grandriver

Funding Rundown

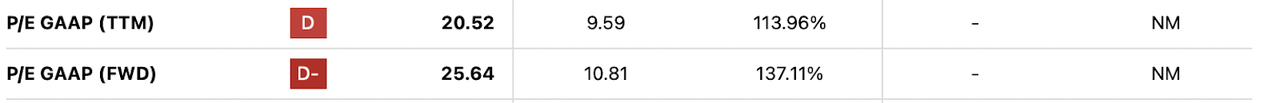

EnLink Midstream, LLC (NYSE:ENLC) is a midstream firm with a fairly well-diversified footprint within the US proper now. The corporate has had an honest within the final 12 months, with the shares up by over 5%, but additionally up very impressively from the underside of $8.Four per share it had in Might of this 12 months. Nonetheless, with the FWD P/E GAAP at over 25, I discover there to be fairly little worth available right here proper now, sadly. The corporate must quickly broaden its backside line, which in fact is pushed by extra optimistic commodity costs, however I feel it’s truthful to say it could have run a bit of too far and a correction could also be due quickly.

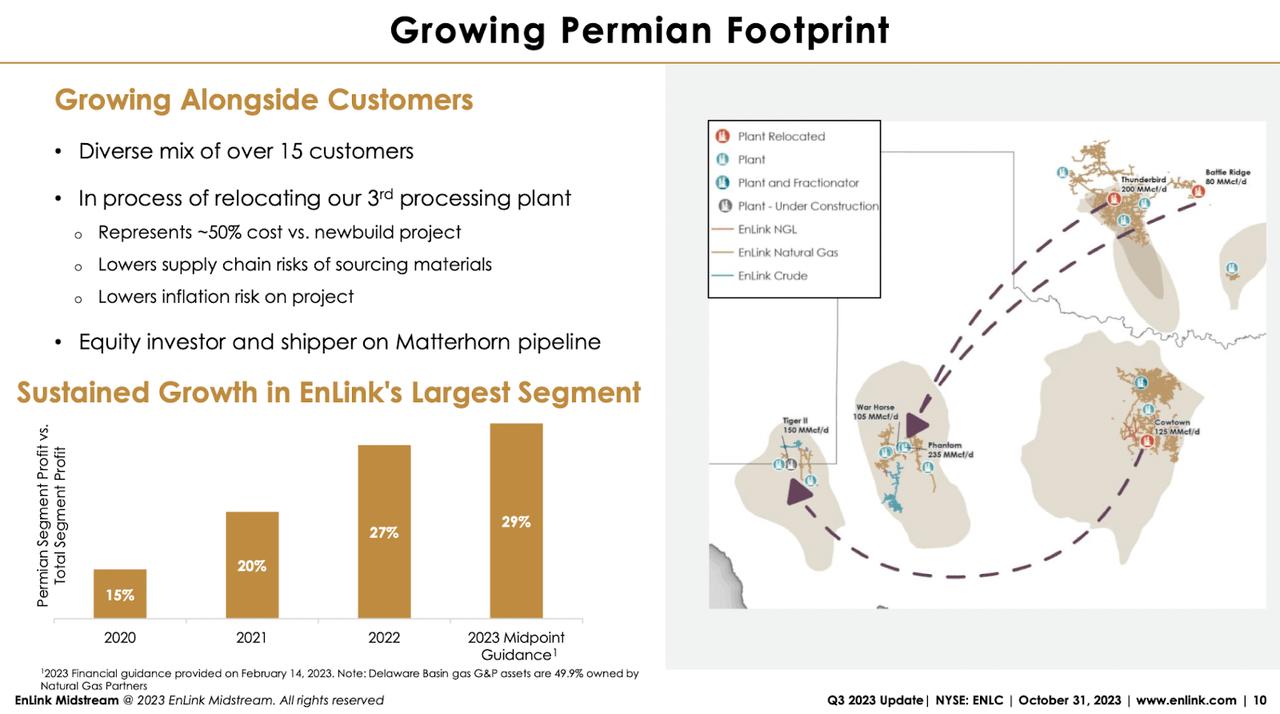

I feel that the dividend appears well-supported in all honesty, and sitting on shares in ELNC over the long run does not seem to be a nasty choice. each oil and fuel are going to be right here for many years nonetheless. What ENLC is additional doing is shortly increasing into interesting markets within the US just like the Permian Basin, for instance, one that would derive important development alternatives for the enterprise. With the present premium so excessive although I will not be a purchaser right here however slightly a holder sitting tight and amassing a strong dividend.

Firm Segments

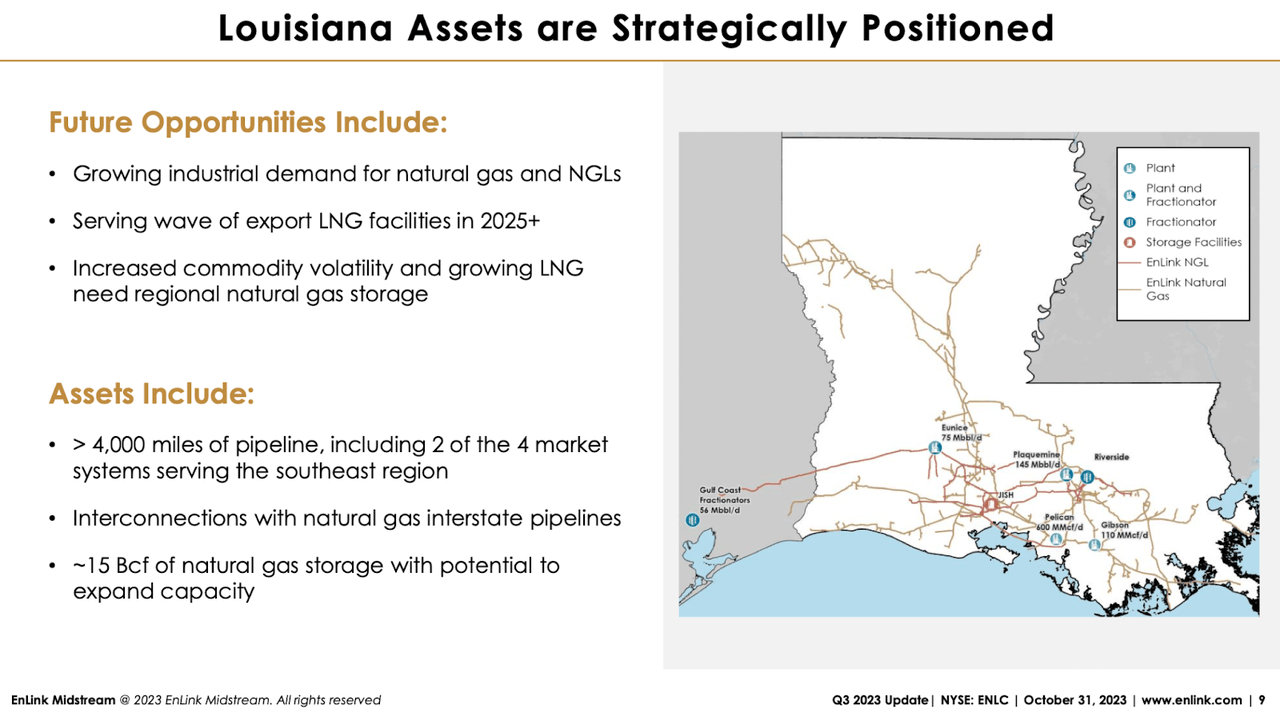

ENLC stands as a mid-sized participant within the dynamic midstream sector, strategically positioned throughout key basins within the south-central United States. The corporate operates in important areas, together with the Permian Basin, Anadarko Basin, Barnett Shale, and Haynesville Shale. This diversified method permits ENLC to faucet into the vitality potential of varied basins, enhancing its adaptability and strategic energy within the ever-evolving vitality trade.

Asset Allocations (Investor Presentation)

ENLC engages in a complete spectrum of actions throughout the vitality sector. Its operations embody gathering, compressing, treating, processing, transporting, and promoting pure fuel. Moreover, the corporate is concerned within the fractionation, transportation, storage, and sale of pure fuel liquids. Additional diversifying its portfolio, ENLC performs a job in gathering, transporting, stabilizing, storing, trans-loading, and promoting crude oil and condensate. This broad vary of actions positions the corporate as a key participant within the intricate internet of processes important to the vitality worth chain.

Market Footprint (Investor Presentation)

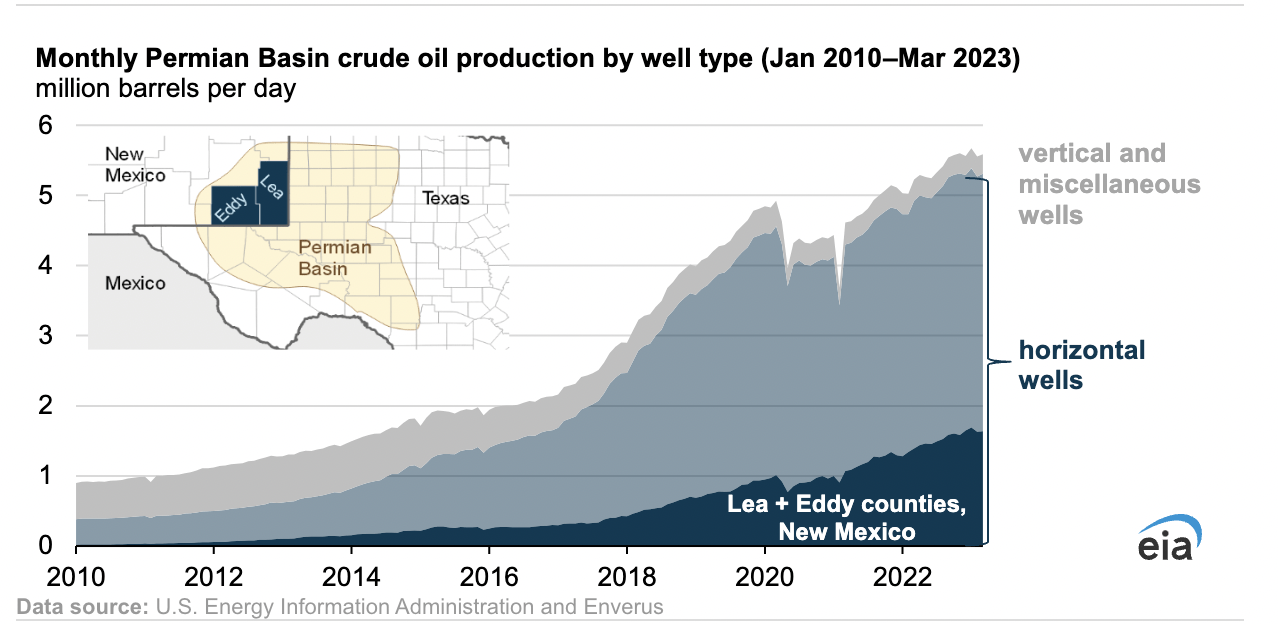

The Permian Basin stands as one of the prolific oil and pure fuel areas in the USA, taking part in a pivotal position within the nation’s vitality panorama. Identified for its huge hydrocarbon assets, the Permian Basin has been a significant contributor to the surge in U.S. oil manufacturing over the previous decade. Its strategic significance is underscored by the abundance of shale formations, significantly the Wolfcamp and Spraberry performs. The outlook for oil and pure fuel within the Permian Basin stays optimistic, pushed by ongoing developments in extraction applied sciences and the area’s substantial reserves.

Permian Basin (US Vitality Data)

With oil and fuel persevering with to be important elements of our vitality technology, I feel having some publicity to those markets remains to be very a lot interesting. With ENLC, as an example, you’re getting a really strong enterprise with a devotion to reward shareholders via its dividend program, which proper now could be yielding above 3.8%. With that mentioned, although, the present valuation of the enterprise is then again not that interesting. The FWD P/E GAAP is 137% above the sector common, and I discover this to be fairly an issue if we’re to make a purchase case. The worth doesn’t supply sufficient incentive of worth to be a purchase. I will probably be discussing it a bit of bit extra under, however in conclusion, traders are higher off holding onto shares and amassing the strong dividend the corporate has.

Markets They Are In

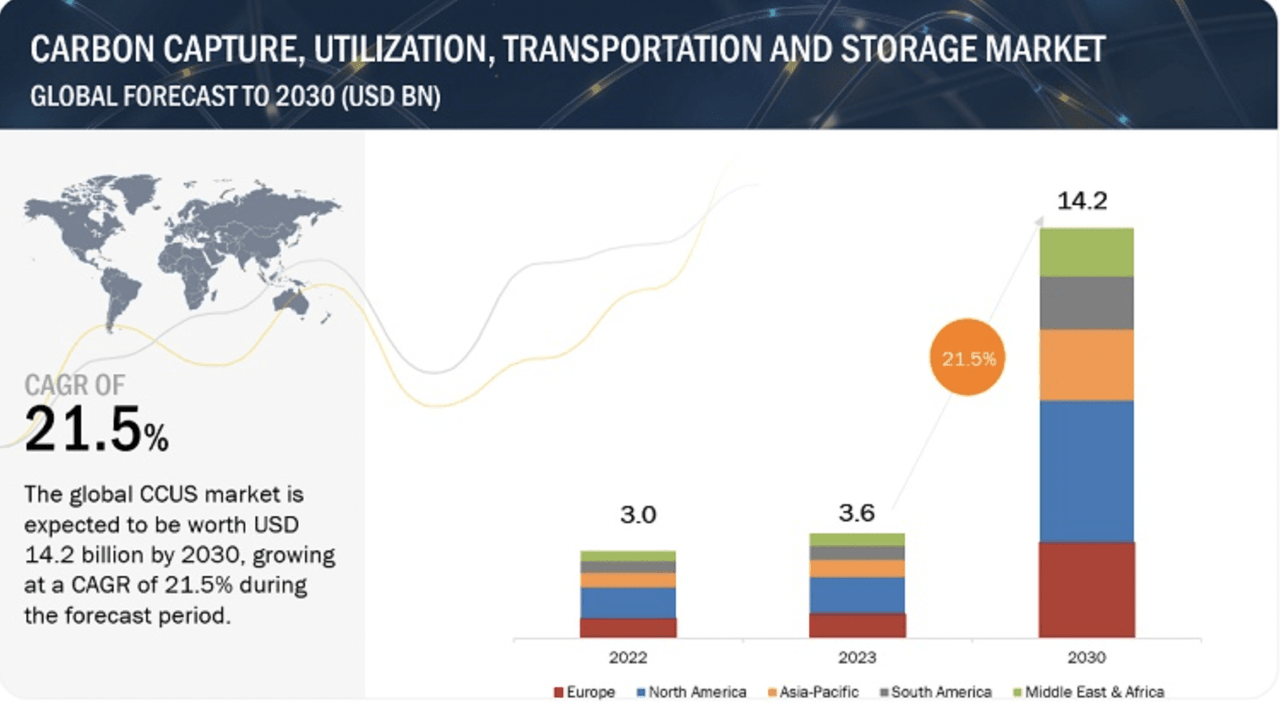

Market Outlook (MarketsandMarkets)

Carbon Seize and Storage (CCS) and Carbon Seize, Utilization, and Storage (CCUS) signify pivotal processes designed to seize carbon dioxide emissions, primarily from industrial actions akin to metal and fertilizer manufacturing. Reasonably than releasing this CO2 into the environment, these processes goal to both sequester it completely underground or repurpose it for varied purposes, together with enhanced oil restoration and even the creation of fizziness in carbonated drinks.

ENTC has been making first rate progress in increasing into these ventures and with the market outlook suggesting a 21.5% CAGR till 2030 I feel ENTC is true to do as properly. The corporate asserts that it could keep a excessive single-digit adjusted EBITDA a number of by managing the preliminary 3.2 million tons of carbon. Nonetheless, this dynamic undergoes a big shift, transitioning to a low single-digit adjusted EBITDA a number of ought to the corporate finally deal with the total ten million tons. By way of how this may look on the revenue assertion for ENTC ought to equal round $20-50 million further EBITDA because the upfront investments whole round $200 million. Now I feel it ought to be famous as properly that the precise capturing of carbon will not start till 2025 so seeing regular climbs within the EBITDA will not be seen till then. Nonetheless, by 2026 traders may count on roughly $35 million further EBITDA added to the revenue assertion which is roughly a 3% annual enhance from the 2022 outcomes which have been $1.Three billion.

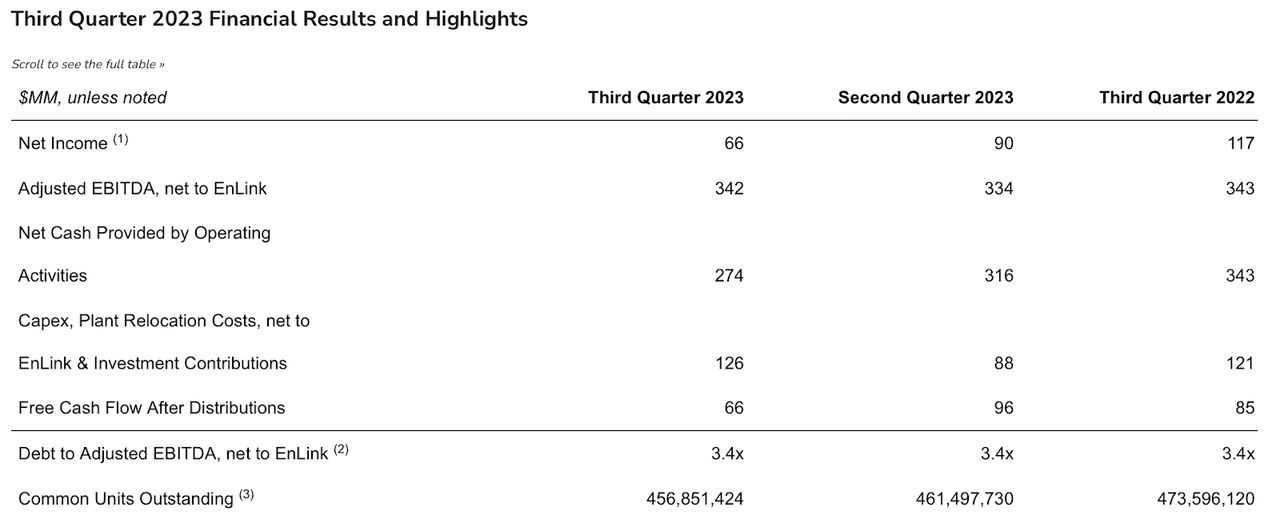

Earnings Highlights

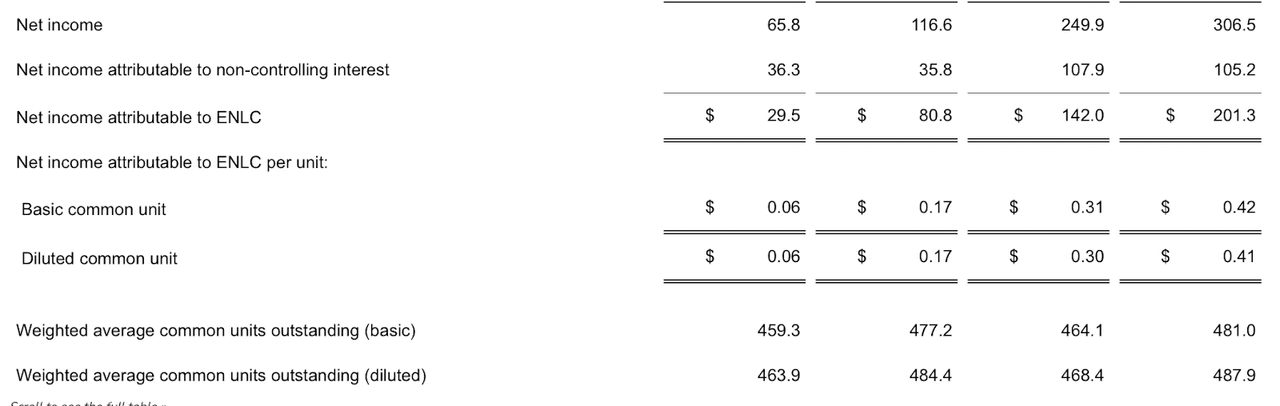

Earnings Assertion (Earnings Report)

From the final revenue assertion by the corporate, it was clear that the earlier 12 months’s robust commodity value atmosphere was very useful. On a YoY foundation, the web revenue for ENTC for Q3 declined by 77% in whole, all the way down to $66 million from $117 million. A lot was pushed by the practically $1 billion decrease in revenues the corporate did but additionally the stickiness of depreciation on its property which was $162 million in whole. I’m fearful in regards to the coming quarters and the bottom-line development for ENTC. If they don’t seem to be able to sustaining margins via powerful pricing intervals, then a decrease valuation ought to be utilized to adequately painting the dangers concerned.

Earnings Assertion (Earnings Report)

With greater rates of interest as properly within the US, the corporate has additionally been pressured to pay greater curiosity bills, which grew by 12% YoY to $67.9 million. I feel that these curiosity expense will simply proceed to climb as ENTC has a debt place of over $4.6 billion at the moment and will not be producing sufficient EBITDA to sufficiently pay down giant sums of it yearly, not less than in my view. In the event that they need to proceed to spend money on the CCS tasks, then they should effectively handle their debt ranges as properly. CCS tasks are pricey as we’ve got found.

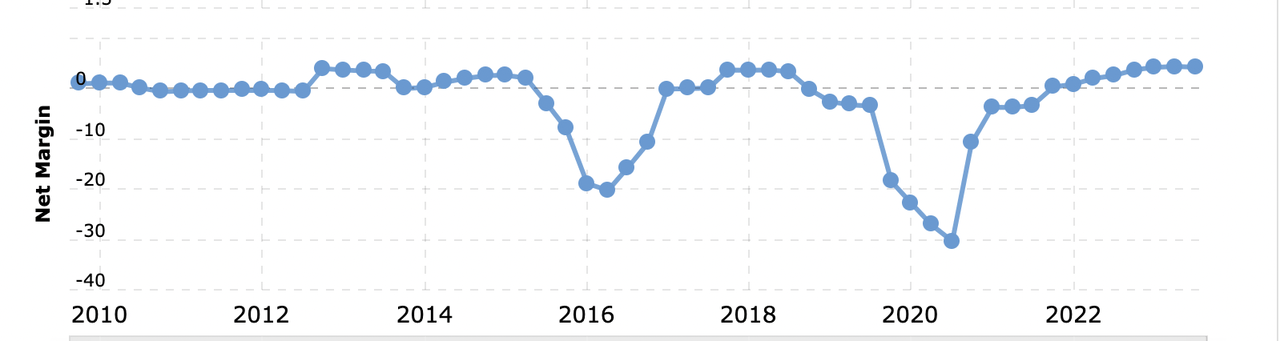

Web Margin (Macrotrends)

For the approaching quarters, I need to see additional expansions within the margins. Since 2020 they’ve steadily been on the rise for the corporate however for my part, they are not rising quick sufficient to justify the present valuation. I might a lot choose to purchase within the vary of 10-12x earnings, and that leaves a big draw back right here nonetheless. However as I see ENTC as a long-term play, draw back danger like that does not make me need to promote, however slightly to simply not purchase or add extra. As the worth would fall, the dividend would proceed to rise as properly, leaving me with a good higher deal.

Dangers

As ENTC experiences regular development, a notable facet of its enterprise trajectory has been its premium valuation. The priority arises when considering the situation of stagnant or declining development, probably inflicting the share value to swiftly revisit the 12 months lows of $8.Four per share. This apprehension stems from the perceived danger inherent within the enterprise.

P/E (Searching for Alpha)

For traders, this danger issue ought to be a vital consideration, representing a big determinant within the evaluation of whether or not the corporate can at the moment be considered a positive funding. It emphasizes the significance of monitoring development sustainability and the related valuation metrics as key indicators for knowledgeable funding choices.

Last Phrases

The oil and fuel trade are nearly the spine of the US financial system in some sense, seeing as they’re accountable for powering our societies and likewise herald huge quantities of revenues. ENTC has seen a powerful restoration from its lows again in Might this 12 months however is at some extent the place I do not take into account the worth pretty valued. I would like one thing within the vary of 10-12x earnings, which is analogous to its sector but additionally means ENTC trades at a big premium to that. My reasoning behind a maintain comes from the very fact I feel the dividend is strong and one thing that makes me nonetheless get some worth from holding shares. Ought to we see the worth return to the $8-9 vary once more, I feel I might flip extra bullish