As 2022 winds down and traders replicate on a horrendous yr, they will take some consolation in the truth that the large guys had their share of misses.

Amongst them is Harris Kupperman, the president of hedge fund Praetorian Capital, who lately blogged about his 2022 calls he nailed — a selloff of huge tech names— and those who missed the mark — a sustained surge in oil costs.

Kupperman is doubling down on the latter in our name of the day, as he predicts 2023 will likely be “the yr of oil crushing all different” investments, with a barrel of crude probably hitting $200, laying that out in his AdventuresInCapitalism weblog (h/t Quoth the Raven)

Oil CL00 CL is about to complete with a acquire of round 6% in a yr that noticed U.S. benchmark futures surge to over $130 a barrel after Russia’s invasion in Europe, earlier than a gradual ratcheting decrease on recession worries as central banks fought to include inflation. West Texas Intermediate crude was buying and selling slightly below $80 a barrel on Wednesday morning.

From early 2022, he defined, “there was minimal spending development on exploration, whereas world demand has continued to rebound and develop. The postponement of my theme was primarily brought on by the surprising purge of SPR stock, together with China going offline resulting from germs. These two developments appeared destined to reverse in 2023,” he stated, including that Russian oil manufacturing is “completely impaired and certain in free fall.”

Notice, China’s quickly fading zero-COVID coverage took one other daring step on Tuesday as the federal government introduced it would begin issuing passports. Nevertheless that has additionally triggered issues about COVID unfold and inflation fallout (extra beneath).

Paying off for Kupperman had been power investments — Valaris VAL and Tidewater TDW — which he stated would prone to proceed main power markets greater in 2023 resulting from their valuations. And whereas his oil futures and futures choices positions didn’t work out as nicely, he’s affected person.

“As soon as once more, I believe it’s essential to repeat that if you happen to haven’t stress-tested your portfolio for oil costs north of $200, you’re going to endure dearly when that ought to come to go,” stated the supervisor.

Kupperman additionally foresaw continued housing market energy in 2022, however is now tossing the names he was holding within the sector that’s rolling over resulting from rising rates of interest. “Whereas I stay bullish, I’m going to attend for building exercise to backside and start its restoration,” he stated.

The supervisor additionally defined the tech rout name that he obtained proper. Since 2019, he’s been pounding the desk over what he known as “Ponzi Sector” firms — Lyft LYFT, Uber UBER and Peloton PTON that had “no capacity or need to ever develop into worthwhile.”

Learn: Lyft inventory closes decrease than $10 for the primary time; three-quarters of its valuation has been wiped away this yr

He predicted these firms would falter in 2022 and drag down the so-called “Tiger-40″ — top quality however overowned large-cap tech shares reminiscent of Microsoft MSFT, Amazon.com AMZN, Meta Platforms META, Roblox RBLX and DoorDash DASH, primarily based on high 40 holdings of hedge fund Tiger World Administration. He notes that “over-owned” fund was aped by most huge portfolio managers.

“That is seemingly brought on by an anticipated financial slowdown, resulting from quickly rising rates of interest. One might say that the market is wanting by way of a interval of over-earning and penalizing their share costs — regardless of many of those firms buying and selling at low single-digit earnings multiples on full-cycle earnings,” stated Kupperman.

Not fairly correct was his name for a “mom of all sector rotations” for 2022, as traders swap out of these high names. Worth names haven’t carried out nearly as good as he’d hoped.

“Whereas my publicity stays subdued, I’ve an incredible buying listing of near-monopoly worth names to buy when The Pause comes, if it turns into apparent that the lengthy finish doesn’t utterly panic. I’ve spent a lot of the yr constructing on this listing, however have executed little in addition to proceed to be taught the names higher,” he stated.

Total, 2022 was a yr to keep away from land mines and “battle one other day,” stated Kupperman. “For now, I need to keep conservative, follow low-risk setups and keep extremely liquid. I believe that 2023 will likely be tough for longs, particularly as oil crushes every part else,” he stated.

Learn the remainder of his weblog for extra positions that did and didn’t work out.

Learn: Listed below are 5 stock-market ‘early indicators’ that would resolve the destiny of your portfolio in 2023

The markets

Inventory futures ES00 YM00 NQ00 are modestly greater, as bond yields BX:TMUBMUSD10Y pull again. The greenback DXY is flat, however surging in opposition to the ruble USDRUB as western sanctions are apparently beginning to chew, and oil CL is decrease.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Day by day.

The thrill

Probably the most oversold it’s ever been, and hit by one other worth goal minimize — Baird to $252 from $316 per share — Tesla shares TSLA are pointing to the primary acquire in seven classes.

And shares of AMC Leisure AMC, whose CEO Adam Aron desires to forgo his 2023 pay and get different executives to do that similar, is greater in premarket after a three-session loss. However AMC’s most well-liked fairness inventory is down about 10% .

U.S.-listed shares of Hong Kong journey group Journey.com TCOM are up after China dropped journey restrictions, although fears of a brand new wave of infections have led nations reminiscent of Japan and Italy to tighten guidelines on inbound Chinese language vacationers. The U.S. is also reportedly contemplating comparable strikes.

Learn: Chinese language are snapping up flights overseas as Beijing drops extra journey restrictions

U.S. Transportation Secretary Pete Buttigieg has vowed to carry Southwest Airways’ LUV accountable over the vacation flight “meltdown” that noticed 1000’s of flights canceled.

FTX founder Sam Bankman-Fried borrowed $546 million from Alameda to purchase an almost 8% stake in commission-free buying and selling app Robinhood HOOD, based on a information report citing court docket papers.

Pending dwelling gross sales are due at 10 a.m. Japanese.

Better of the net

Citing ‘woke tradition,’ Chemours director resigns over abortion advantages for workers

Hybrid working? How the Metropolis of London is getting it executed (subscription required)

A celeb cemetery in Paris has develop into a haven for wildlife

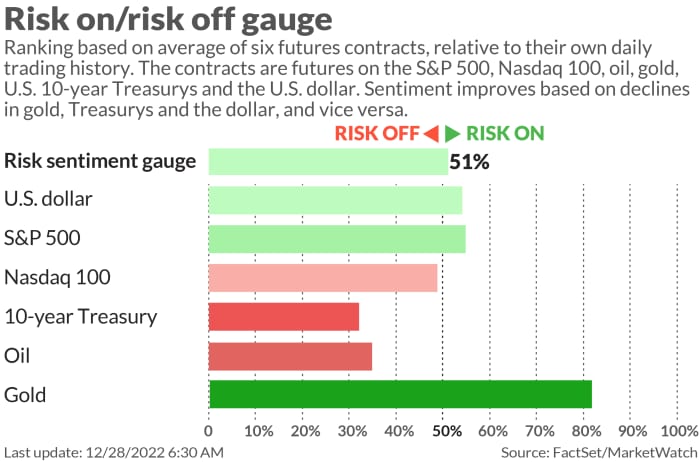

The chart

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m. Japanese:

| Ticker | Safety title |

| TSLA | Tesla |

| APE | AMC Leisure most well-liked shares |

| GME | GameStop |

| AMC | AMC Leisure |

| AAPL | Apple |

| NIO | NIO |

| NVDA | Nvidia |

| AMZN | Amazon.com |

| MULN | Mullen Automotive |

| BBBY | Mattress Bathtub & Past |

Random reads

When Niagara Falls freezes over.

How a calendar of nude residents saved this dying Spanish city.

Mugger tries to take blind BBC reporters iPhone, fails spectacularly.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Japanese.

Hearken to the Greatest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.