anusorn nakdee/iStock by way of Getty Photographs

Introduction

As we progress by way of this century, hydrogen adoption will seemingly change into a extra widespread theme, notably given its helpful qualities in serving to decarbonize the globe’s vitality programs. There are fairly a number of industries corresponding to aviation, naval, heavy industries, high-heat manufacturing, fertilizer manufacturing, and so forth. that can seemingly stay stubborn to the waves of electrification, and that is the place hydrogen’s presence can be felt most keenly. All in all, if we’re to hit web zero emissions by 2050, it’s all however sure that we might have an ever-growing hydrogen economic system taking part in an important half in that narrative.

In case you’re intrigued by the rising scope of the broad hydrogen economic system and are in search of appropriate choices, you could contemplate trying on the Direxion Hydrogen ETF (NYSEARCA:HJEN), which is certainly one of two ETFs that traders may probably pursue.

Portfolio Development

As a part of HJEN’s preliminary screening course of, potential shares, together with ADRs (these shares have to have a minimal market cap of $100m and a 6-month common each day turnover of over $ 1 million) should be concerned in a single, or all of a number of the hydrogen-related sub-themes listed under.

Hydrogen Manufacturing & Era Hydrogen Storage & Provide Gas Cell & Battery Hydrogen Techniques & Options Membrane & Catalyst

Do notice that it is not enough to have simply tenuous exposures to those hydrogen sub-themes. Quite, HJEN’s screeners additionally search to determine if these are “pure-play” shares (hydrogen-related income ought to comprise at the least 50% of the group topline), “quasi-play” shares (hydrogen associated income publicity of 20-50%), or “marginal-play” (lower than 20% income publicity to the hydrogen theme).

Ultimately, the highest 30 pure-play shares by market cap make up HJEN’s portfolio, and if they can not discover 30, they may dip into the quasi-play pool, with choice given to bigger shares (by market cap) and people concerned within the first three hydrogen sub-themes.

Although this can be a US-based product (30% of holdings), notice that the majority of the holdings is predicated in Europe (~42% publicity), with some publicity to Asia-Pac shares as properly (24%).

HJEN versus HYDR

As famous earlier within the article, traders even have the choice of pursuing an alternate ETF that seeks to revenue from the rising profile of the worldwide hydrogen industry- The World X Hydrogen ETF (HYDR) which tracks a barely smaller portfolio of solely 26 shares.

Regardless of coming to the bourses three months after HJEN, HYDR seems to be the extra common product on this area, with an AUM of over $47m in comparison with $31m for HYDR. Buyers could have their distinctive causes for gravitating to a sure product, however after we examine the ETFs, we really feel HJEN is a extra well-rounded providing.

Firstly, on the expense profile entrance, HJEN affords an edge with an expense ratio that’s 5bps decrease. One additionally will get the additional benefit of pocketing a helpful dividend yield of 1.16%, one thing which HYDR would not supply in any respect.

Then, as each portfolios observe a comparatively small variety of shares, you are sure to search out some focus results, however but nonetheless, that impact is comparatively decrease within the case of HJEN. The highest-heavy nature is extra apparent with HYDR with the top-10 shares accounting for nearly three-fourths of the overall portfolio; with HJEN, their weight is much less pronounced at 63%.

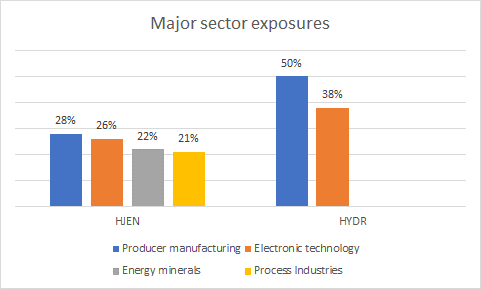

Additionally notice that HJEN spreads its wings pretty evenly throughout shares concerned in numerous avenues. For example, HJEN isn’t overzealously wedged to producer manufacturing or digital expertise which collectively account for 88% of HYDR’s complete portfolio. Quite, the weights are well-spread out past these two sectors and in addition embrace vitality minerals and course of work.

ETF.com

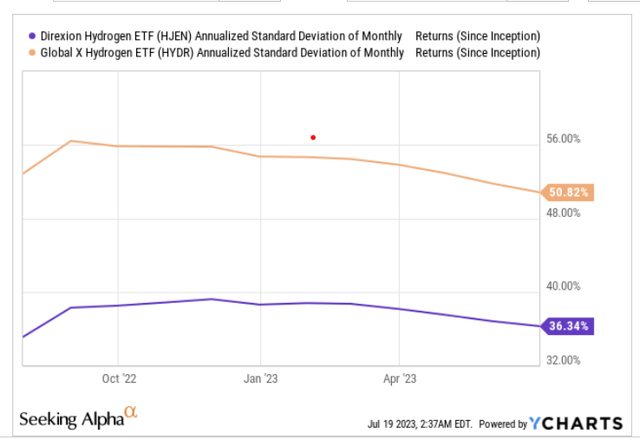

From a danger angle as properly, HJEN comes throughout as much less risky, providing a month-to-month normal deviation profile that’s round 1500bps decrease than HYDR.

YCharts

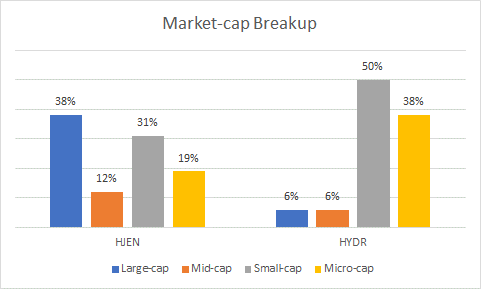

We imagine that is dictated by the pockets that these two ETFs dabble with. HYDR, it seems likes to chase extra unproven, early-in-the-lifecycle names, as exemplified by a heightened publicity of 88% to small and micro-cap shares. Nonetheless, HJEN publicity to those pockets is barely round 50%, with the remainder comprising of enormous and mid-cap shares.

ETF.com

Lastly, additionally contemplate that at the moment, HJEN affords a lot superior worth relative to HYDR. The previous’s holdings are at the moment priced at a weighted common P/E of solely 12x, a 52% low cost to the corresponding a number of of HYDR.

Closing Ideas- Technical Commentary

Going purely by the charts, at this juncture, HJEN doesn’t look like probably the most opportune guess. The picture under highlights how HJEN’s relative power over HYDR has been rising over time within the form of an ascending channel. At the moment, that ratio seems to be quite elevated, buying and selling nearer to the higher boundary of the channel, and considerably increased than the mid-point of the vary. We do not essentially suppose the ratio will collapse to the mid-point any time quickly contemplating the long-term pattern, however the prospect of some mean-reversion shouldn’t be dominated out.

Stockcharts

Apart from if we swap our consideration to HJEN’s personal standalone chart, we are able to see that after an honest efficiency this month, the ETF isn’t too distant from hitting the downward-sloping resistance. We cannot rule out a breakout from this resistance however do contemplate that there have been 4 separate situations the place it has didn’t clear it. The preferable terrain to have staged a protracted place was across the $12-$12.5 ranges the place the risk-reward regarded extra enticing.

Investing