Thomas Barwick/DigitalVision by way of Getty Pictures

By Carrie King

Sturdy Q1 earnings had been a vibrant spot as sticky inflation and dimmed expectations for price cuts solid some shade on U.S. fairness markets. Basic Equities investor Carrie King appears to be like past the headlines to supply 4 takeaways from the latest earnings season.

1. Tech+ shines once more

S&P 500 earnings progress of 5% was pushed primarily by the mega-cap tech+ shares. Eradicating the highest seven index constituents by market cap brings index earnings progress to -2% for the quarter.

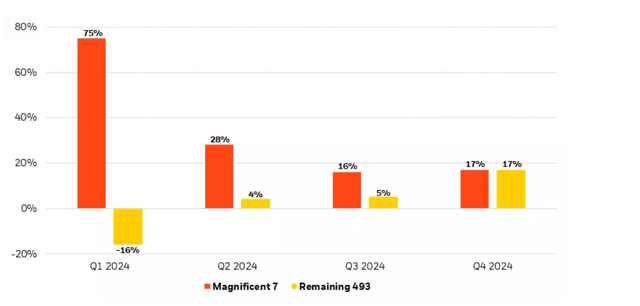

We stay optimistic on know-how and web shares however anticipate the earnings progress chasm between these leaders and the remaining to shut as two divergent enterprise cycles every normalize. The tech-led cycle is forward of the broader market, having soared, declined and reaccelerated since COVID. Different sectors are simply now working off their pandemic malaise and trying to a brighter future, as we mentioned final quarter. We anticipate the earnings progress of the remainder of the market to catch as much as right now’s leaders by the tip of this yr, as proven within the chart under.

Amid the broadening, we see alternative for inventory pickers to parse by means of the basics to establish these corporations with the potential to steer within the subsequent leg of the enterprise cycle.

Closing the chasm

Consensus expectations for year-over-year earnings progress, 2024

Supply: BlackRock Basic Equities, with information from FactSet as of Could 7, 2024. Chart exhibits consensus analyst expectations for year-over-year earnings per share (EPS) progress of the “Magnificent 7” mega-cap shares within the S&P 500 Index vs. EPS progress for the remaining constituents. Previous efficiency will not be indicative of present or future outcomes. Indexes are unmanaged. It’s not attainable to take a position instantly in an index.

Funding takeaway: Broaden your funding lens because the earnings progress hole narrows and alternatives open in different areas of the economic system. We favor healthcare, the place innovation is powerful and valuations are under the market common. We additionally see enhancing prospects in industrials as years of underinvestment are poised for reversal. The American Society of Civil Engineers calculates an infrastructure spending hole of about $2.5 trillion, and the federal authorities is demonstrating bipartisan assist for serving to to shut it. Momentum right here ought to current inventory choice alternatives amongst industrials.

2. Capex pours in

Not solely are tech corporations incomes, however they’re additionally spending. S&P 500 capex this quarter was up 10% year-over-year (yoy) versus 4% in This autumn, in response to Financial institution of America evaluation. Synthetic intelligence (AI) is the motive force.

Hyperscalers, a time period utilized to the biggest cloud service suppliers, have all signaled elevated capex. Total spending on AI infrastructure and cloud is about to rise this yr and speed up even additional in 2025. Our World Know-how staff’s estimates of hyperscaler capex are properly above Wall Avenue consensus estimates, per their increased estimates of AI information heart energy calls for.

An organization’s inventory worth is commonly punished with the announcement of capex spending. We noticed it this quarter when one of many Magazine 7 hyperscalers had spectacular earnings alongside huge capex intentions. However there is a distinction between spending and success-based spending. Whereas some capex could also be ill-fated when enterprise plans do not pan out, capex utilized to high-potential initiatives can reap rewards. We imagine capex directed at generative AI development has main tailwinds that ought to validate the spend and multiply into returns, given AI’s potential to rework companies throughout the economic system.

Funding takeaway: As spending on AI infrastructure will increase and allows higher penetration of the know-how, search for alternatives within the subsequent layers of the AI know-how stack. We see nice potential in corporations that provide information – the gas that enables AI to work – and those who present the reminiscence to retailer it.

3. Clouds collect for shoppers

We have famous earlier than the indicators of stress seen within the client. These indicators are beginning to flash purple in spots, notably among the many lower-income cohort. A significant fast-food chain cited the phrase “worth” 60 occasions in its Q1 earnings remarks, 4x greater than final quarter – a degree Lisa Yang, co-head of our Basic Equities client group, made on a latest episode of The Bid podcast.

Shopper confidence, as measured by the Convention Board, fell to its lowest since July 2022 in April. Survey information additionally confirmed dips in shopping for plans for houses and big-ticket home equipment in addition to declines in trip plans.

Inflation and better charges have shoppers watching their discretionary spend. Some corporations are noting the softening of their earnings steering, citing the tip of the COVID stimulus and restart of scholar mortgage debt repayments that had been on a pandemic-era hiatus.

COVID aftereffects are taking part in out in different areas as properly. We’re seeing stock destocking in locations like autos and semiconductors. Some chips (these wanted for AI optimization) are doing nice, however not those utilized in smartphones and different digital gear, for instance, which had a renewal cycle throughout COVID – pressuring provide then and leading to a listing glut now as corporations had overordered into a requirement decline.

Funding takeaway: Be cautious and be selective. In shoppers, we search for resilient corporations which have sturdy aggressive benefits and wholesome steadiness sheets to prevail and develop market share regardless of the financial backdrop.

4. Brightening skies for healthcare

The healthcare sector noticed the bottom yoy earnings progress (-26%) for the quarter, sitting on the backside alongside power and supplies. But, this paints solely a partial – and overly bleak – image. A few notable outliers, one taking non permanent losses on M&A bills, dragged on the averages.

But, the healthcare sector had a excessive share of gross sales and earnings per share (EPS) beats for the quarter, at 72% and 89%, respectively. That is in comparison with gross sales beats of 63% and EPS beats of 83% for the S&P 500 broadly. We imagine the development is optimistic within the sector as lingering COVID-related results are labored off in some locations and innovation abounds in others. This might bode properly for the undervalued defensive sector after a protracted stretch of underperformance.

Funding takeaway: Valuations are compelling and the healthcare sector affords a superb mixture of protection and progress by means of innovation. Inventory selecting is vital. Working example: Amid a looming flood of patent expirations within the U.S., we favor European prescription drugs given a stronger patent expiry profile. Drug distributors are enticing, as they profit when large-cap pharma corporations lose patent safety, permitting them to distribute an rising quantity of generics, which have a extra enticing margin profile.

Lengthy-range forecast

A optimistic earnings progress outlook (see chart above) bodes properly for U.S. shares general. But, the character of the outlook is especially favorable for inventory choice, in our view. As a extremely concentrated market grows broader and extra various, we see alternative for expert inventory selecting to parse potential leaders and laggards in pursuit of returns past that provided on the index stage.

This publish initially appeared on the iShares Market Insights.

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.