zorazhuang

Targa Sources Corp. (NYSE:TRGP) is a pure gasoline liquids-focused midstream company that primarily operates within the state of Texas. The midstream sector basically has lengthy been among the many favourite areas for income-focused buyers to be attributable to the truth that most of those corporations take pleasure in remarkably secure money flows and excessive dividend yields. Targa Sources is one thing of an exception to this because it does have money movement stability nevertheless it falls considerably quick when it comes to yield. In truth, the corporate solely yields 1.92% on the present value, which is because of a dividend in the reduction of in 2020 that was then partially reversed final yr. The corporate will probably enhance its dividend at a while sooner or later, which we’ll see over the course of this text. Though Targa Sources doesn’t benefit from the excessive yield that we sometimes wish to see right here at Vitality Income in Dividends, it has prior to now and will as soon as once more. Because of this I proceed to debate this firm on my service. General, there are fairly a couple of causes to speculate on this firm at the moment because it has made nice progress in overcoming a couple of of the issues that it had in recent times and is thus positioning itself pretty nicely for the longer term.

About Targa Sources

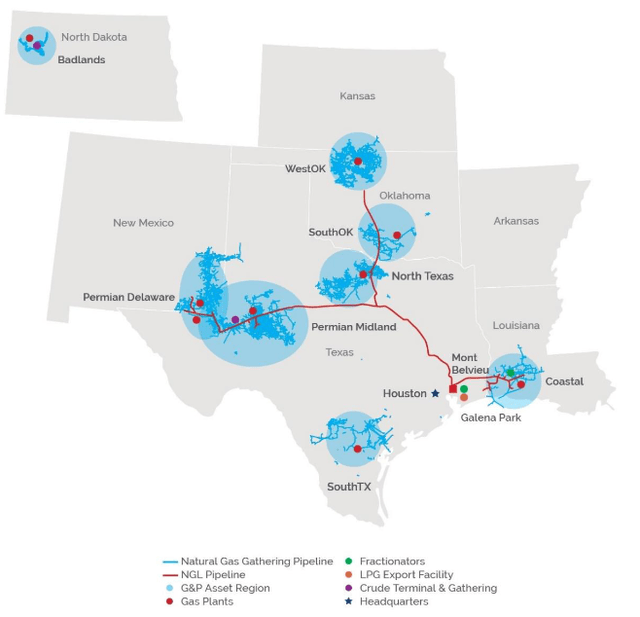

As acknowledged within the introduction, Targa Sources is a pure gasoline liquids-focused midstream company that primarily operates within the state of Texas, though it does have some operations in North Dakota’s Williston Basin:

Targa Sources

In contrast to lots of its friends, although, we will see that the corporate’s pipeline infrastructure is pretty small. This can be a bit deceptive nevertheless as Targa Sources truly has a reasonably substantial gathering and processing infrastructure community. A gathering pipeline is considerably completely different from the big long-haul pipelines that carry sources throughout a state or a rustic. Moderately, these pipelines are pretty quick and low-capacity pipelines that merely seize the sources from the nicely that extracts them from the bottom. The pipeline will then take the sources to the primary cease on their journey, which is normally both a a lot bigger long-haul pipeline or a processing facility. Targa Sources does have a reasonably substantial pure gasoline processing capability as it’s able to dealing with a complete of 11 billion cubic ft of pure gasoline per day throughout its 53 processing vegetation. The processing of pure gasoline is essential as a result of pure gasoline accommodates various impurities and pollution when it’s faraway from the bottom, comparable to water and sulfur. The processing plant removes these impurities and converts the pure gasoline right into a state that can be utilized by the tip consumer. The corporate additionally owns 960,000 barrels per day of pure gasoline liquids fractionation capability. A pure gasoline liquids fractionator splits the sources into the varied pure gasoline liquids that we use in our on a regular basis lives, comparable to propane, butane, and ethane. General, then, Targa Sources is a reasonably main participant within the midstream house, despite the fact that it doesn’t have substantial long-haul pipeline belongings.

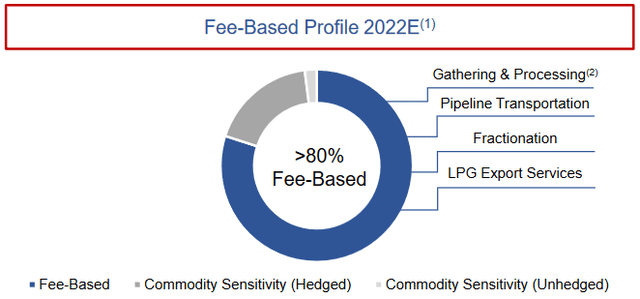

Within the introduction, I acknowledged that Targa Sources tends to take pleasure in remarkably secure money flows no matter situations within the broader economic system. That is as a result of enterprise mannequin that the corporate makes use of. Briefly, Targa Sources enters into long-term (normally 5 to 10 years in size) contracts with its clients. Underneath these contracts, the shoppers ship sources by way of Targa Sources’ infrastructure and compensate the corporate primarily based on the amount of sources dealt with. This offers the corporate with a shocking quantity of insulation in opposition to fluctuations in commodity costs. At this level, some readers may level out that upstream useful resource producers have a tendency to scale back their output when power costs lower. This occurred again in 2020 when the COVID-19 pandemic broke out and brought on the demand for crude oil to plummet. Though Targa Sources doesn’t personal any crude oil infrastructure, pure gasoline and pure gasoline liquids are sometimes produced by the identical wells so the corporate would nonetheless be affected. Thankfully, the corporate has a strategy to shield itself in opposition to this. The contracts that it has with its clients comprise what are often called minimal quantity commitments, which specify a sure minimal quantity of sources that the client should ship by way of Targa Sources’ infrastructure or pay for anyway. Thus, it has a sure portion of its money movement that’s typically unaffected by both power costs or useful resource manufacturing. In truth, 80% of the corporate’s working margin (a proxy for working revenue) comes from these recession-resistant contracts:

Targa Sources

That is one thing that’s sure to be enticing proper now as practically all economists agree that the American economic system will enter right into a recession someday in 2023. One of many traits of recessions is that the demand for power sources declines, which might affect the output of upstream producers a lot because it did again in 2020. The truth that greater than 80% of Targa Sources’ money flows are protected by this offers an excessive amount of assist for the corporate’s dividend and by extension our incomes.

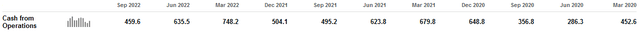

We will see proof of this common stability just by wanting on the firm’s working money flows over time. Right here they’re over the previous eleven quarters:

Searching for Alpha

This offers even additional proof that the corporate ought to have the ability to deal with any imminent recession with ease. In any case, whereas its money flows did decline considerably in 2020, they nonetheless remained rather more secure than is likely to be anticipated contemplating what occurred to power costs throughout that yr. It’s all however sure that any recession that happens in 2023 won’t be practically as extreme as it is extremely unlikely that the federal government will as soon as once more try to lock us all down at dwelling and forbid us from pointless touring. Thus, power demand shouldn’t drop as a lot and we’ll probably not see practically as large of a shock to the business.

Progress Prospects

Naturally, as buyers, we wish to see greater than easy stability. We wish to see development. Thankfully, Targa Sources is sort of well-positioned to ship on this space. As midstream infrastructure comparable to pure gasoline gathering pipelines, processing vegetation, and fractionators solely have a restricted amount of sources that they deal with, and the corporate’s money movement is determined by the amount of sources that transfer by way of its infrastructure, the traditional method for Targa Sources to generate development is to assemble new infrastructure. That is precisely what the corporate is doing, though it admittedly doesn’t have as many development tasks within the works as some friends comparable to Enbridge (ENB) or Kinder Morgan (KMI). One of many firm’s main tasks is the Daytona NGL Pipeline. The Daytona NGL Pipeline was introduced in November of 2022 and has an estimated value of $650 million. This undertaking was initially envisioned as a three way partnership with Blackstone Vitality Companions, though Targa Sources purchased out Blackstone’s stake final week. The Daytona NGL Pipeline is meant as an growth to the Grand Prix NGL system that constitutes one of many largest pure gasoline liquids pipeline networks in Texas. The Grand Prix NGL system is able to carrying 550,000 barrels of pure gasoline liquids per day however the Daytona NGL Pipeline is considerably lower than that as a result of it’s not the one pipeline that’s feeding all the system. Throughout its third-quarter convention name, Targa Sources acknowledged that the Daytona NGL Pipeline can be able to carrying 400,000 barrels of pure gasoline liquids per day when it begins working, though the corporate will have the ability to increase its capability if wanted. This form of expandable capability is sort of widespread because it helps to save lots of on development prices and future-proofs the undertaking. Clearly, these are issues that we should always respect as buyers.

Targa Sources can be working to increase its pure gasoline processing capability. Additionally in November 2022, the corporate introduced that it’ll start development of a brand new pure gasoline processing plant to serve the Permian Basin. This new plant, dubbed Wildcat II, can be able to processing roughly 275 million cubic ft of pure gasoline when it begins operation in early 2024. Because the Daytona NGL Pipeline is predicted to come back on-line in late 2024, Targa Sources will thus be bringing a couple of new tasks on-line throughout that yr.

The great factor about these tasks is that Targa Sources has already obtained contracts for his or her use from its clients. This serves two functions, each of that are helpful for the corporate. The primary of those functions is clearly that we could be assured that the corporate is just not spending an infinite amount of cash to assemble infrastructure that no person desires to make use of. As well as, we could be sure that every of those tasks will start producing cash as quickly as they change into operational in 2024 so we will anticipate regular development over the course of that yr from these two tasks coming on-line. The second function is that the corporate is aware of prematurely precisely how worthwhile the tasks can be so it is aware of that every undertaking will have the ability to generate a adequate return to justify the funding. Sadly, Targa Sources has not specified precisely how worthwhile they are going to be so we can’t carry out an in-depth monetary evaluation presently. Kinder Morgan’s tasks normally pay for themselves in 4 years whereas The Williams Corporations (WMB) has a few six-year payback so it’s probably that Targa Sources’ tasks are in that very same ballpark however that is on no account sure. Regardless, we could be sure that they may present a really noticeable enhance to the corporate’s money movement.

Monetary Issues

It’s at all times essential that we have a look at the way in which that an organization is financing itself earlier than we make an funding in it. It’s because debt is a riskier strategy to finance an organization than fairness as a result of debt should be repaid at maturity. As few corporations have adequate money readily available to fully repay their debt because it matures, that is sometimes completed by issuing new debt and utilizing the proceeds to repay the maturing debt. This could trigger an organization’s curiosity bills to extend following the rollover relying on the situations available in the market. Along with this, an organization should make common funds on its debt whether it is to stay solvent. Thus, an occasion that causes an organization’s money flows to say no could push it into monetary misery if it has an excessive amount of debt. Though Targa Sources has remarkably secure money flows, we should always not ignore this danger as bankruptcies have occurred within the midstream sector.

One metric that we will use to guage an organization’s monetary construction is the online debt-to-equity ratio. This ratio tells us the diploma to which an organization is financing its operations with debt versus wholly-owned funds. As well as, the ratio tells us how nicely the corporate’s fairness will cowl its debt obligations within the occasion of a chapter or liquidation occasion, which is arguably extra vital.

As of September 30, 2022, Targa Sources had a web debt of $11.0646 billion in comparison with $4.7314 billion of shareholders’ fairness. This offers the corporate a web debt-to-equity ratio of two.34. At first look, this ratio appears extremely excessive for any firm however allow us to examine it to among the firm’s friends to get a greater thought of whether or not that is appropriate:

|

Firm |

Web Debt-to-Fairness |

|

Targa Sources |

2.34 |

|

Kinder Morgan |

0.98 |

|

The Williams Corporations |

1.62 |

|

MPLX (MPLX) |

1.50 |

|

Crestwood Fairness Companions (CEQP) |

1.51 |

As we will clearly see, Targa Sources is relying significantly extra on debt to finance its operations than any of its friends. This can be a clear signal that the corporate is utilizing an excessive amount of leverage and thus could have larger dangers of monetary misery than lots of its friends. That is, actually, one of many considerations that we now have had with respect to this firm. I’ve mentioned this in lots of earlier articles right here at Vitality Income in Dividends.

In the end although, the corporate’s capacity to hold its debt is extra vital than the sheer quantity of debt. The same old method that we choose that is by wanting on the leverage ratio, which is also called the online debt-to-adjusted EBITDA ratio. This ratio basically tells us what number of years it is going to take for the corporate to fully repay its debt if it had been to commit all of its pre-tax money movement to that activity. Within the third quarter of 2022, Targa Sources reported an adjusted EBITDA of $768.6 million, which works out to $3.0744 billion yearly. This offers the corporate a leverage ratio of three.60x, which is sort of cheap. As I’ve identified in varied earlier articles, analysts typically contemplate something underneath 5.0x to be cheap however I’m extra conservative and wish to see this ratio underneath 4.0x in an effort to add a margin of security to the funding. All the really useful corporations right here at Vitality Income in Dividends are nicely underneath this 4.0x threshold however traditionally Targa Sources has not been. The corporate now seems to be, which is definitely good to see. The most important cause why Targa Sources minimize its dividend again in 2020 was to repay its debt and it has seemingly loved an excessive amount of success at this activity. That is due to this fact fairly good to see.

Dividend Evaluation

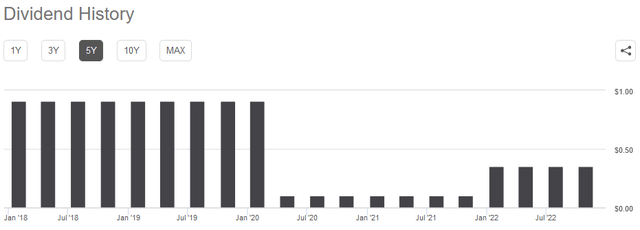

One of many largest the explanation why we spend money on midstream corporations is the excessive dividend yields that these corporations are inclined to pay out. Targa Sources is sadly a notable exception to this rule as the corporate solely yields 1.92% at its present value. It’s because the corporate minimize its dividend again in 2020 and, whereas it did enhance it in early 2022, it nonetheless stays nicely under its peak:

Searching for Alpha

Along with this, the corporate’s inventory has appreciated by 28.31% over the previous twelve months, which has additionally suppressed the yield considerably. The truth that the corporate did minimize its dividend in 2020 is more likely to be a little bit of a turn-off, particularly since there are various different midstream corporations that didn’t want to chop their payout. Nonetheless, you will need to remember that anybody buying the corporate’s shares at the moment will obtain the present dividend on the present yield and so does probably not want to fret in regards to the firm’s disappointing previous. Subsequently, the vital factor for our functions is how nicely the corporate can keep its present dividend. In any case, we don’t wish to discover ourselves the victims of one other dividend minimize since that would scale back our incomes and nearly definitely trigger the inventory value to say no.

The same old method that we choose a midstream firm’s capacity to pay its dividend is by its distributable money movement. Distributable money movement is a non-GAAP determine that theoretically tells us the amount of money that was generated by the corporate’s bizarre operations and is on the market to be distributed to the widespread stockholders. Within the third quarter of 2022, Targa Sources reported a distributable money movement of $594.9 million however solely paid $81.Zero million in dividends. This offers the corporate a distribution protection ratio of seven.34x, which is much above the 1.20x that analysts sometimes contemplate cheap and sustainable. Additionally it is nicely above the same old 1.30x that we wish to see from an organization that we’re invested in. This extremely excessive protection ratio is without doubt one of the the explanation why I prompt earlier on this article that Targa Sources could enhance its dividend in some unspecified time in the future since it could possibly clearly afford to and appears to have gotten its debt considerably underneath management. We should always total not have to fret in any respect a few minimize right here.

Conclusion

In conclusion, Targa Sources might definitely have potential regardless of now not being a high-yielding inventory. The corporate has made nice strides at addressing the debt considerations that we now have had in regards to the firm prior to now, though the debt-to-equity ratio is certainly nonetheless a bit excessive. The corporate additionally has some important development prospects which are more likely to play out over the following two years. Once we mix this with an actual probability of a dividend enhance, we will see some actual causes to buy the corporate at the moment.