Roland Magnusson

Breaking information immediately within the telecom house had merchants shifting positions. AT&T (T) introduced that it might purchase as much as $14 billion of cell tower tools with Ericsson (NASDAQ:ERIC). Shares of the Swedish provider closed 4% increased on Tuesday whereas rival Nokia (NOK) suffered a 5% inventory value dip. The contract was thought of a serious win for ERIC, an organization that had been struggling within the days, weeks, and quarters main as much as the announcement, however questions linger as to how the trade will look beneath the open RAN assemble.

It’s a 5-year deal, with the swap transaction commencing subsequent yr. Curiously, NOK had already fallen prematurely of stories on Monday, and ERIC rose 4% to start out the week. If value motion is any indication, open requirements might assist flip round ERIC’s profitability traits. Critics say, nonetheless, that the breakdown of vendor lock-ins throughout the trade calls into query limitations to entry and margins within the house.

Based mostly on the information, the present valuation scenario, and improved technical evaluation, I’m upgrading ERIC from a promote to a maintain. I want to see proof that there is circulation by to the underside line as dangers stay for the Swedish firm.

Based on Financial institution of America World Analysis, Ericsson is a number one international community tools and software program provider to wi-fi carriers with a concentrate on Radio Entry Community/RAN tools, cellular core community/IMS, and OSS/BSS options. The corporate additionally offers skilled companies comparable to consulting and community outsourcing to carriers.

The Sweden-based $17.Four billion market cap Communications Gear trade firm throughout the Data Expertise sector trades at a near-market 17.1 ahead working price-to-earnings a number of and pays a excessive 4.7% dividend yield. With This autumn 2023 earnings not due out till late January, shares commerce with a reasonable 31% implied volatility proportion.

Again in October, ERIC reported Q3 GAAP EPS of -SEK 9.21, however internet revenue was optimistic by SEK 1.Four billion ex a big goodwill impairment cost. Income for the quarter dipped 5% from year-ago ranges whereas its group natural gross sales fell 10% YoY. EBITDA suffered within the quarter, falling from SEK 7.7 billion to SEK 4.7 billion, together with a 400-basis-point drop in its EBITDA margin. Shares fell 3% in US ADR buying and selling the next session. For US buyers, working EPS of $0.08 got here in a penny above estimates and the January EPS estimate is $0.10, which might be a pointy decline from $0.21 reported in the identical interval this previous yr.

Whereas the administration crew is sticking with its 15% to 18% EBITDA margin goal, they didn’t provide steering past This autumn, which isn’t an encouraging signal, although it did up its FY 2023 EPS steering by 9.5%. Preserve your eye on cost-control measures which might result in higher free money circulation within the coming quarters, although weak funding traits in Europe and with its India roll-out are potential dangers.

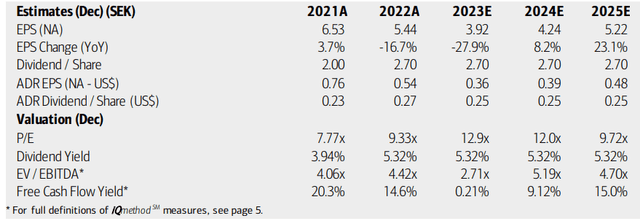

On valuation, analysts at BofA see as-reported earnings falling by practically 28% this yr earlier than per-share revenue progress bounces again in 2024. Working EPS is seen bettering sharply in 2025, however uncertainty stays excessive following the information immediately and ongoing challenges famous earlier. Nonetheless, ADR EPS might high $0.50, in line with Looking for Alpha’s newest consensus estimate, whereas dividends per share for US buyers ought to improve relatively impressively over the approaching quarters. Given a trough in its free money circulation yield this yr, there are blended indicators with respect to the valuation and basic outlooks.

Ericsson: Earnings, Valuation, Dividend Yield, Free Money Stream Forecasts

BofA World Analysis

If we assume normalized ADR working EPS of $0.45 over the following 12 months and apply a below-market 11 earnings a number of based mostly on how unsure the outlook is, then shares must be close to $5. Furthermore, a 7x EV/EBITDA a number of additionally places the inventory within the mid-single digit – that’s presently proper in the course of the agency’s 4x to 9x historic EV/EBITDA vary.

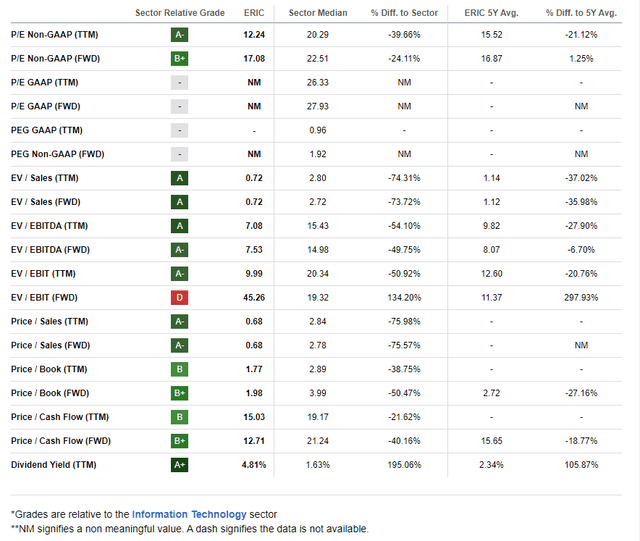

ERIC: Overwhelmed-Down Inventory Outcomes In Low Valuation Metrics

Looking for Alpha

In comparison with its friends, ERIC includes a robust valuation ranking, given the depressed inventory value and excessive dividend yield, a lot pessimism is priced in. Profitability has been weak currently, however a turnaround story might be in play based mostly on the newest estimates. Nonetheless, the expansion trajectory has been unstable whereas share-price momentum is comparatively poor. EPS revisions have been blended currently, and there is motive for optimism following this week’s information that the analyst neighborhood might increase targets. As soon as once more, it is a blended bag right here.

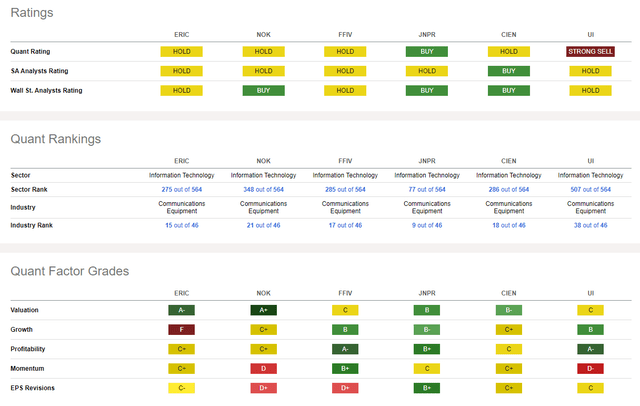

Competitor Evaluation

Looking for Alpha

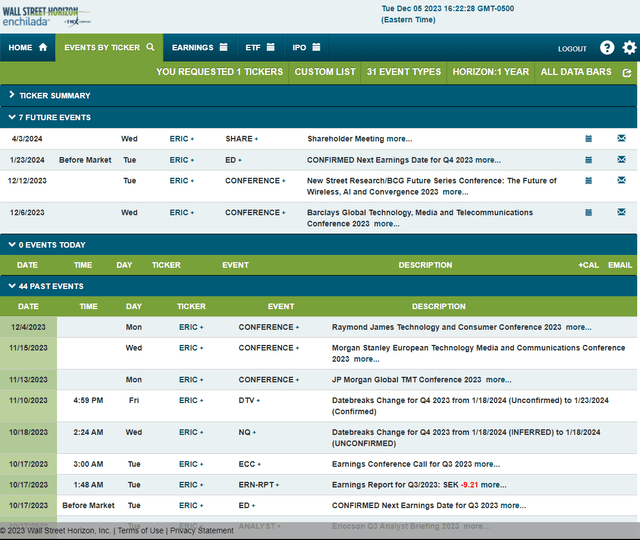

Trying forward, company occasion information offered by Wall Road Horizon present a confirmed This autumn 2023 earnings date of Tuesday, January 23. Earlier than that, the agency’s administration crew speaks at a trio of telecom conferences from this week by subsequent, and the inventory has already been within the information, so I count on volatility to proceed to run excessive by subsequent week.

Company Occasion Danger Calendar

Wall Road Horizon

The Technical Take

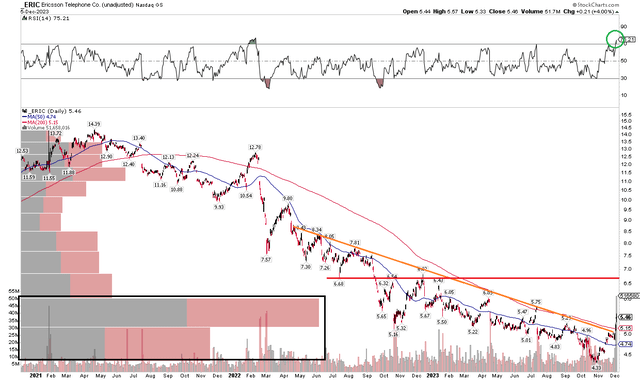

It has been a troublesome previous few years for ERIC shareholders, and I highlighted dangers on the chart a few yr in the past. Discover within the chart under that shares peaked close to $15 in early 2021, however have since fallen dramatically, however steadily to a low beneath $5 this previous October. An necessary transfer was made this week, although. ERIC jumped by its falling long-term 200-day transferring common for the primary time in nearly two years. The Monday-Tuesday rally got here on massive quantity, too, serving to to claim that the bulls have regained some momentum right here.

Additionally, check out the RSI momentum oscillator on the high of the graph – it has hit technically overbought territory – additionally the very best since February 2022. I’d not be stunned to see the inventory back-fill a spot to close $5.25, and the Friday-Monday hole lies beneath that at $5.02. On the upside, a attainable goal to take earnings on an extended place can be within the $6.68 to $6.82 zone – that was a key battleground vary from mid-2022 by late final yr.

General, with a break of the multi-year downtrend on massive quantity, shares look good for a continued rally to the mid-$6s.

ERIC: Bearish Downtrend Damaged Following This Week’s Share-Value Bounce

StockCharts.com

The Backside Line

I’m upgrading ERIC from a promote to a maintain. I believe sufficient pessimism has been priced in, and the technical scenario has improved after a multi-year downtrend.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.