atakan/iStock through Getty Photos

Thesis

Bitcoin (BTC-USD) may very well be establishing for one more bull run, even within the face of a hotter-than-expected January CPI report. To date, there may be little proof to assert that prime inflation is unhealthy (or good) for Bitcoin. I as a substitute look to different components such because the four-year halving cycle and adoption metrics to anticipate Bitcoin’s worth motion.

The CPI Report

The January CPI report was launched on Tuesday, February 14th. Inflation rose 0.5% month-over-month (0.4% anticipated), up 6.4% from final yr (6.2% anticipated). Excluding meals, vitality, and shelter (as a result of who wants these, proper?), inflation rose extra slowly at 0.2% month over month and 4% yr over yr.

Though inflation continues to be trending down from current highs above 8%, it stays very elevated, and this month shocked to the upside. Clearly, excessive inflation is unhealthy for the common shopper, however what about for traders?

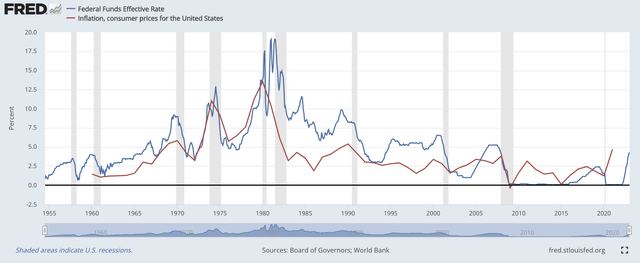

FRED

Traders have in all probability heard many occasions that lowering inflation is prone to be good for shares (and arguably cryptocurrency) as a result of it signifies that the Fed can begin decreasing charges. As proven within the chart above, the Fed funds price is commonly set barely above the inflation price. Throughout previous durations when the inflation price spiked and handed the Fed funds price (particularly the 1970s), inflation did not peak till the Fed funds price handed it.

This chart is considerably behind, as the present Fed funds price is 4.5%-4.75%. Though I might try to predict that this implies the Fed will increase charges to a minimum of 6.4% to match the present inflation price, it is troublesome to say this for positive. In spite of everything, inflation is already falling regardless of the Fed funds price being decrease than the inflation price, and that did not occur within the 1970s.

I do suppose it is seemingly that as a result of inflation elevated sooner than analysts anticipated this month, it is also seemingly that analysts will improve their inflation targets/Fed funds price targets and reduce their inventory worth targets within the quick time period. Regardless of this, I nonetheless consider it is seemingly that charges will attain their peak this yr, no matter whether or not that is nearer to five% or 7%. Which means that shares might have reached their backside already, though no one can say for positive. (It also needs to be famous that shares had a constructive return within the 1970s regardless of excessive charges/excessive inflation.)

Does CPI Impression The Crypto Forecast?

The theoretical correlation between inventory costs and the Fed funds price (and thus the CPI) is well-documented. However will the cryptocurrency market be impacted in the identical manner?

Crypto is barely a decade previous, so we will not look again to the 1970s for a historic instance of what crypto does throughout a interval of excessive inflation. Over the previous decade, the potential use circumstances touted for Bitcoin and different cryptocurrencies have been fairly different, together with:

- A risk-on asset (inflation is unhealthy)

- A scarce retailer of worth (inflation is sweet)

- A cost technique (inflation is arguably good)

- A brand new asset class that is not correlated with present lessons (inflation is irrelevant)

Regardless of touting some use circumstances that might make inflation good for Bitcoin, this hasn’t been the case thus far. 2022 was the best inflation yr since Bitcoin was created, but Bitcoin’s worth was halved from $48Okay in early 2022 to $24Okay at the moment. And because the perception that inflation peaked gained recognition this yr, Bitcoin began the yr off sturdy after bottoming under $16Okay. The small quantity of historical past thus far definitely implies that inflation is unhealthy for Bitcoin.

Google Information

Nonetheless, it is harmful to make such sweeping assumptions from a small quantity of knowledge. For instance, solely someday of knowledge pictured above, one may conclude that hotter-than-expected inflation could be good for Bitcoin and unhealthy for shares. That is the precise reverse of what one would conclude about Bitcoin in 2022. General, Bitcoin’s short-term motion following CPI experiences has been troublesome to foretell. There’s some proof that sustained excessive inflation could be unhealthy for Bitcoin, however not sufficient proof to say this conclusively.

What Is The Crypto Forecast?

Slightly than wanting on the CPI to find out what Bitcoin’s worth will do, I favor to have a look at different components that I consider are extra related. During the last decade, crypto has been one of many best-performing asset lessons, regardless of going through assessments just like the COVID-19 crash and the 2018 tech wreck. By many metrics, crypto has been adopted as shortly because the web, and its use circumstances have expanded quickly to incorporate functions like remittances and collectibles. The long-term development is wanting good for crypto.

Like previous crashes, the current crash has left some folks questioning whether or not crypto will proceed to be adopted quickly going ahead. However in contrast to earlier crashes, this crash hasn’t generated many significant issues from a utilization perspective.

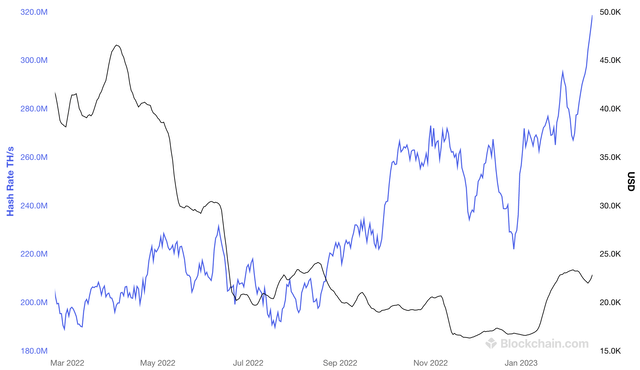

Blockchain.com

The above chart exhibits Bitcoin’s hash price over time. The hash price in terahash/second (purple line) has steadily elevated and is now at its highest worth ever. As I’ve beforehand written, a better hash price corresponds to extra mining and higher community safety.

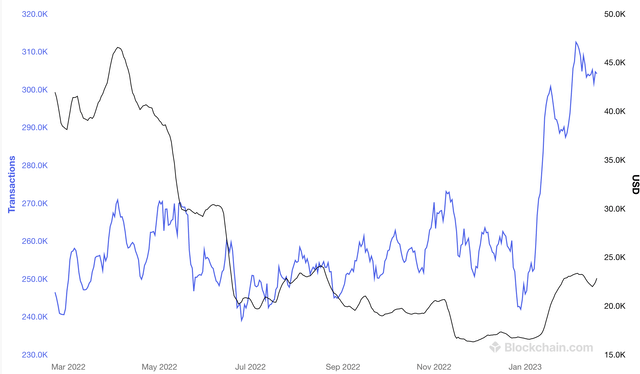

Blockchain.com

It is a comparable story in the case of transactions per day, which is arguably a extra essential metric. The variety of transactions per day (purple line) remained regular at the same time as Bitcoin’s worth crashed early final yr, and the worth not too long ago spiked to new highs.

Why would Bitcoin’s worth fall regardless of these sturdy utilization metrics? It is well-documented that since its inception, Bitcoin has rallied going into its halving occasion and subsequently crashed shortly after the halving completes. With the final halving accomplished in mid-2020, it seems that Bitcoin as soon as once more adopted this cycle. Whereas this sample in all probability will not maintain up without end, traders ought to hope that Bitcoin as soon as once more rallies going into the following halving occasion in early 2024. I consider that the probabilities of a rally are increased if utilization of the community continues to extend.

Admittedly, it is also attainable that exterior components – together with excessive CPI experiences and the inventory market selloff that they supposedly brought on – partly contributed to Bitcoin’s current worth decline. Bitcoin definitely would not be the one high-tech asset to see its valuation diminished regardless of sturdy development lately. Based mostly on what we have seen in Bitcoin’s quick historical past, Bitcoin traders ought to cautiously hope that inflation declines and shares rise. Nonetheless, I will as soon as once more stress that I do not consider inflation is a very powerful issue for Bitcoin in the long run.

Conclusion

Bitcoin has been a top-performing asset regardless of its selloff final yr, and the underlying story about Bitcoin being a steady, decentralized, and scarce asset hasn’t modified in any respect. Though there’s some proof that prime inflation is unhealthy for Bitcoin, speedy adoption of the Bitcoin community has continued even within the face of its current worth crash. Thus, I proceed to carry Bitcoin – in addition to correlated cryptos Ethereum (ETH-USD) and Move (FLOW-USD) – in anticipation of one other bull run beginning at some unpredictable time within the close to future.