imaginima

The case of Enbridge (NYSE:ENB) is kind of distinctive. ENB is a well-run midstream operator with a protracted observe file of sturdy execution. The corporate continues to determine quite a few mission alternatives to reinvest capital. Whereas that does solidify the expansion prospects over the close to and medium time period, this comes at a time when prime tier pipeline friends are starting to prioritize share repurchases. At latest costs, ENB remains to be yielding practically 7%. Whereas the prospects for a number of growth could also be extra muted as in comparison with friends, I view the dividend and its future development as being secured – these in search of a dependable dividend payer with out the everyday midstream Okay-1 tax kind could discover ENB to be a welcome addition to their dividend portfolios.

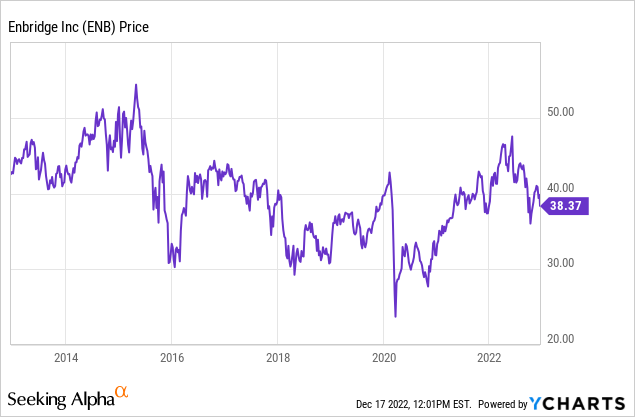

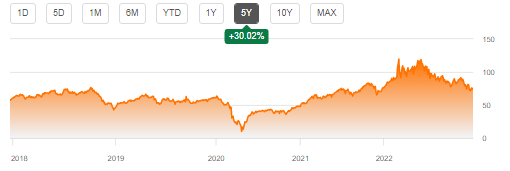

ENB Inventory Worth

ENB has seen its inventory kind of keep in place over the previous decade as a lot of the returns have come from its dividend.

I final lined ENB in April 2021 the place I defined why I used to be not but shopping for the 7% yielding inventory. The inventory has since delivered double-digit whole returns and provided that I’ve since modified to view the midstream sector extra positively, I’m now upgrading ENB to a purchase.

ENB Inventory Key Metrics

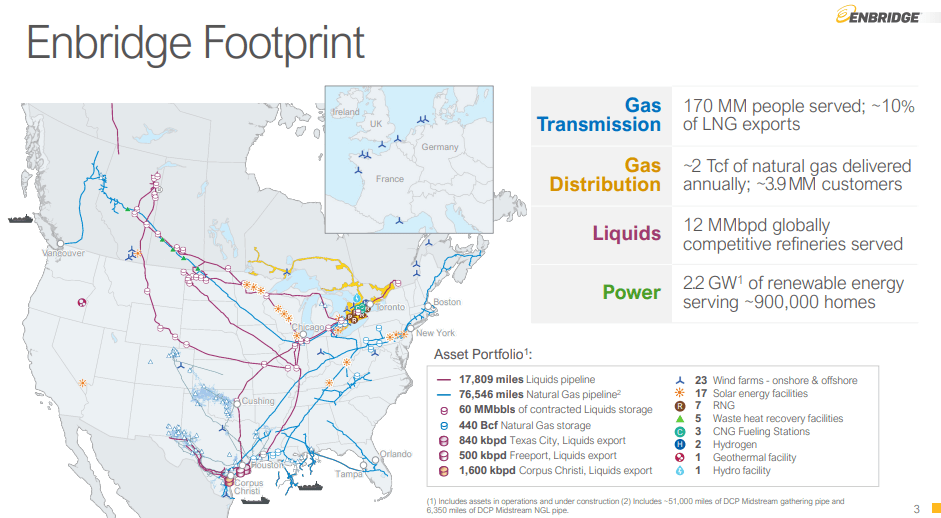

ENB operates one of many largest midstream pipeline footprints in North America.

December Presentation

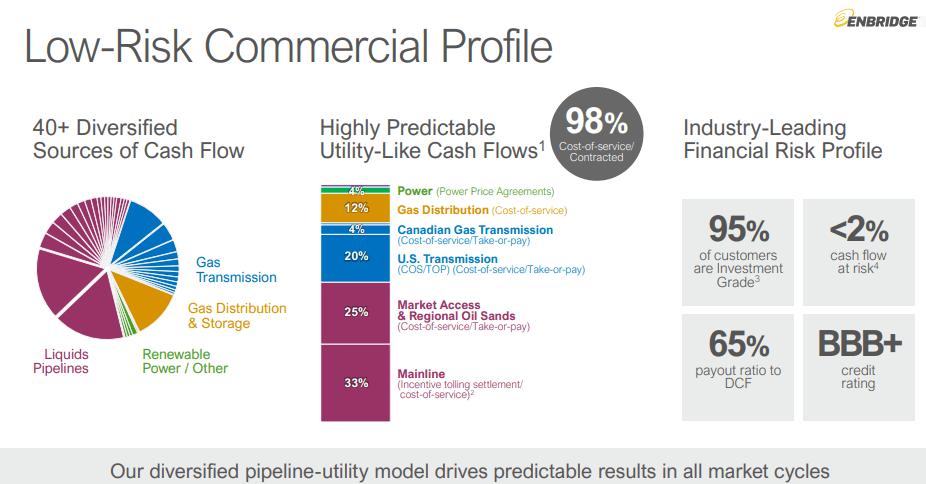

98% of its money flows come from cost-of-service or contracted sources, making the corporate very very like a utility enterprise mannequin.

December Presentation

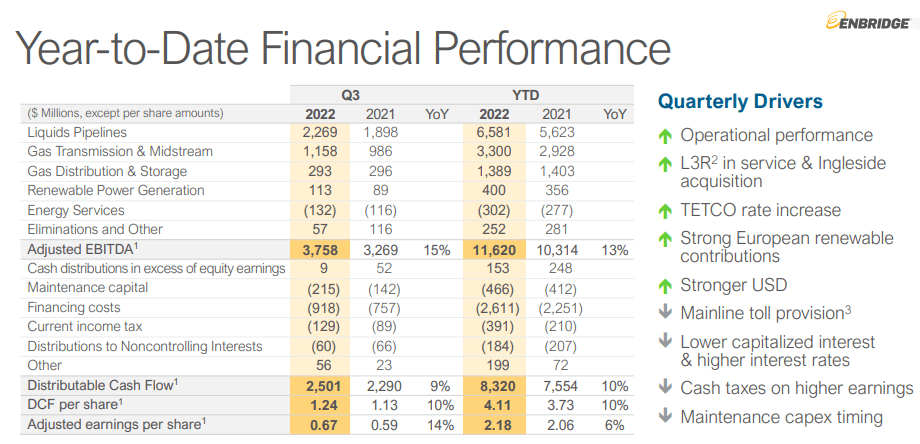

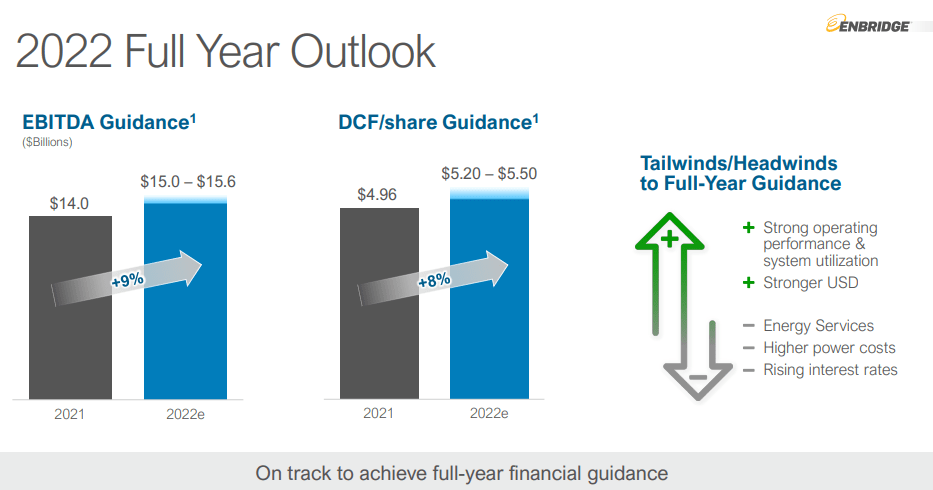

In 2022, ENB has benefitted from stable quantity development as vitality costs remained excessive. ENB was in a position to develop money flows by a double-digit fee on a per-share foundation this yr. The sturdy operational efficiency was greater than sufficient to compensate for the upper prices from increased rates of interest.

December Presentation

On the convention name, administration acknowledged that it expects to return close to the highest half of their EBITDA steering vary and simply above the midpoint of their DCF per share steering.

December Presentation

Is ENB Inventory A Purchase, Promote, Or Maintain?

Why am I upgrading the inventory now? I’ve already written bullish studies on friends Enterprise Product Companions (EPD) and Magellan Midstream (MMP). The thought is straightforward: even after the latest plunge, oil costs stay at multi-year highs.

Looking for Alpha

As a result of vitality costs have remained excessive for a substantial period of time, I anticipate that the counterparties have tremendously improved their steadiness sheets and due to this fact their creditworthiness to pipeline operators like ENB. That helps ease any bearish thesis concerning the flexibility of counterparties to make cost, serving to to help increased valuation multiples.

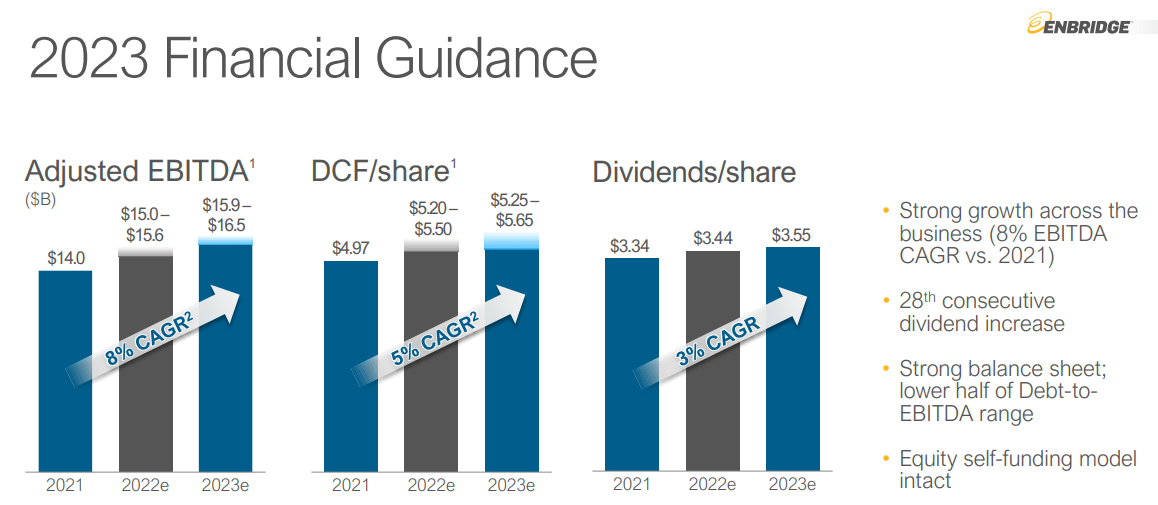

Wanting forward, ENB has already guided for continued development subsequent yr.

December Presentation

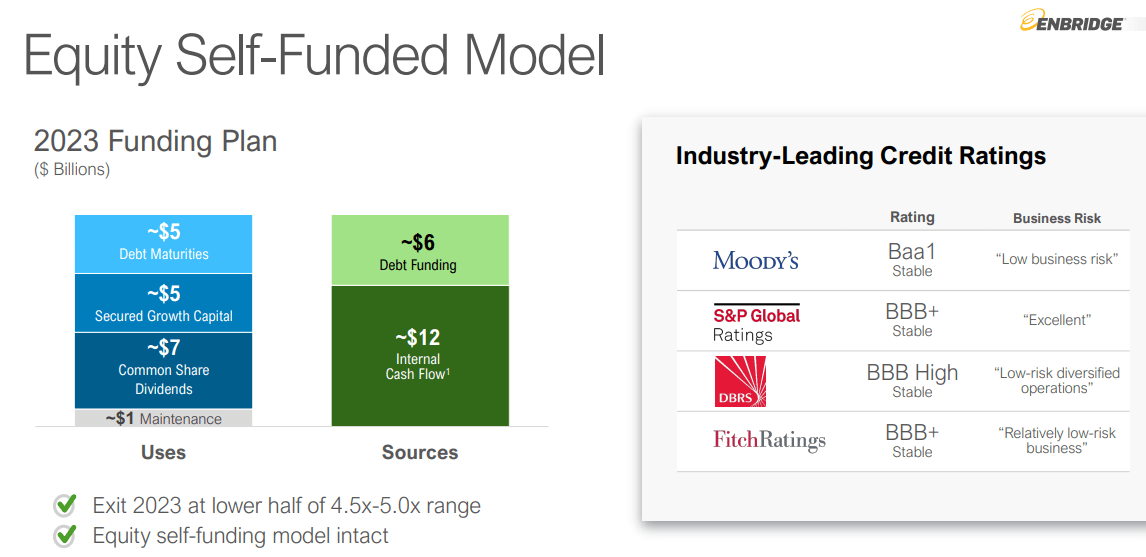

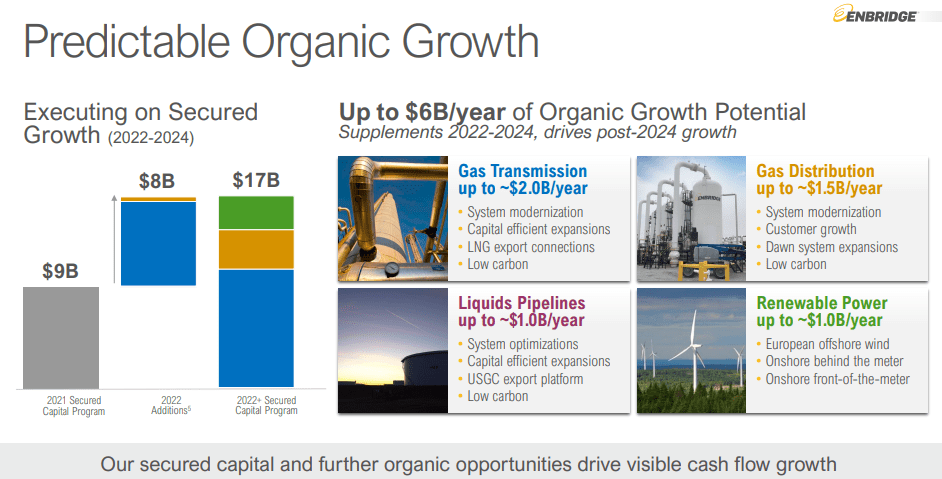

The place will that development come from? Whereas many friends like EPD and MMP seem to have targeted on returning money to unitholders by unit repurchases, ENB has caught loyal to the historic technique of reinvesting in development initiatives. ENB has focused round $5 billion of development initiatives in 2023 which it expects to fund primarily with inner money circulate.

December Presentation

The precise quantity would possibly even come increased, as administration has acknowledged that it has recognized as much as $6 billion of natural development potential per yr by 2024.

December Presentation

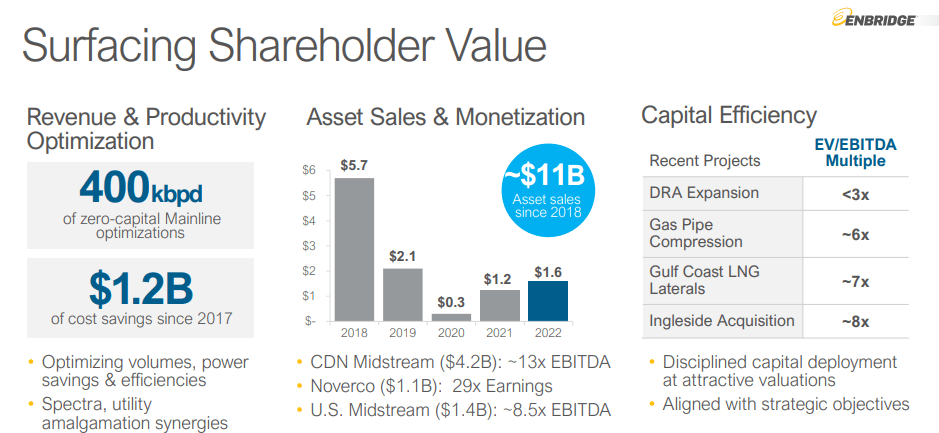

Ought to buyers be blissful to see quite a few reinvestment alternatives and administration’s willingness to spend money on such development initiatives? The reply shouldn’t be so easy. I estimate ENB to commerce at round 9x EV to EBITDA. It has derived stronger returns than that on latest initiatives.

December Presentation

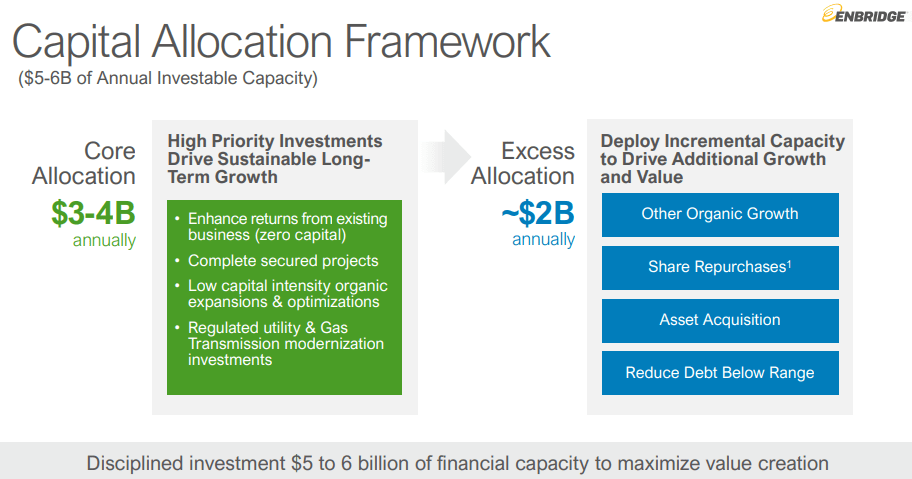

That implies that development initiatives are prone to ship increased returns from an accretion perspective than share repurchases, however which may be lacking the purpose. The place share repurchases would possibly lag when it comes to accretion, they might compensate from the potential for a number of growth. In my expertise, shares that constantly repurchase their shares are likely to ultimately notice appreciable a number of growth sooner or later or one other. That a number of growth may create far higher worth on a per-dollar foundation than development initiatives may. For instance, $four billion of annual development initiatives is predicted to result in round 5% in DCF per share development. But when ENB can obtain a 5% dividend yield as a consequence of share repurchases, then that may as an alternative result in 40% development within the inventory worth. For that matter, debt paydown, although it might be even much less accretive than share repurchases, could arguably be probably the most engaging use of capital as a consequence of it additionally having a excessive potential to result in a number of growth (decrease debt means decrease danger which can warrant increased multiples). Administration seems to have positioned natural development alternatives on the prime of their capital allocation priorities, forward of each share repurchases and debt paydown.

December Presentation

Whereas ENB has been repurchasing some inventory this yr, these repurchases have been very modest at simply $151 million this yr (for reference, this can be a $77 billion firm). On the convention name, the commentary additionally appears to help that view, with administration saying “below our self-funded mannequin we nonetheless have ample funding capability out there for additional natural development, tuck-in M&A, debt reimbursement and even share buyback.” That phrasing makes clear that their precedence is development initiatives.

But even so, this inventory seems to be low-cost. The inventory is yielding round 7% and has round 3% projected ahead development. Absent yield compression, the inventory is priced for round 9% to 10% annual whole returns, however even in at present’s market, shares with 3% dependable development charges are likely to commerce across the 5% to six% yield vary, implying some upside. Unsurprisingly, a shift in the direction of higher share repurchases or debt paydown could also be an vital catalyst for a number of growth.

What are the dangers? Forex danger ought to be thought-about. ENB is a Canadian firm and thus pays its dividends in Canadian {dollars}. The strengthening US greenback has led to fluctuations within the dividend cost, although ENB is constantly rising its dividend. One other danger is that of the sustainable development fee. Midstream operators have traditionally sustained development by reinvesting of their property. If native governments proceed to prioritize renewable vitality sources, then ENB could also be unable to reinvest in such initiatives as a consequence of regulatory backlash. There may be additionally the danger that vitality costs fall from right here, which might nullify my aforementioned view that the counterparty danger has been addressed. I view ENB as a purchase at at present’s costs as this can be a market which has emphasised earnings and return of money to shareholders. I’d not be stunned if ENB delivers double-digit returns from right here as buyers welcome the excessive and rising yield with out the Okay-1 tax kind.