Clear futuristic electrical vehicles highway site visitors

gremlin

Introduction

A number of days in the past, I analyzed ARK’s Genomic ETF (ARKG). I believe ARK Make investments do good work on specialised analysis specializing in long run transformation potentials of firms. Therefore, their ETFs are certainly a bunch of extremely promising firms with very uneven risk-reward profiles.

I consider one of the best ways to revenue from these ETFs is to take our personal possession of the macro issues to speculate solely in favorable environments. When the worldwide financial atmosphere is up-beat, I consider ARK Make investments’s funds will outperform the market handsomely.

On this article, I discover the prospects of one other certainly one of Ark’s innovation themes:

ARKQ: Publicity to Autonomous Expertise & Robotics

The ARK Autonomous Expertise & Robotics ETF (BATS:ARKQ) seeks publicity world firms whose major enterprise is in promoting competencies in areas comparable to autonomous transportation, robotics and automation, 3D printing, vitality storage and area exploration.

ARKQ ETF Publicity Combine

Diversified Sector Combine

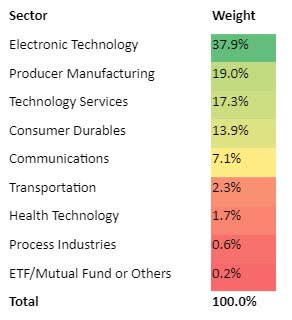

ARKQ ETF Sector Publicity (ARKQ ETF Web site, Creator’s Evaluation)

I might say ARKQ has a broad sectoral publicity total, notably in industries that mix using know-how with {hardware}. One noteworthy distinction I spot is the stark distinction in weights within the producer manufacturing business (19% weight) and the method industries comparable to chemical compounds (0.6%). This illustrates ARKQ’s publicity to know-how spend related to discrete, device-related parts. That is in distinction to know-how spends related to software program to manage the stream of processes comparable to fluids and gases.

Most Firms in North America however Numerous Finish Markets

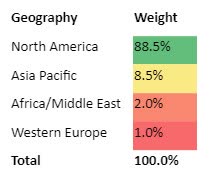

ARKQ ETF Geography Combine (ARKQ ETF Web site, Creator’s Evaluation)

The chart above reveals that lots of the firms in ARKQ are in North America. Nonetheless, you will need to observe that the income profile could be a lot diversified. For instance, I believe that Western Europe, which has many automotive firms would make up greater than 1% of income publicity.

Diversified High 5 Holdings Combine

ARKQ ETF High 5 Holdings Publicity (ARKQ ETF Web site, Creator’s Evaluation)

ARKQ’s prime 5 holdings embrace Trimble (TRMB), Kratos Protection & Safety (KTOS), Iridium Communications (IRDM), Tesla (TSLA), and UiPath (PATH).

Given the sector specialist focus of the ETF, I consider that is fairly a diversified publicity with the highest 5 making up 37.6% of the complete portfolio. Furthermore, the weights are much less asymmetrical than is the case in a few of ARK Make investments’s ETFs comparable to Genomics (ARKG).

Basic Drivers of ARKQ

The diversified nature of ARQ means no particular person inventory contributes disproportionately to the general efficiency of the ETF. Moderately, it’s extra helpful to contemplate the underlying drivers of buyer spends:

I observe that autonomous transportation, robotics and automation, 3D printing, vitality storage and area exploration options are sometimes capex-spend choices versus opex spend choices. Some business commentaries recommend a desire for opex-related spends, with capex spends anticipated to get better extra slowly. This might be a headwind for firms in ARKQ, holding potential room for downward shock in gross sales.

I consider capex spends might be extra energetic throughout occasions of buoyant industrial exercise. To that extent, I observe that a big a part of world industrial exercise in america, China and Japan (which make up virtually 50% of GDP) is in contraction mode. Till these nations’ respective PMIs float above the 50-line once more, I doubt there could be any real set off for bullishness in ARKQ’s constituent holdings.

Technical Evaluation

Relative Learn of ARKQ vs. S&P 500

ARKQ vs. SPX500 Technical Evaluation (TradingView, Creator’s Evaluation)

In opposition to the S&P500 (SPY), ARKQ has had it tough because it exploded to its peak in February 2021, adopted by a pointy bearish drop so far. Nonetheless, the ARKQ/SPX500 pair might need reached its backside after returning to the crucial month-to-month assist degree, as highlighted within the chart above.

I anticipate a slowdown in momentum round this degree and a gradual sideways sample alongside the month-to-month resistance and assist zones to find out the directional momentum that follows. My examine of monetary market bubbles means that recoveries after a bubble pop comparable to right here are typically sluggish and gradual moderately than sharp. To verify a change in pattern, I have to see a transparent false breakdown and a pointy rebound, trapping sellers and early patrons.

Standalone Learn of ARKQ

ARKQ Technical Evaluation (TradingView, Creator’s Evaluation)

On the standalone chart, I anticipate the same value sample with ranging value motion. Nonetheless, on this case, I believe ARKQ is more likely to have a go to right down to the $35.38 month-to-month assist, as this assist degree has extra historic relevance.

Takeaway

If capex spends take longer to rebound, then a basic bullish case for ARKQ could not materialize so quickly. I’m monitoring business commentaries and the worldwide economic system’s PMIs as a proxy to evaluate the underlying spending atmosphere.

Nonetheless, this doesn’t imply the bleeding down of the ETF value will proceed. Moderately, I believe we’re forming a little bit of a neighborhood backside and I anticipate a sluggish and gradual build-up of an accumulation base earlier than any materials transfer upwards. To maximise IRR, I consider it’s best to attend a number of months and purchase once more at comparable costs.

Thus, my total evaluation is a ‘maintain’ on ARKQ.