Dzmitry Dzemidovich/iStock by way of Getty Photos

Tax Loss Promoting Basket & Wash Gross sales

I’ve just lately defined (right here and right here) my technique for constructing a basket of overwhelmed down shares which might be seeing aggressive tax loss promoting. At present I might prefer to introduce one other candidate, this one that is additionally seen a downgrade from Goldman Sachs.

However earlier than doing so, let me add one nuance about this technique. Wash sale guidelines prohibit recognizing a loss if one re-buys the identical safety, or choices contract for the safety, inside 30 days of the sale. Which means that anybody who really would nonetheless prefer to personal the inventory, however first desires to acknowledge losses she or he has incurred, should wait 30 days after the tax loss gross sales. This informs my holding interval, which is thru February of the next 12 months, as a result of there may be purchase backs by tax loss sellers from the tip of January by the center of February. By the point February closes, I feel the structural facet of the commerce is over.

As I will focus on intimately under, DBV Applied sciences (NASDAQ:DBVT) is a French firm centered on bettering the lives of sufferers affected by meals allergic reactions.

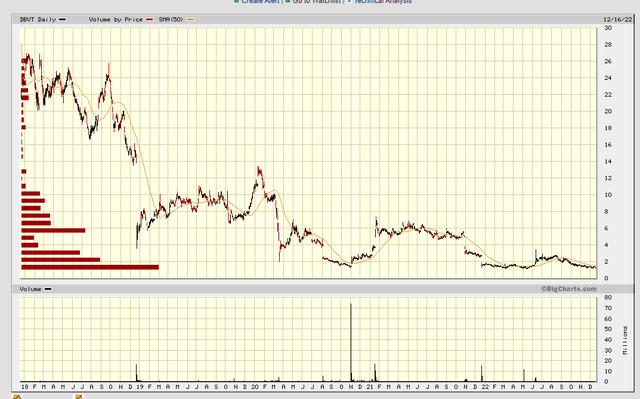

The corporate’s inventory has been declining for a number of years now, partially because of a competitor, Aimmune Therapeutics (AIMT), beating DBVT to the punch in peanut allergic reactions. For our functions because of this most DBVT holders are holding at a loss, and the longer they’ve held the shares, the better the loss. These are all potential tax loss sellers in my view.

bigcharts.com

On the six month chart, we are able to see what would be the starting of tax loss promoting, although the largest sell-off bar coincides with a downgrade of the inventory.

bigcharts.com

Inventory Downgrade

In search of Alpha summarizes the Goldman Sachs’ downgrade right here, together with this rationalization:

DBV Applied sciences ADR dropped within the morning hours Friday after Goldman Sachs downgraded the French biotech to Promote from Impartial citing unsure prospects for its lead candidate Viaskin Peanut, an immunotherapy focused at peanut allergic reactions.

Whereas VP has the potential to win “significant” market share given its favorable dosing profile and fewer difficult tolerability, the “timing of market entry and regulatory path ahead is the important thing concern for us,” the analysts wrote.

In September, DBV Tech (DBVT) introduced that the FDA imposed a partial scientific maintain on its Section Three scientific trial for VP focused at kids aged 4 – 7 with peanut allergy.

Figuring out the difficulty as “the latest roadblock to VP’s path ahead,” Goldman Sachs opines that the choices out there to resolve the partial maintain will improve growth bills for VP.

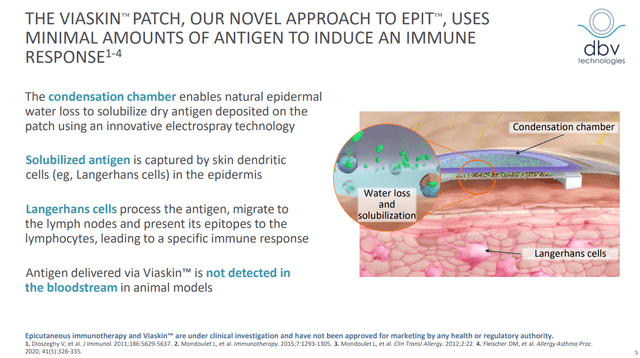

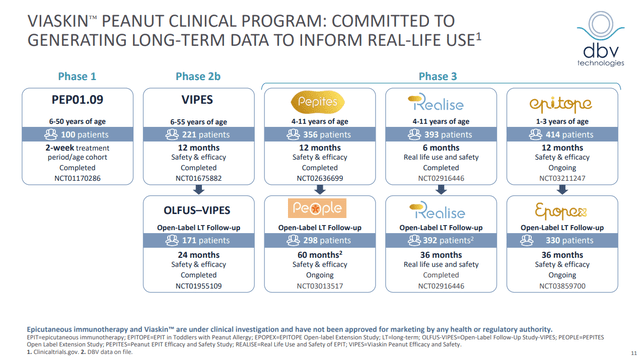

DBV Applied sciences

DBVT’s core know-how is its Viaskin patch which it makes use of to coach the immune system. From the corporate’s August 2022 company presentation:

Company presentation

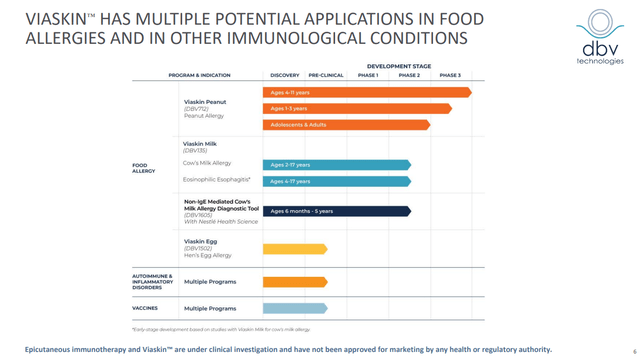

The pipeline at the moment contains treating peanut, milk and egg allergic reactions.

Company presentation

Viaskin is in a number of Section III peanut trials for various age teams, these for 4-11 12 months olds are within the open label comply with up part, whereas that for 1-Three 12 months olds is ongoing and in comply with up concurrently.

Company presentation

DVT’s resolution additionally presents a comparatively handy administration:

Company presentation

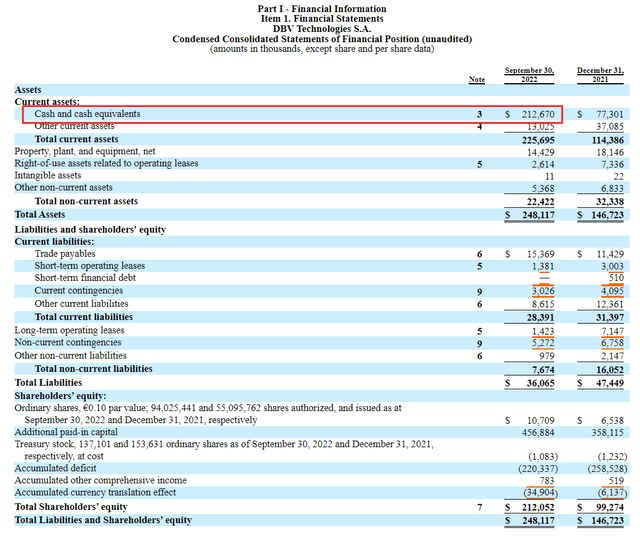

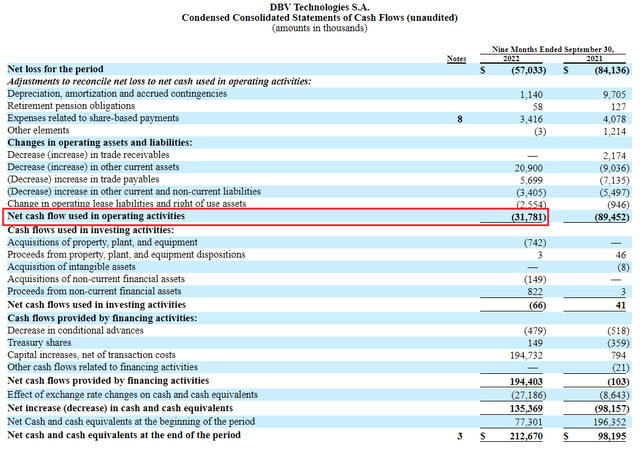

Money Place

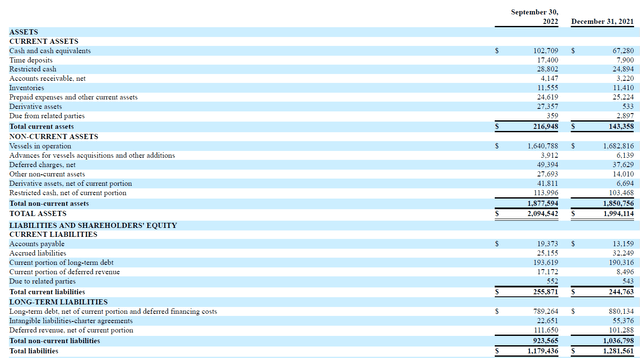

DBVT had $212M in money out there as of September 30, 2022. It burns about $42M a 12 months in money, in order that ought to be good for a Four 12 months runway with no need to lift money (notice the money circulate assertion under is for 9 months, which I’ve extrapolated to 12 months). The corporate has about 94M shares excellent, such that it has about $2.25 per share in money and money equivalents. Thus when buying and selling under $1 it’s buying and selling at lower than half of money available.

Each of those details, in my view, scale back the chance of holding DBVT for my multi-month holding interval.

sec.gov 10 Q

sec.gov 10 Q

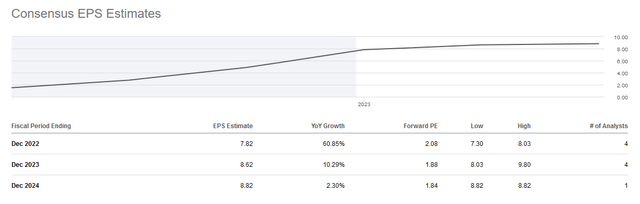

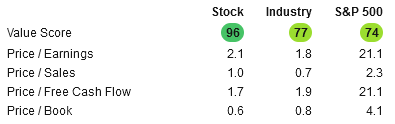

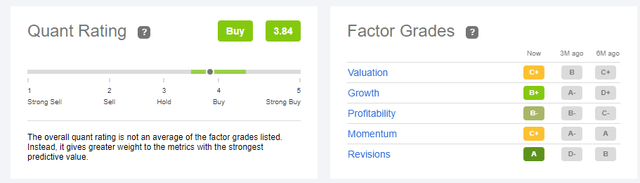

In search of Alpha Quant Ranking

DBVT at the moment sports activities a “Purchase” ranking of three.84 in In search of Alpha’s proprietary quant ranking system. This too provides confidence for a multi-month purchase.

In search of Alpha

Dangers

The dangers of shopping for DBVT are multifold. First, one other competitor was first to return out with an accredited peanut allergy resolution. There may be possible room for a couple of product right here, however AIMT has first mover benefit.

Second, DBVT has, as of but, no accredited merchandise so there’s a danger that it by no means turns into business.

Third, the corporate has seen delays and a trial maintain (see the downgrade data above). This too places a purchase order of DBVT in danger.

One offsetting level, nonetheless, is that DBVT trades at lower than money available, so some unhealthy information is already baked into the inventory worth in my view.

Buying and selling Technique

I’ve purchased a half place in DBVT and am bidding decrease for the opposite half. I plan to promote in increments if the inventory rises and to be totally out of the commerce on the newest by mid-March.