MCCAIG

Now we have written loads on why it is an enormous misunderstanding to suppose that the most important U.S. banks would be the safer ones in a systemic disaster state of affairs. Over the previous two years, we now have revealed articles on a lot of the bigger U.S. banks. We even have just lately written an article on massive banks publicity (round $700B) to high-risk shadow banking intermediaries. As well as, a few weeks in the past, the Fed launched 4 new shocks to its stress assessments, which can be utilized solely to the most important and essentially the most advanced banks.

On this article, we wish to talk about collateralized mortgage obligations (CLOs), one other main difficulty for the U.S. largest banks.

For starters, a CLO is a safety backed by a pool of debt. Most CLOs are backed by loans granted to non-public fairness companies, enterprise capital funds, and firms with low credit score rankings. On condition that these securities are a lot riskier than conventional company loans, they’ve greater yields. CLOs are similar to mortgage-backed securities – MBS, which triggered the Nice Recession. The one distinction between them is the kind of underlying mortgage throughout the basket.

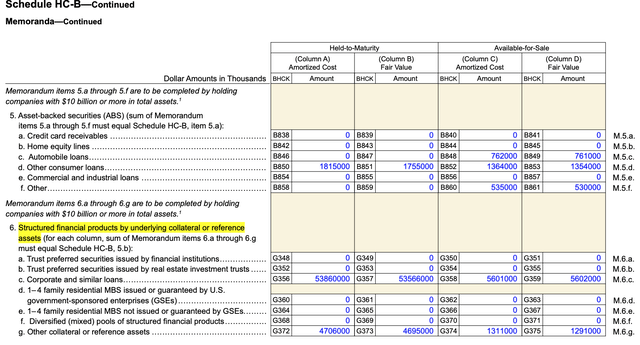

It is a actually troublesome quest to seek out the place U.S. banks disclose quantities of CLOs on their stability sheets. Clearly, you’ll not discover this knowledge within the financial institution’s investor shows or of their press releases, given the excessive danger represented by these monetary devices. The banks disclose CLO-related knowledge in Schedule HC-B of the Kind Y-9C submitting beneath the road “structured monetary merchandise backed or supported by company and comparable loans.” For instance, this is how this disclosure seems to be for JPMorgan (JPM).

Firm knowledge

As of the tip of 2023, JPM had $60B of structured monetary merchandise backed by company and comparable loans, of which $54B had been held-to-maturity and $5.6B had been available-for-sale. We are able to see that there is nearly no distinction between “truthful worth” and “amortized value” as these securities aren’t tradable. The $60B is a major quantity even for one of many largest U.S. banks provided that it’s nearly 20% of its complete fairness. JPM is the most important holder of CLOs within the U.S. banking system.

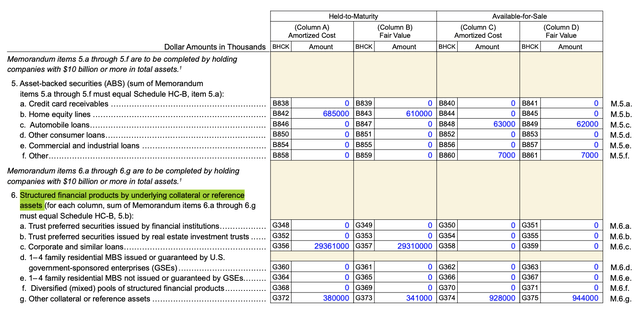

The second largest holder of CLOs is Citigroup (C), which had $29.7B of those securities as of the tip of 2023. The $29.7B is 16% of Citi’s complete fairness.

Firm knowledge

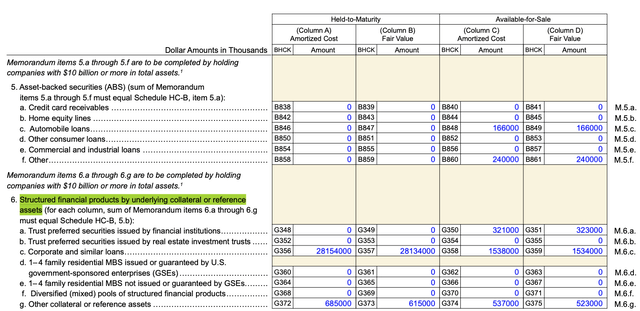

The third-largest holder is Wells Fargo (WFC), which had $29.4B of those securities as of the tip of 2023, which corresponds to 14% of Wells’ fairness.

Firm knowledge

Much like shadow banking-related loans, CLOs are a whole black field as swimming pools of company loans aren’t disclosed publicly. However, as we stated earlier, these are normally the riskiest loans. Bloomberg has just lately reported that about 8.6% of CRE loans bundled into CLOs had been 30-plus days delinquent as of January 2024. That is a lot greater than the respective metric of conventional CRE loans.

Bloomberg

Moreover, whereas CLOs are already very dangerous, U.S. banks are rising the riskiest segments of those devices. This week, Bloomberg reported that Goldman Sachs (GS) and Morgan Stanley (MS) have elevated their underwriting of the so-called fairness parts of CLOs, that are riskiest elements of those securities.

Backside Line

In case you nonetheless suppose that the most important banks would be the most secure in a systemic disaster state of affairs, regardless of all our earlier articles, this is one other difficulty of which you should be conscious. Contemplate that there was one primary difficulty which triggered the Monetary Disaster of 2007-2009. At present, there are a number of comparable dangers on the books of the most important banks.

I need to take this chance to remind you that we now have reviewed many bigger banks in our public articles. However I have to warn you: The substance of that evaluation isn’t trying too good for the way forward for the bigger banks in the USA, particulars for that are right here.

Furthermore, for those who imagine that the banking points have been addressed, I am sorry to tell you that you simply doubtless solely noticed the tip of the iceberg. We had been in a position to determine the precise causes in our public article which triggered SVB to fail nicely earlier than anybody even thought-about these points. And I can guarantee you that they haven’t been resolved. It is now solely a matter of time.

On the finish of the day, we’re talking of defending your hard-earned cash. Subsequently, it behooves you to interact in due diligence concerning the banks which at present home your cash.

You have got a duty to your self and your loved ones to ensure your cash resides in solely the most secure of establishments. And for those who’re counting on the FDIC, I counsel you learn our prior articles, which define why such reliance is not going to be as prudent as it’s possible you’ll imagine within the coming years.

It is time so that you can do a deep dive on the banks that home your hard-earned cash with the intention to decide whether or not your financial institution is really stable or not. Our due diligence methodology is printed right here.

Housekeeping Issues

This text, in addition to Saferbankingresearch.com, is a mix of efforts between Avi Gilburt and Renaissance Analysis, which has been protecting U.S., European, LatAm, and CEEMEA banking shares for greater than 15 years.

If you want notifications as to when my new articles are revealed, please hit the button on the backside of the web page to “Observe” me.

Additionally, for these which can be questioning why all feedback (together with mine) undergo moderation, you’ll be able to learn right here: Haters Are Gonna Hate – Till They Be taught.

Lastly, I’ve requested the editors to shut the feedback part, as I can be out over the subsequent few days.