Tronox Holdings plc (NYSE:TROX) This fall 2022 Earnings Convention Name February 16, 2023 8:00 AM ET

Firm Members

Jennifer Guenther – VP, IR

John Romano – Co-CEO

Jean-Francois Turgeon – Co-CEO

Tim Carlson – CFO

John Srivisal – SVP, Enterprise Growth & Finance

Convention Name Members

Duffy Fischer – Goldman Sachs

James Cannon – UBS

David Begleiter – Deutsche Financial institution

Frank Mitsch – Fermium Analysis

John McNulty – BMO Capital Markets

Jeff Zekauskas – JPMorgan

Hassan Ahmed – Alembic International

Michael Leithead – Barclays

Matthew DeYoe – Financial institution of America

John Roberts – Credit score Suisse

Will Tang – Morgan Stanley

Roger Spitz – Financial institution of America

Operator

Welcome to the Tronox Holdings This fall 2022 Earnings Name. Right now, all contributors are in a hear solely mode. A short question-and-answer session will comply with the formal presentation. [Operator Instructions] Thanks.

Now, let me flip the decision over to your host, Jennifer Guenther, Vice President, Investor Relations. So Jennifer, you could start your convention.

Jennifer Guenther

Thanks, and welcome to our fourth quarter and full yr 2022 convention name and webcast.

Turning to Slide 2, on our name in the present day are John Romano and Jean-Francois Turgeon, Co-Chief Govt Officers; and Tim Carlson, Chief Monetary Officer; John Srivisal, Senior Vice President, Enterprise Growth and Finance. We might be utilizing slides as we transfer [Technical Difficulty] entry the presentation on our web site at investor.tronox.com.

Transferring to Slide 3. A pleasant reminder that feedback made on this name and the knowledge supplied in our presentation and on our web site embrace sure statements which are forward-looking and topic to numerous dangers and uncertainties, together with however not restricted to the precise elements summarized in our SEC filings. This data represents our greatest judgment based mostly on what we all know in the present day. Nevertheless, precise outcomes could fluctuate based mostly on these dangers and uncertainties. The corporate undertakes no obligation to replace or revise any forward-looking statements.

Through the convention name, we are going to confer with sure non-U.S. GAAP monetary phrases that we use within the administration of our enterprise and consider are helpful to traders in evaluating the corporate’s efficiency. Reconciliations to their nearest U.S. GAAP phrases are supplied in our earnings launch and within the appendix of the accompanying presentation. Moreover, please notice that every one monetary comparisons made through the name are on a year-over-year foundation until in any other case famous.

Transferring to Slide 4, it’s now my pleasure to show the decision over to John Romano. John?

John Romano

Thanks, Jennifer, and good morning, everybody, and thanks for becoming a member of us in the present day. For these of you who’ve joined and could also be a bit new to the Tronox story, we are the world’s largest vertically built-in TiO2 producer with 9 pigment crops, six mines and 5 upgrading services throughout six continents.

Our 2022 income totaled $3.5 billion and was pretty evenly distributed throughout the Americas, Europe, Center East and Africa and Asia-Pacific. Our $1.1 million tons of pigment capability helps our well-balanced base of roughly 1,200 prospects globally. Vertically built-in enterprise mannequin provides roughly 85% of our inner feedstock wants at full efficient capability and this ensures constant and safe provide for our prospects.

Along with TiO2, we additionally generated vital worth because the world’s second largest producer of zircon with roughly 300,000 tons of capability. Our technique is targeted on positioning Tronox because the advantaged world TiO2 chief to the manufacturing of protected, high quality, low price sustainable tons.

Now let’s flip to Slide 5, the place I need to take a second to cowl the numerous strides we made in 2022 in our sustainability efficiency. In our sustainability report launched in June, we accelerated the carbon discount targets we had printed beforehand growing our 2025 aim to 35% from 15% emission reductions and we elevated the 2030 aim to 50% from 35% emission reductions relative to our 2019 baseline.

We stay dedicated to our internet zero aim by 2050, in addition to different sustainability associated commitments, together with zero waste to externally devoted landfills by 2050 and focusing on zero workforce accidents. The revision to the targets was made doable largely as a result of vital renewable vitality challenge we introduced in 2022 in South Africa. This 200 megawatt photo voltaic challenge with SOLA Group is predicted to offer 40% of Tronox’s South African electrical energy wants and cut back our publicity to electrical energy price will increase within the area.

It is also anticipated to decrease our International Scope 1 and a pair of emissions by 13%. And we’re very excited in regards to the constructive affect this challenge can have on our group each regionally and globally as it’s anticipated to be accomplished by the primary quarter of ‘24. We additionally added extra disclosure on local weather associated dangers in accordance with TCFD and aligned our reporting to SASB requirements. We’re constantly working to know the requirements and expectations of our stakeholders and align our inner priorities accordingly.

Lastly, as we highlighted final quarter, we’re constantly realizing growing worth from greater worth co-product streams together with uncommon earth minerals. We proceed to see demand for the varieties of uncommon earth components present in our monazite reserves growing, given their use within the inexperienced financial system. We’re exploring alternatives to improve the uncommon earth content material of what we promote to extract extra worth from our mineral sources.

Now let’s flip to Slide 6 to evaluation the important thing messages for 2022. 2022 was undoubtedly a story of two halves and we’re pleased with the perseverance of our group all through 2022 as we ended the yr very completely different from what it started. The primary half of 2022 started with appreciable momentum, whereas the second half was characterised by vital market pullback beginning in China, adopted by the remainder of Asia-Pacific, EMEA and the Americas.

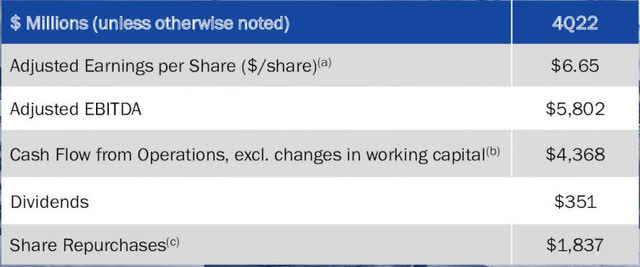

Regardless of a 34% TiO2 quantity decline in a 44% zircon quantity decline within the fourth quarter of 2022 in comparison with the prior yr, we have been capable of obtain full yr 2022 adjusted EBITDA of $875 million and adjusted EBITDA margin within the mid-20s, whereas producing full free yr money stream $170 million after investing $428 million in capital expenditures. These outcomes have been pushed by prudent administration of manufacturing and our price construction to align with the present market surroundings whereas remaining centered on our business pricing technique.

Our capital funding of $428 million in ongoing key capital initiatives included Challenge newTRON and our mining growth initiatives that reinforce Tronox’s dedication to strengthening our enterprise mannequin. The $170 million of free money stream generated within the yr got here in properly above our expectations. Regardless of the rise in price pressures within the fourth quarter and the AR securitization initiative coming in decrease than anticipated resulting from decrease receivables. We efficiently managed money — our money place to greater than offset these headwinds.

Within the yr, we returned roughly $137 million to shareholders, together with share repurchases and dividends. As we highlighted within the fourth quarter, the unanticipated occasions, specifically the fireplace at our KZN perception in South Africa, and historic flooding in Australia unfavorably impacted prices by $30 million within the fourth quarter. We have been additionally negatively impacted on the associated fee aspect by decrease absorption as we adjusted our manufacturing to be extra carefully aligned with the decrease market demand.

In complete, we incurred over $60 million in prices from fourth quarter occasions and unfavorable absorption expenses. We anticipate to see continued impacts of those occasions within the first quarter, specifically on zircon tons accessible sale and the price of ore from the brand new mine. Nevertheless, these impacts are anticipated to start to enhance throughout the first quarter and due to this fact, we anticipate higher recoveries to EBITDA as we transfer into the second and third quarters.

Slide 7 offers a bit extra element on the complete yr efficiency in your reference. So let’s flip to Slide Eight and we’ll evaluation the fourth quarter in additional element. Income of $649 million was impacted by a swift market contraction throughout all areas. Enhancements and pricing have been greater than offset by operational price will increase and decrease gross sales volumes.

As I beforehand outlined, the fourth quarter consists of roughly $60 million of idle facility and decrease price to market expenses together with greater prices from This fall occasions and decrease mounted price overhead absorption. Our efficient tax price for the quarter was 26%, whereas our normalized price was 24%. Our GAAP diluted loss per share was $0.09 and our adjusted diluted loss per share was $0. 17.

Adjusted EBITDA within the quarter was $113 million and our adjusted EBITDA margin was 17.4% impacted by greater occasion pushed operational prices within the quarter. And our free money stream within the quarter was $126 million.

Now let’s transfer to Slide 9 for a evaluation of our business efficiency. Whereas we did see a big discount in demand throughout all areas, our TiO2 volumes got here in inside our beforehand guided vary for the quarter. Pricing throughout each TiO2 and zircon was in keeping with our expectation pushed by continued execution of our business pricing technique.

TiO2 volumes declined 28% sequentially, whereas common promoting costs declined barely by 1%, whereas FX impacts have been lower than half of a % (ph) favorable. Zircon value — zircon volumes declined 30% in comparison with the prior quarter owing to decrease manufacturing from the fourth quarter and our zircon pricing remained comparatively flat to the prior quarter.

Income from different merchandise was $80 million, a lower of 12% to the prior yr largely pushed by decrease pig iron gross sales. The strengthening of the U.S. greenback within the quarter was a headwind to income in comparison with the prior yr resulting from unfavorable translation impacts primarily from the weakening of the euro. We firmly consider we noticed the trough in our TiO2 volumes within the fourth quarter as we said beforehand and we’re already starting to see a rebound.

We anticipate the primary quarter pigment demand to extend from the fourth quarter, pushed by a bigger rebound in Europe than in different areas. We anticipate North America and Asia to get better a bit slower as demand continues to stay low, though nonetheless up from the fourth quarter lows. We anticipate the restoration in demand to proceed as we enter into the coating season and anticipate seeing progressively bettering gross sales volumes in all areas as we transfer all through the second and third quarters.

We additionally proceed to see the advantages of our margin stability initiatives and our monetary outcomes. Even with the current vital quantity reductions, we anticipate our general TiO2 pricing within the first quarter to stay comparatively flat to the fourth quarter stage. That is pushed by the number of contract preparations we now have available in the market with our prospects that help our margin stability initiatives.

As we have communicated beforehand and demonstrated in This fall, we don’t anticipate pricing to maneuver because it has in earlier financial transitions. Owing largely to the business method we efficiently carried out over the past a number of years.

I will now flip the decision over to JF for a evaluation of our operational efficiency. JF?

Jean-Francois Turgeon

Thanks, John, and good morning. Turning to Slide 10. Our adjusted EBITDA sequential decline was pushed by decrease gross sales quantity, greater prices, together with freight and unfavorable pricing affect. FX price have been a good offset. As John outlined, the quarter was considerably impacted by a fireplace at our KZN facility in South Africa and an historic flooding in Australia, which delayed the commissioning of our Atlas Campaspe mine.

In South Africa, we’re changing the ultimate spiral this month that suffered injury from the fireplace and we might be again to 100% manufacturing stage on the web site by the top of this month. Because of this, our first quarter will even be impacted by the decrease zircon accessible for gross sales and the decrease mounted price absorption.

In Australia, whereas the heavy rain abate late final yr, the world the place the mine is positioned is in a basin. The place the water continued to gather and end in by no means earlier than seen flooding stage on this millennium. We have been capable of attain an vital milestone this month at Atlas Campaspe resulting from vital effort and negotiation by our workforce, the heavy mineral focus being produced is now efficiently being trucked off the positioning utilizing an alternate previous street, albeit at a better price.

An excellent accomplishment given the numerous affect of the flood on our lack of ability to make use of the unique roadway. We’re enthusiastic in regards to the worth this mine will deliver to our operation and the development to our backside line. We are going to see from using the feedstock. We are going to start to see this in our second quarter end result within the type of incremental zircon sale. All by the associated fee profit for the ore might be additional delay as it should take time for the ore to stream by our pigment plant.

We anticipate to see a extra vital profit as we transfer into the second half of the yr. In complete, these occasions affect our end result by $30 million. As we beforehand communicated, we additionally slowed our manufacturing to align extra carefully with the decrease market demand within the fourth quarter, leading to decrease mounted price absorption and idle facility and LCM cost. This impacted end result by a further $30 million, leading to a complete of roughly $60 million of affect to the fourth quarter EBITDA.

We anticipate to see continued affect from these occasions within the first quarter, specifically on zircon ton accessible for gross sales and on the price of ore from the brand new mine. On account of the business dynamic John beforehand outlined and the hangover impact from the fourth quarter occasion, we anticipate the primary quarter 2023 adjusted EBITDA to be within the vary of $120 million to $130 million and adjusted EBITDA margin to stay within the high-teens.

The affect to zircon manufacturing and our Australian ore price is predicted to start to enhance throughout the first quarter and we due to this fact anticipate a higher restoration to EBITDA as we transfer into the second and third quarter.

Turning to Slide 11. On account of the macroeconomic backdrop, we’re taking motion to navigate the present panorama and place Tronox for achievement. We make use of a strong course of as part of our forecasting evaluation that allow us to plan for quite a lot of financial situation. Mixed with our enterprise optimization mannequin, we’re capable of react swiftly and optimize our portfolio. We proceed to be laser centered on price discount and have a variety of levers to optimize efficiency throughout quite a lot of situation that we’re executing on.

Now we have already begun executing on our price discount playbook. Now we have carried out a hiring freeze. We’re decreasing skilled payment, journey and different discretionary prices. We’re additionally optimizing our mounted prices and driving extra provide chain initiative. We’re prudently managing working capital. Declining demand drove elevated TiO2 stock stage within the third and fourth quarter. One good thing about this was enabling the replenishment of our security inventory, which has been beneath seasonal norm stage within the first half of 2022.

Our goal to be an 85% vertically built-in TiO2 producer is a part of our long-term technique. This led us soak up market fluctuation whereas optimizing our feedstock asset, which have greater mounted prices relative to our TiO2 asset. On account of present decrease TiO2 manufacturing stage pushed by buyer demand, which is down within the 30% vary year-on-year we’re taking motion to cut back our feedstock manufacturing stage. This can end in barely greater mining and beneficiation prices within the first and second quarter of the yr.

On capital expenditure, as we now have highlighted beforehand, vertical integration funding and newTRON are key challenge to help our medium and long-term worthwhile progress initiatives. Nevertheless, we now have carried out plan to considerably cut back our annual capital spend to be beneath $275 million in 2023 to adapt to the macroeconomic surroundings because it unfold.

Whereas it will delay our potential to comprehend profit from these challenge, we do consider that is the suitable choice for the enterprise presently and is in keeping with our potential to flex our capital spend. We anticipate these actions will allow Tronox to generate constructive free money stream throughout quite a lot of situation together with our recession case. We are going to proceed to steadiness money technology whereas making certain we now have the product needed to fulfill our buyer wants and are successfully positioning Tronox for future success.

I’d now like to show the decision over to Tim Carlson for a evaluation of our monetary place. Tim?

Tim Carlson

Thanks, JF. Turning to Slide 12. We ended the yr with complete debt of $2.5 billion. Our internet leverage on the finish of the yr was 2.Eight instances. Our steadiness sheet stays sturdy with no close to time period vital maturities till 2028 and no monetary covenants on our time period loans or bonds. Complete accessible liquidity, as of December 31 was $608 million together with $164 million in money and money equivalents, which is properly distributed throughout our world operations.

Capital expenditures totaled $428 million in 2022 roughly $125 million was for upkeep and security capital, $75 million was for challenge newTRON, and $200 million was for operational vertical integration initiatives, together with Atlas Campaspe. Depreciation, depletion and amortization expense was $269 million for the yr and our free money stream totaled $170 million, resulting from our sturdy money earnings.

We returned $137 million to share homeowners in 2022 within the type of dividends and share repurchases. As that is my final earnings name earlier than my retirement from Tronox on April 1, I’d similar to to say thanks in your help over the past six years. I am extraordinarily proud to have performed a job in Tronox’s transformation to the place it’s in the present day, well-positioned to navigate the present surroundings and ship significant worth sooner or later and I stay up for remaining a shareholder for a lot of extra years.

I will now flip the decision over to John Srivisal, who will talk about the primary quarter outlook. I’ve labored very carefully with John over the previous a number of years as a enterprise accomplice on the manager workforce and I am assured that the management, monetary abilities and strategic imaginative and prescient, he brings to the position will proceed to place Tronox for achievement. John?

John Srivisal

Thanks, Tim, for these variety phrases. Whats up, everybody. I am excited to be right here this morning. I have been wanting ahead to assembly lots of you over the approaching months.

Turning to Slide 13. At Tronox, we make use of a strong bottoms-up evaluation of our markets, operations, and the dangers and alternatives in creating our forecast. Whereas the tempo and timing of the restoration stays to be seen, we’re assured that we now have seen the trough on TiO2 volumes. Nevertheless, as John and JF outlined, we anticipate to proceed to see the affect of zircon volumes and working prices within the first quarter from fourth quarter occasions.

Primarily based on this in our present bottoms-up evaluation, we anticipate adjusted EBITDA to be within the vary of $120 million to $130 million for the primary quarter. This assumes that TiO2 volumes will improve sequentially within the low to mid-teens vary. As John indicated, this additionally assumes comparatively flat TiO2 pricing given the reset in a few of our margin stability contracts.

With respect to zircon, we do anticipate volumes to say no sequentially by about 5,000 tons, owing a decrease manufacturing at KZN in Australia for the explanations mentioned earlier. Moreover, resulting from these two occasions, we now have included into our first quarter vary, roughly $25 million in greater manufacturing prices. The vary additionally assumes a headwind from FX, primarily pushed by the Australian greenback and South African rand.

Now stepping again from the quarter, as you’d recall, we launched a recession case at our Investor Day in June 2022. Whereas we stand agency behind the evaluation supporting that vary, there are three vital elements to contemplate within the time since then. First, we modeled the market correction beginning 12 months to 18 months from our Investor Day.

As an alternative, we noticed the beginning of a downturn inside 60 days of Investor Day. We due to this fact hadn’t absolutely realized the newTRON advantages we had initially assumed we achieved by the top of 2023. As an alternative, we now have now delayed facets of the challenge to cut back capital, which additionally delays the belief of financial savings beforehand anticipated.

Second, the historic flooding in Australia has considerably delayed the advantages from the Atlas Campaspe mining challenge. And third, TiO2 volumes declined 15% year-over-year in 2022, whereas the recession case assumes a 10% decline. Whereas we anticipate TiO2 volumes to sequentially improve from the This fall trough, we anticipate 2023 full yr volumes to be flat to barely up from 2022.

Importantly, nevertheless, pricing dynamics have performed out precisely as we anticipated. As we now have emphasised over the past a number of years, the steadiness packages our business workforce has put in place have efficiently lowered the volatility available in the market.

Transferring to our expectations for 2023 money makes use of, we anticipate working capital to be roughly $150 million use, which is greater than the place we would prefer it to be. We’re working to cut back these anticipated outflows by additional optimization efforts. We anticipate internet money curiosity expense to be roughly $130 million, money taxes of roughly $35 million and capital expenditures of lower than $275million.

JF shared earlier the actions we’re at present taking as a enterprise. We are going to proceed to evaluate and execute in opposition to the levers we are able to pull relying on the financial situations to make sure adequate liquidity and continued alignment of our manufacturing and value to the financial backdrop. We stay centered on delivering on our commitments.

That concludes our ready remarks. With that, I would like to show the decision over for questions.

Query-and-Reply Session

Operator

Thanks. [Operator Instructions] The primary query we now have from the telephone traces comes from Duffy Fischer of Goldman Sachs. Your line is now open, Duffy. Please go forward.

Duffy Fischer

Sure. Good morning. First query, simply on the final feedback in regards to the differential out of your trough case. Are you able to quantify roughly what these three buckets would do to your trough case?

John Romano

Certain, Duffy. And good to speak to you once more. So when you take these three buckets individually, we first centered on newTRON financial savings. And as we offered at Investor Day, we anticipated about $150 to $200 per ton of financial savings. And as we shared as properly, a few third of that associated to volumes. So given this market surroundings, we do not anticipate to see these financial savings come by till the market picks up later in 2024. Moreover, a portion of that associated to price financial savings, which required full integration of our ERP throughout the globe. So a portion of that quantity associated to people who we can’t see for some time.

Turning to the Atlas, as we talked about earlier than, we anticipate about — we had initially assumed and relate to you that about $50 million of profit we would see from the Atlas. Nevertheless, as you possibly can anticipate, simply given the downturn available in the market, given the delay within the mine opening up, we do see some extra prices coming by. So with that and the actions that we’re doing to attempt to deliver that ore to accommodate for the floods, we’ll see extra price hitting. In order that’s roughly about $25 million.

After which lastly, as I discussed, recession case assume 10% quantity declines and we’re seeing greater than that.

Duffy Fischer

Okay.

Jean-Francois Turgeon

And there is a component. It is price and it is the amount on that zircon that we’re not getting early within the yr as properly.

Duffy Fischer

Okay. After which simply type of a steadiness sheet query, volumes have been down huge final yr, however but your stock was up over $200 million and now you are guiding to working capital being up one other $150 million this coming yr as you are calling volumes type of flattish. So what’s that? Why do we want a lot extra working capital than we did it a yr in the past?

John Romano

Duffy, we’re nonetheless constructing stock. Now we have introduced down manufacturing at our websites, however not as a lot as the amount on TiO2 have come down. Moreover, we’re constructing feedstock. In order that’s an enormous portion of the construct within the stock stage.

Jean-Francois Turgeon

Duffy, you’d understand that I imply we’re 85% vertically built-in. And in This fall, we noticed a drop in that (ph) and TiO2 demand within the order of 30% and we’re anticipating the identical drop in Q1 versus a yr in the past quarter. So we now have to decelerate our mine and smelter and people are excessive mounted operations. So we do not need to sluggish them down an excessive amount of. In order that’s why we’re nonetheless constructing stock in the intervening time. Look, clearly, that may place us very properly for the second half, if we see the market choosing up.

Tim Carlson

Hey, Duffy. It is Tim. The opposite element of working capital and doubtless the extra major factor is receivables. This fall of 2022, clearly was a trough for the degrees we have by no means seen earlier than. We see the uptick in Q1. We see the uptick persevering with by This fall, so simply stock ranges in This fall year-on-year at barely improved DSOs will trigger a rise as properly.

Duffy Fischer

Nice. Thanks, guys.

Operator

Thanks. Our subsequent query comes from the road of Josh Spector of UBS. Please go forward, if you end up prepared, Josh.

James Cannon

Hello, guys. That is James Cannon on for Josh. I used to be simply going to ask about your 1Q outlook. It appears somewhat bit extra optimistic that upward (ph) to mid-teens versus a competitor that was rather less optimistic. I used to be questioning, when you might simply touch upon what offers you confidence in that restoration and whether or not you have seen that pickup to this point within the quarter otherwise you’re anticipating additional enchancment to return?

John Romano

Yeah, James. So look, I imply, we are able to let you know what we’re seeing available in the market. And what we’re seeing available in the market, as we talked about within the prior quarter, we thought the fourth quarter was going to be a trough. And in reality, it was our volumes are choosing up in all areas. We made reference on the decision that Europe is choosing up somewhat bit or truly faster than the remainder of the world, however we’re seeing a rise in North America. We’re seeing a rise in Asia. There’s loads of optimism going round in India proper now.

India is an enormous portion — I believe loads of our traders assume China is an enormous a part of our enterprise. India is an even bigger a part of our enterprise than China is at this explicit stage and there is vital progress happening there. So after we take into consideration the place we’re in the present day in comparison with the place we have been within the fourth quarter, pigment volumes are choosing up that is why we’re assured that these margins that we referenced are going to proceed. We additionally referenced the place we have been on the pricing. We referenced that pricing was going to be comparatively flat. Now we have loads of agreements which have adjusted on the margin stability aspect which have allowed us to offset and truly most likely overcome among the decreases.

So net-net after we consider comparatively flat, that might be flat to barely up relying on what occurred. So we’re assured in what we’re seeing within the first quarter and that first quarter construct goes to construct into the second quarter as a result of we anticipate to see volumes to proceed to extend.

Jean-Francois Turgeon

And James, I’d add to that, that clearly in This fall with the drop of 30% of quantity and with what we anticipate for Q1, as John stated, is an enchancment, however nonetheless removed from what was our regular quantity and this drop is far more than what our buyer are experiencing. So it was not sustaining to see the kind of drop that we now have in This fall.

James Cannon

Acquired it. Thanks guys.

Operator

Thanks. We now have David Begleiter of Deutsche Financial institution. Please go forward, if you’re prepared.

David Begleiter

Thanks. Good morning. Simply on zircon, how does the market reacting to the lack of your volumes and what does that imply for pricing do you assume for the complete yr?

John Romano

Effectively, as we talked — and we referenced within the name, our quantity — our pricing for the fourth quarter — from fourth quarter was flat and we anticipate to see, I would say, secure pricing transferring into the primary quarter. So with China being down, I’d say that there was a little bit of a lower in demand. It did not affect us as a result of as you realize, we have been brief on stock to start with and the Atlas Campaspe delay continued to drag again on our stock.

So we’re nonetheless assured that as we transfer into the primary quarter and into the second that we’ll see pricing that continues to be comparatively flat to the place we’re in the present day. And as after we begin eager about the affect of what is occurring in Atlas, if we might have had that manufacturing, we might have had about 5,000 to 10,000 extra tons within the first quarter and we consider we might have positioned these on the similar value.

David Begleiter

Superb. And simply on newTRON, all of the precise financial savings in ‘22, what do you assume they’re going to be in ‘23 and even ‘24 now?

Tim Carlson

So on newTRON, David, Keep in mind, we talked about an enchancment of about $50 million for 2022 and we are going to preserve that clearly in 2023 and we’re most likely going to barely improve it by, I would say, one other $20 million by automation of a few of our plant and steady growth of our superior course of management and our upkeep apply as a result of all of these components, the investments have been performed in ’22 and the profit will begin to present in ’23.

As John talked about, we now have paused the ERP deployment worldwide. So that may decelerate a bit, the advantages associated to that a part of the challenge. And clearly, all the extra ton at newTRON value giving us, it will likely be accessible when the market picks up. In order that’s in a nutshell the place we’re.

David Begleiter

Superb. Thanks.

Operator

Thanks, David. We now have Frank Mitsch, Fermium Analysis. Your line is now open.

Frank Mitsch

Thanks, and greatest needs in your retirement, Tim. It was a pleasure working with you for certain. John, in response to one of many questions that was requested earlier, you talked about misplaced revenues and income from zircon. And so type of begs the query, you had a $60 million adverse affect from the flood and the fireplace in 4Q. In your slide, you talked about a $25 million affect in 1Q, nevertheless it sounds just like the affect is perhaps greater than that. Are you able to type of step us by as to what the impacts is perhaps right here in 1Q and what lingers into 2Q?

John Romano

Yeah, Frank. So once more, after we take into consideration — let’s begin with what’s occurring in Atlas proper now. So Atlas is definitely up and operating. And after we pull that [indiscernible], after we pull the heavy mineral focus out of Atlas, it has to go to Damaged Hill and that is the difficulty. The street to Damaged Hill continues to be flooded. Now we have come up, as Jeff talked about in his feedback, we’re now delivery HMC from Atlas to Damaged Hill by way of an alternate route that existed. The first street hasn’t been repaired but. So we’re getting materials there.

And as we get into the second quarter, we’ll begin to see extra profit from what’s popping out of that asset. However the huge affect within the first quarter and within the fourth quarter was that Damaged Hill wasn’t actually operating. You had mounted prices there. We additionally had our mine in Ginkgo that was supposed to return down, which we proceed to run in order that we are able to proceed to run ilmenite by Damaged Hills in order that we are able to have ilmenite to provide pigment.

So there are a number of compounding results which have occurred from that flood which are persevering with to roll into Q1 and after we take into consideration the place we at the moment are in our expectations, as we stated, as we might anticipate to see the fourth quarter price are literally, our price to enhance as we transfer into the latter half of the yr as we begin to get the roads again in full manufacturing by the extra capability, we’ll be capable of ship on that major street once more.

Jean-Francois Turgeon

Yeah. And Frank, we are going to clearly shut the mine that’s the excessive price mine as quickly as we might attain full manufacturing from that street and that is the large unknown for us this yr as a result of we do not know when that street will open. We’re clearly working with the county and with the native authority to attempt to even assist them reopen that street and do what’s needed. However that is why it was onerous for us to foretell what would occur for the entire yr.

Frank Mitsch

Understood. So the best way that we take into consideration it’s not simply the $25 million within the manufacturing prices, however the misplaced zircon tons, so that you’re most likely speaking one other materials loss profitability in 1Q? Is that not how we should always take into consideration that? After which a few of that spills into 2Q as properly?

John Romano

Yeah. It is about $15 million on zircon, $10 million on Atlas and $15 million on South Africa, which isn’t going to repeat as a result of as JF talked about, South Africa is coming again on-line on the finish of this month and that is from the fireplace.

Frank Mitsch

Acquired you. All proper. Nice. After which only a query concerning stock ranges downstream, with ‘22 being beneath the recession case by way of TiO2 volumes. Is your expectation that the downstream volumes are most likely beneath common or would you say that your buyer stock ranges are most likely in line? And so I am simply attempting to guage, is there a possible in ‘23 or maybe ‘24 that we see a restocking profit downstream?

John Romano

That is an excellent query. And the fact is after we talked within the fourth quarter that was loads of the destocking happening. Clearly, there’s been a drag on impact from demand. So I believe you are precisely proper. We consider the vast majority of the destocking has stopped as a result of we’re beginning to see our prospects’ order a bit faster than they’d earlier than. So after we — as you — I imply China is a superb instance. Within the month of January, we now have — from January to February, we have seen a big transfer in quantity requests from prospects as China begins to choose up.

So you may begin to see what was being exported out of China absorbing a few of that extra progress. And I do consider there may be alternative as we get into the again half of the yr for a restocking of it. It will not be as vital because it was possibly two years in the past with the intention to get again as much as the place we have been within the yr the place we had all of the COVID profit from the extra cash that was coming into the system within the type of subsidies. However we do consider that there is an upside in restocking and it might occur earlier than the top of the yr.

Frank Mitsch

Thanks a lot.

Operator

Thanks. We now have John McNulty with BMO Capital Markets. Please go forward if you’re prepared.

John McNulty

Yeah. Thanks for taking my query. So I assume are you able to converse to vitality prices? 2022 clearly, Europe had an enormous spike, remainder of the world was type of combined. You guys have been considerably resistant to that as a result of the hedges now vitality plunged again down. I assume are you able to type of assist us to consider how vitality will affect you in’23 versus ‘22 general? How ought to we be eager about that?

Tim Carlson

Hey, John. It is Tim. From an general vitality standpoint, it will likely be considerably impartial for us, ‘23 versus ‘22, somewhat little bit of incremental price that we have constructed into our plan because of some considerations that we now have in Europe, however nowhere close to the extent of will increase that we noticed in ‘21 or in ‘22, sub-$10 million.

John McNulty

Acquired it. Okay. After which possibly simply to make clear as a result of admittedly, I am somewhat bit confused by among the earlier questions. So with regard to the mine, mine points that you just guys confronted within the fourth quarter, it appears like, from a value perspective, within the fourth quarter, you had a few $60 million hit. Within the first quarter, you are going to have extra like a $25 million hit. After which on prime of that, there’s going to be some type of challenge round zircon and your potential to maneuver zircon. I assume are you able to converse to — relative to the fourth quarter, will your zircon gross sales and volumes, I assume be up or down or flat?

John Romano

So John, to take the completely different items of that, because it pertains to our Q1 run price, there’s about $10 million of incremental Atlas price that we usually wouldn’t have had. There’s about 15,000 tons of zircon gross sales within the quarter that we might have had if the truth is Atlas had been on-line and if the truth is we didn’t have the KZN in hearth. Along with that, as Jeff talked about as a part of his ready remarks, volumes are down 30% year-on-year within the fourth quarter. And we see that once more in Q1 simply given the information that we gave you on volumes.

And if you’re down 30%, our advantages of vertical integration, we battle a bit as a result of we goal 85%, however if you’re down 30%, we have got to sluggish our mines down somewhat bit, which we’re doing as a part of Q1 and that is a further $15 million of unfavorable over absorption. So it is actually these three items in Q1 which are impacting our Q1 information.

John Srivisal

I imply simply from the zircon query although, I imply, so the primary quarter of ‘23 goes to be about 5-ish down from the place we have been within the fourth quarter after which it begins to maneuver up. However after we discuss in regards to the street, this alternate street from Atlas to Damaged Hill. It is not the street that had the aptitude to take the amount that we might have been utilizing on that major street. So we have got approval to make use of that street on a smaller quantity of fabric going from Atlas to Damaged Hill to change to transform that into MAGs and non-MAGs. And finally, we can’t have full capability till we get most likely extra within the mid-year when that major street is again up and operating. So that is the limiting impact. After which if you get into third quarter, you begin to see zircon numbers transfer again as much as what these regular ranges can be.

John Romano

John, when you have a look at This fall to Q1 particularly, as I discussed earlier on the decision, we’ll be down 5,000 tons quarter-over-quarter from zircon.

John McNulty

Acquired it. Okay. No, thanks very a lot. That undoubtedly helps to clear it off.

Operator

Thanks. We now have Jeff Zekauskas of JPMorgan. Please go forward if you end up prepared, Jeff.

Jeff Zekauskas

Thanks very a lot. Your titanium dioxide volumes have been down 34%. Are you able to discuss in regards to the regional variations? In the event you group it into Europe, America and Asia, what have been the relative modifications? After which when you can overlay demand from coatings and paper and plastic components. How did these demand modifications work?

John Romano

Yeah. So within the fourth quarter, Europe was down extra considerably than Asia-Pacific. Asia-Pacific was down, I assume I would say, second to the Europe, Center East and Africa market. After which North America, had not moved down as a lot, nevertheless it was nonetheless down. So after we take into consideration how that breaks down into the segments, I would not say there was a big push in both path. Possibly there was a bit extra of a pullback on the paper laminate aspect in Europe than there was on the coating aspect.

However we noticed a destocking impact happening within the fourth quarter that was fairly constant round all market segments. It wasn’t closely weighted within the coatings. Now, clearly, as we glance into Q1, I discussed that Q1 is stronger than This fall in North America, though, it is rising at us — I imply, it is choosing up slower, that’s closely weighted on coatings. In order we get into coating season, we’re anticipating that we’ll begin to see these volumes choose again up and that is why we referenced within the second quarter, we’ll see volumes choosing up considerably in each area.

Jeff Zekauskas

Are you able to simply body somewhat little bit of a level of quantity contraction in North America, that order of magnitude was it 10% or 20% or 25% or 5%? And are you choosing up market share in Europe within the present quarter?

John Romano

Yeah. So in Europe, we’re seeing a big improve in quantity from the fourth quarter. To the purpose that JF made beforehand, we’re not the place we have been beforehand, however we’re seeing a big improve. And market share features, it is onerous to say, I imply, clearly, there’s nonetheless some manufacturing offline. There’s some — there are different rivals on the market which are having extra problem than we’re. So there might be some market share acquire, nevertheless it’s not being pushed by value. It is possibly pushed by among the buyer agreements that we now have which are extra long run.

Jean-Francois Turgeon

And I would say, Jeff, that our sustainable method being vertically built-in and the best way we function our mine pigment plant and our constructive affect on the surroundings and our status with our buyer is definitely serving to us sustaining and I would say, gaining share. And that is clearly a narrative that we use to our benefit. Particularly, in opposition to Chinese language competitors.

Jeff Zekauskas

And within the fourth quarter, what have been North American volumes like in TiO2?

John Romano

North American volumes, I would say we’re down most likely about 5% to 10% greater than what we might usually see within the fourth quarter downturn. And as we transfer into the primary quarter, they’re transferring up, however most likely not as a lot as we might have seen beforehand. And that is once more North America was type of the final one to decelerate and we noticed Europe and Asia choosing up a bit extra. And as we glance into the forecast as a result of we’re midway by the quarter, we’re already getting a sign from prospects and so the second quarter is seeking to enhance in all areas.

Jeff Zekauskas

Okay. Thanks a lot.

Operator

Thanks, Jeff. We now have Hassan Ahmed from Alembic International. Please go forward if you’re prepared.

Hassan Ahmed

Good morning, John and JF. I am nonetheless somewhat confused in regards to the trough earnings energy of the corporate. I imply, out of your form of commentary, it appears you are form of backing away from the $800 million to $1 billion form of steerage you had given earlier. However my confusion type of stems from, if I check out to illustrate, the Q1 steerage of $120 million to $130 million in EBITDA you guys have given.

On an annualized foundation, that is $480 million to $520 million proper? If I check out your This fall quantity, $113 million and factoring the $60 million of one-offs and annualized that, that’s $700 million after which clearly the $800 million to $1 billion that you just guys had talked about. So the place are we now by way of that form of cross earnings potential.

John Romano

So thanks for the query. Look, so when you consider — let’s simply have a look at the place we’re within the — between on our steerage, $120 million to $130 million, so choose the center of $125 million and consensus is on the market like $152 million. So the $25 million that we needed to bridge, we would say about $20 million of that’s connected to Australia and $5 million of that is connected to South Africa. And of that $20 million, $10 million of that’s most likely EBITDA that may have been connected to zircon gross sales and the opposite $10 million is connected to extra price from the mine. So that may get you to the place we might be not less than that bridges to consensus.

Once you begin eager about transferring into the second and third quarter, once more, you possibly can’t, as we have all the time stated, we do not need you to take the steerage that we supplied and multiplied by 4 as a result of that’s properly beneath. I believe John made some reference into how you could possibly bridge to the place we might be. You consider what John stated on Atlas by itself. We stated $50 million there’s some extra prices. So $75 million simply coming from Atlas for the yr as a result of we’re not getting that worth that we might have traditionally the place we talked about it being a $50 million constructive.

As we get into the second half of the yr, our margins are going to be, when you — I will simply say that when you took the numbers that we’re anticipating within the third quarter and multiplied them by 4, you would be numbers which are inside our recession case. I do not know, if that JF, if you wish to make a remark, however that gives hopefully somewhat bit extra shade.

Jean-Francois Turgeon

No, I believe that was the suitable means. I hope Hassan, you perceive that Atlas was clearly after we did our recession case at Investor Day, we assume that Atlas Campaspe might be in full operation and it is not. In the mean time, there’s completely no worth from Atlas in Q1. In reality, there may be prices related to Atlas in the intervening time as a result of we proceed to run a mine that we should always have shut down.

So we now have extra prices and fewer worth. In order that’s defined why This fall and Q1 are beneath our regular recession run. And we hope that look because the yr progress, we are able to go even above that. We do not know what would the market do, however we’ll be in an excellent place to react to the market. We’ll have the feedstock and the pigment to fulfill our buyer demand.

John Romano

And possibly only one extra follow-on. Once more, it is a repeat of what John stated earlier, after we got here out with that recession case, we we’re not anticipating that 60 days later, we would begin to see that recession case hit. So we’re ranging from a decrease level now exacerbated by what JF simply stated. So nonetheless consider in that recession case, it is simply going to take somewhat little bit of time to get better as a result of factors that we simply famous.

Hassan Ahmed

Understood. And simply form of carrying ahead with that form of, name it, recession case and the way you guys are modeling it and eager about it within the like, because it pertains to free money stream technology, proper? I imply, clearly, regardless of the entire form of headwinds and the like, I imply, $126 million in free money stream technology in This fall, which is round $0.80 a share, annualized $3.20 and your share value is $15 in change, proper?

So I am simply attempting to form of reconcile the way you guys are eager about the free money stream technology potential of the corporate and the way you parlay that with share buybacks as a result of if my — numbers of me, proper? I imply, you guys simply purchased again 2.5 million shares in This fall.

John Romano

We did not purchase any shares again within the fourth quarter. So I am unsure the way you backed into that.

Hassan Ahmed

Say that once more? I am simply wanting on the share rely the place it was in Q3 relative to what you guys have logged in This fall?

Tim Carlson

Yeah. The weighted common shares are clearly are coming down as a result of we did purchase $50 million of shares again in Q1 and Q2, however that is a weighted common calculation by quarter.

Hassan Ahmed

And the way are we eager about shopping for again shares on a go ahead foundation, notably with the sturdy free money you guys have?

Jean-Francois Turgeon

So we’ll proceed Hassan to guage based mostly on what we anticipate from the market. In the mean time, as John talked about, we’re seeing some working capital that’s enjoying in opposition to us particularly, properly, in This fall it was the case and in Q1 it should nonetheless be the case. And that is enjoying in opposition to us as a result of I imply the drop in demand has been so sturdy that even when we’re slowing down our pigment plant in our mine, we’re not slowing as quick because the demand.

Within the second half of the yr although, we are going to see a reverse of that and that ought to assist and we’re clearly attempting to enhance that working capital use for using 2023. And our plan is clearly with the free money stream to keep up dividend and to guage on an opportunistic foundation, if we should always pay down debt or if we should always purchase again share. As you realize, we now have nonetheless $250 million accredited by the board to purchase again share. And John, and I are nonetheless dedicated to that method of utilizing the free money stream.

Hassan Ahmed

Very useful guys. Thanks.

Operator

Thanks, Hassan. We now have the subsequent query from Mike Leithead of Barclays. Please go forward, everytime you’re prepared.

Michael Leithead

Nice. Thanks. Good morning, guys. First query simply round working capital. I believe final quarter you talked about it doubtlessly being a $200 million plus hit for 2022. It appears prefer it got here in so much higher than that, so are you able to simply type of sq. type of what the delta was as 4Q unfolded? There’s clearly loads of transferring items within the fourth quarter.

John Srivisal

Yeah. There are a selection of items Mike because it pertains to our actions in This fall. One of many items is, we securitized our receivables out of Australia. We additionally did fairly a bit of labor by way of our credit score and collections workforce considerably decreasing DSOs beneath what we have had beforehand. They did an excellent job on the finish of the yr. And by way of managing money, and we additionally received a pair extra days out of DPO and picked up fairly a little bit of deposits in a few of our different receivables that we had excellent.

Michael Leithead

Acquired it. Is sensible. After which secondly, I simply wished to type of come again to money stream and steadiness sheet, however possibly from a special angle. I believe after 1Q, you may be about Three instances trailing leverage and I assume, it most likely ticks up a bit within the second quarter from our document 2Q ’22. You laid out about $600 million of money prices by dividends about $85 million.

Do you assume you are going to have the ability to fund the dividend from working money stream? I assume it is type of a again finish means of asking you to assume full yr EBITDA might be above 685. After which [indiscernible] EBITDA above. [Multiple Speakers] Nice. After which extra money stream ought to that go to debt paydown or how ought to you consider extra money stream past that?

John Romano

So extra money stream between — we are going to have a look at that opportunistically as debt paydown or share buybacks relying upon as we transfer by the yr. So proceed to be in keeping with what we stated beforehand.

Michael Leithead

Nice. Thanks, guys.

Operator

Thanks. We now have Matthew DeYoe of Financial institution of America. Please go forward if you’re prepared Matthew.

Matthew DeYoe

Good morning, all. Are you — like simply to hit somewhat bit on the vitality price aspect in Europe, The place does among the idled capability is beginning to restart throughout a few of your rivals? So are you apprehensive that maybe a few of that capability comes again on-line as a result of decrease price however is not essentially wanted by the market. I am simply type of apprehensive about rampifications to cost deflation in Europe if we see an enormous ramp there?

John Romano

Yeah. I will additionally make a remark and I will let Tim try this. Look, so there’s been loads of capability that is been slowed down within the fourth quarter and even within the third quarter resulting from excessive vitality prices. There wasn’t — whether or not or not that capability truly goes down over time, that is but to be seen, however we did anticipate as vitality began to abate a bit that we might see that capability come again on-line. So I would say the brief reply is, it wasn’t a problem earlier than we do not anticipate that to be a problem. We anticipate demand to begin to choose again up.

As we talked about, Europe, we’re seeing a powerful restoration once more, it is not as sturdy as we had been beforehand, however we might anticipate a few of that quantity that is being introduced on-line to be offset by among the exports that have been coming from China into Europe, there was a big improve within the fourth quarter of exports from China into Europe and now with the China financial system choosing up, we might anticipate a few of that is going to remain in nation. We talked generically about pricing. Pricing in China, out of China and in China is transferring up We noticed about $150 improve in our pricing on China and we’d anticipate that to proceed to maneuver up.

So Tim, I don’t know, if you wish to make a remark.

Tim Carlson

The opposite remark I would prefer to make that Matthew because it pertains to vitality. Power was about 12% of our price of product in 2022. We see that coming all the way down to 11%. So somewhat little bit of moderation, however not so much. It ranges from 4% to 20% that relying on our facility, the best prices are clearly within the UK. After we do the modeling of our UK facility. Sure, we do have some advantages, however they are not vital relative to the numerous will increase we noticed in ’21 and ’22. A number of the modeling that we have performed by way of aggressive price per ton vitality costs that must fall considerably, we consider for there to be any potential market strain on us.

Matthew DeYoe

All proper. That is useful. After which, I assume if I have been to consider simply general price inflation for 2023, that quantity was astronomical final yr. However, you realize, I believe the previous rhetoric was regular years, $40 million, so the place are we? Is it $80 million, clearly, you have received $25 million coming in from Atlas once more. However what do you assume the bogey is for this yr?

Jean-Francois Turgeon

Look, Matthew, clearly, what we’ll see is extra type of flat to 2022. For 2023, we might clearly have preferred to see it happening however that is not what we’re experiencing in the intervening time. You are completely proper. I imply, there was an enormous bounce from ‘21 to ‘22. And keep in mind, I imply, when you go all the best way to 2020, I imply, we noticed greater than $400 million of improve in these two years. However what we’re anticipating for ‘23 is extra of a flat place to what we had as a trigger in ’22.

John Romano

And we might anticipate, first, second quarter, not seeing as a lot transfer on raws, however we’ll begin to see that transfer extra doubtless within the third and the fourth quarter. So I believe that flat quantity consists of some extra mounted price absorption and value connected to what’s occurring in Australia. So on common flat, however in another areas, it is down and that extra prices that we talked about is, what’s type of getting us to that flattish quantity for ‘23.

Matthew DeYoe

Thanks for that.

Operator

Thanks. We now have John Roberts of Credit score Suisse. Please go forward with you’re prepared.

John Roberts

Thanks, and greatest needs, Tim. You talked about China is choosing up. There’s some debate about whether or not the China restoration might be primarily a providers restoration and never supplies. May you give us a way put up Lunar New 12 months the place the orders are versus a yr in the past?

Tim Carlson

Yeah. So it is a good level on Lunar New 12 months as a result of what I’d say in January, our volumes have been down in China, most likely 50% decrease than what we might have seen within the prior fourth quarter. And as we get into February and March, we’re beginning to see these numbers up possibly 40%, 50% from the place they have been in January. So we’re beginning to see that restoration.

Good query on whether or not or not that is a service business or not, however there’s our opinion and based mostly on what we’re seeing available in the market proper now, is that demand in China is beginning to choose up. Pricing in China is beginning to transfer up. We’d anticipate that we’ll proceed to see value will increase transferring into the third quarter from China.

And keep in mind, we now have a plant there. It is not a big facility, however we now have a very good deal with on what’s occurring. So I believe it’s nonetheless juries out on how a lot of that service business, however we’re seeing a pickup in demand which is being mirrored within the forecast as we talked about that — a part of that’s serving to us as we transfer by Q2 and Q3 to get again to extra regular hopes.

John Roberts

After which in your uncommon earth initiative, the world’s been apprehensive about China’s dominance for many years. Was there one thing previously that stored you from exploring that chance?

Jean-Francois Turgeon

I believe John, what I’d say is, the truth that the world is fear about China create the chance in the intervening time for us. As a result of there’s curiosity from authorities, as a result of our mine are located in Australia and in South Africa, and that materials might be upgraded with out having to go to China, that is the place the curiosity is coming in the intervening time. And look, we clearly are stockpiling that materials for a number of years now. So we now have accumulate materials and we now have a pleasant reserve of this, look, we’re promoting it.

And as John talked about, we’re getting some income out of it and that is transferring on the quick tempo. However the worth would actually be, if we focus that tailing into monazite and if we focus that monazite into uncommon earth. And we’re performing some work and we’re performing some lab exams and upgrading and we’re creating in order for you a plan to create actual worth for our investor out of that. And we expect that it is a good match with our current enterprise.

John Romano

And we have been promoting tailings for years. I assume the fact is, the Chinese language had been very able to controlling funding into the uncommon earths by manipulating the value. And to JF’s level, there’s loads of curiosity now that is on the market, which is permitting us to truly get extra worth. These monazite streams for 2024 are going to be extra or these uncommon earth streams are going to be extra value like $40 million to $50 million for us.

So it is a vital uptick and we see that there is upside. It is a pure extension of what we at present do with our mines. So we’ll proceed to guage what that chance might be. And I’ll say that there is clearly some curiosity in among the governments as JF talked about on attempting to get us to assist possibly pace that up a bit.

Jean-Francois Turgeon

Yeah. And John, I hope it is clear that we’re nonetheless promoting tailings in the intervening time. We’re not concentrating something but, however that is the plan. And that is the place you actually begin to including worth if you transfer from tailing to monazite and if you transfer from monazite to uncommon earth.

John Roberts

Thanks.

Operator

Thanks. We now have subsequent query from the road of Vincent Andrews of Morgan Stanley. Your line is now open. Chances are you’ll proceed.

Will Tang

Hey, guys. That is Will Tang on for Vincent. Thanks for taking my query right here. Only a fast one for me. I do know you guys talked about your expectations for uncooked supplies type of outdoors of TiO2 feedstock briefly. However I am questioning when you might go into extra element round that and I assume extra particularly round your chlorine price?

John Romano

Yeah. Look, so I will contact on chlorine price not less than in North America as a result of that is somebody that appears to be spotlighted. Chlorine price is clearly one thing that we spend loads of time on. I will simply say generically that we have not seen a pullback on chlorine at this explicit stage. We do not anticipate a big uptick from the prior yr.

And we proceed to take a look at alternatives to attempt to maximize the profit that we might get from the chlorine utilization that we now have as regards to how we use it and the way we devour that. In the remainder of the world, chlorine, it is an affect, however North America is the one which has the largest take affect as regards to inflation that we have seen within the final two years.

Tim Carlson

That is spot on, John. Important will increase in 2022 to the tune of $40 million and simply a few single-digit million is what we’re anticipating in ‘23 for the yr.

Will Tang

Acquired it. Thanks, guys.

Operator

Thanks. Our last query from the telephone line comes from Roger Spitz with Financial institution of America. Please go forward, if you end up prepared, Roger.

Roger Spitz

In March 2022, you entered a $75 million AR securitization facility. It appears such as you offered these $75 million receivables and also you derecognize them out of your steadiness sheet. These appear to be U.S. receivables. On final quarter’s calls, I assume, only a few minutes in the past, you stated you’d entered $125 million ARR securitization solely, which have been Australian and receivables.

So the great query I’ve is, these are two completely different services. So that you — and you’ve got presumably offered the $125 million as of December 31. So on the finish of the yr, you have received $75 million of offered and derecognized U.S. receivables after which $125 million offered in derecognized Australian receivables. Do I’ve that understanding appropriate?

Tim Carlson

Shut Roger, simply to let you realize that the services themselves, they’re lengths, however they’re two separate services. The power within the U.S. is $75 million. Facility in Australia is $125 million, so a complete of $200 million, however we solely had $147 million accessible as of the top of the yr. Due to the numerous drop-off in gross sales resulting from destocking. We do anticipate to get better a big chunk of that as gross sales proceed to get better in Q2, Q3 and This fall and people services must be utilized earlier than the top of 2023.

Roger Spitz

Acquired it. So simply to ensure I understood, $147 million of mixed services was offered on the finish of the yr and derecognized from the steadiness sheet as of December 30?

Tim Carlson

Right, with the full availability of $200 million as revenues get better.

Roger Spitz

Proper. Thanks very a lot.

Tim Carlson

Thanks, Roger.

Operator

Thanks. Now we have no additional questions within the queue. So I would like to show the decision again to Mr. Turgeon for some closing remarks.

Jean-Francois Turgeon

Brica, thanks, and thanks everybody for becoming a member of the decision in the present day. As we enter into 2023, we are going to preserve a relentless concentrate on sustainability and security, proceed to align manufacturing with buyer demand and prudently cut back prices accordingly, handle our key capital challenge with out shedding sight of the long run profit to Tronox together with decreasing our price per ton and generate free money stream throughout any financial situation. That conclude the decision and thanks everybody for listening. Have an excellent day.

Operator

Thanks all for becoming a member of. That does conclude in the present day’s name. Please have a stunning day, and you could now disconnect your line.