bin kontan

Among the best earnings shares that passive earnings traders can discover within the high-yield market proper now’s Rithm Capital (NYSE:RITM), in my opinion.

The mortgage belief is well-diversified, is actively engaged on including new income streams and simply comes out of a really worthwhile and profitable third quarter. The Sculptor Capital transaction is anticipated to shut in November, on revised time period.

For the second time in a row, Rithm Capital has reported robust dividend protection resulting from non-recurring gross sales of extra Mortgage Servicing Rights [MSR]. The dividend yield of 11% is just not solely coated by distributable earnings, however has a really excessive margin of security and has room to develop.

The inventory is now promoting at an exaggerated 26% low cost to e-book. Sturdy Purchase.

My Score Historical past

The creation of a brand new income stream, ensuing from the acquisition of Sculptor Capital, was one cause for me to suggest the mortgage REIT to passive earnings traders a few months again. Persistently excessive dividend protection pushed by extra MSR gross sales and potential for dividend progress proceed to make RITM inventory a Sturdy Purchase.

Sculptor Capital Deal Set To Shut In November

Rithm Capital introduced in July that they deliberate to amass different asset supervisor Sculptor Capital for $639 million. The asset supervisor had greater than $34 billion of AUM and the acquisition provided diversification potential for Rithm Capital in addition to an entry into the third-party capital administration enterprise.

The acquisition solely just lately was authorized by each firms’ boards of administrators after Rithm Capital raised its bid to $12.70 per share, representing a premium of 13.9% over the preliminary bid of $11.15 per share. The deal is anticipated to shut in November.

Mortgage Servicing Rights And Dividend Protection

Within the final two quarters, Rithm Capital’s dividend protection ratio has considerably improved as a result of mortgage REIT promoting extra MSR.

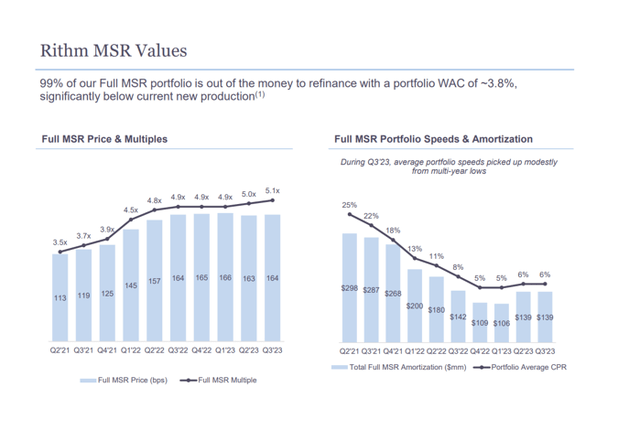

MSR are a special-kind of mortgage-related funding as a result of their values (valuation multiples) have a tendency to extend during times of steepening rate of interest curves.

MSR grow to be extra invaluable throughout rising-rate environments due to slowing prepayment speeds which in flip ends in increased servicing earnings.

Multiples for MSR have elevated considerably within the final yr because the central financial institution moved aggressively to include four-decade excessive inflation charges.

After actual property and different securities, MSR had been the second largest asset class on Rithm Capital’s steadiness sheet, with a good worth of $8.7 billion.

MSR Values (Rithm Capital Company)

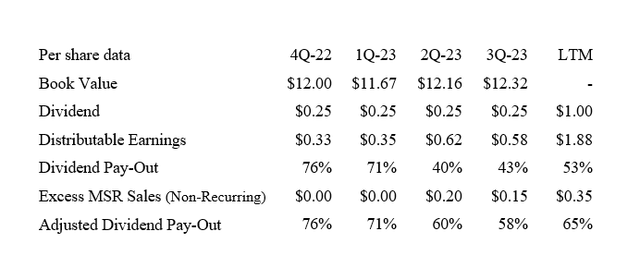

Rithm Capital earned $0.58 per share in distributable earnings within the third quarter and the belief paid out simply 43% of those earnings as dividends, primarily resulting from new gross sales of extra MSR. These MSR gross sales boosted distributable earnings by $0.15 per share within the third quarter. The payout ratio within the final twelve months was 53%, so I proceed to fee Rithm Capital’s 11% dividend yield extremely.

Adjusting for the affect of extra MSR gross sales in each 2Q-23 and 3Q-23, since they’re non-recurring, the payout ratio nonetheless seems fairly good: Rithm Capital’s adjusted dividend payout ratio was 58% in 3Q-23 and 65% on an LTM foundation. Thus, the mortgage belief’s dividend, with or with out incremental MSR gross sales transferring ahead, ought to be fairly protected.

Pay-Out Ratio (Creator Created Desk Utilizing Belief Data )

Promoting At An Unreasonable BV A number of

Promoting MSR at a time when MSR multiples are prolonged is an efficient strategic choice. I need Rithm Capital to promote such belongings at or close to the height of the current rate-hiking cycle.

The opportunity of the central financial institution reducing rates of interest subsequent yr has weighed on Rithm Capital’s valuation a number of just lately. MSRs are inclined to lose worth throughout falling fee durations, suggesting that the current compression in Rithm Capital’s a number of is pushed by uncertainty concerning the steepness of the yield curve transferring ahead.

With that being mentioned, I feel that passive earnings traders are exaggerating the scenario a bit right here as Rithm Capital has a diversified actual property portfolio and is protected in opposition to various doable rate of interest paths by way of investments and various completely different mortgage belongings corresponding to actual property securities, MSRs and single household properties.

Moreover, Rithm Capital has traditionally deployed capital opportunistically, suggesting, for example, that MSRs might grow to be enticing once more as an anti-cyclical funding for the mortgage belief throughout the subsequent downcycle in charges.

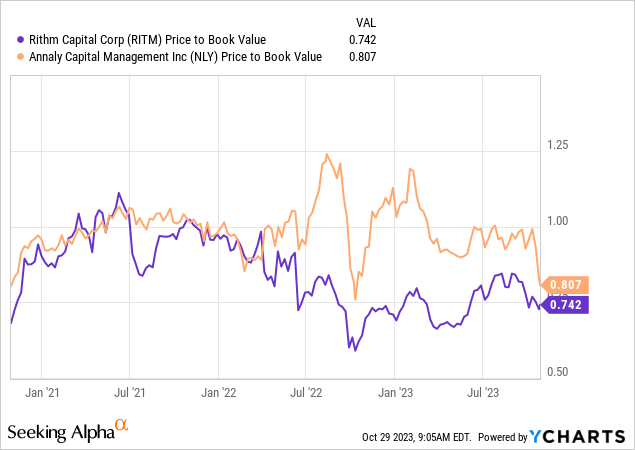

Presently, the 26% low cost to e-book worth for Rithm Capital appears fairly excessive and unjustified (once more), significantly as a result of a mortgage belief like Annaly Capital Administration (NLY), which additionally owns MSR, has a a lot smaller low cost of 19%, regardless of being much less diversified than Rithm Capital and posting a considerably increased payout ratio.

Rithm Capital has not solely room to develop its dividend (versus Annaly Capital Administration), but additionally a a lot better threat/reward relationship resulting from its extra diversified mortgage/actual property funding technique.

Quantitative Easing And MSR Publicity: A Key Danger For Rithm Capital

Rithm Capital has positioned itself for a wide range of rate of interest environments as its investments embody MSR in addition to loads of conventional mortgage belongings corresponding to actual property loans and actual property securities.

As soon as the central financial institution turns again to quantitative easing (which I anticipate for 2024) and brings long-term curiosity down, I might anticipate rising stress on the valuation of Rithm Capital’s sizable MSR investments.

Taking into consideration the belief’s giant extra dividend protection even when excluding MSR gross sales, I feel that the dividend as such might be sustainable.

My Conclusion

The third quarter was a great quarter for Rithm Capital and the mortgage REIT simply introduced that it’s finalizing the acquisition of Sculptor Capital at a better value, however which provides another asset administration earnings stream to its diversified portfolio of mortgage belongings.

The acquisition of Sculptor Capital was excellent news for passive earnings traders, however what was even higher information was that the dividend payout ratio was simply 43% (58% adjusted for non-recurring MSR gross sales), suggesting that the extreme low cost to e-book worth is just not actually justified, and neither are issues concerning the belief’s 11% dividend yield. Sturdy Purchase.