Shares on Friday seemed able to retreat a smidgeon as Wall Road closes out the week.

That’s OK, the S&P 500 SPX is already up 5.75% in 2023, helped by the assumption that slowing financial system and softening inflation will enable the Federal Reserve to be much less aggressive in elevating borrowing prices.

This has meant that considerably poor financial knowledge is usually effectively acquired by fairness traders. (Catastrophically unhealthy financial information could also be a distinct matter!).

That correlation could also be put to the take a look at once more subsequent week when the Fed is predicted to ship a 25 foundation level charge hike, adopted by a press convention with Chairman Jay Powell.

However inventory bulls who hope to search out alerts the central financial institution will quickly cease tightening coverage might want to suppose once more. That’s the warning from Citi’s quantitative international macro strategist Alex Saunders, who says traders should brace for a shift in market responses.

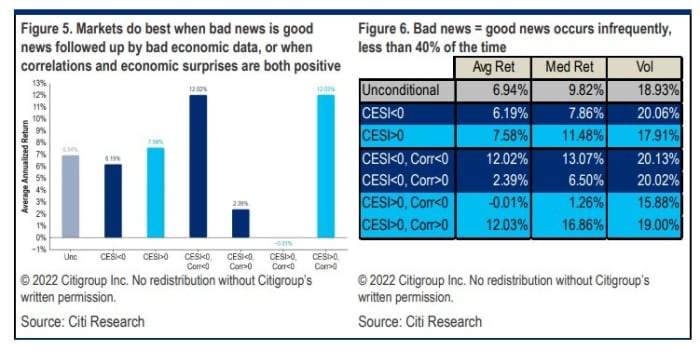

“U.S. fairness market response to financial surprises proper now could be that unhealthy information is sweet for markets. This is likely one of the finest regimes for U.S. equities. This correlation between information circulation and fairness markets is typical throughout mountain climbing cycles,” he says.

Saunders studied Citi’s financial shock index and its relationship to inventory market motion, and overlaid that with the financial coverage cycle.

The chart beneath reveals the imply returns in 4 regimes. The perfect regime, says Saunders, is with optimistic financial surprises, and a optimistic fairness/shock correlation, which occurs 34% of the time.

The worst end result is when the market will get good financial information and fairness/bond correlations are adverse, which occurs 18% of the time.

Nevertheless: “The present studying on Citi’s financial surprises index is -15 and the correlation between surprises and returns is adverse – markets have tended to react positively to a weaker shock index.”

The seemingly motive is equities search aid from the top of mountain climbing cycles.

However this relation tends to flip as soon as the Fed goes on maintain, “Because the mountain climbing cycle matures, the correlation between financial surprises and U.S. fairness market efficiency may flip optimistic. On this case, weak financial knowledge from a possible 2H U.S. recession would weigh on markets”.

Such a transition to a regime the place unhealthy information is unhealthy information “might be the signal that the bear market rally is fading -– for instance, the sell-off after weak retail gross sales numbers earlier this month”.

The truth is, Saunders can see the market portray itself right into a nook.

“Moreover, a string of optimistic financial releases would additionally give us pause in equities, because the Fed may see this as a inexperienced mild to tighten monetary circumstances additional,” he says.

“The slender path for equities is both to proceed buying and selling unhealthy information in hope of a Fed pivot, or for recession fears to fully recede, inflation to proceed falling, and good financial information to turn into good market information once more,” he concludes.

(For extra on how telling financial surprises will be see The Chart, beneath).

Markets

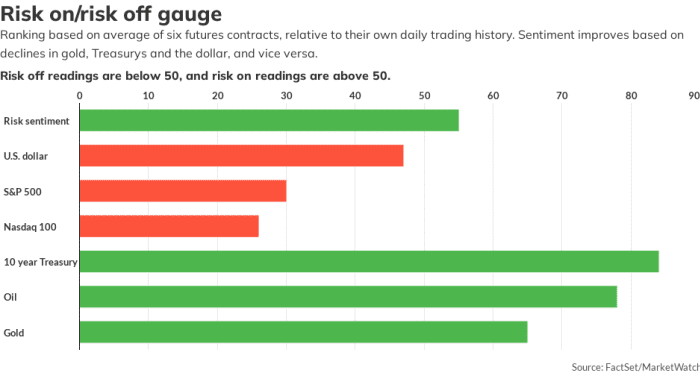

Inventory futures ES00 YM00 are tilting south, led by Nasdaq-100 futures NQ00 after poorly-received outcomes from Intel. The 10-year Treasury yield BX:TMUBMUSD10Y is up 5 foundation factors to three.547%, whereas the greenback DXY is flat, gold GC00 is softer and crude CL is perkier, up 1.2% to $81.98 a barrel.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Day by day.

The thrill

Intel INTC shares are down practically 10% in premarket motion after the chip maker late Thursday reported– a giant fourth-quarter miss, and a dark forecast.

Be careful at 8:30 a.m. Jap for the PCE value index report. It’s the Fed’s most well-liked inflation measure and is prone to have an effect on the central financial institution’s considering because it prepares to ship its financial coverage resolution subsequent Wednesday.

Additionally to return on Friday: actual disposable incomes and actual client spending for December might be launched at 8:30 a.m., adopted at 10 a.m. by the College of Michigan client sentiment index alongside 1-year and 5-year inflation expectations, all for January. December pending residence gross sales are due at 10 a.m. All instances Jap.

The sell-off in shares of corporations linked to Gautam Adani, Asia’s richest man, continued on Friday after hedge fund titan Invoice Ackman lent his assist to Hindenburg Analysis, the quick vendor who this week revealed a important report into the Adani empire’s actions.

American Categorical AXP inventory is up 5% premarket after delivering better-than-expected outcomes and boosting the dividend.

Shares in Hasbro HAS are down practically 4% after the toy maker mentioned it plans to put off about 15% of its workforce and warned Wall Road of a loss and income drop after a disappointing vacation season.

Chevron’s inventory CVX is down 1% after the oil and gasoline large missed fourth-quarter revenue expectations, whereas income rose above forecasts.

Better of the online

How Russia’s warfare on Ukraine modified the worldwide oil commerce.

Addressing the “Smoothie Delusion”: huge tech slashes workplace perks.

Meet the newest housing-crisis scapegoat.

The chart

German shares have been doing effectively of late. The DAX 40 was up 14.6% over the previous three months at Thursday’s shut, whereas the S&P 500 has gained 6.6%.. The chart beneath from Deutsche Financial institution partly explains the distinction. Sliding vitality prices in Europe over the winter, and extra not too long ago the opening up of China’s financial system, have made German enterprise leaders extra optimistic, feeding into financial knowledge.

It’s surprises that the majority transfer markets. And the Eurozone knowledge has been extra positively stunning than these within the U.S.

“The massive query for 2023 is whether or not the momentum in Europe and China and the current loosening of world monetary circumstances might help offset some very worrying current U.S. knowledge. It’s potential that the worldwide financial system is normalising from the shock of the Ukraine warfare and China’s zero COVID coverage and that this may assist the U.S. within the close to time period,” mentioned Deutsche strategist Jim Reid.

Prime tickers

Right here had been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Jap.

Random reads

Gold coated mummy.

Bear takes 400 selfies.

Lottery winner blew $50 million in simply Eight years.

Have to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Jap.

Take heed to the Greatest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton