Darren415

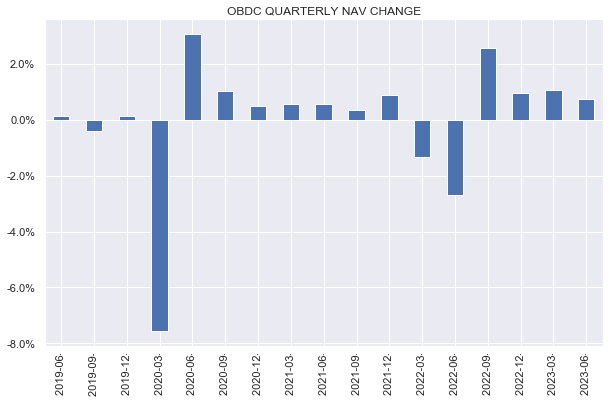

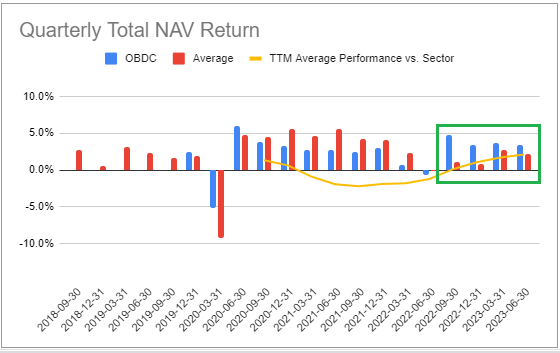

On this article we check out the Enterprise Improvement Firm Blue Owl Capital Corp (NYSE:OBDC). The corporate has prolonged its terrific run of efficiency with a +3.4% whole NAV return in Q2.

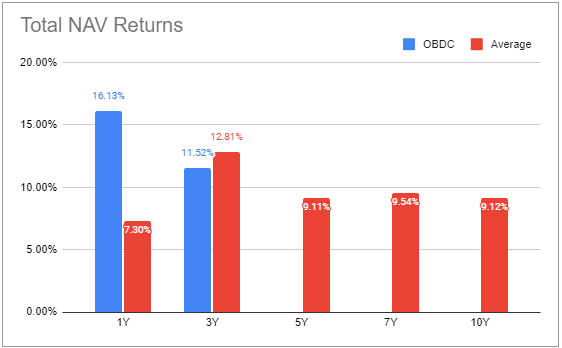

Over the previous 12 months the corporate delivered an distinctive +16.1% whole NAV return, outperforming the median BDC in our protection by 8.4%.

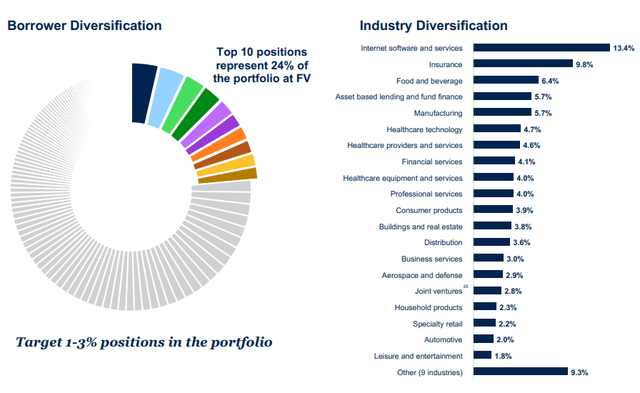

OBDC targets debtors within the higher middle-market house with a weighted-average EBITDA of $186m within the portfolio. Its prime sectors are software program, insurance coverage, healthcare and others

Blue Owl

OBDC trades at an 11.8% yield and a 11% low cost to e book. Its internet earnings worth yield of 14.15% is 0.45% above the sector common.

Quarter Replace

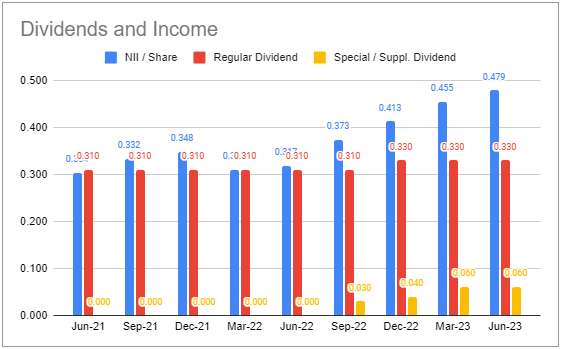

Internet earnings rose by over 5% to $0.48. That is under the double-digit tempo we noticed over the earlier three quarters. The stabilization is due primarily to the slowdown in the tempo of short-term price rises – a improvement we’re seeing throughout the sector.

Systematic Earnings BDC Software

OBDC declared the identical base dividend of $0.33 however hiked the supplemental by a penny to $0.07 for a complete dividend of $0.4. The $0.07 supplemental is half of the surplus dividend ($0.48 internet earnings much less $0.33 base dividend) which is what the corporate targets to pay out. OBDC additionally maintains a spillover of $0.19.

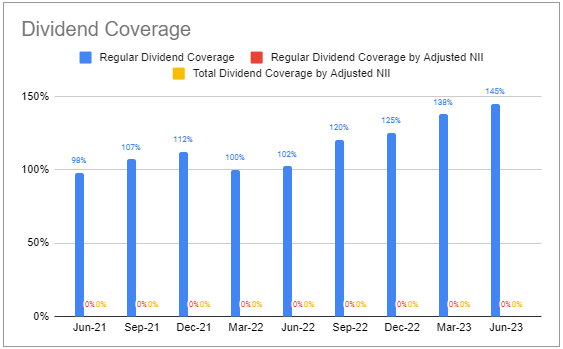

Base dividend protection is a really excessive 145% whereas whole dividend protection is 119%.

Systematic Earnings BDC Software

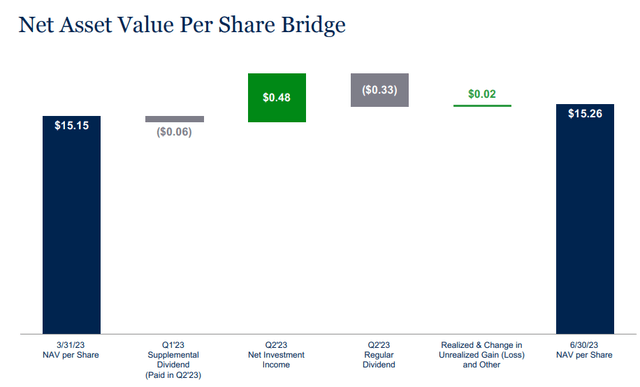

The NAV rose by 0.7% – nicely above the sector common stage which got here in barely above zero. That is the fourth straight NAV rise by the corporate – there have been solely two quarters of destructive NAV progress within the post-COVID interval.

Systematic Earnings

The rise within the NAV was largely resulting from retained earnings. That is the very best NAV stage because the firm’s IPO in 2019.

Blue Owl

By the top of Q2, the corporate had repurchased a complete of $75m shares at a weighted-average worth of $12.22, producing small further NAV returns. There may be extra capital left for repurchases nevertheless administration have indicated they’re much less doubtless to make use of it at present valuation ranges.

Earnings Dynamics

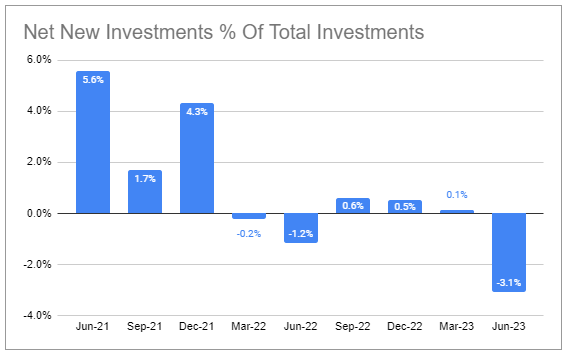

Internet new investments have been destructive as repayments exceeded fundings.

Systematic Earnings BDC Software

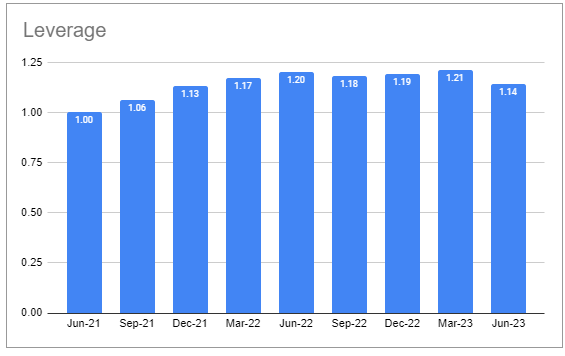

Consequently leverage ticked decrease and stays firmly within the goal vary of 0.9 – 1.25x.

Systematic Earnings BDC Software

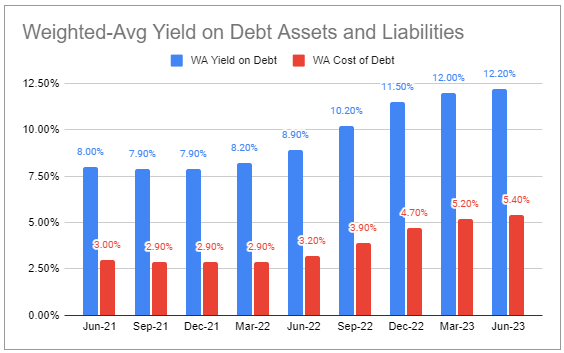

Portfolio yield ticked up by 0.2% to 12.2% as did curiosity expense to five.4%. Internet internet this can be a acquire for total internet earnings as about half of the fund’s whole belongings are unleveraged. The yield unfold of 6.8% is according to the sector median stage.

Systematic Earnings BDC Software

Administration additionally indicated that whereas spreads have compressed they continue to be wider than they have been 18-months in the past which continues to supply a tailwind to internet earnings.

Portfolio High quality

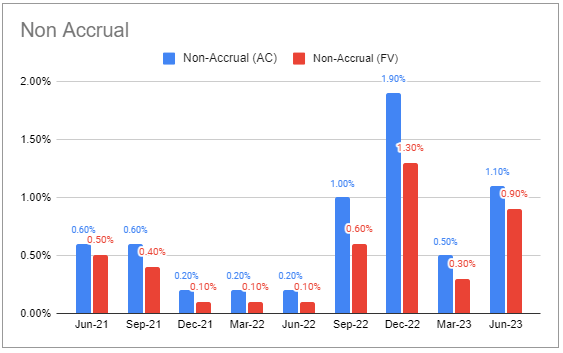

One portfolio firm was added to non-accrual in the course of the quarter, for a complete of three. On a fair-value foundation this comes out to 0.9% – under the sector common.

Systematic Earnings BDC Software

PIK got here in at 13.6% – nicely above the sector common stage. Administration have indicated that greater than 90% of PIK earnings comes from offers originated as PIK for firms that need further flexibility. OBDC PIK offers sometimes have a 2-Three 12 months restrict.

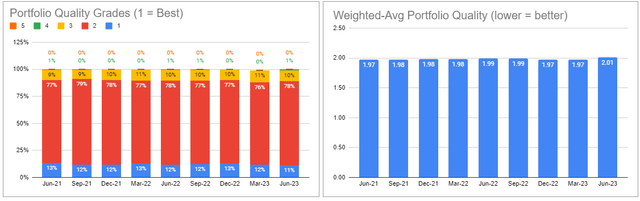

Portfolio high quality, as gauged by inner rankings, fell barely nevertheless that was primarily resulting from firms falling out of the very best score bucket to the following score bucket.

Systematic Earnings BDC Software

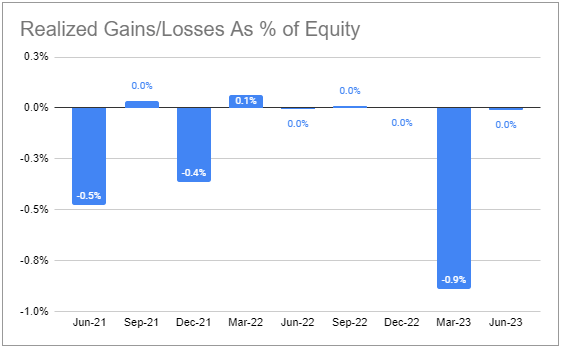

There was a really small internet realized loss which rounded right down to zero.

Systematic Earnings BDC Software

Administration stated they anticipate curiosity protection to maneuver in the direction of a mid-1x stage subsequent 12 months. 7 names within the portfolio have curiosity protection under 1 which is anticipated to rise to 12. On a share foundation it really works out to round 5% in line with administration.

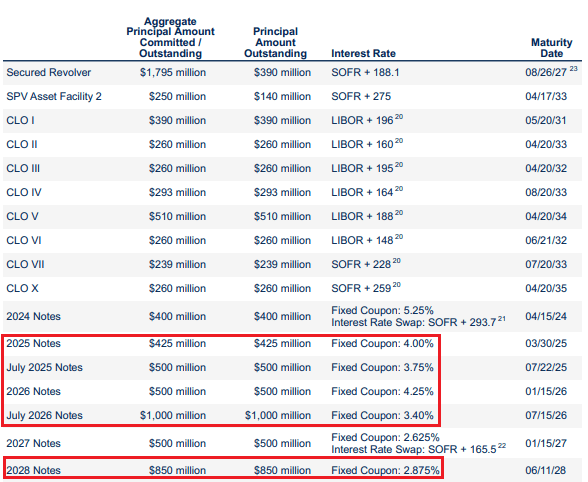

The corporate maintains an above-average stage of floating-rate debt which has been a headwind to internet earnings. Its low-coupon bond maturities (highlighted under) solely begin in 2025 which is an effective place to be. Additionally, its 2024 bond, which is swapped to a floating price, will mature in Q2 subsequent 12 months which can be excellent news as its curiosity expense is north of 8%. The corporate ought to be capable to refinance it at a decrease fastened price because the yield curve stays inverted.

Blue Owl

Valuation and Returns

The corporate continued its streak of outperformance with a fourth consecutive outperforming quarter.

Systematic Earnings BDC Software

It has underperformed the sector barely over the previous Three years however has completed exceptionally nicely over the previous 12 months.

Systematic Earnings BDC Software

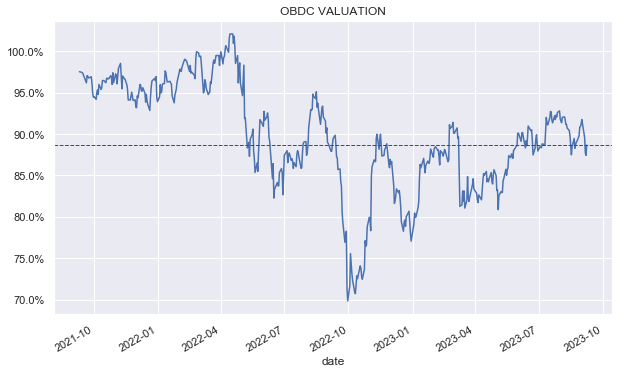

The worth has tended to commerce under the NAV.

Systematic Earnings

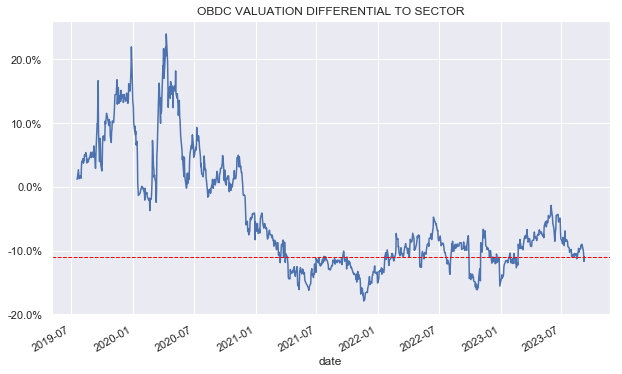

From round 2021, OBDC went from buying and selling at a premium to a reduction to the sector common valuation. It stays at a reduction of round 11% to the sector (89% vs. 100% sector common valuation).

Systematic Earnings

The corporate’s shift to outperformance alongside a under common valuation makes the inventory engaging in our view.

Stance And Takeaways

We now have been build up our OBDC place since Q1, as quickly as we observed its shift to outperformance and powerful portfolio high quality. Since then it has completed very nicely however has remained at a sub-par valuation – a superb mixture so as to add to the inventory. The inventory stays Purchase-rated in our Excessive Earnings Portfolio.