anyaberkut

DoubleVerify (NYSE:DV) gives a worthwhile service to advertisers who wish to maximize their digital promoting budgets. It provides them the knowledge they should make knowledgeable choices by independently verifying that their adverts are being seen by actual individuals, not automated bots. Because of this, advertisers can optimize their advert spend, attain their target market, and generate a constructive return on funding. DoubleVerify is making progress in content material promoting and has seen a rise in media transaction measured quantity, placing it in a positive place in gentle of the present adjustments in Advert Spending. DV has improved profitability and no long-term debt on its stability sheet, making it an interesting long-term candidate.

Firm Overview

With out third-party cookies, DoubleVerify will nonetheless have the ability to present its clients a extra non-public and safe methodology of measuring the effectiveness of their on-line commercials. This permits DV to handle considerations round knowledge privateness, which is more and more essential in in the present day’s privacy-conscious setting. This may be seen as a serious benefit for the corporate, because it permits it to proceed to offer its providers to purchasers whereas additionally satisfying their wants on the subject of knowledge safety. This is a bonus for the corporate because it permits it to proceed offering providers to purchasers whereas nonetheless assembly its obligations relating to knowledge safety. Moreover, one of many fruits of DoubleVerify’s revolutionary options is its increasing greenfield buyer base and continued development in new enterprise emblem wins. These enterprise emblem wins are established enterprises of their respective industries, which positions DV favorably long run.

…Within the third quarter, we gained Mattel, GAP and a number of other different giant and high-profile advertisers away from our opponents.

As well as, we efficiently broke by way of plenty of greenfield accounts, TUI, Marina Bay Sands, and Sensible Power U.Ok. Actually, 71% of our third quarter wins had been greenfield, representing the best share of greenfield wins in any quarter this yr. Our huge TAM stays largely untapped with a big variety of international greenfield alternatives for us to win and broaden our enterprise with, over the long-term. Supply: Q3’22 Earnings Name Transcript

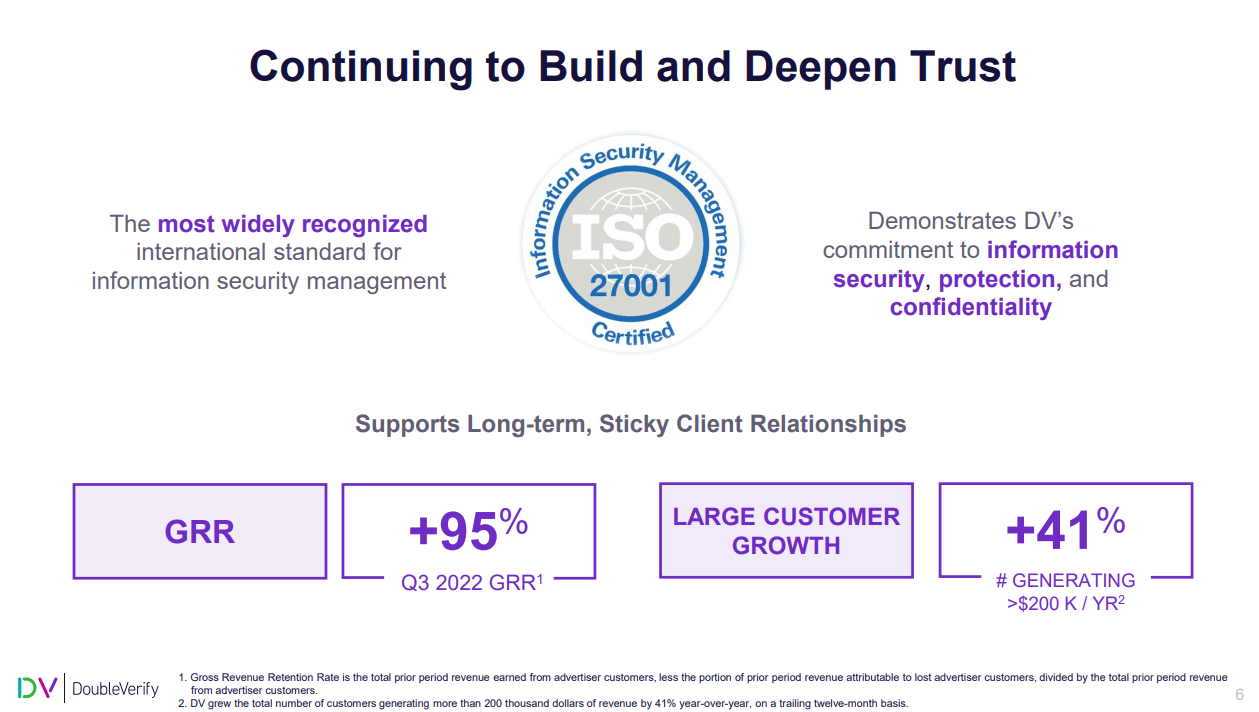

That is very true given the corporate’s robust gross retention fee of 95% and important YoY development in its giant buyer base depend, as seen within the picture beneath.

DV: Bettering Buyer Base and Excessive Gross Retention Price (Supply: Q3’22 Earnings Name Presentation)

Moreover, regardless of in the present day’s macroeconomic challenges, DV manages to broaden its income to $112.three million, up 35.09% from $83.1 million in Q3’21, owing to stronger quantity, as quoted beneath.

On volumes, our 17% year-over-year development continues to considerably outpace the trade as mirrored in Magna’s forecast of seven% development in 2022 US Digital Advert Spend, ex-Search. As regards to pricing, our MTF development of 10% within the quarter was primarily pushed by improved premium product combine, adopted by the affect of the programmatic show and video worth bifurcation which we initiated on our core programmatic merchandise within the first quarter of this yr. Supply: Q3’22 Earnings Name Transcript

One other focal point is its rising Activation providers, that are based mostly on content-driven knowledge and don’t use third-party cookies or cross-site monitoring know-how. This division continues to be DV’s largest income contributor, with $62.17 million on the finish of the quarter, up 48.37% from $41.90 in Q3’21. In line with administration, new shopper activation is driving this development.

…Roughly 60% of ABS’s income development was fueled by new shopper activations whereas 40% was generated by current purchasers rising their ABS impression volumes.

Elevated quantity in our normal programmatic merchandise additionally considerably contributed to our Activation income development, in addition to the affect of the worth bifurcation. Supply: Q3’22 Earnings Name Transcript

DoubleVerify’s experience in measurement and verification, mixed with its increasing capabilities in influencer advertising and marketing and linked TV promoting positions the corporate effectively for long-term development.

The primary is enlargement on Social the place, as Mark talked about, our model security and suitability measurement merchandise have now launched on TikTok and are persevering with to broaden on Linkedin in addition to on different main platforms

The second is CTV the place Netflix chosen DV to offer viewability and fraud measurement throughout its platform, with model security and suitability to observe. The third is Genuine Consideration, which is gaining momentum with Advertisers following the launch of DV’s Genuine Consideration snapshot. Supply: Q3’22 Earnings Name Transcript

The corporate’s cross-selling catalyst is a key issue that’s anticipated to drive important development and deepen its relationships with its clients sooner or later, as said beneath.

Lastly, there’s the continued alternative to cross-sell our Measurement suite to Activation solely purchasers. Of our high 500 clients, over 20% have used DV’s options for Activation solely however not for Measurement this yr. Utilizing each product suites permits advertisers to additional optimize media high quality and scale back media waste, a compelling buyer worth proposition for our industrial staff to cross-sell. Supply: Q3’22 Earnings Name Transcript

To sum it up, DV’s new buyer base, its worldwide enlargement initiatives and cross-selling alternative, place the corporate effectively particularly contemplating the long run market restoration.

Valuation

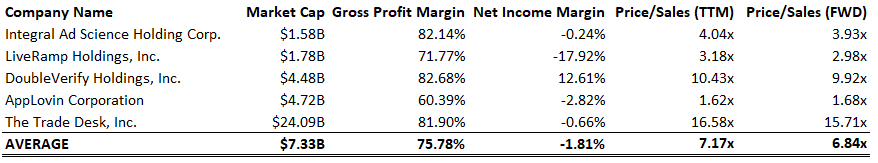

DV: Relative Valuation (Supply: Information from SeekingAlpha. Ready the Writer)

Integral Advert Science Holding Corp. (NASDAQ:IAS), LiveRamp Holdings, Inc. (NYSE:RAMP), AppLovin Company (NASDAQ:APP), The Commerce Desk, Inc. (NASDAQ:TTD)

DV maintains its trade management with an increasing moat in social media and linked TV. Actually, it boasts stronger gross margin and web margin as in comparison with its friends, as proven within the picture above. This explains why it trades at the next a number of than its friends. Moreover, DV stays interesting, particularly given its 4.42x ahead P/S in 2026, which is enticing in comparison with its 16.03x P/S in FY21.

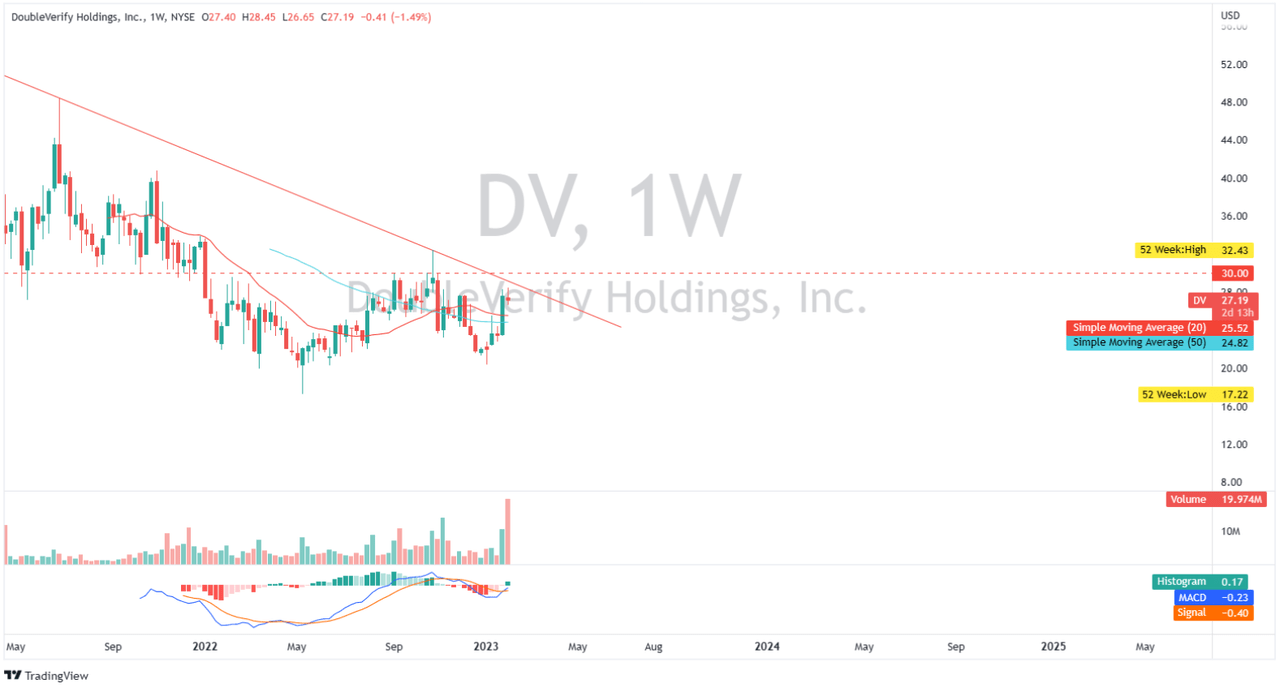

Approaching $30 Resistance Stage

DV: Weekly Chart (Supply: Writer’s TradingView Account)

DV’s weekly chart reveals that it’s approaching a robust psychological resistance at round $30. However, in the present day’s growing purchaser curiosity suggests a attainable breakthrough on this resistance. This sentiment is supported by the MACD’s bullish crossover, as seen within the chart. If one is cautious of coming into throughout breakouts, ready for consolidation above the $20 help zone would provide a extra favorable entry level.

Caveat

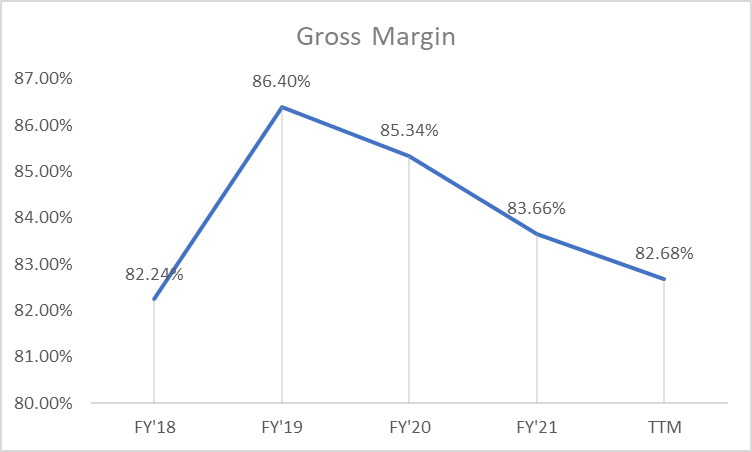

Apart from the present bearish macro setting, one of many challenges DV is dealing with is its slowing gross margin, as proven within the picture beneath.

DV: Slowing Gross Margin (Supply: Information from SeekingAlpha. Ready by the Writer)

In line with the administration, one of many causes for the slowdown in gross margin is because of greater software program prices to help elevated volumes. This might additional restrict its EBIT development, and actually, the administration has guided for a slower EBITDA margin on the midpoint of 31%, down from the 33% recorded in FY’21.

Remaining Key Takeaways

Regardless of its non permanent weak spot talked about earlier, DV’s stability sheet stays strong with no long-term debt. In line with the administration, they’ll proceed to ramp up their capital expenditure to $35 million this FY’22, up $9.Four million in FY’21. Out of the $35 million price range, $25 million is allotted to workplace house for worldwide enlargement. DoubleVerify’s inclusion within the S&P SmallCap 600 index will make this inventory extra liquid and will entice extra merchants and buyers. Total, DV’s enhancing profitability and powerful monetary place make it lengthy candidate.

Thanks for studying and good luck everybody! Pleased February!