skynesher

Chubb Restricted (NYSE:CB) supplies insurance coverage providers to companies and people, extremely current in property & casualty insurance coverage. I imagine the inventory is priced fairly modestly in comparison with the corporate’s very defensive earnings nature, constituting a buy-rating.

The Firm

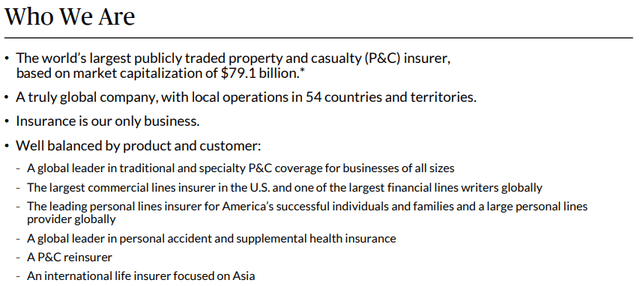

Chubb condenses the enterprise nicely within the firm’s Q2 earnings presentation:

Chubb Q2 Earnings Presentation

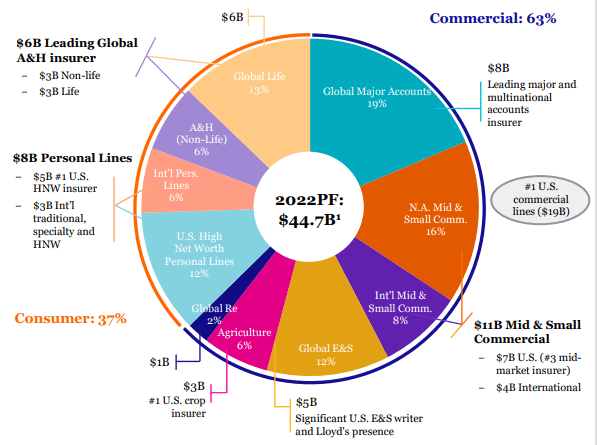

Additional, the corporate is current on a number of segments, as the corporate supplies a diversified providing of insurance coverage merchandise:

Chubb 2022 Investor Presentation

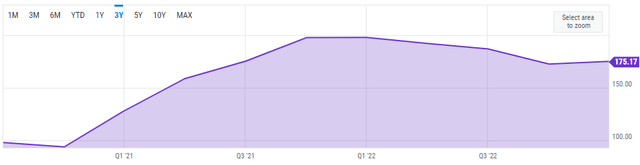

As Chubb is segmentally and geographically diversified firm, I imagine the corporate’s threat profile on a single vertical is kind of low – geographically, the corporate operates subsidiaries in 54 nations, and round 58% of the corporate’s revenues come from america. The low threat profile is additional demonstrated by a fairly steady long-term development within the inventory’s value, because the inventory has appreciated at a CAGR of round 10.6%:

Chubb’s 30-year Chart (Looking for Alpha)

On high of the appreciation, Chubb does pay out a small quarterly dividend, with a present estimated annual yield of 1.68%.

Financials

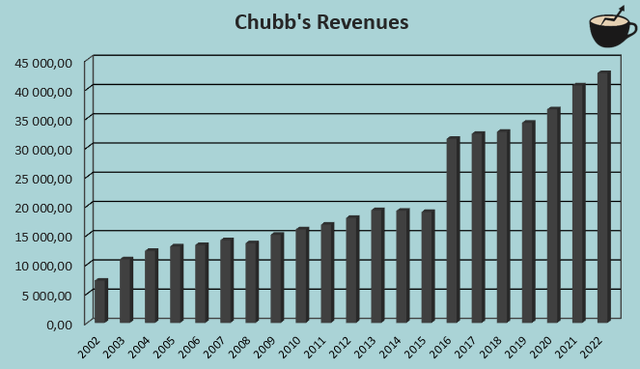

Chubb has had a fairly good income historical past, as the corporate’s compounded annual charge has been 9.3% from 2002 to 2022:

Creator’s Calculation Utilizing TIKR Knowledge

A very good quantity of the expansion has been natural, however not totally – for instance, the leap from 2015 to 2016 is said to ACE Restricted’s acquisition of Chubb for round $29.5 billion in whole. Associated to the acquisition, the shaped firm modified its identify to the present identify of Chubb Restricted from ACE Restricted.

The expansion doesn’t appear to have stopped but – though the expansion is generally non-organic as in 2022 Chubb acquired Asian insurance coverage companies for round $5.Four billion, the corporate’s development nonetheless appeared good at 24.9%. The expansion doesn’t appear to be altered by a difficult economic system – Chubb’s Q2 earnings name appeared to have a optimistic tone with CEO Evan Greenberg speaking additional momentum into the second half together with a double-digit EPS development.

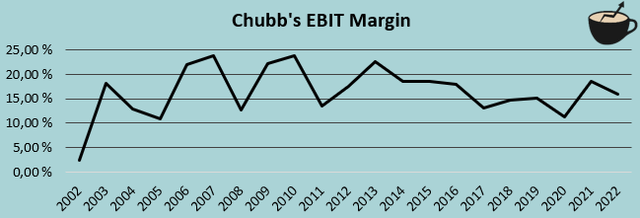

Chubb has saved EBIT margin within the firm’s historical past, with a median of 16.5% from 2002 to 2022:

Creator’s Calculation Utilizing TIKR Knowledge

The present trailing determine of 16.7% falls in step with the corporate’s historical past – Chubb appears to have the ability to hold a steady margin by way of correct pricing.

Chubb leverages some debt within the firm’s steadiness sheet – the corporate has round $14.5 billion of long-term debt, of which $0.7 billion is to be paid off inside a yr. In comparison with the corporate’s market capitalization of $84 billion, the quantity appears very cheap when additionally contemplating the corporate’s fairly steady money flows. The corporate additionally has a money steadiness of round $2.Three billion.

A Present Safehaven

As rates of interest hold climbing greater, the economic system is at a dangerous state. With the inflation nonetheless at 3.2% in July regardless of rising rates of interest and a GDP displaying mainly steady figures, the dangers of a recession are nonetheless excessive. The insurance coverage trade ought to be comparatively a safehaven if an financial downturn ought to come; insurance coverage premiums ought to nonetheless are available regardless of a worse economic system. Though the industrial phase representing 63% of revenues ought to be considerably riskier than the patron phase, I believe Chubb ought to be fairly protected.

S&P 500’s trailing EPS as of Q1/2023 is round 11.5% beneath the determine of Q1/2022:

S&P 500 EPS (YCharts)

In the intervening time, Chubb has already confirmed monetary efficiency within the turbulent economic system, as the corporate continued to enhance earnings in Q2 of 2023. I imagine that Chubb ought to be a comparatively protected decide for traders, rising attractiveness within the present state of affairs.

Valuation

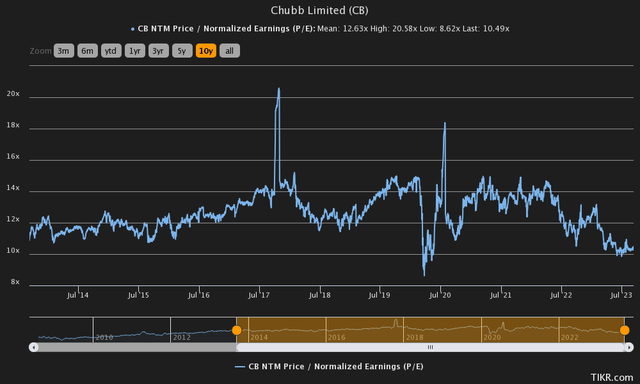

Though the corporate appears to have monetary historical past and a low threat profile, the corporate appears to be fairly low-cost in comparison with the S&P 500’s P/E of round 24.5 – Chubb is presently buying and selling at a ahead price-to-earnings ratio of 10.5, beneath the corporate’s ten-year common:

Chubb’s Ahead P/E Historical past (TIKR)

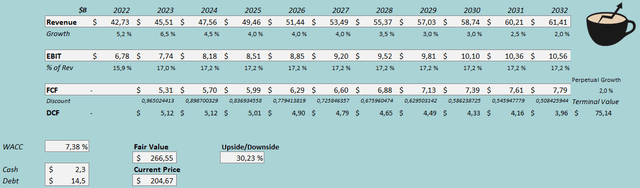

To additional analyse the valuation, I constructed a reduced money stream mannequin of Chubb. Within the mannequin, I estimate the insurance coverage supplier to have a development of 6.5% for 2023, signifying slight decreases within the second half – I imagine that is fairly conservative in comparison with the CEO’s feedback of continued momentum, however I like to remain on the conservative facet. Going additional, I estimate a development of 4% for a number of years that finally slows down right into a perpetual development of two% in steps. The expansion estimate is considerably beneath the corporate’s historic common of 9.3%, however because the DCF mannequin doesn’t account for acquisitions, I imagine the estimates are truthful.

As for the EBIT margin, I estimate Chubb to have a fairly steady future – I estimate a margin of 17.0% for 2023, with a rise to 17.2% in 2024 that stays because the margin into perpetuity. These estimates together with weighed common value of capital of seven.38% craft the next DCF mannequin situation with an estimated truthful worth of $266.55, round 30% above the present value:

DCF Mannequin (Creator’s Calculation)

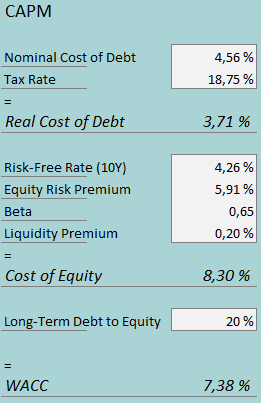

The used WACC is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

In Q2 of 2023, Chubb had $165 million in curiosity bills. With the corporate’s long-term debt steadiness of round $14.5 billion, Chubb’s rate of interest round 4.56%, used within the mannequin. As the corporate is included in Switzerland, Chubb appears to pay fairly a low tax charge, and guides for a tax charge between 18.5% and 19% for the present yr. As Chubb has traditionally had an affordable quantity of debt, I anticipate the debt-to-equity ratio to remain fairly steady at a ratio of 20%.

For the risk-free charge, I exploit america’ 10-year bond yield of 4.26%. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s estimate for the US, made in July. Tikr estimates Chubb’s beta to be 0.65. Lastly, I add a small liquidity premium of 0.2%, crafting a price of fairness of 8.30% and a WACC of seven.38%, used within the DCF mannequin.

Takeaway

On the present value, Chubb looks like a protected decide. Though the inventory shouldn’t have a really giant development, the present valuation appears to mirror the next threat profile than I imagine the inventory has – Chubb has a P/E ratio that’s round 40% decrease than the S&P 500 in whole, though Chubb’s systemic threat ought to be decrease than the indexes. For that reason, I’ve a buy-rating for the inventory.