phototechno

It simply retains getting worse.

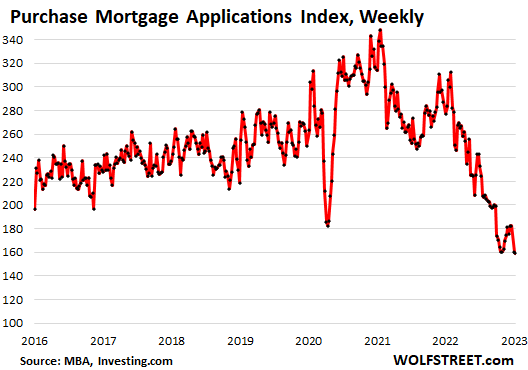

Mortgage purposes to buy a house are a forward-looking indicator of the place dwelling gross sales quantity might be. Current dwelling gross sales that closed in November already plunged by 35% year-over-year, the 16th month in a row of year-over-year declines, making for a historic plunge. And mortgage purposes went within the incorrect route from there, regardless of the dip in mortgage charges.

Purposes for mortgages to buy a house fell to the bottom degree for the reason that Christmas week of 2014, and past the lows of 2014, we have now to return all the best way to 1995, in keeping with knowledge from the Mortgage Bankers Affiliation right this moment.

In comparison with a yr in the past, buy mortgage purposes have plunged by 44%. Even throughout Housing Bust 1, mortgage purposes did not plunge that a lot yr over yr.

MBA, Investing.com

That little dip in mortgage charges had no impression. This drop in mortgage purposes got here regardless of the dip in mortgage charges that began in mid-November from the 7.1% vary and hit a low level in mid-December at 6.28%. Within the newest reporting week, the common 30-year mounted price was at 6.42%, in keeping with the Mortgage Bankers Affiliation right this moment.

The drop in mortgage purposes signifies that it would not actually matter to the quantity of dwelling purchases whether or not the 30-year mounted price is 6.3% or 7.1%. The distinction is simply beauty. The present dwelling costs – although they’ve come down in lots of markets, and have come down exhausting in some markets – are nonetheless merely means too excessive.

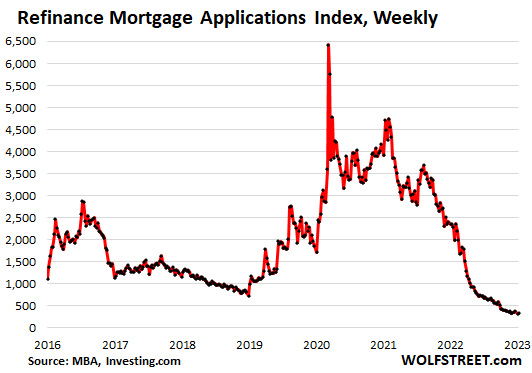

Refinance mortgage quantity has died: Purposes to refinance a mortgage have collapsed by 86% from a yr in the past, regardless of the invisibly small uptick within the newest week. Since October, refinance purposes have hovered on the lowest ranges for the reason that yr 2000. And this is sensible as a result of hardly anybody could be refinancing a 3% or 4% mortgage with a 6% or 7% mortgage, besides when underneath duress to extract money.

MBA, Investing.com

Mortgage lender woes

Mortgage lenders, whose revenues have collapsed as mortgage purposes quantity has collapsed, have spent the final 12 months shedding folks and shutting down divisions. Some smaller operations have shut down completely.

Wells Fargo (WFC), as soon as the biggest total mortgage lender after which the biggest financial institution mortgage lender, is the newest to make the information with its extra efforts to step again from the mortgage market, on prime of the steps it had taken in 2022.

CNBC reported on Tuesday that it had “realized” that the financial institution will now re-focus its mortgage enterprise solely on its current financial institution and wealth-management clients, and debtors in minority communities; that it’s shutting down its enterprise that buys mortgages that had been originated by third-party lenders; and that it’s “considerably” lowering its mortgage-servicing portfolio by asset gross sales. All this may entail a brand new spherical of layoffs, on prime of the layoffs in its mortgage enterprise that began in April final yr.

Wells Fargo solely had about 18,000 mortgages in its retail origination pipeline within the early weeks of the fourth quarter, which was down by as a lot as 90% from a yr earlier, in keeping with CNBC, citing folks with information of the corporate’s figures.

Wells Fargo shares are down 29% from their latest excessive in February 2022, and down 36% from their all-time excessive in January 2018.

The mortgage lenders that surpassed Wells Fargo a number of years in the past are non-banks – they had been aggressive in getting the mortgage enterprise through the Simple Cash period, then acquired crushed, and in 2022 made it into my pantheon of Imploded Shares. They’ve all shed giant numbers of staff, and a few have shut down whole models so as to survive.

Their shares have collapsed from their highs:

- Rocket Firms (owns Quicken Loans): -81%

- United Wholesale Mortgage (owns United Shore Monetary): -73%

- LoanDepot: -94%

However mortgage delinquencies and foreclosures are nonetheless close to file lows.

What the true property and mortgage industries are lamenting is the plunge within the quantity of dwelling purchases and the plunge within the quantity of mortgage originations, which have brought about their revenues to break down.

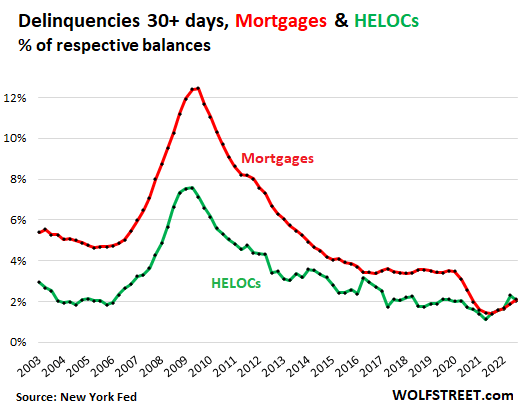

The problem will not be the credit score high quality of the prevailing mortgages. Not less than not but; that part could come later if and when unemployment reaches excessive ranges, which is simply not taking place but regardless of the layoffs in tech, social media, and finance. Mortgage and HELOC delinquencies, although they’ve ticked up from file lows through the pandemic, stay very low.

The HELOC 30-day-plus delinquency price ticked right down to 2.0% in Q3, 2022, according to the lows through the Good Occasions, in keeping with knowledge from the NY Fed (inexperienced line).

The mortgage 30-day-plus delinquency price ticked as much as 2.1% (crimson line), nonetheless far decrease than earlier than the pandemic.

New York Fed

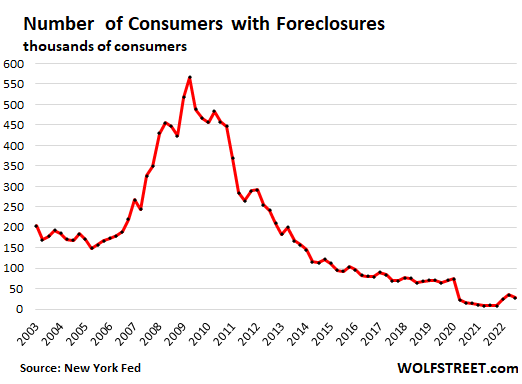

Foreclosures ticked down once more in Q3 to only 28,500 mortgages with foreclosures, and stay properly under the quantity through the Good Occasions earlier than the pandemic when there have been about 70,000 mortgages with foreclosures:

New York Fed

Authentic Submit

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.