Overview:

Scharfsinn86

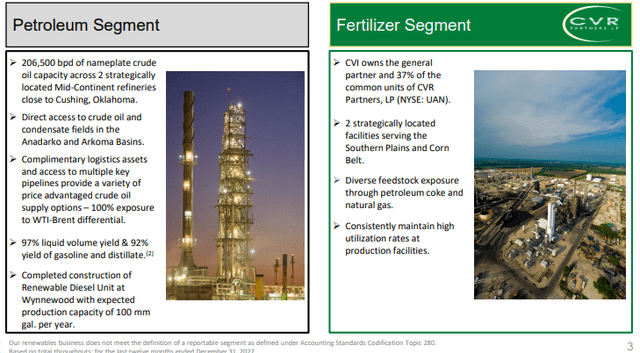

CVR Vitality, Inc. (NYSE:CVI) is an vitality firm that refines petroleum, produces bio-diesel and makes fertilizer via its 37% possession of CVR Companions LP (UAN). In line with its web site here’s a description of its enterprise.

CVI Vitality is a diversified holding firm primarily engaged within the petroleum refining and nitrogen fertilizer manufacturing industries, with an growing deal with the manufacturing of renewable biofuels, the vitality transition, and decrease carbon emissions Supply: CVI Vitality

CVI

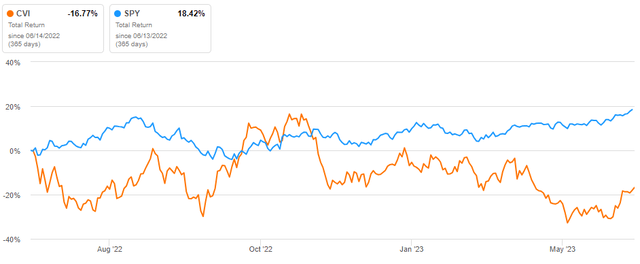

Over the past yr, CVI has underperformed relative to the S&P500 (SPY).

Searching for Alpha

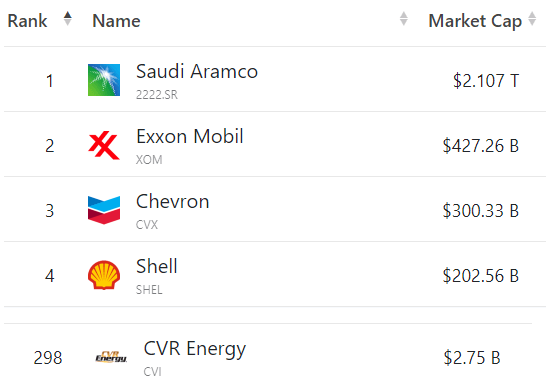

On a market cap foundation, CVI is ranked 298th on this planet, considerably smaller than among the extra outstanding oil firms on this planet.

companiesmarketcap.com

The a lot smaller dimension has made CVI fly beneath the radar considerably, however it’s making progress in all areas.

In this text, we are going to take a look at CVR Vitality’s prospects for the subsequent yr to attempt to decide the value path out to 2024 as in comparison with final yr.

CVI Inventory Key Metrics

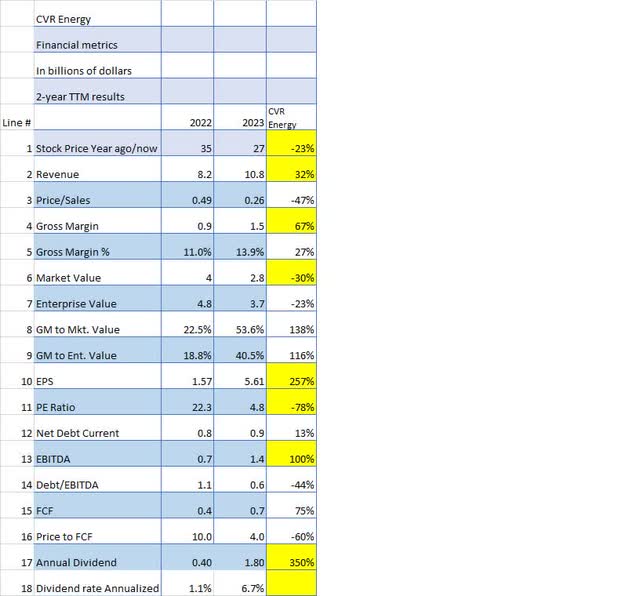

Let’s take a look at CVR Vitality’s monetary metrics, evaluating the newest TTM (Trailing Twelve Months) with the earlier yr. In CVR Vitality’s case, the TTM coincides with the top of Q1 2021 and Q1 2022 years ending March 31.

We will make an affordable comparability of at present’s worth versus final yr’s worth. As soon as we’ve got made that comparability, we are going to make an try and see how the approaching yr might play out.

Searching for Alpha and creator

One fast take a look at the monetary metrics desk above evaluating 2021 to 2022 exhibits monumental enchancment in outcomes for CVR Vitality over that point interval.

I’ve highlighted in yellow the objects I take into account essentially the most constructive in comparison with the opposite objects. The orange objects are these which might be questionable from an funding standpoint. Notice that CVR has no orange objects, that means I am unable to discover any negatives in any respect of their comparable monetary metrics.

CVR Vitality’s worth (Line 1) has decreased by 23% during the last 12 months, regardless of a rise in Income (Line 2) of 32%. Gross Margin (Line 4) can be up considerably (67%) in comparison with Income. This might indicate operational efficiencies seemingly improved over that 1-year time interval.

Nevertheless, regardless of the excellent yr, the PE Ratio (line 11) is far decrease at about 5x in comparison with 22x a yr in the past.

And EBITDA (line 13) doubled and the debt-to-EBITDA ratio (Line 14) dropped by 44%.

As well as, FCF (Line 15) surged 75% in 2022 over 2021 reducing the Value to FCF (Line 16) from 10x to 4x.

And at last, the dividend was raised from .40 to 1.80, a staggering improve of 350%. And administration goes to make use of future FCF to assist the dividend.

We are going to proceed to deal with maximizing free money circulation, which underpins our peer-leading dividend yield. Supply: CVR Earnings Name

All in all, CVI’s monetary metrics have been overwhelmingly good, however despite that, the share worth went down.

This might indicate that CVI is within the cut price bin.

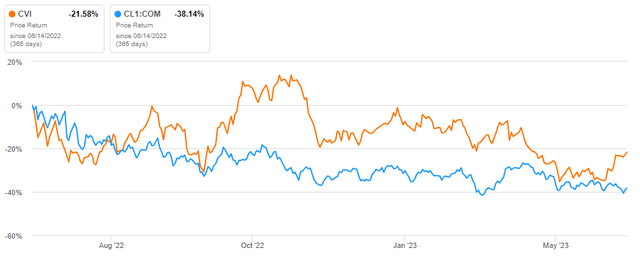

How Did CVI Vitality’s Share Value Evaluate to the Value Of Oil?

A great way to visualise CVR Vitality’s worth efficiency is to match it to grease costs over the identical time frame.

The chart under exhibits that regardless of a gentle, constant drop in oil costs during the last yr, CVI outperformed oil, however each have been down greater than 20%.

Searching for Alpha

So from an funding standpoint, oil costs have traditionally not been the dominant determinant of CVR Vitality’s worth. That is because of refinery margins not being tied immediately to grease costs.

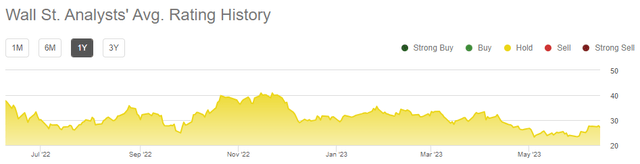

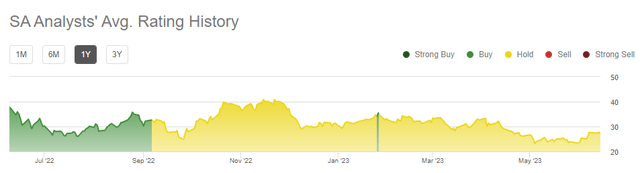

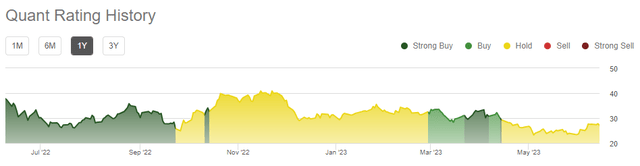

What Do Analysts Assume?

Wall Road analysts, Searching for Alpha analysts, and quants are decidedly impartial on CVR Vitality with everybody having a Maintain score in the intervening time. Nevertheless, earlier within the yr, each SA analysts and quants had CVI a purchase.

Searching for Alpha

Searching for Alpha

Searching for Alpha

How Does CVR Vitality Evaluate To Different Oil-related Shares?

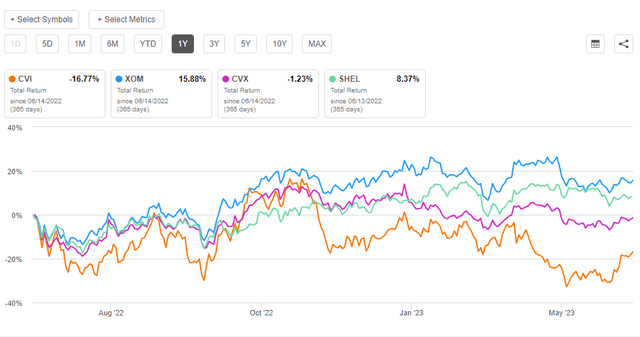

A professional query when any inventory is to match its potential with different shares in the identical market sector. If we take a look at CVR Vitality’s efficiency during the last yr and evaluate it to different massive market worth shares within the oil sector during the last yr, (Exxon (XOM), Shell (SHEL), Chevron (CVX)) we are able to see CVR Vitality has carried out poorly in comparison with the opposite three with a complete return (together with dividends) at a detrimental 17%.

Searching for Alpha

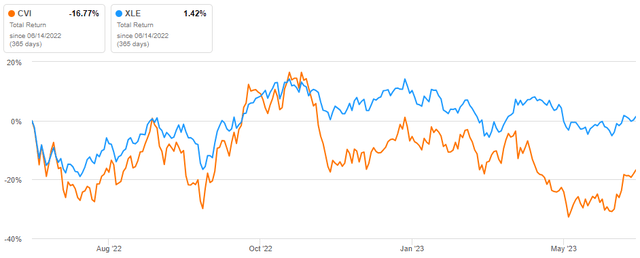

One other good comparability is with the Vitality Choose Sector SPDR ETF (XLE) which incorporates all of the oil majors in a single ETF.

Searching for Alpha

It’s simple to see as soon as once more that CVR Vitality has not carried out in addition to the oil sector, typically, has carried out during the last 12 months.

Is CVI Inventory A Purchase, Promote, or Maintain?

Clearly, there are dangers with a CVR Vitality funding. For instance, if the oil worth falls to $50 a barrel, CVR Vitality will nonetheless generate enormous quantities of money circulation however will definitely not be capable to preserve its present share worth. The opposite huge threat for CVI is regulatory. As well as, CVI’s 37% possession of CVR Companions LP places a giant chunk of its earnings in danger due to the intense volatility of fertilizer costs.

However primarily based upon all the data above, it’s simple to see that CVR Vitality has carried out extraordinarily from a monetary standpoint, regardless that its share worth has tumbled. This might indicate it’s a good, albeit dangerous, turnaround inventory.

Additionally coming on-line this yr is CVI’s new biodiesel refinery which ought to add much more income and income assuming oil costs do not drop too far. We continued to extend throughput charges at our Wynnewood renewable diesel unit within the quarter, processing roughly 22 million gallons of vegetable oil feedstock. Supply: CVI Earnings name

I see CVR Vitality, Inc as a robust purchase with enormous turnaround potentialities and a considerable 6% dividend.