Brett_Hondow/iStock Editorial through Getty Photos

Boot Barn Holdings, Inc. (NYSE:BOOT), a life-style retail chain, operates specialty retail shops in the USA. The corporate’s specialty retail shops supply western and work-related footwear, attire, and equipment for males, ladies, and youngsters.

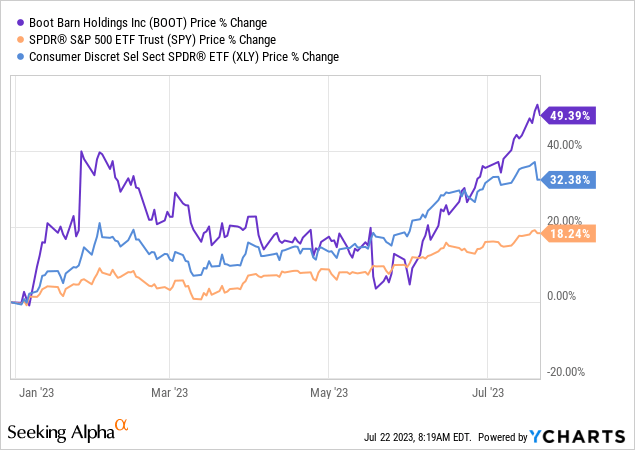

Boot Barn has gained the eye of many traders this yr, because the agency’s share worth has considerably outperformed the broader market and likewise the buyer discretionary sector, year-to-date.

In right this moment’s article, we’re going to be specializing in whether or not this outperformance is justified and whether or not it may well stay sustainable within the coming quarters. To take action, we will likely be discussing the macroeconomic setting, primarily indicators which can be regarding the shopper and its spending behaviour. Later, we may even take a look at some firm particular metrics, primarily those that may be useful to gauge the profitability and the effectivity of the corporate.

Macroeconomic setting

As BOOT is a life-style retail chain, it’s working within the shopper discretionary sector and inside that within the attire retail trade. The gadgets that they’re promoting are non-essential, discretionary gadgets, so we’ve to know, which macroeconomic components can have an effect on the demand for such items and due to this fact on the monetary efficiency of the corporate.

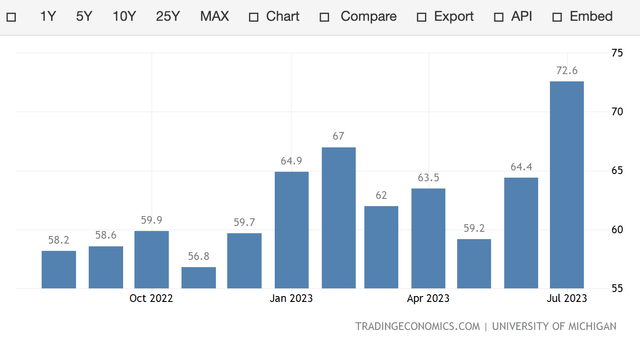

Shopper confidence

Shopper confidence gauges how optimistic or pessimistic the persons are about their monetary outlook and in regards to the general state of the economic system. Increased readings point out that persons are much less unsure about their prospects going ahead, and will point out that they’re extra prepared to spend bigger sums on non-essential gadgets. The chart beneath shows how the buyer confidence in the USA has developed over the previous 12 months.

U.S. Shopper confidence (tradingecnomics.com)

The development is obvious. In our opinion, this may increasingly result in an rising demand for BOOT’s merchandise and ultimately result in higher monetary efficiency.

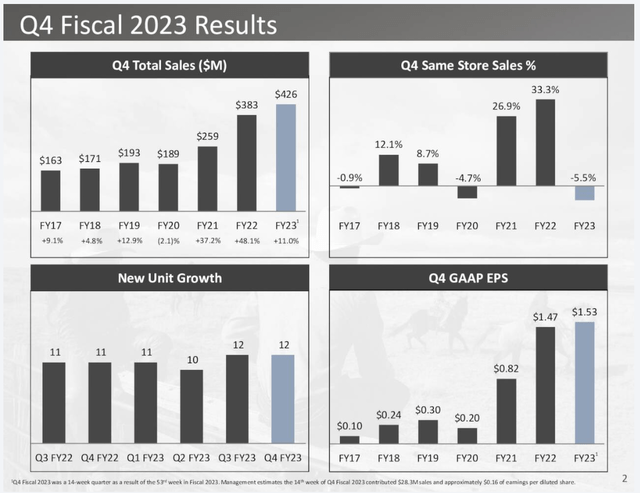

Vital to notice that through the previous years, regardless of the difficult macroeconomic setting, BOOT has managed to realize substantial progress. However we’ve to know, the place this progress is coming from. In most Q4s, we may see similar retailer gross sales progress as wells as progress because of opening new shops. Nevertheless, previously quarter there was really a decline in similar retailer gross sales, which may very well be a results of a softer demand as a result of state of the buyer. Alternatively, we imagine that as a result of bettering shopper confidence studying, the income and EPS progress could return to its long run pattern.

This fall outcomes (BOOT)

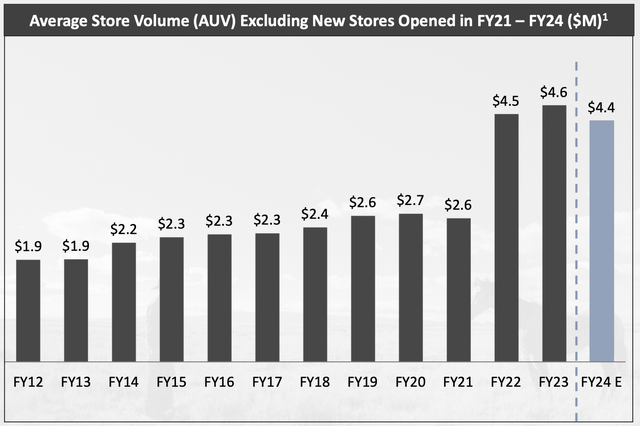

Returning to the longer-term could take a while, although. In accordance with the agency’s estimates in FY2024, the common retailer quantity is prone to stay about according to the 2023 and 2022 figures.

AUV (BOOT)

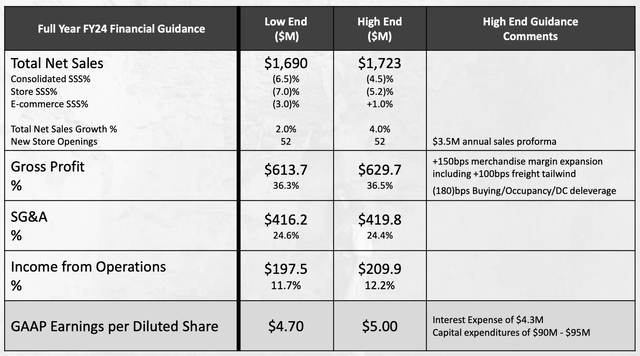

The next chart exhibits the agency’s detailed expectations for the next yr.

Steerage (BOOT)

Inflation

Whereas shopper confidence is impacting BOOT’s enterprise from the demand facet, inflation performs a extra essential function on the price facet. Elevated inflation ranges usually end in elevated prices, which the companies could not all the time be capable of totally move over to their prospects.

Nevertheless, with inflation moderating previously months, the corporate’s monetary efficiency could enhance within the coming months. Declining prices can have a optimistic affect on the event of the margins and due to this fact on the bottomline outcomes of the corporate. As proven on the desk above, the agency is anticipating a merchandise margin growth of as a lot as 150 bps, together with a 100 bps growth pushed by the freight tailwind.

All in all, from a macroeconomic perspective, we imagine that the inventory worth improve this yr was justified as a result of bettering outlook for the approaching quarters.

Firm particular components

Profitability

We now have already talked a bit in regards to the profitability of the agency within the earlier part, stating the expectations for the margin improvement within the close to time period.

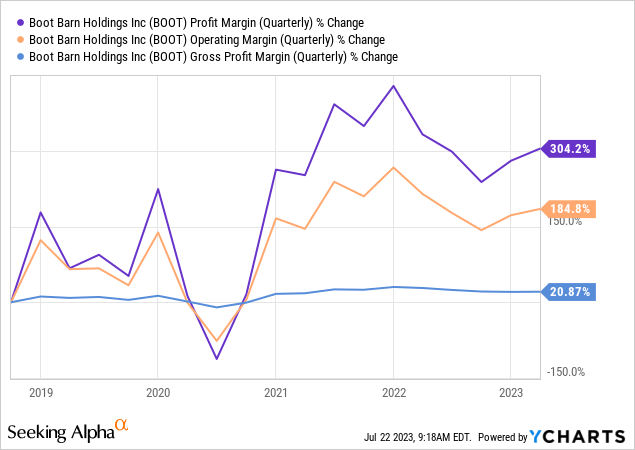

Allow us to have a look of how the corporate’s profitability has developed over time. The next chart exhibits how the agency’s margins, together with internet revenue margin, working margin and gross revenue margin, have improved over the previous 5 years. We’re undoubtedly happy to see the significant enchancment throughout all metrics.

Trying forward, we imagine that with the bettering macroeconomic setting, BOOT will be capable of keep and even increase its margins within the close to time period, simply because the agency’s administration expects.

Effectivity

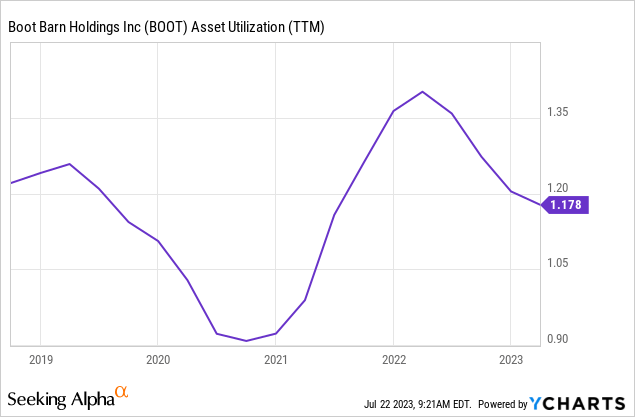

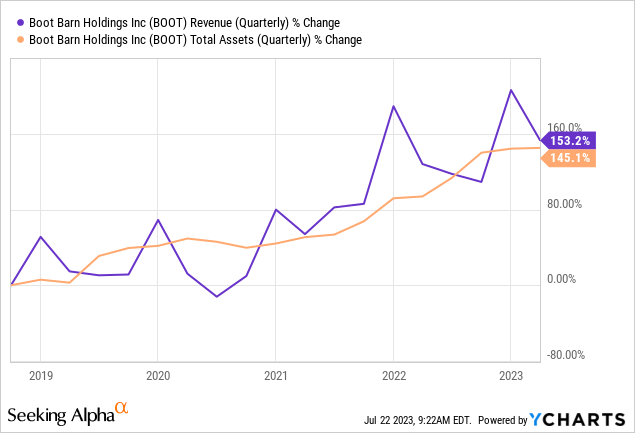

Asset utilization or asset turnover can be utilized to gauge a agency’s effectivity. It’s outlined because the ratio between income and complete property.

Whereas profitability has exhibited a transparent enchancment over time, the agency’s effectivity has been fairly risky and has not proven any enchancment over the previous 5 years.

If we take a look at the long run pattern of income progress compared with complete asset progress, we are able to see that the 2 roughly align. That is the explanation why effectivity has not improved. Basically, this isn’t a nasty signal. Having comparatively steady effectivity over time can show that regardless of the rising asset base, the agency continues to be capable of function effectively.

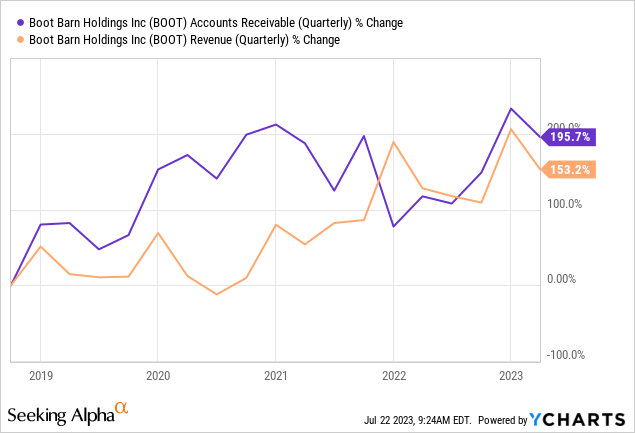

At this level, we usually like to try the accounts receivable, simply to see whether or not there may be any indication for potential manipulation of the gross sales figures. If accounts receivable improve at a a lot quicker fee than revenues, it is likely to be a sign that the agency has began promoting extra on credit score or has modified income recognition insurance policies, simply to take care of income progress. As the next chart exhibits, that is fortuitously not the case for BOOT.

Conclusion

Because the starting of the yr, the macroeconomic setting has improved, as indicated by the upper shopper confidence readings and the decrease inflation ranges. These developments can have a optimistic affect on BOOT’s monetary efficiency within the coming quarters and will justify the share worth improve seen year-to-date.

The agency’s profitability metrics additionally present a constant enchancment over time, and we imagine that this pattern could also be sustained as a result of bettering macroeconomic setting. The agency’s effectivity has fluctuated previously 5 years, however there isn’t a signal of long run deterioration.

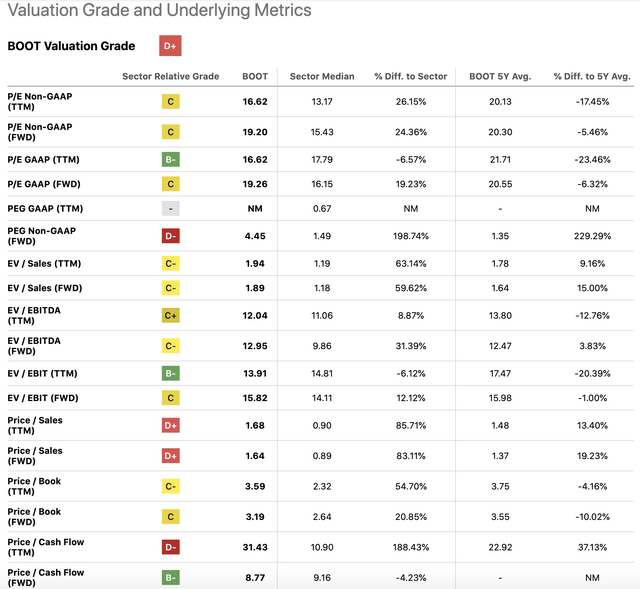

In accordance with a set of conventional worth multiples, BOOT’s inventory is promoting now at a premium in comparison with the buyer discretionary sector median. Alternatively, the inventory stays to be attractively priced in comparison with the corporate’s personal 5Y averages.

Valuation (In search of Alpha)

As a result of present valuation, we fee the inventory as “maintain”. We want to see the impacts of the optimistic macro adjustments materialising earlier than we may assign the inventory a “purchase” score.