It was solely final week that Morgan Stanley opined that one of many macroeconomic surprises for 2023 may very well be that the Financial institution of Japan decides to not make any modifications to its ultra-loose coverage.

That simply goes to point out the perils of forecasting surprises after Japan’s central financial institution on Tuesday widened the band that it could tolerate bond yields by 1 / 4 level, a transfer that despatched the yen surging and rattled markets.

Extra on the BOJ to come back.

Analysts at wealth supervisor Glenmede Funding Administration level on the market’s been an enormous disparity between the efficiency of actual property funding trusts listed publicly, and people which can be personal.

The Nationwide Council of Actual Property Funding Fiduciaries Open Finish Diversified Core Fairness Index — phew that’s a mouthful — has gained 22% during the last 52 weeks, by the tip of the third quarter. Examine that to the MSCI U.S. REIT BBRE, which fell 16% over the identical time interval. In keeping with Glenmede, the 38% outperformance for personal REITs is the strongest on file, with information going again to the late 1970s.

There’s a reasonably good purpose for the disparity. Public REITs face practically instantaneous pricing courtesy of the open market, whereas personal REITs benefit from the luxurious of a periodic appraisal course of.

That units up a chance, nevertheless. In keeping with Glenmede, when public REITs underperform by a minimum of 30%, they then outperform by an annual 13.5% over the subsequent three years. The final time there was such an outperformance, in early 2009, public REITs greater than doubled in worth, whereas personal REITs fell 18%.

The market

U.S. inventory futures ES00 NQ00 eased after the shock from the BOJ. The massive transfer was within the yen USDJPY, which jumped 3% vs. the greenback. Marc Chandler, chief market strategist at Bannockburn International Foreign exchange, stated the transfer within the yen was about two normal deviations, in comparison with 4 when the British pound slumped in response to the funds of former U.Okay. Prime Minister Liz Truss.

Bond yields, not simply in Japan BX:TMBMKJP-10Y however within the U.S. BX:TMUBMUSD10Y, rose.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Every day.

The excitement

Basic Mills GIS upped its outlook after beating revenue estimates. Nike NKE and FedEx FDX will report outcomes after the shut.

The European Fee reached a settlement with Amazon.com AMZN over market insurance policies with out imposing a high-quality.

3M MMM says it would take as much as a $2.Three billion cost because it stops making PFAS-based additive merchandise.

U.S. housing begins spotlight the economics calendar.

Negotiators launched their 4,000+ web page appropriations invoice, forward of a vote on the $1.7 trillion bundle.

FTX founder Sam Bankman-Fried agreed to be extradited to the U.S.

Better of the net

Binance’s ex-CFO didn’t have full entry to its books, a Reuters profile of the cryptocurrency change finds.

Neither Citigroup C nor Goldman Sachs GS have employment information for Rep.-elect George Santos, who stated he labored for each main banks, in keeping with The New York Occasions.

Listed below are the brand new shopping for incentives for electrical automobiles.

Prime tickers

These had been probably the most lively inventory market tickers on MarketWatch as of 6 a.m. Japanese:

| Ticker | Safety title |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Leisure |

| AAPL | Apple |

| NIO | Nio |

| MULN | Mullen Automotive |

| COSM | Cosmos Well being |

| AMZN | Amazon.com |

| APE | AMC Entertaiment preferreds |

| CEI | Camber Power |

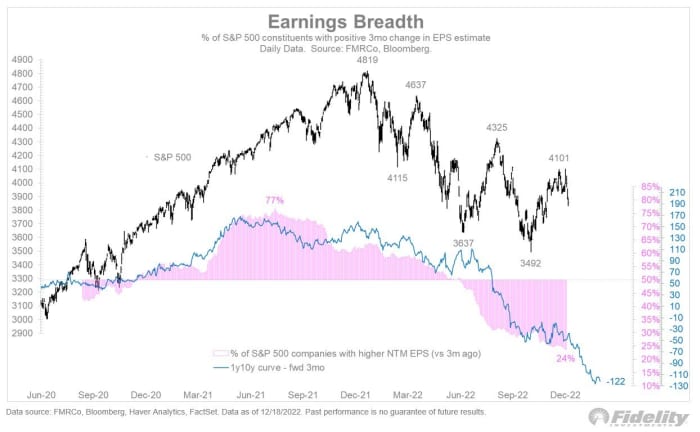

The chart

Jurrien Timmer, director of worldwide macro at Constancy Investments, says the proportion of firms seeing earnings downgrades retains rising. He stated given how inverted the yield curve is, this might proceed, as he anticipates 2023 to be a “sideways uneven market.”

Random reads

Fugitive cows in Canada have earned some followers.

The brand new King Charles III banknotes had been unveiled.

The bizarre climate phenomenon often known as hair ice, which has popped up in Scotland.

Have to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.

Hearken to the Finest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.