Compassionate Eye Basis/Steve Smith/DigitalVision by way of Getty Photos

Funding Thesis

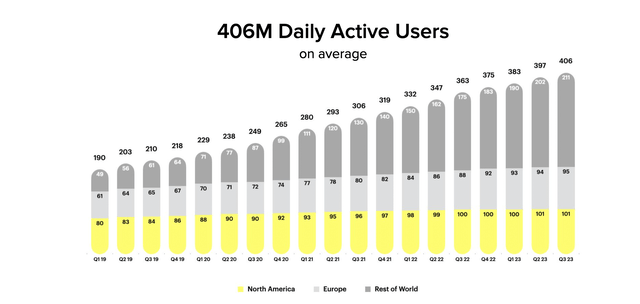

Snap Inc. (NYSE:SNAP) owns probably the most well-liked social networking apps on the planet. As of its Q3 2023 earnings report, it has 406 million each day energetic customers (DAUs) and 750 million month-to-month energetic customers (MAUs) in over 25 nations. Snap estimates that over 75% of individuals aged 13-34 use its app, and 90% of individuals aged 13-24. Snap is rising at a decent fee and steadily gaining customers with its enjoyable and easy-to-use app that helps individuals around the globe keep linked.

Snapchat DAUs (SNAP Investor Relations)

Snap’s first objective to drive development is including customers. They see an enormous world alternative to proceed including customers, as evidenced by the principle development in DAUs and MAUs coming from worldwide growth. I imagine this development will proceed, and so does Snap administration.

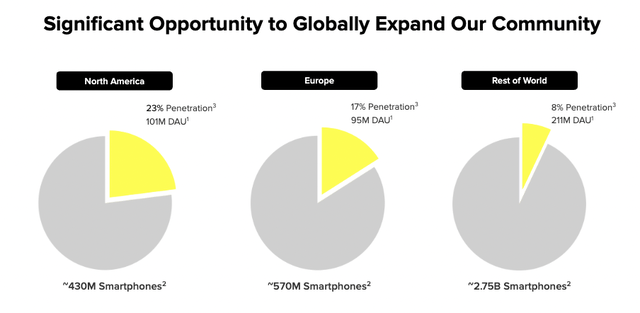

Snapchat World Alternative (SNAP Investor Relations)

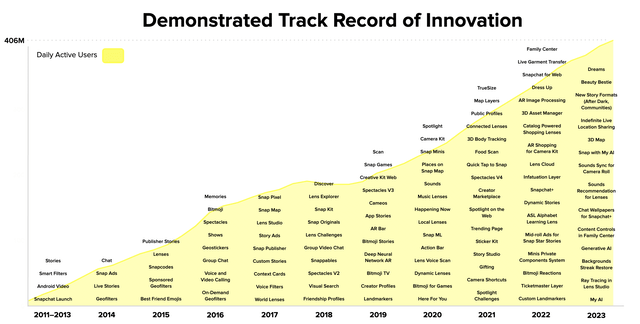

Snap’s second objective is innovation and monetization. It’s always innovating its product choices to raised monetize its platforms. Snap struggled to take care of profitability final yr however has proven higher indicators this yr. It has a small market share within the advert market that it’s trying to develop because it grows customers and app utilization. Highlight, Snap’s model of TikTok or Reels, noticed a 200% improve in whole time spent watching Highlight content material in Q3.

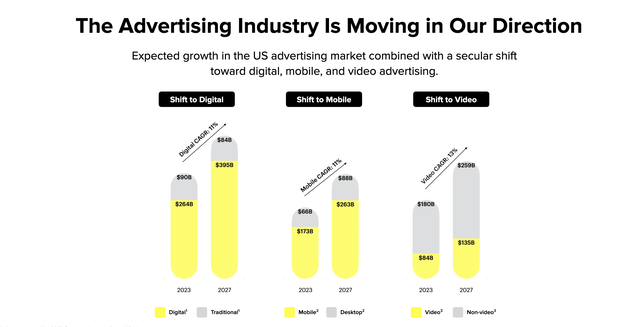

This reveals me that Snap is executing on innovation. It has an enormous whole addressable market (TAM) and has simply begun to monetize its 750 million and rising MAUs. Snap believes that anybody with a smartphone or who’s current on present social networking apps (like Fb, Instagram, or TikTok) is a possible person. This solely helps administration’s case that the advert market is shifting of their path, towards digital, cellular, and video promoting.

Snap’s Advert Business Projections (SNAP Investor Relations)

I imagine that Snap will use each of those catalysts, world development, and platform monetization, to develop the corporate and return capital to shareholders. The inventory at the moment trades at slightly below $10 a share with a market capitalization of simply over $16 billion. Snap has constructed an enormous platform with a powerful person base and model consciousness.

Yr after yr, Snap has delivered new merchandise and know-how to app customers. Administration has diversified the platform and is now targeted on profitability to spark share value development. Snap has been round for over 10 years now and reveals no indicators of slowing down. The enterprise is just getting larger and providing extra with Snapchat Plus, augmented actuality, Highlight, lenses, and extra.

Snap’s Innovation Historical past (SNAP Investor Relations)

I imagine that Snap has a powerful maintain on the youthful technology, as they love its digital platform and staying linked with associates via prompt footage and movies. As its present customers age and new customers attain their teenage years, they are going to constantly see extra customers on its platform.

I like SNAP as a long-term funding as a result of it’s a dominant participant within the social media business. I imagine that world development and platform monetization will drive the inventory larger. I do know that it has been a tough trip for shareholders the previous two years, however I believe that purchasing in now for a small place might be an excellent funding for long-term development traders.

Fundamentals

The issue that has haunted Snap for years is being profitable. It’s nonetheless not worthwhile on a GAAP foundation however is lastly exhibiting income on non-GAAP EPS, except for a blip final quarter. Snap has barely any free money circulate (FCF) available, with solely $2.three million, spending most of it on inside development and M&A.

FCF peaked at $221 million in 2021 and has shrunk since then, as advert spending pulled again. Nevertheless, advert spending has proven indicators of life once more, with constructive development up to now quarter and rising common income per person (ARPU).

FCF and money from operations will likely be two key numbers to look at going ahead, as they are going to point out whether or not:

- Snap’s monetization methods are working.

- Advert spending is rising.

- Site visitors is rising.

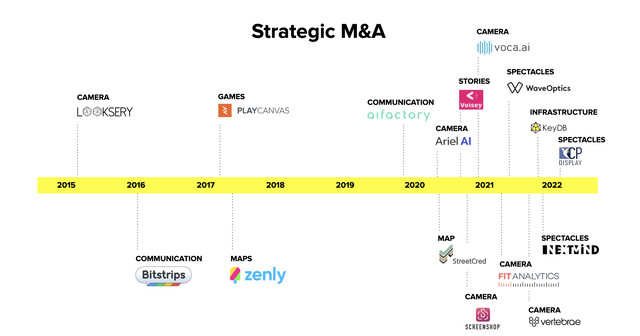

The agency might want to begin producing extra cash to proceed to spend money on itself and compete with opponents’ know-how. Analysis and improvement (R&D) and mergers and acquisitions (M&A) will drive the corporate’s future and its means to realize customers. These are the methods Snap has used up to now, with some ventures working rather well and others failing utterly. Both approach, they’re needed steps to proceed to innovate and compete.

SNAP Strategic M&A (SNAP Investor Relations)

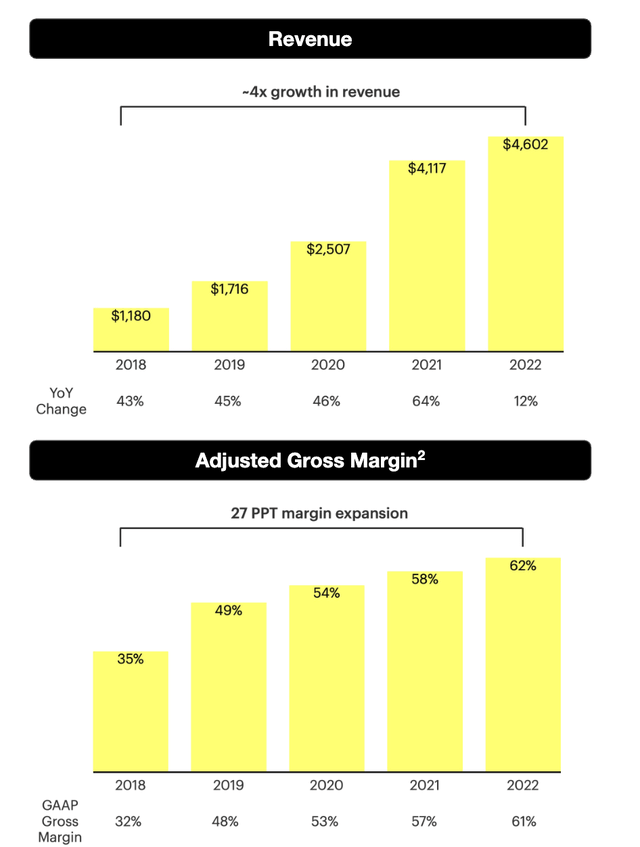

The great development we have been seeing with Snap is that gross margins have been trending up. Snap is changing into extra environment friendly in working its operations, maximizing its workforce and spending. GAAP gross margins got here in at 61% final yr, which is almost double what they have been in 2018 (32%).

If Snap can proceed to develop gross sales and concentrate on environment friendly development, with economies of scale making the method simpler, I just like the inventory’s future. It has executed nicely up to now, and I imagine its loyal app customers are right here to remain.

Snap’s Income and Gross Margins (SNAP Investor Relations)

Snap’s debt had been rising into 2022 earlier than the financial system began to weaken. Since March 2022, the agency has began to handle its sizable debt ranges by paying off $60 million up to now 18 months. Most of its debt is now long-term, over the subsequent 5-10 years, however it’s at all times one thing to control when an organization has not but proven indicators of constant profitability.

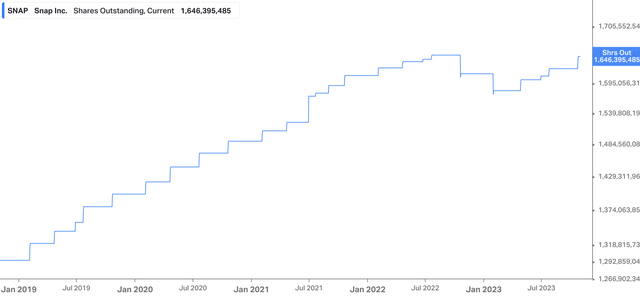

With Snap, we additionally wish to control shares excellent, that are up 26% within the final 5 years. Administration has been elevating cash/fairness to assist finance development. I had no drawback with this when the inventory value was $60 or larger, however at $10 a share, I don’t suppose diluting shareholders extra is the suitable reply.

SNAP Shares Excellent (SNAP Investor Relations)

Total, Snap just isn’t good. It’s nonetheless younger and in its development section. It must take dangers and spend cash to proceed rising and progressing. It’s turning its focus towards profitability, and I imagine these efforts will repay. Advert spending will come again, and Snapchat+ looks like one of many methods it plans to monetize its platform.

Value Targets & Valuation

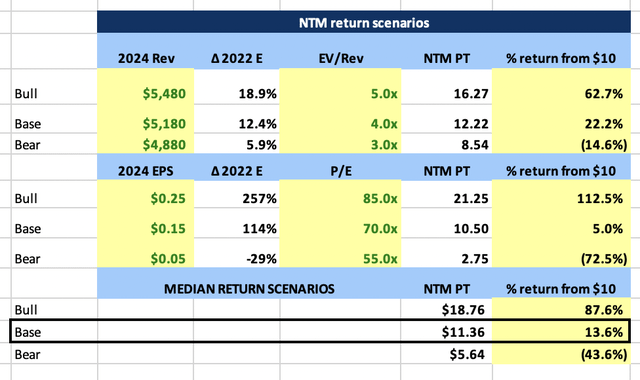

Snap is difficult to worth on a price-to-earnings (P/E) a number of as a result of it is just non-GAAP worthwhile and has simply began to be worthwhile. It at the moment trades at a loopy 142x 2023 P/E, but when it sees EPS develop because it hopes, that a number of will come down. On a 2024 ahead EPS, the inventory trades at 66x. Utilizing the inventory’s estimated valuation together with analyst estimates, we will create a subsequent twelve-month (NTM) value goal situation desk utilizing each P/E and enterprise worth to gross sales (EV/S).

The EV/S a number of has come down for Snap up to now few years and appears to have discovered a spread that it’s buying and selling in for now. Our value goal desk reveals us that the reward is huge, however so is the chance when investing in Snap.

SNAP NTM Value Goal Situation (Writer Calculations Primarily based On Analyst Estimates From Information on Koyfin)

The chance-to-reward (R:R) ratio at $10 a share just isn’t nice at 2x, however the probability of 80% plus returns in our bull case is interesting to development traders keen to tackle some danger, as you’ll be able to see above.

Traders needs to be conscious that SNAP is down 88% from its all-time excessive (ATH), so a number of danger has already been flushed out of the inventory. The inventory value has been consolidating between $eight and $12 a share, and I believe underneath $10 is a good place for development traders who use and imagine within the app to park a sliver of cash for development. SNAP presents an attention-grabbing alternative and shouldn’t be neglected.

Danger

The primary danger to handle is the corporate’s lack of profitability up to now. When rates of interest have been near zero, Snap might tackle as a lot debt because it needed to attempt to spark development. Now, everybody cares about earnings and profitability, and that has precipitated Snap to chop spending and assess its selections.

Advert spending additionally slowed, which didn’t assist the corporate’s profitability ranges. Advert spending tends to be cyclical, which will even have an effect on gross sales and the inventory. Relying on financial situations, different corporations will likely be roughly prone to spend on advertising. Snap is a good place to market with thousands and thousands of customers, however there need to be prospects keen to spend.

The opposite danger to notice is the big selection of competitors that exists and might be created. Meta (META) created Threads to compete with X, and Snap made Spotlights to problem Reels and TikTok. It is all a part of the sport. When corporations can safe thousands and thousands of customers to a platform, it is only a matter of time earlier than others copy the product and provide one thing new and higher. Because of this it will likely be essential for Snap to proceed to innovate and spend money on its future.

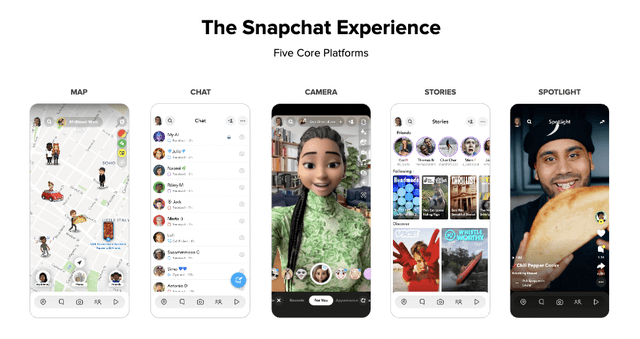

Snap’s App Expertise (SNAP Investor Relations)

The final danger to notice is valuation. If profitability can not develop at a excessive tempo or Snap struggles to even keep worthwhile, the inventory value will fall, and the a number of will contract, not in a great way. A 142x 2023 P/E could be very costly, and I’m stunned that the value has even been holding up on this market. Nevertheless, the truth that it has proven me that the market and folks imagine in and like this firm.

Conclusion

As a each day person of Snapchat, I’ve no plans to cease utilizing the app anytime quickly. I do know that lots of of thousands and thousands of different customers really feel the identical approach, and I count on administration to proceed monetizing the platform sooner or later. They’ve accomplished an awesome job of retaining issues contemporary and providing new and seasonal choices, and their newest hit, Snapchat+, already has 5 million paying customers.

Money has been used rapidly for development, each internally and thru M&A, however the firm wants to start out producing extra income via operations to proceed rising and succeeding. The numbers present that folks love the app, so the query is whether or not they can flip that into income. I imagine they will.

Customers might not prefer it, however extra advertisements and particular options, like Snapchat+, will likely be coming. As a shareholder, I’m okay with that. Snapchat has a singular maintain on the youthful generations, and I believe that development will proceed. Do not wait to overlook the preliminary transfer larger in SNAP; begin including right here underneath $10.