grandriver

Introduction

Vitality has been an enormous a part of my analysis because the pandemic. That’s primarily attributable to my perception that the sector advantages from sturdy secular tailwinds, together with peak manufacturing progress in U.S. shale, long-term demand tailwinds, and a really engaging valuation of all the sector.

Though I promise readers that I’ll hold a balanced protection combine, vitality will stay a cornerstone of my analysis. This consists of Devon Vitality (NYSE:DVN), a inventory that has been introduced up so much by readers in latest weeks.

One of many causes is my aggressive investments in LandBridge (LB) and Texas Pacific Land (TPL), two landowners within the Permian Basin, America’s greatest oil basin.

These corporations have offers with Devon Vitality, together with oil and fuel royalties and water-related offers, that enable these two corporations to take part in Devon’s rising manufacturing.

That mentioned, whereas LB will quickly announce its first-ever dividend, each LB and TPL usually are not prone to flip into high-yield shares anytime quickly. That is one of many the reason why readers stored mentioning Devon Vitality.

Though Devon Vitality doesn’t have an asset-light enterprise mannequin like my royalty investments, it has different advantages, together with glorious drilling operations, rising pricing tailwinds, and a concentrate on (particular) dividends.

My most up-to-date article on this firm was written on Might 14, once I went with the title “Devon Vitality Believes It Presents ‘Unbelievable Worth’ – I Agree.” Since then, shares have dropped roughly 9%, primarily pressured by decrease oil and fuel costs.

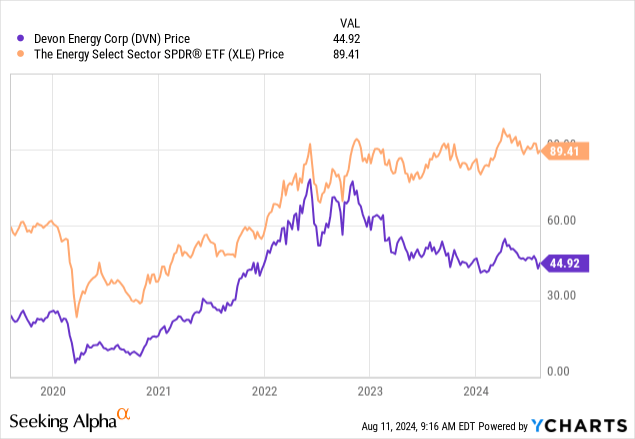

To make issues worse, the inventory has proven a divergence from the broader Vitality Choose Sector SPDR Fund ETF (XLE), which has gone sideways since early 2023 – excluding dividends.

On this article, I will replace my thesis and clarify the professionals and cons of shopping for what may very well be a extremely engaging dividend inventory within the vitality house.

So, let’s dive into the main points!

Devon’s Focus On Greater Development

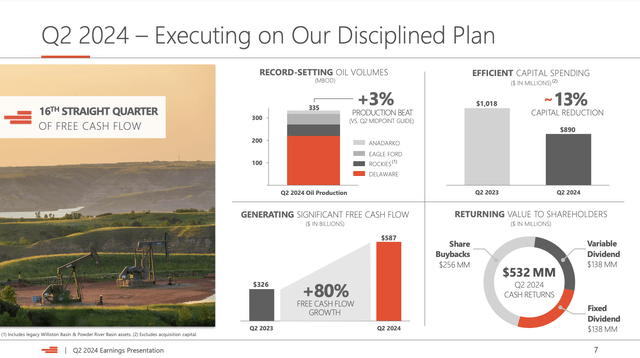

Devon Vitality is a heavyweight within the Delaware Basin. The Delaware Basin is a part of the Permian Basin. Its operations on this basin allowed it to spice up oil manufacturing to a file of 335 thousand barrels per day.

In accordance with the corporate, by optimizing its manufacturing processes, together with the addition of a brief fourth frac crew, it introduced 62 new wells on-line within the Delaware Basin, with per-well recoveries anticipated to attain an uplift of greater than 10% in comparison with final 12 months’s program.

Devon Vitality

Typically, the corporate could be very upbeat about its successes elsewhere as nicely, together with Eagle Ford, Powder River Basin enhancements, and powerful manufacturing from its legacy Williston operations.

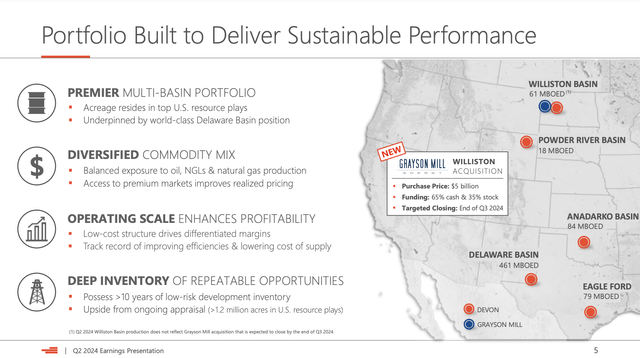

As we are able to see beneath, whereas Delaware is its greatest operation, it additionally has operations in different areas, together with an growth within the Williston Basin via the acquisition of Grayson Mill Vitality for $5 billion.

Devon Vitality

This transaction is predicted to just about triple Devon’s manufacturing within the Williston Basin, making the corporate one of many largest oil producers in america, with common day by day charges estimated to be roughly 375 thousand barrels of oil per day.

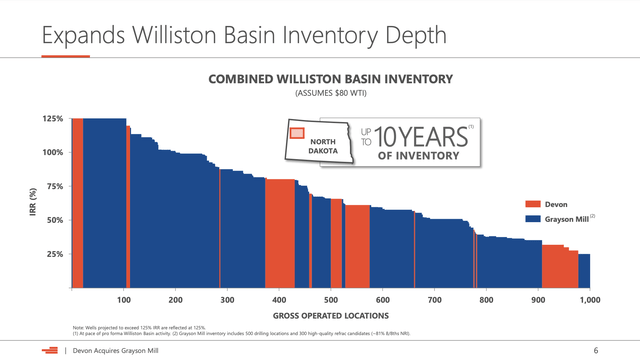

Even higher, the acquisition not solely will increase Devon’s operational footprint but additionally improves its stock, offering about ten years of Bakken stock on the present fee of improvement.

Devon Vitality

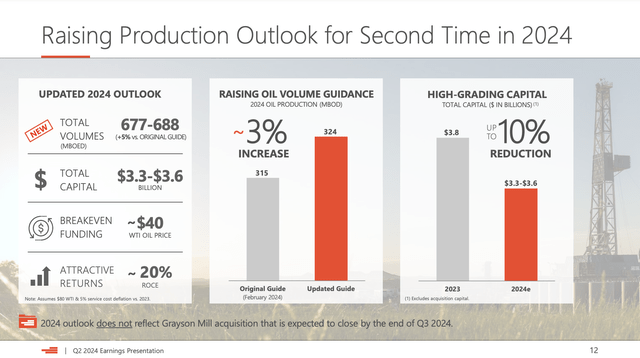

On a full-year foundation, the corporate expects to supply between 677 thousand and 688 thousand barrels of oil equal per day. That is 5% greater than initially anticipated. Oil manufacturing is predicted to be 324 thousand barrels per day, 3% greater than initially anticipated.

Oil manufacturing is predicted to account for 47% of the corporate’s whole manufacturing.

Devon Vitality

It additionally helps that the corporate is anticipating to spice up manufacturing with much less capital spending.

All of that is nice information for shareholders.

There’s Deep Worth In Devon Vitality

Devon Vitality continues to do what it does finest: reward shareholders. It will probably do that as a result of it has low breakeven costs and a wholesome steadiness sheet, two of an important elements within the trade.

- The corporate has a internet leverage ratio of simply 0.6x EBITDA.

- It has $1.2 billion in money.

Furthermore:

- The corporate has initiated a $2.5 billion debt discount program, anticipated to be accomplished “inside the subsequent few years.” As soon as this program is completed, I’d not wager in opposition to increased shareholder distributions.

Particularly in gentle of the Williston acquisition, the corporate could be very upbeat about its future. That is why it determined to spice up its buyback program by 67% to $5 billion.

To make use of the corporate’s personal phrases (emphasis added):

We count on sustainable accretion to earnings and free money movement. Given the power of this transaction, we have expanded our share repurchase program by 67% to $5 billion. This elevated authorization gives us ample capability to proceed to opportunistically repurchase our inventory and bolster our per share progress trajectory for the subsequent few years. We count on free money movement from this acquisition to be additive to our dividend payout in 2025 and past. – DVN 2Q24 Earnings Name

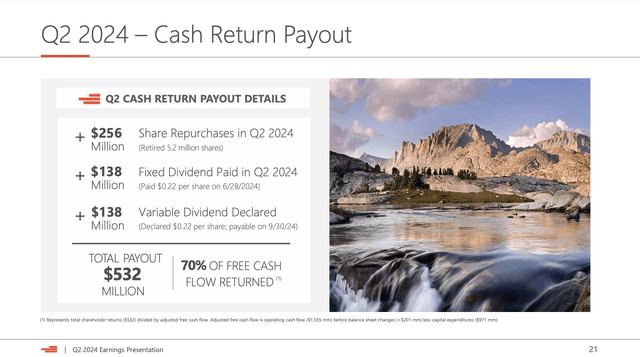

Within the second quarter, the corporate returned roughly 70% of its extra free money movement to shareholders via buybacks and dividends.

This consisted of $256 million price of buybacks, $138 million of its mounted quarterly dividend, and $138 million in variable dividends.

The particular/variable dividend is evaluated on a quarterly foundation, relying on elements like free money movement.

Devon Vitality

The present mounted quarterly dividend is $0.22 per share. This interprets to a base yield of two.0%.

When including the particular/variable dividend, the annualized yield jumps to 4.0%.

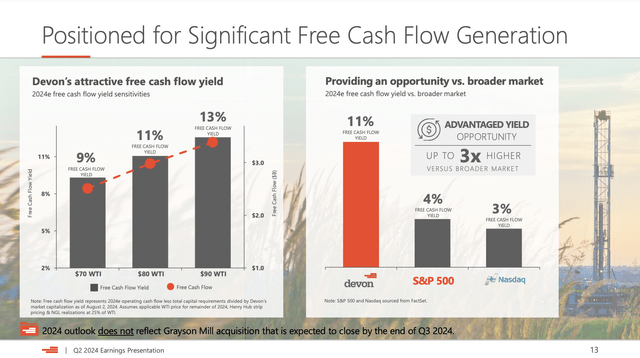

The excellent news is that there’s a lot of room for revenue. At $80 WTI, the corporate expects to generate greater than $Three billion in annual free money movement. That interprets to 11% of its market cap. A 70% distribution payout signifies an annualized shareholder yield of seven.7%!

Though oil is at present struggling attributable to weak international progress, a $90 WTI worth signifies a return yield of 9.1% (70% of 13% FCF yield).

Devon Vitality

So, what about its valuation?

Valuation

Devon Vitality has underperformed its vitality friends lately. I imagine this is because of various causes:

- Greater than half of its manufacturing is non-oil. Particularly in gentle of Permian takeaway constraints, pricing is a matter for low-margin pure fuel. In 2Q24, realized pricing for pure fuel was roughly $1.10 per Mcf, 42% beneath the benchmark. Personally, I imagine there are higher investments available on the market to put money into pure fuel (like these three). The excellent news is that the Matterhorn Specific Pipeline might be operational quickly, offering Permian producers with higher pure fuel costs.

- DVN distributes 70% of its free money movement. Whereas this can be a lot, the corporate is competing with corporations like Diamondback Vitality (FANG). That firm will quickly increase its payout past 70% after lowering debt associated to the Endeavor merger. FANG additionally produces extra oil than non-oil with terrific operational enhancements.

- Devon is utilizing M&A to develop its reserves. Though DVN has good reserves, we should always count on M&A to stay a problem attributable to slowing manufacturing progress charges in the most effective Permian drilling spots.

That mentioned, the positives nonetheless outweigh the negatives, particularly as a result of DVN could be very low-cost!

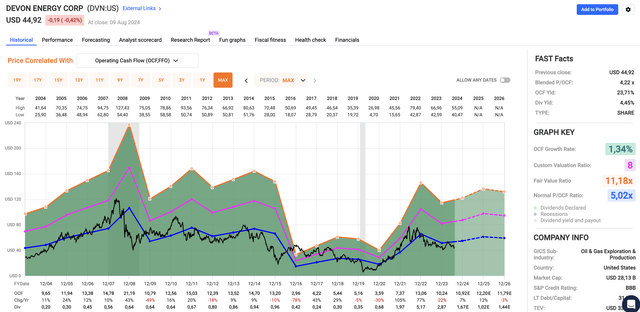

Utilizing the information within the chart beneath, DVN has a normalized P/OCF (working money movement) a number of of 5.0x. Diamondback Vitality has an 8.7x common. EOG Sources (EOG) and Occidental Petroleum (OXY) have multiples near 7.0x.

FAST Graphs

Furthermore, DVN at present trades at a blended P/OCF ratio of 4.2x, even decrease than its common.

Utilizing present analyst estimates of flat OCF progress (FactSet information from the chart above), which is sensible within the present oil worth surroundings, we get a good inventory worth of roughly $60, 33% above the present worth.

Nevertheless, as I wrote in my prior article, I don’t imagine a 5.0x a number of is honest. Particularly if financial progress makes a rebound and more cash rotates from progress to worth shares, I count on DVN to slowly however steadily transfer to an 8x a number of.

This is able to suggest a $95 inventory worth goal, greater than twice its present worth.

As such, I stick with the Sturdy Purchase score, anticipating DVN to return substantial shareholder worth within the years forward.

Nonetheless, I want to say that DVN is risky. This isn’t a sleep-well-at-night dividend inventory for most individuals. Please pay attention to the volatility and its dependence on oil and fuel costs.

Takeaway

My analysis within the vitality sector stays centered on discovering sturdy, value-driven alternatives for long-term progress, with Devon Vitality standing out as a compelling candidate.

Regardless of latest worth volatility, Devon’s operational power, strategic acquisitions, and dedication to shareholder returns, particularly via dividends, help its long-term potential.

Whereas the inventory is risky and closely impacted by oil and fuel costs, I imagine Devon is considerably undervalued, with the potential of substantial features within the years forward, particularly if pure fuel and oil costs rebound.

Professionals & Cons

Professionals:

- Operational Power: Devon’s file manufacturing within the Delaware Basin and strategic growth into the Williston Basin increase its long-term progress potential.

- Shareholder Returns: With a concentrate on dividends and buybacks, Devon persistently rewards shareholders with elevated return potential.

- Valuation: Devon trades at a compelling valuation with important upside potential, particularly if oil costs get well.

Cons:

- Volatility: Devon is very risky, and its inventory worth and shareholder distributions are extremely tied to the worth of oil and fuel.

- M&A: Acquisitions would possibly increase issues about long-term reserve sustainability and progress, as the corporate might should dedicate extra future money to reserve-expanding M&A.

- Pure Fuel Publicity: Weak pure fuel costs have pressured Devon’s margins, making it much less engaging in comparison with oil-focused friends. Nevertheless, given my view on pure fuel, I count on secular progress like new pipelines, information heart demand, LNG exports, and different elements to create a good outlook for pure fuel. So, this “con” might flip right into a “professional.”