William_Potter

It was January 24, 1848, when James Wilson Marshall found a lode of gold whereas engaged on the development of a brand new sawmill. From that second on, hundreds of miners scoured each nook of California, giving rise to a frenzied hunt for gold. Opposite to in style perception, ultimately it was not the various gold prospectors who bought wealthy however these few who bought the instruments to prospect for it, resembling shovels and picks.

As previous as this story is, greater than 150 years, I believe it’s a good analogy to explain my funding thesis. The curiosity of many is directed towards 21st century gold, thus Taiwan Semiconductor Manufacturing Firm Restricted’s (NYSE:TSM) (“TSMC”) chips, however I believe it’s extra affordable to give attention to who permits the chips to be constructed, particularly ASML Holding N.V. (NASDAQ:ASML). On this article I’ll clarify this idea intimately by clarifying the explanations behind my bullish thesis on ASML and bearish thesis on TSMC.

The significance of semiconductors on this planet

Earlier than making a comparability between ASML and TSMC, I believe it’s value stating the primary points of the market during which they function.

Semiconductors make up a market that was value $600 billion in 2021 and can probably be value not less than a trillion {dollars} by the top of the last decade. Their significance is essential, since they’re current in any digital machine, from the smartphone you’re studying this text from, to the washer the place you wash your garments. With out them, it might be nearly inconceivable to have the ability to maintain the identical life-style, however there may be extra. At this time’s society is more and more geared towards technological options involving new digital gear; due to this fact, the extra time passes, the extra dependent we’re on semiconductors.

The present dependence that every one nations on this planet have on semiconductors is one thing extraordinarily harmful in my view, as a result of historical past has taught us that when everybody relies on one thing, new conflicts are prone to be created. Oil a number of instances has been the reason for wars due to its essential significance in right this moment’s industrialized financial system, and gasoline is not any totally different. In any case, we don’t want a conflict to understand how dependent we already are on semiconductors; in truth, the pandemic was sufficient to place us on alert. Steady lockdowns utterly disrupted the semiconductor provide chain, an issue we’re nonetheless paying for right this moment. On the peak of the pandemic, it had turn into advanced to even purchase a automotive and obtain it earlier than a yr had handed.

Lastly, there may be yet another side of semiconductors that needs to be emphasised, most likely a very powerful of all: semiconductors are additionally the primary element for constructing weapons and protection mechanisms. Which means that the nations which have entry to one of the best semiconductors are essentially the most militarily superior ones. So, this market, after all, is more and more the article of curiosity by governments all over the world. To be technologically backward would indicate an incapability to defend in opposition to army assault.

TSMC vs. ASML

TSMC and ASML are two pivotal firms within the semiconductor market, and on this part we are going to see what their biggest strengths and dangers are. As soon as I’ve analyzed the businesses individually, I’ll make a comparability that can help my funding thesis.

TSMC: everyone needs its chips

In the beginning of the article, I in contrast TSMC’s chips to gold, however this comparability most likely doesn’t do justice since they’re value way more than gold. The aggressive benefit this firm has gained over the previous decade is one thing spectacular, and its numbers nearly sign a monopoly place.

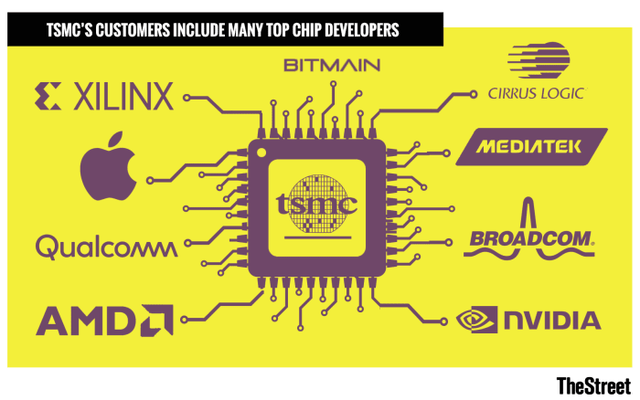

The Avenue

- 90% of the world’s tremendous superior pc chips are manufactured by TSMC. Main clients embrace Apple (AAPL), Qualcomm (QCOM), and Nvidia (NVDA).

- TSMC has a 53.40% share of the worldwide pure-play foundry market.

Furthermore, its essential opponents, Intel (INTC) and Samsung (OTCPK:SSNLF), don’t come near TSMC’s present dominance. Intel is investing closely in new crops in each america and Europe, however it’s nonetheless lagging far behind in 5nm chip manufacturing. Suffice it to say that TSMC will ship 3nm chips in 2023 and is already well-positioned on manufacturing 2nm ones. Samsung has a 16.50% share within the world foundry market and is barely forward within the manufacturing of 3nm chips; nonetheless, it nonetheless stays one step behind TSMC, because the latter has a greater buyer base. Even when Samsung produces 3nm chips a number of months upfront, it doesn’t have the identical demand as TSMC. As we now have seen earlier than, Apple is a significant buyer, and there should not that many firms that want such highly effective chips.

However why does TSMC have a greater buyer base? The reply lies within the totally different enterprise mannequin in comparison with Intel and Samsung. TSMC operates as a contract producer that produces chips designed by different firms, whereas Samsung and Intel are IDMs, so they’re concerned in each chip design and manufacturing. So, for a possible buyer, it seems each cheaper and extra environment friendly to design their very own chips and outsource manufacturing to TSMC. That is precisely the method adopted by “fabless” firms resembling Nvidia and Superior Micro Gadgets (AMD).

As well as, there may be additionally motive to incorporate the side associated to attainable conflicts of curiosity within the circumstances of Samsung and Intel. Assuming Intel was within the present place of TSMC, it’s unlikely that it might produce AMD-designed chips, since this could favor the sale of AMD processors. The identical is true for Samsung with its opponents. For TSMC, being engaged solely in manufacturing, this drawback doesn’t exist because it doesn’t compete in opposition to firms that design chips.

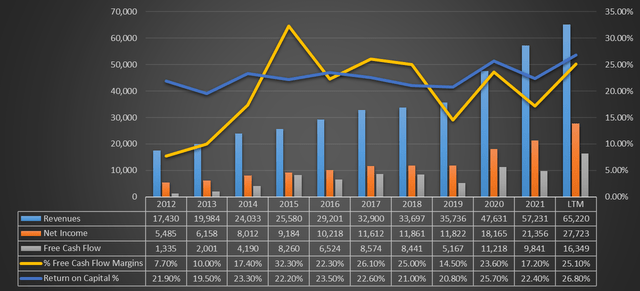

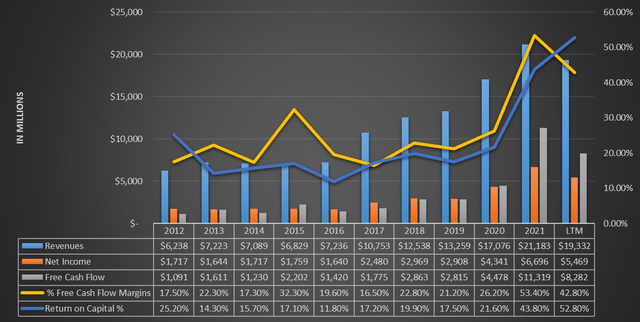

TIKR Terminal

Contextualizing what has been mentioned in financial/monetary information, TSMC is principally a cash machine. Revenues and earnings rising nearly yearly, return on capital firmly above 20%, and a excessive free money circulation margin contemplating the business during which it operates. Objectively, TSMC is presently top-of-the-line firms on this planet when it comes to aggressive benefit and profitability.

The benefit Taiwan Semiconductor has gained over its opponents is so nice that it might not take simply years to shut it. In Intel’s case most likely not even a decade. As well as, it’s to be dominated out that new opponents may take over in these years because it operates in an business during which giant sums of capital are wanted to start out a enterprise. An organization ranging from scratch and wanting to check itself with TSMC would face an nearly insurmountable barrier to entry. TSMC’s aggressive benefit is prone to endure; in truth, analysts predict that revenues can proceed to develop quickly pushed by rising demand for essentially the most refined chips.

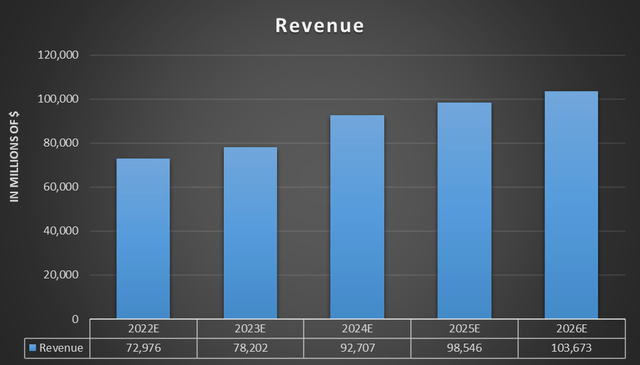

TIKR Terminal

In accordance with TIKR Terminal analysts, TSMC may cross the $100 billion income threshold in 2026, nearly double the quantity produced within the full yr 2021. In mild of those concerns, one would possibly assume that TSMC is the proper firm, however that’s not fairly the case. In contrast to most firms, its essential weak spot will not be financial, however geopolitical. In reality, the following part will cope with this.

Taiwan Semiconductor: The geopolitical danger

As defined earlier, the semiconductor market is more and more turning into a political problem, which is why the world’s main nations are doing every little thing they’ll to seize one of the best chips. Since TSMC is the corporate on which just about your entire world relies upon for the manufacturing of essentially the most superior chips, it’s apparent that it has attracted the curiosity of the key financial powers, particularly China and america.

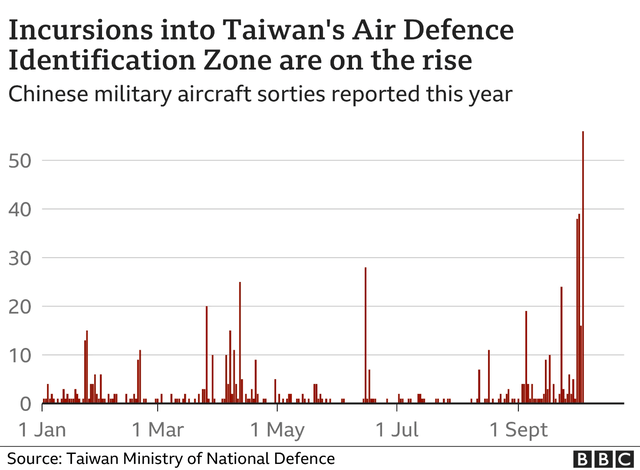

The issue is that TSMC is a Taiwanese firm, and China has made it very clear a number of instances that it doesn’t settle for Taiwan’s independence. Alternatively, america clearly doesn’t need China to have management over TSMC, as it might have too nice a bonus within the semiconductor market. President Biden has already acknowledged that the U.S. will defend Taiwan militarily within the occasion of an assault, however Xi Jinping has additionally declared in flip that he’ll take all mandatory measures to reunify Taiwan. In the meantime, Chinese language incursions have gotten increasingly more frequent.

BBC, Taiwan Ministry of Nationwide Defence

At the moment, TSMC is within the eye of the storm, and I personally can’t see how this case could be resolved. My hope is that it will not come to a army battle, however I’ve my doubts about that, since neither China nor america is stepping again. Having dominance over one of the best semiconductors is just too essential as a result of it might imply being the primary energy on this planet. However in all this, how is TSMC doing?

Taiwan’s largest firm is attempting to diversify its enterprise away from its headquarters in order to untie itself from Beijing’s grip. In Arizona, TSMC is giving delivery to its most technologically superior manufacturing unit, whereas different investments are being made in Japan. This diversification course of, nonetheless, is under no circumstances simple, as there are three issues:

- The primary is that extreme funding overseas, and particularly “in enemy territory” may set off an assault from China. Definitely, the investments in Arizona didn’t please Xi Jinping.

- The second is that the manufacturing capability of factories in Taiwan is large, and years of abroad funding won’t be sufficient to diversify the enterprise. For instance, the manufacturing unit in Arizona, as technologically superior as it’s, will likely be nowhere close to comparable when it comes to manufacturing capability to these in Taiwan. Definitely, a $12 billion funding will not be sufficient to diversify the enterprise of an organization as giant as TSMC. Big quantities of capital will likely be wanted to take a position, however with out upsetting China an excessive amount of.

- The third drawback is that sustaining crops overseas tends to be costlier, which would scale back revenue margins. Paying labor prices in america will not be the identical as paying them in Taiwan, in addition to many different bills.

Total, the scenario is just too advanced from a geopolitical perspective, and nobody now can know exactly what this may result in. As a lot as I recognize TSMC’s numbers, I’m compelled to not put money into it as a result of I consider that the dangers associated to an funding could outweigh the advantages. Everybody needs its chips, however the issue is that an assault on Taiwan is turning into extra of a actuality than a black swan. From the phrases of Protection Minister Chiu Kuo, Taiwan is already making ready:

We’re build up our arsenal and making ready for conflict in keeping with our personal plan. We wish to guarantee we now have a sure interval of stockpiles in Taiwan, together with meals, together with crucial provides, minerals, chemical substances and power after all.

Lastly, if you’re questioning what would occur to TSMC within the occasion of a army assault, right here is the reply from its president Mark Liu:

No person can management TSMC by drive. When you take a army drive or invasion, you’ll render TSMC manufacturing unit not operable. As a result of that is such a complicated manufacturing facility, it is determined by real-time reference to the skin world, with Europe, with Japan, with U.S., from supplies to chemical substances to spare elements to engineering software program and prognosis.

ASML: Little-known however extraordinarily essential

Beforehand we now have seen how TSMC, Intel, and Samsung are preventing for an ever-larger share within the semiconductor market. Everybody needs to supply one of the best chips and everybody needs to purchase one of the best chips. However have you ever ever questioned how TSMC, Samsung and Intel produce such cutting-edge chips? How have they got such highly effective machines to generate 3nm chips? The reply is that every one the key semiconductor firms are depending on equipment from the identical provider, ASML.

All the semiconductor provide chain depends on ASML, as a result of its EUV lithography machines are presently the one ones on this planet that allow the creation of essentially the most superior chips. If for TSMC there may be Samsung that comes near its know-how, for ASML there isn’t a competitor that may maintain a candle to it, since nobody has been capable of develop such superior know-how. Furthermore, what makes the hole with opponents develop even wider is that ASML continues to innovate. By subsequent yr, the primary Excessive-NA EUV lithography machine could possibly be delivered, and early hypotheses are already being made concerning the Hyper-NA EUV. For ASML, competitors exists solely within the sale of DUV lithography machines, that are these designed to create lower-performance chips. Nonetheless, the technological improvement of right this moment’s society requires more and more high-performance chips, so the expansion of ASML appears nearly inevitable.

TIKR Terminal

As could be seen from this graph, ASML skilled some difficulties rising earlier than 2017, however from that yr on, development has not stopped as EUV lithography started to be broadly used. What’s extra, the demand for superior chips is favoring the sale of EUV machines, and the outcomes achieved prior to now three years are proof of that. In accordance with TIKR Terminal analysts, this firm may practically double its revenues by 2026.

TIKR Terminal

Ascertaining how essential and strong ASML is, I want to elaborate additional concerning its aggressive benefit as I believe it’s fascinating. As you’ll have guessed, ASML is a very powerful know-how firm on this planet as a result of it manufactures one of the best lithography machines, that are crucial within the preliminary stage of producing one of the best chips round. With out ASML, TSMC wouldn’t have the ability to manufacture Apple’s designated chips, and the identical goes for Samsung and Intel. So, it’s clear that if ASML have been to cease promoting its machines, the entire world couldn’t proceed to develop technologically. However how is it attainable that one firm has a lot energy? How is it attainable that nobody else may create an EUV lithography machine? Extra importantly, couldn’t the machines already bought by ASML be “copied” by a technique of reverse engineering? A complete article would most likely not be sufficient to reply these reliable questions, however I’ll attempt to be as clear and concise as attainable.

ASML

To begin with, the EUV machines bought by ASML are tough to breed due to an financial problem. They’re presently bought for $200 million every, whereas the brand new Excessive-NA EUV ones will likely be bought for not less than $300 million every. This side already places off potential opponents who don’t current sufficient funds to breed them.

Those that do have the cash, nonetheless, could have appreciable problem sourcing main and minor elements in addition to assembling them. An EUV system weighs practically 200 tons and consists of 100,000 elements, 3,000 cables, 40,000 bolts and a pair of kilometers of hoses. All bought from 5,000 totally different suppliers.

Even assuming {that a} hypothetical firm managed to have every little thing readily available, it nonetheless wouldn’t have the ability to correctly assemble the 100,000 elements. Reproducing the mechanism of an EUV system is one thing extraordinarily advanced even when in possession of all the required elements and hundreds of engineers readily available. To present you an thought, the corporate acknowledged that an EUV system controls mild beams so exactly that it’s equal to shining a flashlight from earth and hitting a 50-cent coin positioned on the moon. Lastly, as if that weren’t sufficient, it takes 40 cargo containers, unfold over 20 vans and three cargo planes, to ship an EUV system.

China has been attempting for years to breed what’s presently essentially the most highly effective machine on this planet, however it’s nonetheless too removed from discovering an answer. What’s extra, the Dutch authorities, below stress from america, has banned the export of the most recent EUV techniques to China. The goal is clearly to go away China as far behind as attainable from a technological perspective. At the moment, ASML can proceed to promote solely the much less refined techniques resembling DUV to China. This final side will likely be mentioned in additional element within the subsequent part on ASML’s dangers

ASML: U.S. stress and technical limitations

ASML is the one firm on this planet able to creating EUV lithography machines, so it goes with out saying that there’s a geopolitical element to investigate right here as properly. As anticipated earlier, america pressed the Dutch authorities to ban ASML from exporting EUV lithography machines to China. This selection, though affordable from a sure perspective, hurts its profitability because it can’t broaden its enterprise in China. Furthermore, it have to be mentioned that earlier than the blockade China had already bought some EUV lithography machines; due to this fact, this determination doesn’t profit ASML in any manner. Sooner or later, it can’t be dominated out that DUV lithography machines will even be subjected to the identical therapy, and this could make the scenario even worse. Ought to this second ban turn into a actuality, a discount in revenues of about 10% is anticipated. Past this attainable quick loss, I consider the long-term financial injury is bigger, since China is prone to be the most important semiconductor market on this planet.

The second danger is solely technical in nature. How lengthy can ASML innovate? Present lithographic know-how borders on perfection, and it is going to be tough to enhance on the brand new high-NA EUV machines. Past the bodily limitations that stop chips from being miniaturized past a sure degree, there may be additionally an financial side to think about. ASML CTO Van den Brink doesn’t presently consider that hyper-NA EUV is possible, and high-NA EUV could be the final NA.

We’re researching it, however that does not imply it’ll make it into manufacturing. For years, I have been suspecting that high-NA would be the final NA, and this perception hasn’t modified. Theoretically, it may be finished. Technologically, it may be finished. However how a lot room is left out there for even bigger lenses? May we even promote these techniques? I used to be paranoid about high-NA and I am much more paranoid about hyper-NA. If the price of hyper-NA grows as quick as we have seen with high-NA, it’ll just about be economically unfeasible. Though, in itself, that is additionally a technological problem. And that is what we’re wanting into.

Ultimate Ideas

Earlier than I summarize my the reason why I consider ASML is a greater funding total, I want to say my two cents about an occasion involving TSMC lately that could be mentioned within the feedback.

In current weeks, I’ve observed that there was a variety of positivity about TSMC after it was found that Warren Buffett invested $4.1 billion in it. Definitely this can be a constructive sign, however I don’t assume it may be decisive in an funding thesis. Because the day this information got here out, I’ve seen a variety of evaluation based mostly on bullish theses, as if “the Warren Buffett impact” has utterly erased geopolitical danger. For my part, having crucial and private pondering is the idea of any profitable funding, as a result of copying the operations made by another person (even when it’s the greatest investor in historical past) will not be essentially an excellent technique. Berkshire Hathaway’s (BRK.B) causes for investing in TSMC could also be totally different from these of the common investor, who maybe expects a revenue as early as the following few months.

As well as, one should additionally take into account that for Berkshire to take a position $4.1 billion in an organization represents just one.40% of the entire portfolio. There are numerous points to think about so as to not copy an investor managing a whole bunch of billions of {dollars}, and if you’re you will discover extra info on this article. To put money into TSMC, it isn’t sufficient to know that Warren Buffett did it, however we have to perceive whether or not this firm matches our area of data and whether or not, by our personal quantitative valuation, it’s undervalued.

That mentioned, the conclusion of the article displays my private comparability of ASML and TSMC.

ASML and TSMC from a quantitative perspective current an unusual power, furthermore they’re completely positioned inside a market that’s destined to develop in the long term. If we seemed solely on the numbers, these firms are extraordinarily fascinating, Nonetheless, this isn’t sufficient, as we should additionally take into account the context during which they function. The latter side, in truth, is what leads me to doubt investing in Taiwan Semiconductor in the long run.

China won’t cease urgent TSMC, america won’t again down, and Taiwan is already ready to defend itself in opposition to an assault. Nobody can know precisely what this geopolitical pressure will evolve into, however actually the premises should not rosy. Primarily based on my diploma of danger aversion, with remorse, I favor to keep away from investing in Taiwan Semiconductor since I already know that I might not expertise properly any value fluctuations because of the upcoming information between China and Taiwan. I wished to level out that it’s a remorse for me, for the reason that firm is undoubtedly a cash machine. If it weren’t for this side, I might put money into it at an acceptable value.

The entire world relies upon primarily on TSMC, Samsung and Intel in chip manufacturing, and these firms are warring with one another to supply one of the best chips. Nonetheless, though geographically totally different from one another, they’ve one factor in frequent: all of them rely on ASML’s EUV lithography machines. It’s true that ASML additionally has a geopolitical danger, however it’s restricted to the lack to promote its EUV/DUV machines in China; the remainder of the world in truth should buy them. Personally, I even take into account it extra affordable to put money into Intel quite than TSMC. Along with not having geopolitical danger, current investments in high-NA EUV may skinny the hole with each TSMC and Samsung. I lately wrote an article about this.

To conclude, linking again to the preliminary thesis, whether or not it’s Taiwan Semiconductor, Samsung, or Intel that dominates the semiconductor market sooner or later issues little to ASML, since they are going to all have to purchase its machines anyway. Nobody can know who would be the winner and who would be the loser within the race to supply essentially the most superior chips, however we do know that whoever produces the machines to construct them will profit from the competitors. As within the mid-nineteenth-century gold rush, one of the best technique could change into to not search what everybody needs, however to promote the means to hunt what everybody needs.