josefkubes/iStock Editorial by way of Getty Photographs

Having survived a difficult setting final 12 months amid COVID-driven provide constraints and outsized uncooked materials inflation pressures, issues are lastly on course for Japanese auto producer Nissan Motor (OTCPK:NSANY). In its most up-to-date quarter, Nissan posted sharply larger working earnings and earnings development YoY, helped by easing constraints and continued yen depreciation. Anticipate extra of the identical by way of this fiscal 12 months as the provision/demand dynamic continues to revert, helped by resilient US auto demand and a continued manufacturing restoration.

Additionally serving to the chance/reward are the continuing United Auto Employees (UAW) strikes within the US, which threatens to skew competitiveness in its favor (together with different Asian producers like Hyundai Motor (OTCPK:HYMTF)) over the long term. In the meantime, the relative lack of China earnings contribution (vs. different producers by way of their equity-method JVs) implies restricted contagion threat ought to the financial system deteriorate.

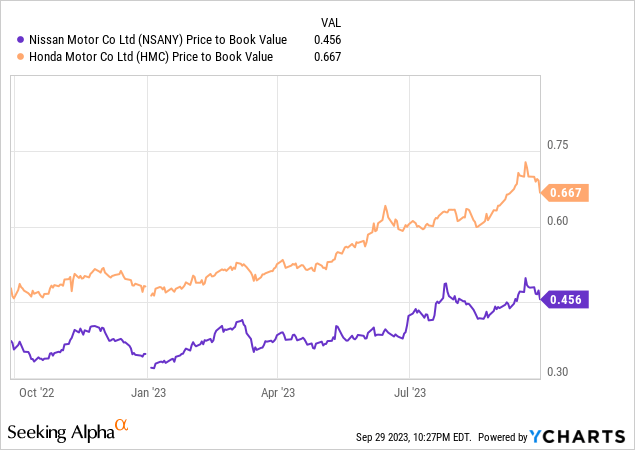

To be clear, among the positives are already within the worth – Nissan inventory is having one in every of its finest years on report at +60% year-to-date, effectively forward of the TOPIX index. But, Nissan nonetheless trades at a steep ~50% e book worth low cost (vs. key peer Honda’s ~30% low cost to e book) regardless of retaining robust money era capability. The mid-term plan later this 12 months presents a possible upside catalyst, together with upsized capital returns (dividend or buybacks) amid reform pressures from the Tokyo Inventory Trade.

UAW Strikes Increase Close to-Time period Earnings Prospects

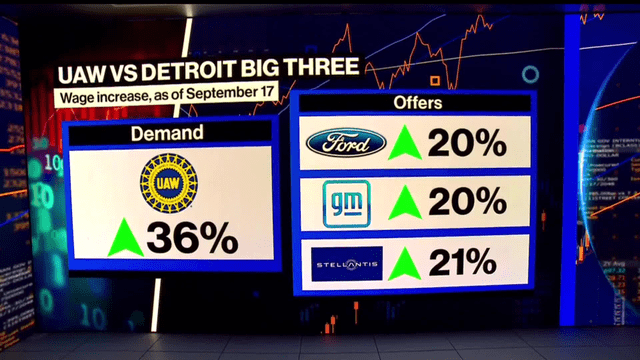

Coming off a strong begin to the fiscal 12 months, Nissan seems to be set for an additional earnings increase from the escalating UAW union dispute, masking staff of the Detroit-Three US automakers (Ford (F), Normal Motors (GM), and Stellantis (STLA)). Because the strike motion commenced earlier this month, the union has rejected a 21% pay hike from STLA (deemed a ‘no-go’ by President Shawn Fain) and appears set to rebuff the same 20% provide from Ford. Given how far aside either side are proper now, count on a drawn-out strike, maybe even longer than the final 40-day strike at GM in 2019.

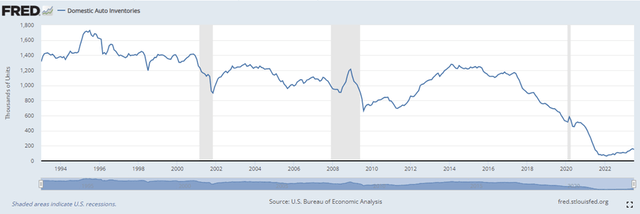

Whereas the preliminary UAW strike gained’t hit automobile output significantly exhausting, additional escalation will imply as a lot as 55-65okay of misplaced manufacturing per automaker. So, relying on the size and severity of those strikes, provide may effectively tighten by >500okay automobiles in a worst-case state of affairs (not together with post-strike disruptions). Given home auto inventories are already on the decline and vendor inventories (~2m in September) are additionally set to sluggish, this bodes effectively for firmer US auto pricing going ahead.

St Louis Fed

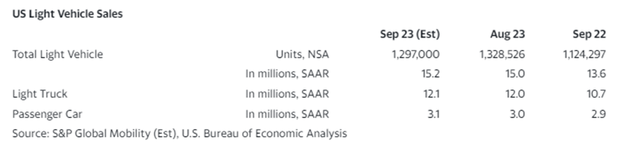

As for the demand facet, the surge of latest mild automobile gross sales within the US (+17% YoY to 1.3m items; one other ~1.3m projected for September) signifies a robust financial system regardless of the Fed’s prolonged financial tightening. Whereas improved new automobile provide post-COVID has helped to soak up some ‘pent-up’ demand, the UAW strikes ought to once more tighten the supply-demand steadiness by way of year-end. For the likes of Nissan, longer UAW strikes current a chance to seize share and increase its export earnings this fiscal 12 months. Even when a slowing financial backdrop materializes (because of the lagged affect of upper rates of interest), demand for lower-priced automobiles will acquire possible momentum on the expense of higher-end choices, benefiting Nissan’s concentrate on worth.

S&P

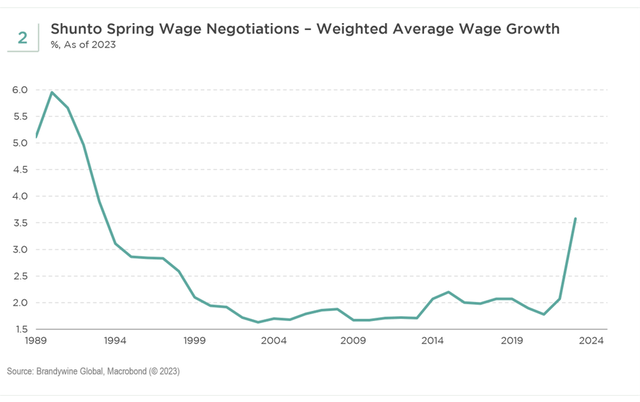

In the meantime, home auto gross sales are additionally shaping up properly – total Japan auto gross sales rose +17% YoY in August and may proceed to realize momentum as report Spring wage hikes increase client demand. Both means, the setup for Nissan seems to be nice heading into its subsequent quarterly earnings reviews.

Macrobond

Constructing on Manufacturing Benefits for the Mid to Lengthy-Time period

The largest upside to Nissan, for my part, is over the mid to long run. Managing labor pressures is vital, and going by how vital wage pressures have been on the US-based Detroit-3 (be aware the UAW is at present demanding ~36% vs. the >5% hike for Japanese autos), their incapability to take action will have an effect on their relative competitiveness going ahead. Even assuming we see the UAW settle someplace within the center (possible within the ~30% vary over the subsequent 4 years), plenty of that can nonetheless come out of margins, so it’s exhausting to see the US pricing setting not turning into extra disciplined going ahead. Nissan’s restricted US manufacturing footprint can be an enormous benefit right here – its presence in lower-cost areas like Mexico, the place it already has the dimensions, means it has a head begin on the US automakers’ ‘near-shoring’ push within the coming years.

Bloomberg

Poised to Capitalize on UAW Disruptions

Nissan’s inventory has efficiently climbed final 12 months’s wall of fear to emerge as one of many best-performing auto names this 12 months. On the one hand, the shortages that weighed on earnings final 12 months have begun to reverse. Alongside the aggressive increase from additional yen devaluation, Nissan has seen larger automotive earnings and the market has rightly rewarded the inventory. That mentioned, Nissan nonetheless trades in a steep ~50% e book worth low cost (far under its Japanese friends), so it’s not at all overvalued.

From right here, the US market will probably be key – amid a resilient demand backdrop, UAW-driven manufacturing disruptions have given international producers like Nissan a window of alternative to realize incremental market share near-term. And within the mid to long run, a wider labor price differential vs. the Detroit-3, helped by Nissan’s lower-cost manufacturing base in Mexico and Japan, bodes effectively for its earnings energy. The dearth of China publicity additionally means much less draw back potential because the area continues to see demand weak spot and protracted pricing strain, significantly on EVs. Within the meantime, buyers receives a commission an honest ~3% dividend yield (with ample room for a hike) to attend.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.