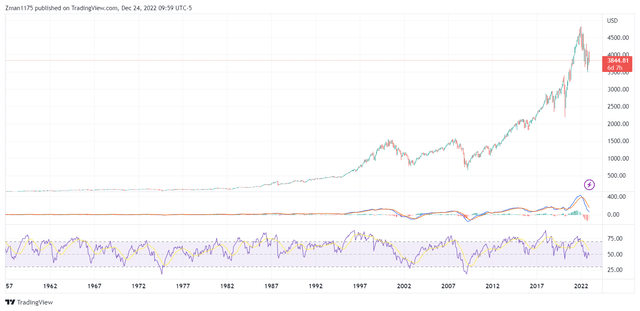

S&P 500 (tradingview.com)

The month-to-month chart above supplies a long-term perspective on how the S&P 500 traded by way of overbought and oversold circumstances. The RSI (purple line on the backside of the chart) has been declining and is displaying weak point under 50, and could possibly be headed for an oversold situation under 30. Be aware that the final two main bear markets in 2008 and 2002 drove the RSI under 30. I did not rely the COVID recession as a result of that was an anomaly and never part of the longer-term pure enterprise cycle. If this bear market behaves equally to the 2002 and 2008 markets, then there may be far more draw back to go.

The MACD indicator above the RSI has been in decline and appears bearish because it has been dropping in the direction of the zero line. Be aware that the MACD did drop under the zero line in 2002 and 2008. So, this might additionally point out that we might see a lot decrease costs in 2023 for the S&P 500.

Value-wise, the S&P 500 misplaced about 50% within the dot com bubble bear market and about 58% within the 2008 monetary disaster bear market. We might see losses much like the 2000-2002 bear market as valuations might have to return down additional earlier than the underside is in. If we get a 50% drop on this bear market from the market highs, we might see the S&P 500 drop to $2400. Nevertheless, the market could not fall that a lot on this bear market.

2023 Forecast for S&P 500

It may be troublesome to forecast precisely the place the S&P 500 shall be on the finish of 2023, however I’ll make an informed calculation for leisure functions. I’ll do that based mostly on anticipated earnings and the valuation for the S&P 500.

I believe the rate of interest will increase will take slightly longer to have a big detrimental impression on the financial system to the purpose of two consecutive quarters of detrimental development. So, I’m projecting that we see a recession in Q3 & This autumn of 2023.

I believe that analysts are overestimating the S&P 500 earnings for 2023. Goldman Sachs Group is projecting S&P 500 EPS of $224, whereas JPMorgan Chase & Co (JPM) initiatives $205. The consensus estimate is $231. I’m projecting a decrease EPS of $180. The rationale why I’m going decrease is as a result of I believe the vitality sector will take a success within the 2nd half of 2023. Power will most likely stay sturdy within the 1st half of 2023 because the financial system stays weak however not in deep recession territory. The vitality sector (oil costs particularly) tends to drop considerably throughout full-blown recessions. I imagine that can occur within the 2nd half of 2023. Subsequently, earnings for oil and energy-related firms are prone to decline considerably in Q3 and This autumn 2023 for my part.

The S&P 500’s valuation by way of trailing P/E ratio is presently about 19. I’m projecting that the S&P 500’s PE ratio drops to 16 by the tip of the 12 months because the market continues to sell-off throughout an finish of 12 months recession. Subsequently, my projection for the S&P 500 value on the finish of 2023 is $2880 (PE of 16 x EPS of $180). This may be a few 40% drop from the all-time excessive of $4818 and 25% decrease than the present value.

There are a lot of elements/dangers to think about that might make my projections incorrect. An precise finish of the Russian-Ukraine conflict can be constructive for the market and would seemingly result in a rally. The actions of China opening up its financial system could possibly be extra constructive for the worldwide financial system than anticipated and assist us to keep away from a recession.

Alternatively, if China backtracks and implements full blown lockdowns someday throughout the 12 months, it might result in financial circumstances to be worse than anticipated. If the Ukraine conflict escalates and different international locations develop into extra concerned, it might result in a way more bearish market and decrease than what I’m projecting.

I’m usually constructive and optimistic concerning the inventory market and the financial system. Nevertheless, the present developments have me realistically bearish when 2023.

Editor’s Be aware: This text was submitted as a part of Searching for Alpha’s 2023 Market Prediction contest. Do you’ve a conviction view for the S&P 500 subsequent 12 months? If that’s the case, click on right here to search out out extra and submit your article right now!