Galeanu Mihai

The macro-outlook suggests earnings progress will wrestle in 2023

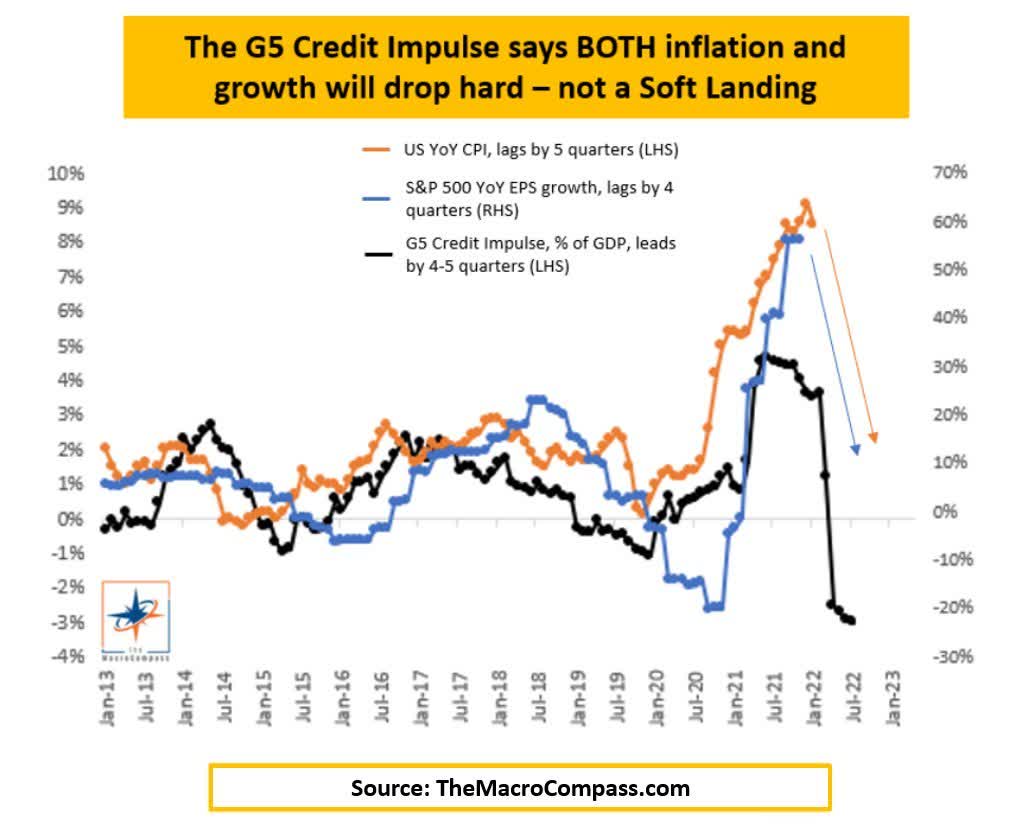

Company earnings are inheritably cyclical and have a tendency to fluctuate consistent with the enterprise cycle, thus having vital implications on inventory value efficiency. Although now we have seen earnings progress decelerate to a level all through 2022, whether or not we see a real earnings recession over the following 12-18 months stays key. The macro and liquidity indicators definitely counsel that is possible. Before everything, the G5 credit score impulse is foretelling earnings will roll over meaningfully in some unspecified time in the future throughout 2023.

@MacroAlf

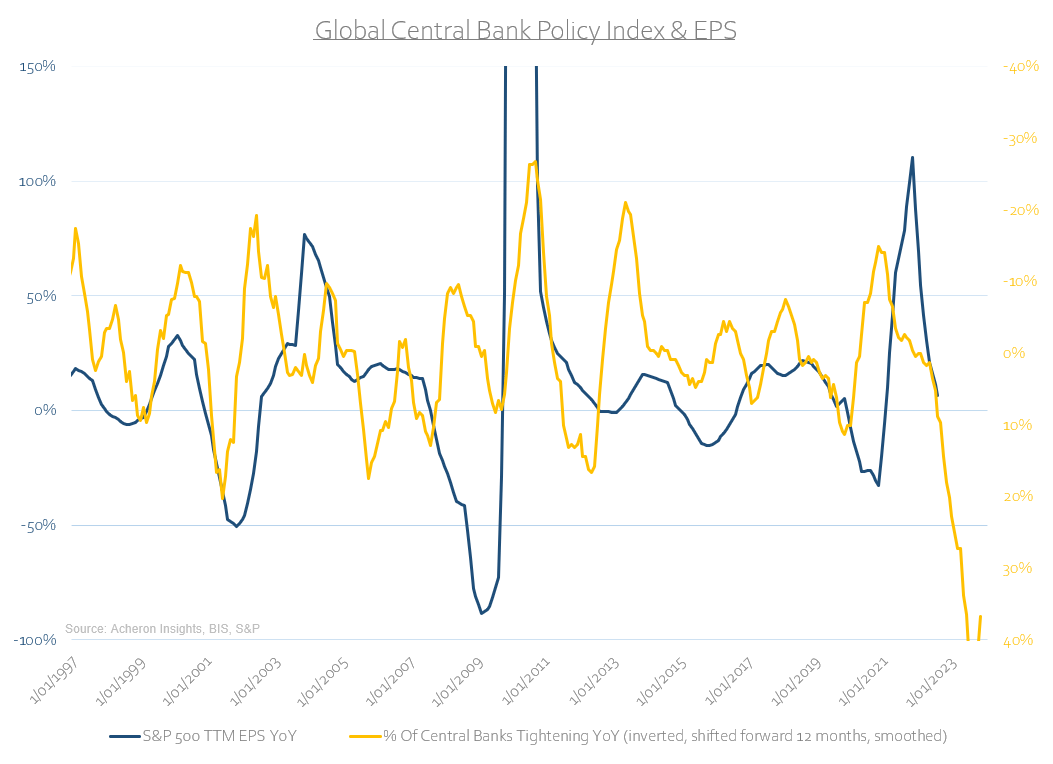

Financial coverage and liquidity situations worldwide additionally counsel a fabric slowdown in earnings is coming in some unspecified time in the future. Elevated borrowing prices ought to proceed to materially influence profitability for over-leveraged corporates, whereas tighter monetary situations will strain client spending. The latter dynamic has but to materially translate into consumption tendencies (though indicators of stress are rising in client bank card exercise), and when it does, company earnings will possible take successful.

Acheron Insights, BIS, S&P

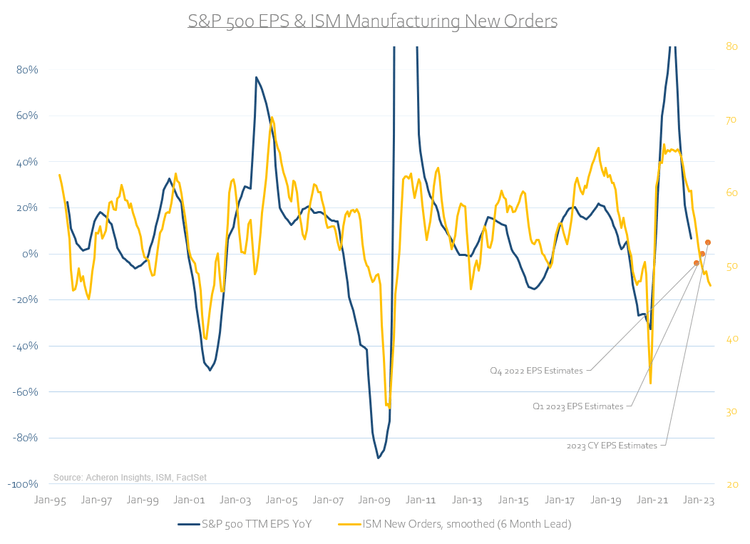

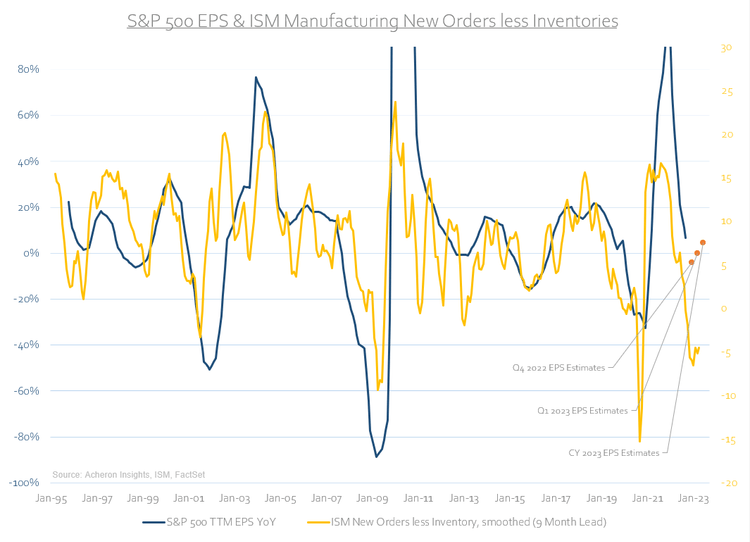

The enterprise cycle-related main indicators of progress appear to be corroborating this message. Each the ISM Manufacturing New Orders index and New Orders much less Inventories unfold lead EPS progress by round six to 9 months, and each counsel earnings progress ought to decline materially in 2023.

Acheron Insights, ISM, FactSet

Acheron Insights, ISM, FactSet

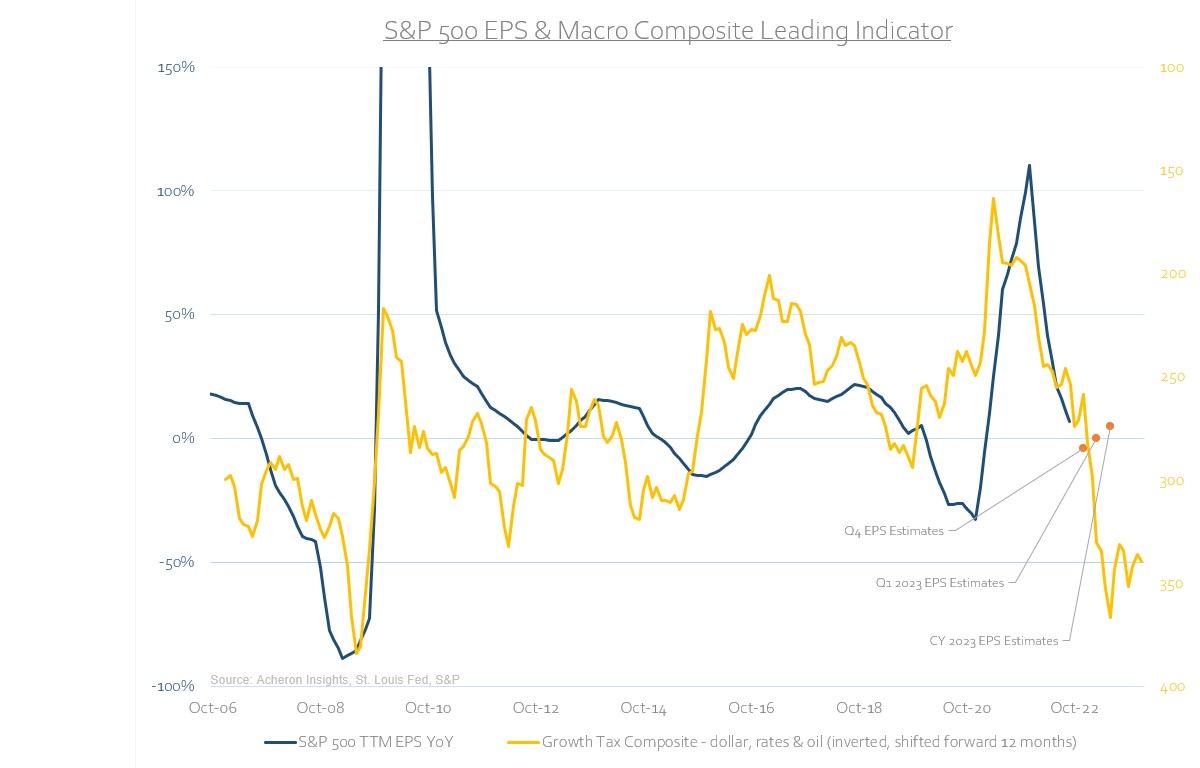

Current actions within the greenback, charges, and vitality prices additionally assist this outlook. Once we mix the actions of all three right into a single composite, we are likely to get a reasonably correct concept of the place company earnings are headed over the next 12 months. The rising price of capital, rising vitality prices, and diminished overseas revenue through a stronger greenback are all nonetheless headwinds for company profitability. Whereas This autumn 2022 and Q1 2023 EPS estimate could seem too pessimistic (notably if this financial cycle continues to play out slower than many imagine it would), the identical is probably going not true for 2023 estimates as an entire.

Acheron Insights, St. Louis Fed, S&P

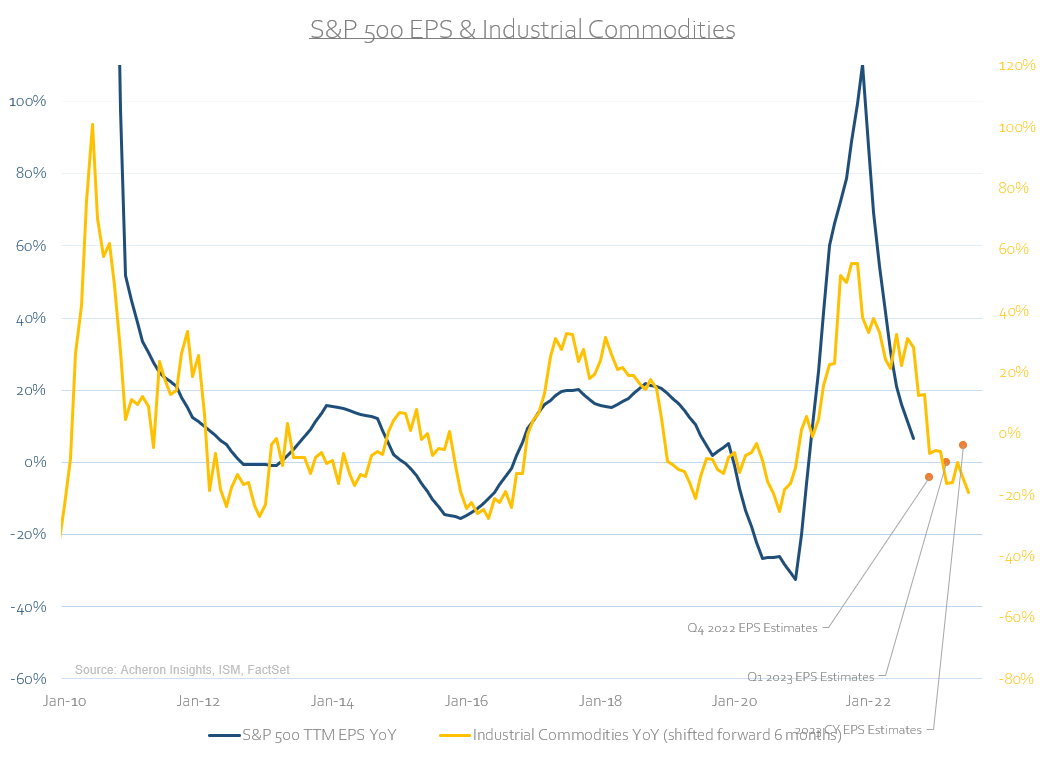

The actions in industrial commodities are additionally substantiating this message.

Acheron Insights, ISM, FactSet

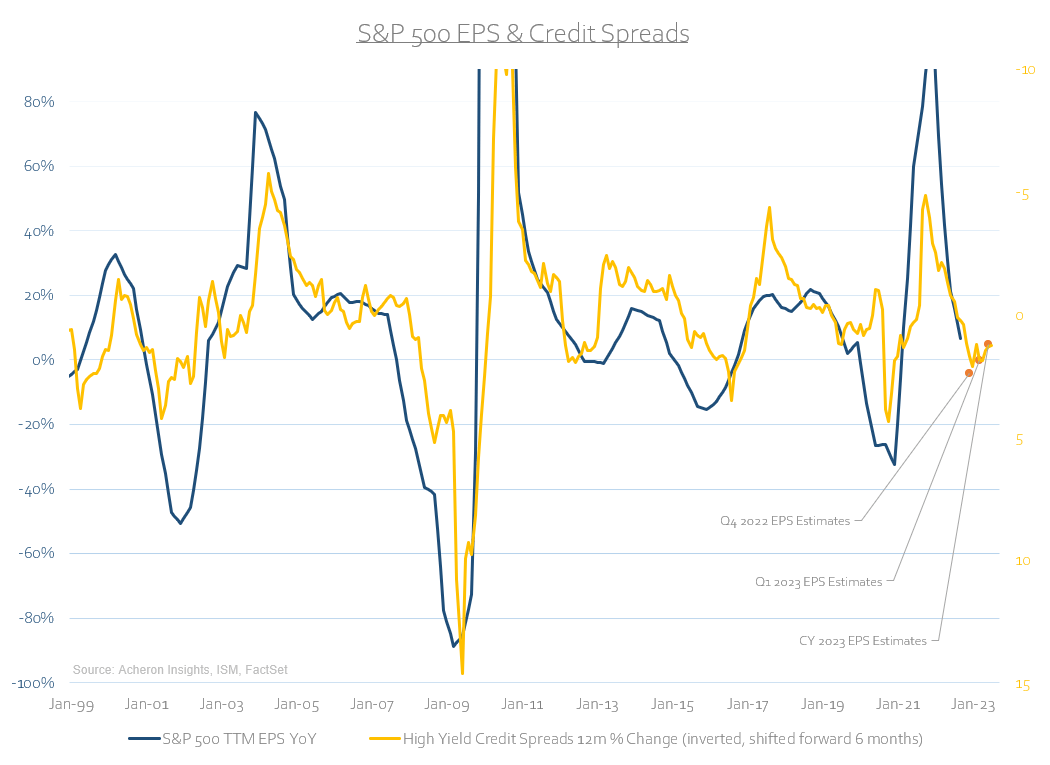

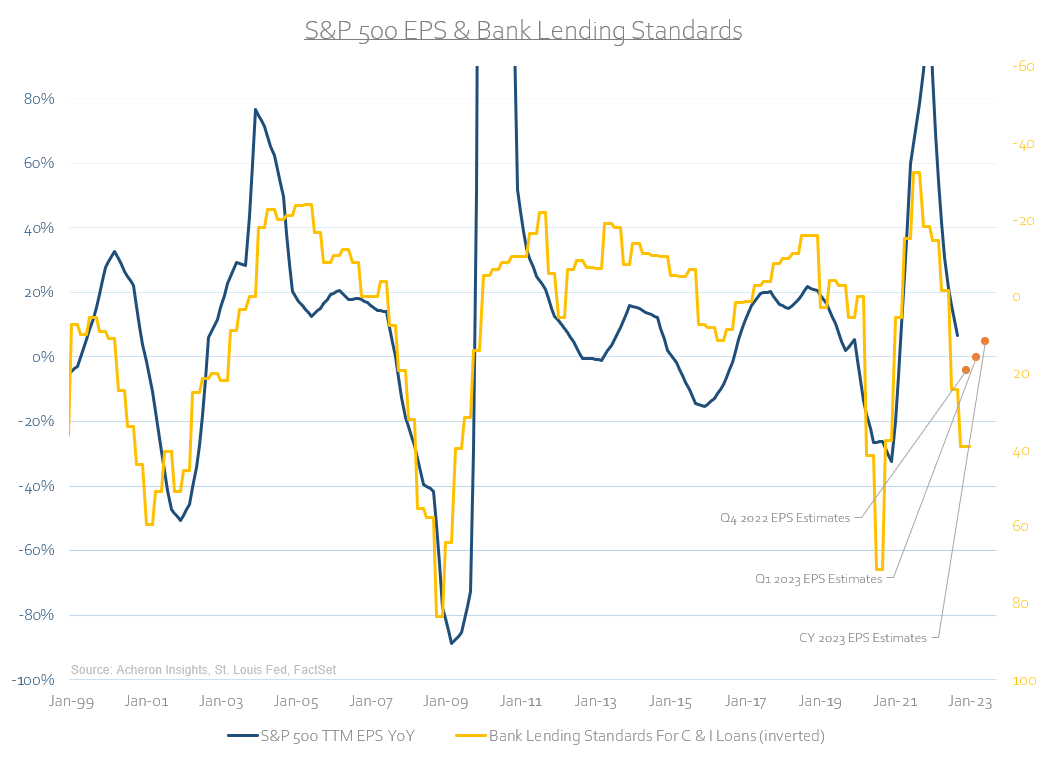

For now, nevertheless, the credit score cycle is but to sign any trigger for concern for corporates. Credit score spreads counsel bottom-up This autumn earnings estimates of round -3.9% (the primary quarter of destructive year-over-year earnings progress since Q3 2020) could also be a little bit of an overreaction.

Acheron Insights, ISM, FactSet

Once more, though this financial cycle continues to play out slower than anticipated as client steadiness sheets and coincident financial progress tendencies are holding up properly, the credit score cycle is one other space of the financial system wherein the forward-looking indicators counsel will deteriorate as 2023 progresses (a dynamic I mentioned right here), which itself doesn’t bode properly for company earnings or inventory market volatility.

Acheron Insights, St. Louis Fed, FactSet

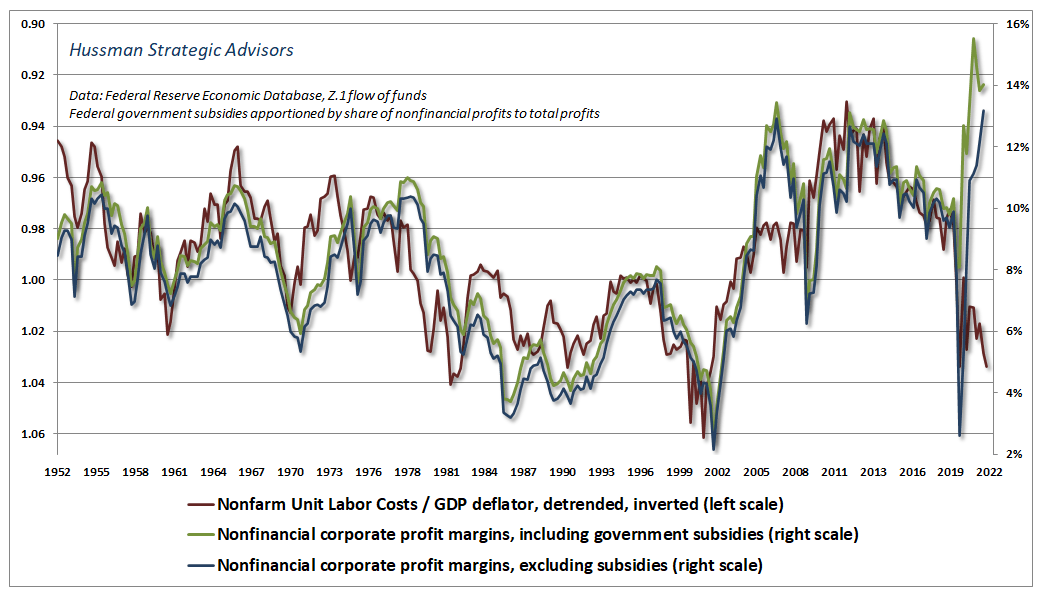

And even perhaps extra prescient for the viability of long-term earnings progress are the dynamics at the moment being performed out within the labour market. Over the long run, revenue margins are extremely correlated to labour prices (i.e. wage progress). With the labour market nonetheless secularly tight and wage develop sturdy, historical past suggests revenue margins will ultimately want to regulate downward to replicate these larger prices of labour. This can weigh on earnings, however once more, is probably going a narrative for the second half of 2023.

John Hussman – Hussman Funds

Company steadiness sheets ought to assist earnings for now, as ought to client spending

As I’ve touched upon, I believe earnings progress could shock to the upside over the primary half of 2023. Why? As a result of company steadiness sheets and present financial progress tendencies ought to proceed to be considerably supportive of company profitability, This autumn 2022 and Q1 2023 estimates could also be too pessimistic.

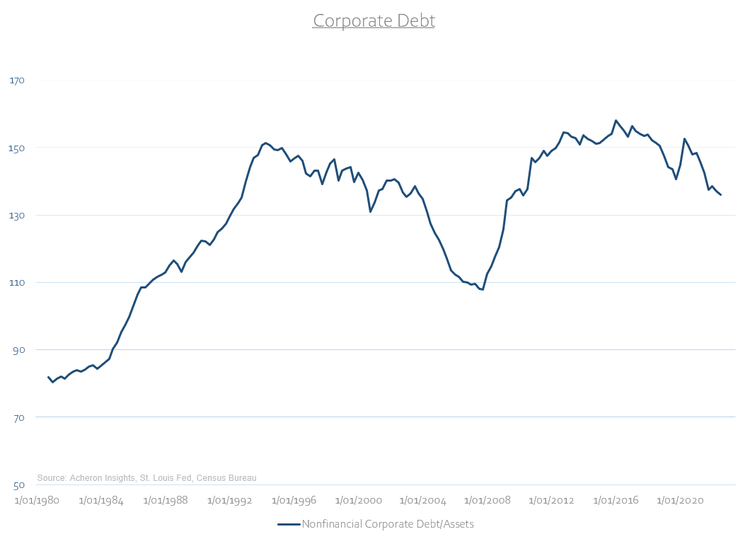

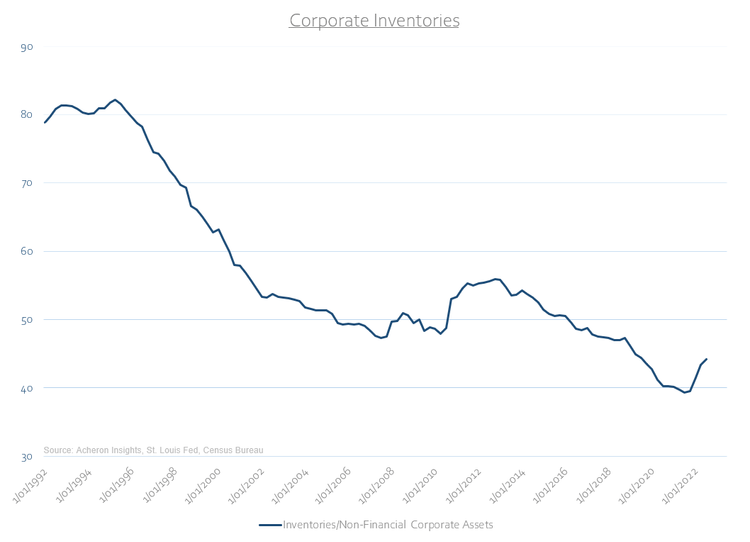

Though company leverage continues to be elevated relative to the pre-1990s, you will need to keep in mind that debt ranges stay removed from any excessive degree of over-indebtedness seen through the 2010s (a interval the place earnings progress ex-FAANG was practically non-existent), whereas stock ranges are additionally close to secular lows.

Acheron Insights, St. Louis Fed, Census Bureau

Acheron Insights, St. Louis Fed, Census Bureau

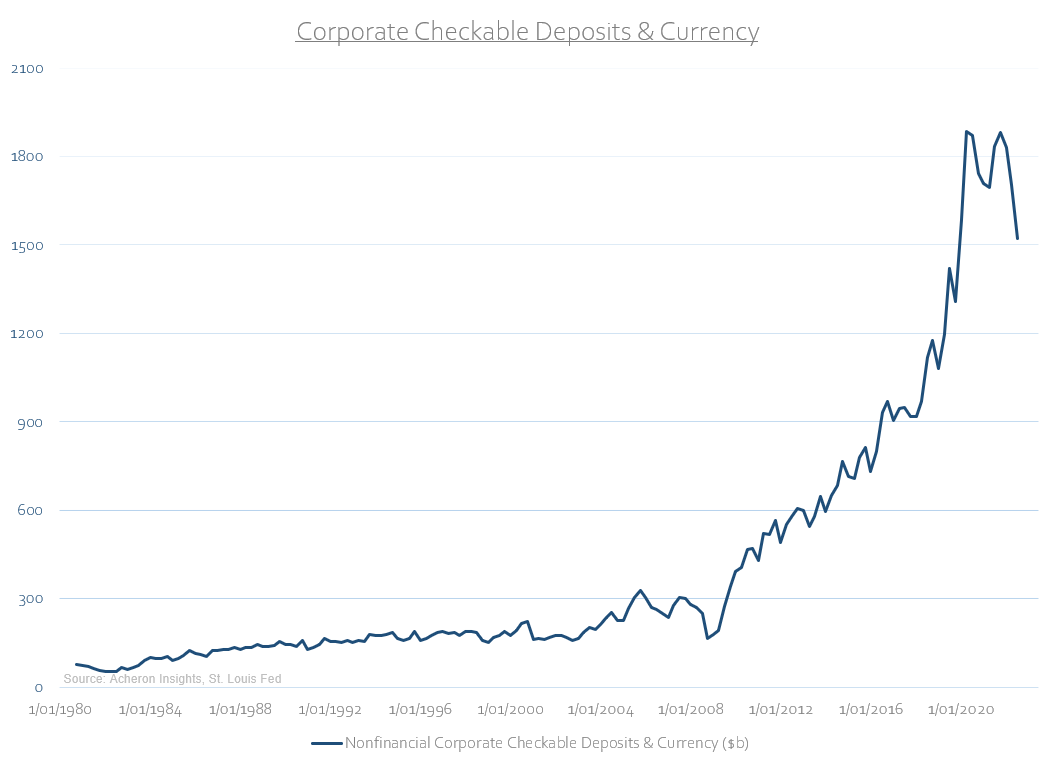

Moreover, due to the abundance that was Covid associated stimulus, corporates are nonetheless flushed with money (as are households).

Acheron Insights, St. Louis Fed

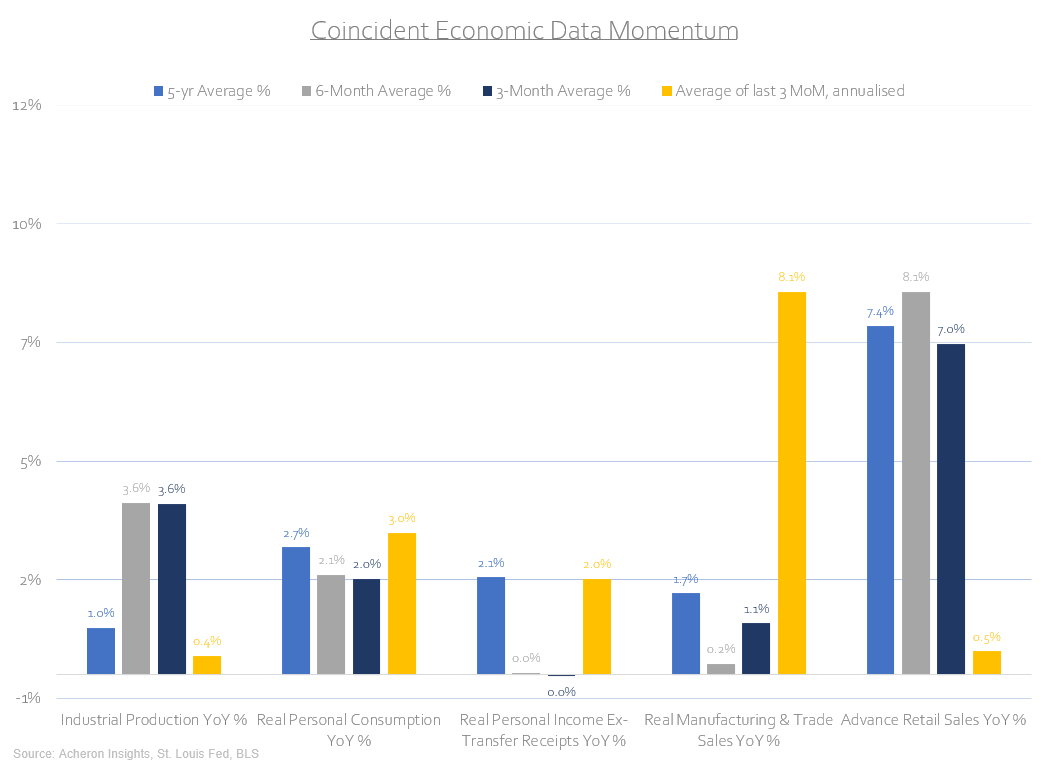

In the meantime, coincident measures of financial progress momentum proceed to counsel a sturdy financial system, regardless of the poor outlook for the enterprise cycle. Many individuals (myself included) have been stunned by the resilience of the US financial system and given the strong progress momentum in areas like actual consumption and manufacturing, and commerce gross sales, this resilience ought to see the cycle play out slower than anticipated. Ought to we see an earnings recession or an financial recession in 2023, I believe it would possible not be till Q3 on the earliest. The ‘transitory goldilocks’ regime we could expertise within the meantime may assist earnings for the approaching quarters in consequence.

Acheron Insights, St. Louis Fed, BLS

The inventory market is already pricing in a big earnings decline

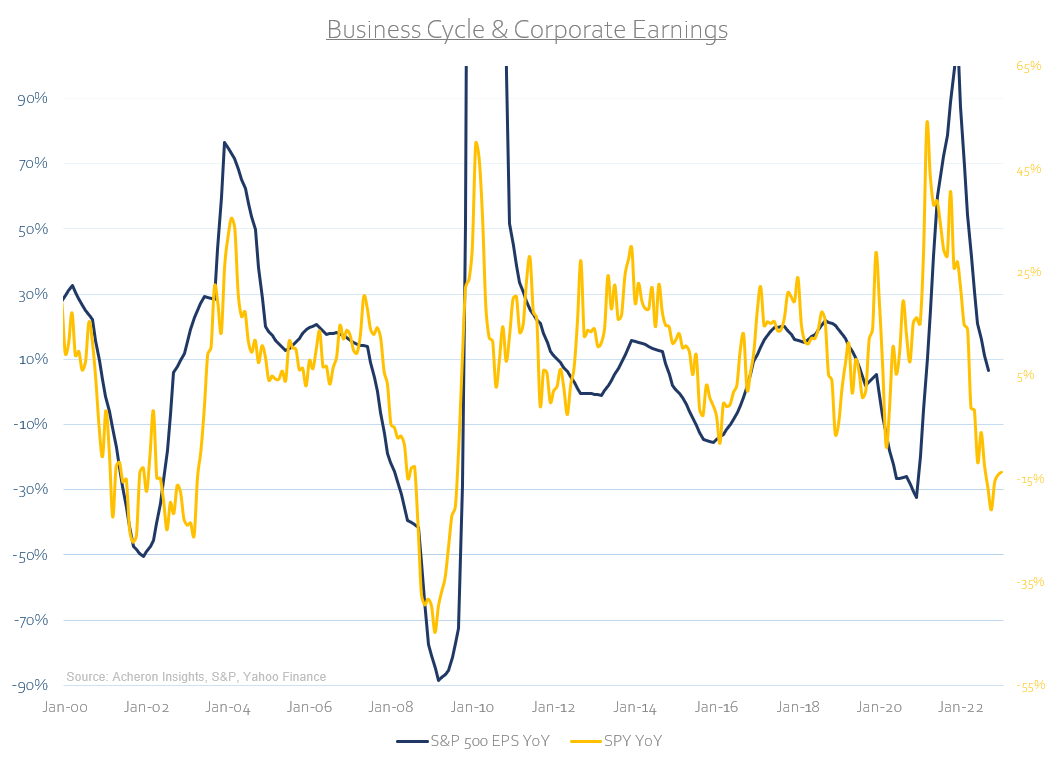

The truth is, once we couple this dynamic with the EPS outlook already being priced by the inventory market, earnings seem like removed from any headwind for shares at current. Just like analysts’ expectations, maybe traders have turn into a bit of too bearish on earnings too quickly. In the meanwhile, the ache commerce seems to be to the upside for shares.

Acheron Insights, S&P, Yahoo Finance

When earnings do roll over, they might roll over exhausting

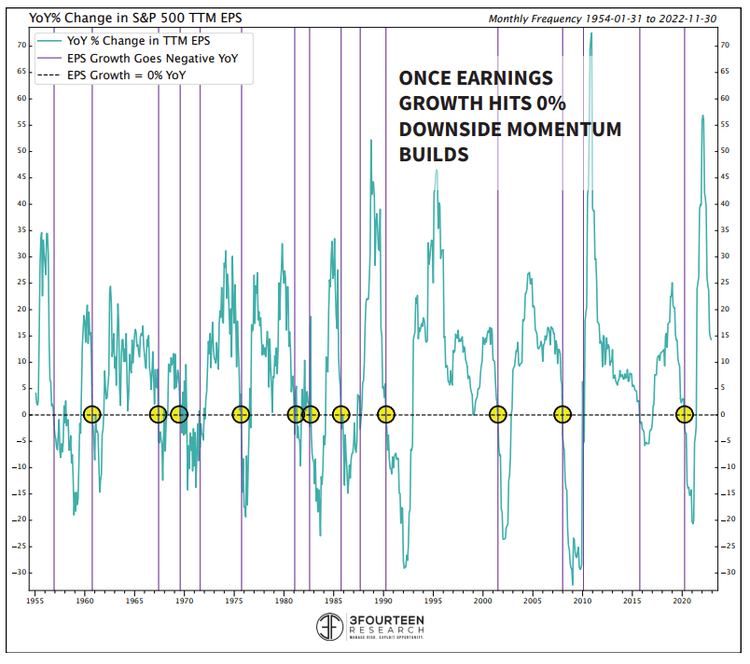

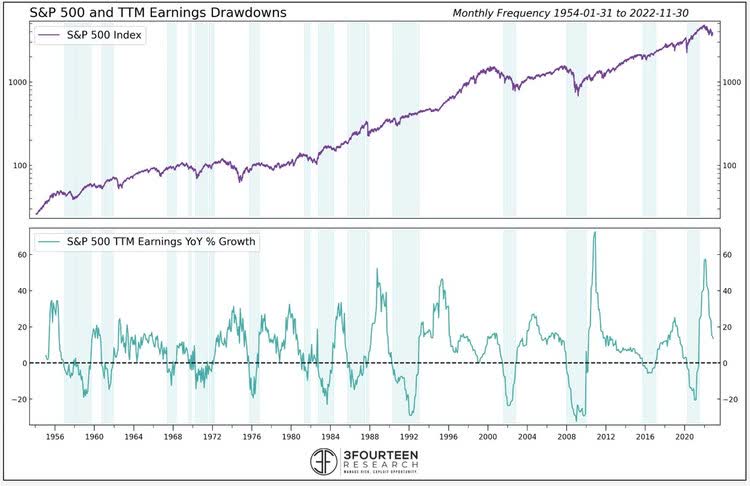

Nonetheless, the issue with a ‘transitory goldilocks’ regime is that it’s transitory. Ought to earnings progress certainly ultimately roll over because the main indicators counsel they’ll, this might occur exhausting and quick.

As we will see under per the work of 3Fourteen Analysis, when earnings progress turns destructive it tends to materially decline thereafter.

3Fourteen Analysis

3Fourteen Analysis

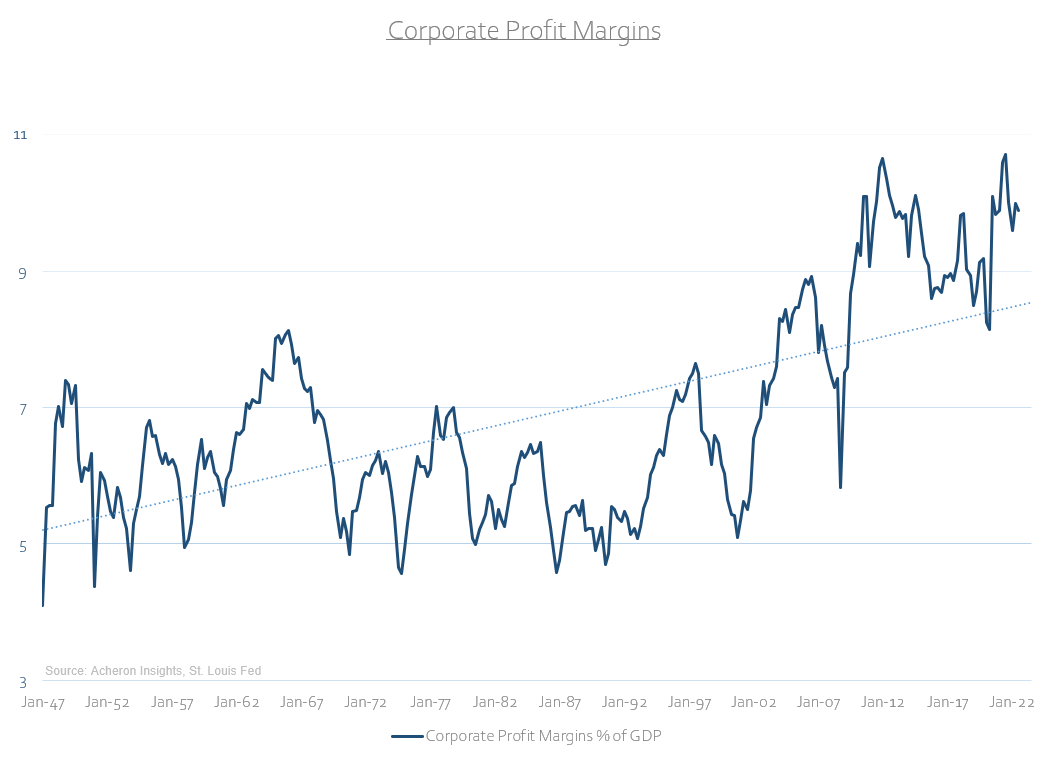

What makes company earnings extremely inclined to a sustained materials decline is the potential reversal of a number of the long-term tendencies which have so supported revenue margins in latest instances. By way of a interval of secular stagnation the place financial coverage and globalisation favoured capital on the expense of labour, low-to-no wage progress resulted. With stagnant wages got here inflated revenue margins, which stay considerably above their long-term pattern.

Acheron Insights, St. Louis Fed

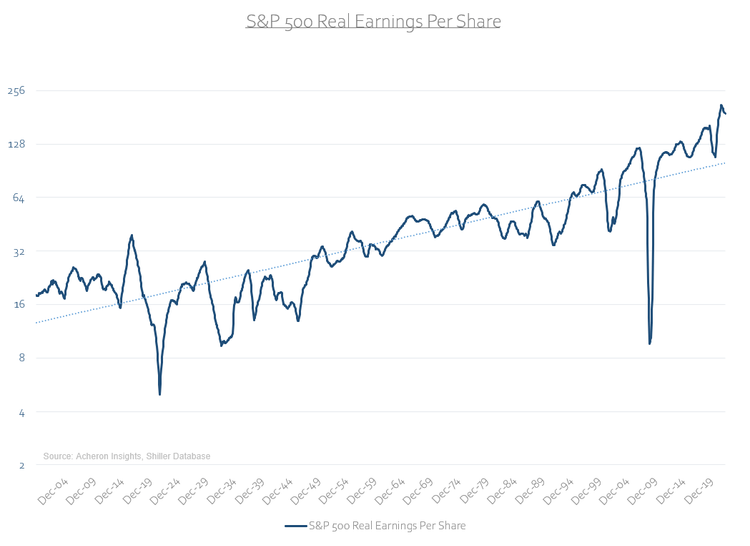

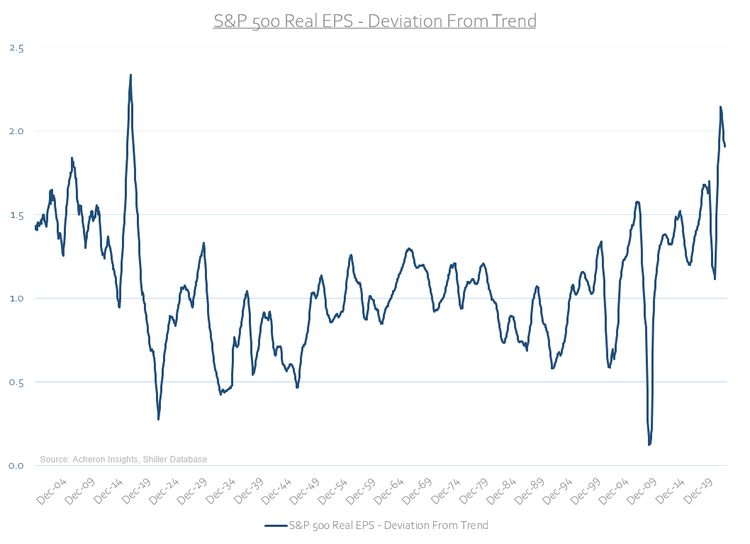

The identical may be mentioned of the long-term pattern in EPS. Given the present state of the labour market and the pressures of secular inflation (peak-globalisation, geopolitical instability, inexperienced vitality transition, and populism to call just a few), one can not assist to assume that over the following few years, earnings could haven’t any alternative however to replicate this new state of occasions. Solely time will inform.

Acheron Insights, Shiller Database

Acheron Insights, Shiller Database

Authentic Submit