Denis-Artwork/iStock by way of Getty Pictures

Thesis

On 06/27/2023, Origin Supplies, Inc. (NASDAQ:ORGN) introduced the manufacturing startup of the Origin 1 plant, as anticipated, making a promising step in direction of the execution of its preliminary venture. On 08/09/2023, the Q2 2023 earnings report was launched. The press launch additionally included details about an impactful change in Origin’s enterprise technique. The preliminary schedule falls no less than 18 months behind whereas financing and working uncertainties come up. The inventory plunged ~72% in two days, and Origin Supplies should now show that this time will imply enterprise whereas repelling criticism. Contemplating the above, a Maintain ranking is now fairer for Origin Supplies; regardless of the enticing valuation at present or decrease ranges, there’s additionally the necessity for Origin to regain belief.

Q2 2023 ER – The brand new actuality

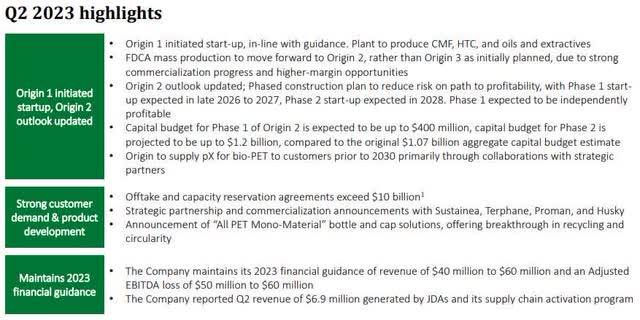

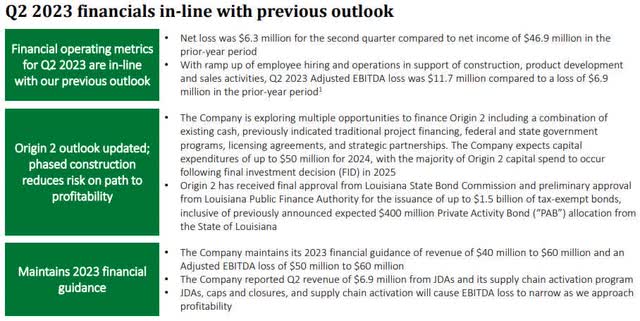

Sadly, a few of the dangers talked about in my earlier article and its final sentence proved sibylline. The Q2 2023 ER announcement introduced hypothesis and uncertainty to these unaware of the brand new venture. The corporate now plans a phased building of the Origin 2 plant, saying a substantial delay and a major rise within the capital price range. Moreover, the corporate will transfer FDCA mass manufacturing ahead to Origin 2, slightly than Origin three plant following the sturdy buyer demand. Origin claims that is the best way to derisk the venture and prioritize higher-margin product manufacturing. The CEOs sounded optimistic through the earnings name.

Origin Supplies Q2 2023 Earnings Presentation

The nice

- The Origin 1 plant began manufacturing as anticipated and is now up and operating.

- Strategic buyers, companions, and clients did not flee after the announcement, exhibiting that they’re in contact with the administration to type issues out relating to the restructuring of the preliminary venture.

- New partnerships introduced with Sustainea Bioglycols, Husky, Terphane, and Proman.

- The corporate intends to license Origin Know-how and co-develop crops with strategic companions, introducing a distinct income.

- The capability reservations elevated but for an additional quarter.

- The corporate launched the brand new, all-PET bottle caps enclosures, enterprise.

The unhealthy

- A inventory sell-off occurred amid the announcement of the venture revision exhibiting that some buyers did not like the very fact and bought instantly on the occasion.

- The brand new venture features a considerably elevated capital price range relating to Origin 2 completion, an 18-month delay within the manufacturing startup, and a 2-year delay in attaining profitability. Each forecast is worse in comparison with the preliminary plan.

- Regardless of statements about numerous various financing choices, there’s a increased chance of extra debt issuance and dilution.

The ugly

- The doable lack of belief within the administration will take time to get better. Buyers, companions, and clients will in all probability have second ideas about every part till tangible proof of a profitable execution seems.

- The corporate is technically valued at 0 (market cap =< internet money), but management did not come ahead to emphatically buy inventory offering a vote of confidence within the firm and the brand new technique.

Origin Supplies Q2 2023 Earnings Presentation

(Re)Valuation

At current, Origin’s worth is under zero. Its market cap is ~$192M whereas its Q2 2023 internet money is ~$205M. The market costs the Origin 1 plant, a big TAM, patents and mental property, companions, clients, and future potential at $0. In concept, one can purchase 100% of Origin’s inventory, obtain all of the money paid instantly again, plus its property, and preserve the change. The delay, the funding and the profitable execution of the brand new venture in all probability hassle the market. The valuation calculations of the earlier article are usually not correct now. Thus, a contemporary try to estimate future valuation needs to be set at 2028. In keeping with Origin’s 2028 forecast for Origin 2, a $600M income is anticipated. Including an estimated Origin 1 $100M income totals $700M. Making use of a P/S ratio of 1.13 based mostly on its present sector median in keeping with Looking for Alpha metrics would end in a $791M market cap. Slashing Origin’s forecasts to $400M income for Origin 2 would end in a $565M market cap. Making use of a premium 1.50 P/S ratio would end in a $1.05B and $750M market cap respectively. Contemplating these assumptions, new-coming buyers might multiply their invested capital by 2028. Potential licencing or co-production income isn’t included. Evidently, these estimates are extremely speculative.

Origin Supplies Q2 2023 Earnings Presentation

Conclusion

In a nutshell, I don’t often panic-sell except there’s a robust chapter chance when one wants to avoid wasting no matter they’ll. Such uncomfortable conditions simply occur, and the loss is inevitable. On the subject of binary bets, buyers should examine every case rigorously and resolve in the event that they consider within the venture or to not make the proper name. In Origin’s case, the introduced strategic adjustments are essential, and buyers have to rigorously look at if they need to maintain onto their positions whereas looking for constructive indicators to common down (or provoke a place) or promote, take their losses and transfer on. The market values the corporate under 0$ (market cap<internet money) and locations the brand new plan close to a trash can. Management and high executives ought to come ahead and purchase Origin’s inventory to reassure buyers that the time is correct and they’re assured the corporate will succeed. On a closing word, Origin’s story remains to be intriguing, regardless of the timeline enlargement and capital price range enhance. Therefore, I’ll stick with my place and intently watch future developments to resolve whether or not I enhance it.