cemagraphics

By James Knightley, Padhraic Garvey, CFA and Chris Turner

25bp with extra nonetheless to come back

Having raised the Fed funds goal vary by 425bp in 2022, together with 75bp and 50bp strikes, expectations are firmly centred on the Federal Reserve opting for a extra modest 25bp rate of interest enhance on Wednesday – taking the goal vary to 4.5-4.75%. Whereas inflation continues to be properly above goal and unemployment is at a cycle low, there are indicators that the economic system is responding to tighter financial coverage and the Fed might be cognisant of fears that mountaineering charges too onerous and quick dangers toppling the economic system into recession.

Officers definitely look like backing “normal” 25bp will increase any more after enacting their most aggressive mountaineering cycle for 40 years, however most are warning that there’s nonetheless extra work to be accomplished. Consequently, we anticipate to hear that ongoing rate of interest hikes are “applicable” with the steadiness sheet shrinking technique remaining in place.

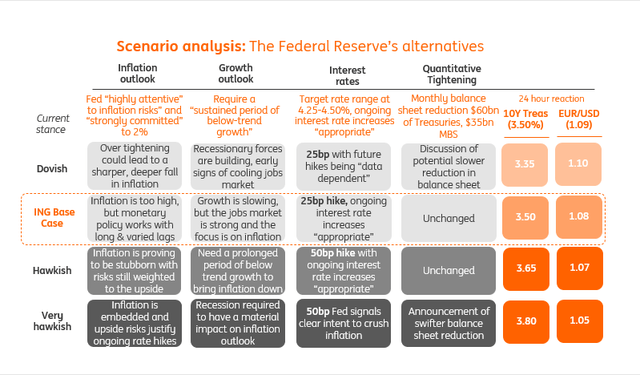

Situations for the Federal Reserve assembly

ING

Officers are unlikely to modify to a “information dependency” narrative simply but, fearing that adopting too dovish a line might gas market expectations for eventual charge cuts. In flip, this might result in an undesirable loosening of monetary circumstances that contribute to inflation staying larger for longer.

Conversely, signalling 25bp however then mountaineering by a extra aggressive 50bp would generate a big risk-off response with sharply larger borrowing prices. Nearly all of the committee would seemingly contemplate this too dangerous an possibility given the potential to accentuate recessionary forces that might find yourself excessively dampening inflation.

With no new Federal Reserve forecasts at this assembly, the accompanying press convention is more likely to re-affirm that it’s applicable to maneuver in smaller 25bp steps any more and we’re not on the endpoint but.

The Fed might over and/or under-hike different charges for technical causes, however seemingly gained’t

Aside from the headline funds charge vary of 4.25% to 4.50%, the Fed may even alter larger the speed on the reverse repo facility and on extra reserves. These are presently at 4.3% and 4.4% respectively, and are sometimes seen because the tighter hall inside which the efficient Fed funds charge sits (presently 4.33%).

There’s fixed hypothesis on the probability of the Fed deciding to under-hike the speed on the reverse repo facility, to convey it to flat to the Fed funds ground (it’s presently 5bp over). The logic could be to encourage much less use of this facility, which routinely takes in US$2tr in extra liquidity on a rolling day by day foundation. Nonetheless, most likely, repo would merely commerce right down to the identical space, with no materials impact on volumes.

There’s a related argument to as an alternative over-hike the speed on extra reserves, say by 30bp (as an alternative of 25bp). The concept right here could be to encourage a downsize in the usage of the reverse repo facility rather than an upside in financial institution reserves (larger relative remuneration). This might permit the Fed to raised handle financial institution reserves, guaranteeing that it would not fall too quick, because it regularly ratchets its steadiness sheet decrease by the continuing comfortable quantitative tightening programme (because it permits $95bn of bonds monthly to roll off the entrance finish).

Most likely, it gained’t do that both. It’s already a 10bp unfold between the reverse repo window and the surplus reserves one, and widening that to 15bp won’t make a fabric distinction. That mentioned, a ramification of 20bp simply would possibly, and is one thing the Fed might contemplate down the road i.e., under-hiking the reverse repo charge and over-hiking the speed on extra reserves. On this event, there could be fairly a shock if it did something alongside these traces, not less than not at this juncture.

The Fed might additionally upsize the quantitative tightening agenda, however seemingly gained’t both

The Fed has additionally been fairly quiet on the steadiness sheet roll-off programme. Evidently’s the best way it likes it – churning away quietly within the background, and never inflicting too many market ripples. The large query on this area is whether or not the Fed might contemplate outright promoting some bonds off its books, and thereby have interaction in a tougher model of quantitative tightening. It might be large if it did. There’s definitely an urge for food for bonds available in the market if the latest Treasury auctions are something to go by.

Nonetheless, such promoting of bonds outright would seemingly be a step too far at this juncture, as it might seemingly generate a tantrum. But it surely’s all the time there ought to the Fed begin to really feel that the autumn in longer-dated market charges is performing opposite to its mountaineering efforts on the entrance finish. Even a point out that it’s this down the road would have a fabric impact. Not anticipated, however these are potential market movers that we have to cross off because the assembly final result unfolds.

Importantly, any point out of doubtless upsizing the bond roll-off sooner or later or contemplating any bond promoting (e.g. of the longer-dated mortgage portfolio) would sign it was uncomfortable with the place longer-dated market charges are at.

However the outlook is darkening and the height is shut

We predict that the Fed will in all probability hike as soon as extra on 22 March, however that may mark the highest for the coverage charge. We’re involved that indicators of a slowdown will unfold and intensify with a recession our baseline forecasts.

Residential development has fallen in every of the previous six months, industrial manufacturing has been down for the previous three months and retail gross sales have dropped by 1% or extra in each November and December. Sadly, enterprise surveys provide no trace of a flip with each the manufacturing and repair sector ISM indices in contraction territory and the Convention Board’s measure of CEO confidence on the most depressed degree for the reason that World Monetary Disaster – a transparent sign that companies might be focusing extra on cost-cutting reasonably than income enlargement this yr.

On the identical time, the heavy weighting of shelter and automobiles inside CPI and clear indicators of softening company pricing energy imply that inflation might be near 2% by the top of this yr. Rents have topped out in most main cities whereas automobile costs at the moment are falling, with the Nationwide Federation of Unbiased Enterprise survey on worth intentions pointing to a pointy slowdown in core inflation by the second quarter into the third quarter of this yr.

As for the roles market, whereas headline payrolls development stays spectacular, there are flashing warning lights with the non permanent assist element reporting falling employment numbers in every of the previous 5 months. That is regarding as a result of this grouping of staff is often simpler to rent and hearth by the character of the place so they have an inclination to guide broader shifts in payrolls.

Worryingly, the declines are getting greater every month, suggesting the momentum within the jobs market is souring. In an atmosphere of weak exercise, falling inflation, and mounting job losses, we doubt the Fed will increase charges past March with charge cuts the order of the day from the third onwards.

FX: Issues are getting attention-grabbing

It has been just about one-way site visitors for the greenback bear pattern since early November. Clear indicators of easing US worth pressures and a slowing economic system have upended the prior narrative of a Fed compelled to tighten right into a recession. Danger property have rallied strongly.

Knowledge reveals that the EUR/USD six-hour response to final yr’s Federal Open Market Committee (FOMC) selections triggered strikes of anyplace between +/- 0.7%. And the FX choices market has a 90 pip vary priced for EUR/USD over the interval which covers each the Fed and the ECB conferences subsequent Wednesday/Thursday.

We had been about to say that an anticipated 25bp charge hike from the Fed and a comparatively unchanged assertion would have little influence on FX markets. But we’ve got simply seen FX markets transfer on the Financial institution of Canada’s resolution to halt its tightening cycle at 4.50%. The greenback was marked decrease on this resolution, presumably on the minority view that the Fed may be able to name time on its tightening cycle.

This implies that the FOMC assembly might show extra attention-grabbing than the market has priced. Our base case would assume that EUR/USD continues to commerce close to 1.08/1.09 after the FOMC assembly. Any suggestion that the Fed was just about accomplished tightening might ship EUR/USD by 1.10. Whereas aggressive Fed push-back towards the 50bp of 2023 easing already priced by the market might briefly ship EUR/USD to 1.07.

Within the greater image, we anticipate EUR/USD to go larger this yr – maybe to the 1.15 space within the second quarter – this would be the time when US inflation is falling extra sharply and China re-opening is offering a tailwind to the pro-cyclical currencies, together with the euro.

Content material Disclaimer

This publication has been ready by ING solely for info functions no matter a selected person’s means, monetary scenario or funding goals. The data doesn’t represent funding suggestion, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra.

Authentic Put up

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.