bpawesome

|

Editor’s Be aware: That is the transcript model of the beforehand recorded present. Attributable to time and audio constraints, the transcription is probably not good. We encourage you to hearken to the podcast embedded above or on the go by way of Apple Podcasts or Spotify. Click on right here to subscribe to The Money Circulate Freaks. This episode was recorded on March 1, 2023. |

Transcript

Austin Hankwitz: Promoting, I am going to say it. I am promoting. I do not assume although that, like, I am not – see, that is the factor. You made it so black and white by your self. I am sitting on my palms. I am greenback value averaging slightly bit, proper?

Daniel Snyder: Welcome again to Investing Consultants Podcast. I am Daniel Snyder. In the present day, we’re joined by Austin Hankwitz from Money Circulate Freaks on Searching for Alpha. We dive into the Hims & Hers Well being (NYSE:HIMS) earnings report that was simply introduced. And if he thinks the corporate remains to be a purchase or now a promote after the 19% pop and share value. We additionally get insights of what is going on on in his $2 million portfolio mission that he is sharing, and I put him within the excessive see for what his sport plan is for this 12 months.

Only a reminder, something you hear on the podcast shouldn’t be thought-about funding recommendation, at occasions myself or the visitor my very own positions within the securities point out. However that is for leisure functions solely and it is best to search recommendation from a licensed skilled earlier than investing. And when you loved this episode, please do us a favor, share it with someone. It is fairly easy to do. Hit that little arrow button in your favourite podcasting app, ship it to them by way of textual content and say, you’re lacking out.

Now, let’s get into the present. Austin, at all times good to have you ever again. I bought to say I miss each different co-host on the present, however I like that we keep in contact. We get your particulars of, like, what is going on on with the businesses that you just’re watching, the $2 million portfolio and all the things else? However let’s simply begin issues off with the individuals that do not know who you’re. Give them a fast little recap of the way you guys began investing, your background, the way you began your service, and form of what you guys do in there?

Austin Hankwitz: Yeah, 100%. Thanks a lot for having me, Daniel. I do additionally miss co-hosting this podcast with you. However yeah. So fast only one, two right here about myself is my title is Austin Hankwitz. I am 26 years previous, so I am not certainly one of these veteran accolade having traders that you just may see or may host right here on this podcast. I am younger, proper? So I’ve this youthful mindset.

I am 26. I went to College of Tennessee. I bought a level in Finance and Economics in 2018. I took that to go to mergers and acquisitions for a publicly traded healthcare firm referred to as, Amedisys (AMED). All through three years out of faculty, we did about $1.2 billion in deal circulation over that – of that point interval. And as soon as the pandemic hit in 2020, I form of had this bizarre need to speak about my genuine and clear relationship with cash because it pertains to investing or shopping for actual property or constructing my creditor something and all the things in between.

And so as an alternative of lip syncing and dancing on TikTok, I made a decision to speak about my portfolio. And seems individuals actually appreciated that, proper? Individuals actually appreciated this 20 one thing 12 months previous on the time, speaking about his wins and losses and making an attempt to select shares and allocation towards this particular index or this particular trade or sector, no matter it could be.

And in order that form of became a e-newsletter that that I bought a variety of actually cool form of traction with. After which I mentioned, you already know, what? “Let me share these inventory picks. Let me share these concepts. Let me simply form of deliver this right into a extra formal style and do this on Searching for Alpha, proper? So that is the Money Circulate Freaks.

Primarily, it is a service round figuring out and investing in two corporations who’re both 100% free money circulation constructive. They’re paying and rising their dividends. It is a good time. Or in an organization who we will speak about in slightly bit, form of on the alternative facet of the aisle, they’ll flip free money circulation constructive within the coming 12 or 18 months maybe, and their share value ought to see some appreciation due to that.

Daniel Snyder: This firm that you just’re describing proper now and for individuals which have been listening to this present for a very long time, they’re going to know what this firm is since you’ve talked about it numerous occasions. You talked about it final 12 months. We talked about it and did the entire episode on it. Then we did one other episode on this firm starting in January with Raul Shah. He gave his take. You additionally form of batch it up and you are like, sure, this all makes a lot sense.

And now they only reported final evening, Monday, after the bell with unimaginable outcomes, perhaps you need to get individuals the title of the corporate, what they do as a abstract, and what these numbers are.

Austin Hankwitz: Completely. And so I simply need to rewind although and provides the credit score phrases as a result of individuals at first that I do not know once we had that episode. It was September, October, November, no matter. However we did a complete episode pitching this firm to you guys and the way a lot we appreciated it, how cool we thought it was. Daniel had some good push again, some good skepticism, however it all turned out to work out fairly effectively right here. However the title of the corporate is Hims & Hers Well being, proper? So ticker image, HIMS.

And to form of like provide you with guys the fast play by play on what occurred right here, the corporate was launched in 2017. It is a healthcare tech firm. This could have constructed the answer to attach individuals in search of medical care with the licensed suppliers, proper? So obtain their app, share your location, and also you’re instantly provided an choice to – the choice to deal with a variety of illnesses like sexual well being, hair and pores and skin, psychological well being, and on a regular basis well being care like chilly and flu, major care, stuff like that, proper?

But when you concentrate on this now as not only a form of Teladoc 2.Zero vibe, but in addition from a software program SaaS firm within the sense of, like, a subscription-based mannequin. HIMS is basically attention-grabbing and that is the place, to me, I bought so enthusiastic about this and the opposite visitors, I believe the identical as rule that we talked with was additionally so excited. So this is what occurs, proper? And that is clearly relevant to individuals in a bunch of various and distinctive methods, however I can solely communicate for myself.

So me personally, I’m scared of shedding my hair, proper? So I would take a prescription referred to as finasteride and it is like slightly 10 milligram tablet daily simply be sure that I do not lose my hair. That prescription is given to me as a subscription by means of Hims & Hers, proper?

So I pay HIMS each single month a month-to-month subscription quantity. And in return, I get my medicine delivered to my door. And so I am now – if you concentrate on it now to this type of perspective of a SaaS firm, I am now that that buyer, proper? I am not giving them the MRR, the ARR that they are in search of, and to form of give slightly bit extra shade as to what that common buyer is paying throughout the This autumn earnings that got here out simply the opposite day right here is $55 per thirty days on common is how a lot the typical subscriber pays to Hims & Hers to obtain their prescriptions.

And to me, that concept of form of saying, okay, we get the Teladoc, we get how enjoyable and funky that’s to fulfill with a health care provider, get linked to a licensed supplier. However then additionally say, “Hey, this isn’t only a one-time change of products and companies and cash right here. It is a – how can we get them to return again each single month, proper? How can we get them to subscribe to one thing that we can provide them?” And Hims & Hers additionally affords – we talked concerning the hair and pores and skin, the psychological well being, on a regular basis well being care, sexual well being stuff like that.

And particularly, I believe what’s cool about this firm is the medication that they prescribe at the moment are at this level the place they’re generics within the sense that they’re the finasterides, there’s for ED, there’s tons for various beginning controls, the place there is a bunch of various pharmaceuticals which can be prescribed to those sufferers which have margins that may form of generate margins within the 70% to 80% for the corporate.

So to form of spherical off this complete considered the SaaS enterprise mannequin, you assume a SaaS firm like a monday.com (mdny) or a Datadog (DDOG), they’ve margins within the 70%, 80% vary. They have the month-to-month recurring income, the annual recurring income. They’re at all times touchdown and increasing. And HIMS is doing the identical, however they are not a software program firm and so they’re not being priced but as a software program firm, however they’ve all the similar traits and margins as one.

In order that’s form of only a high-level breakdown there of why I am usually excited concerning the firm. Completely happy to dive deeper into the specifics because it pertains to their earnings.

Daniel Snyder: I’ve bought questions for you. I am trying right here at my cost. And I imply, it is a inventory that is up 17% on the earnings that have been – was simply introduced, proper? Model-new 52-week excessive. I believe once we did the episode, final 12 months, I believe it was like round a $6 share inventory or perhaps rather less even. Since our January episode, the inventory is up like 66%.

So my first query off the highest earlier than we get into the precise metrics and a few satan’s advocate questions I’ve for you is, is that this firm nonetheless a purchase? I believe that is what individuals are going to ask you firstly. Primarily based on analysis, they are not free money circulation constructive, they’re nonetheless engaged on EBITDA. Would you continue to be recommending this inventory to individuals at this time?

Austin Hankwitz: So it is actually humorous. The quick reply, sure. It is nonetheless a purchase for my part. It is actually humorous. I had shared that I believe what had occurred was Jefferies, the funding financial institution, upgraded them from a maintain to a purchase, forward of their This autumn earnings launch about three weeks in the past or so. And their inventory simply – it did an amazing quantity, proper? It went up perhaps, I do not know, name it, 15% or 20% a day due to that. And individuals are like, wow, I missed the boat. It now at $9. What do I do?

Pay attention at a $2 billion valuation, an organization who will do, name it, $1 billion in income subsequent 12 months, they’re buying and selling at two occasions gross sales. At any time when we talked about this firm, Daniel, they have been buying and selling at one time gross sales, proper? And as an organization who’s and also you talked about the adjusted EBITDA, they really simply reported constructive adjusted EBITDA for the very first time for the quarter, so $3.9 million for This autumn and that may proceed to be constructive for the remainder of hopefully without end, proper?

However in 2023, it should be constructive, 2024, 2025. And we’ll get to these steerage right here in slightly bit. However for the particular person listening proper now, it is like, “Hey, did I miss the boat? What is that this? Do I even take a look at this anymore personally?” I’d say sure. I’d say that it is nonetheless a purchase, it is nonetheless an organization to have a look at. It is nonetheless an organization to think about due to particularly the 2025 steerage that the corporate administration crew had offered us throughout their earnings name, and that particularly is income of $1.2 billion in 2025 and adjusted EBITDA of $100 million.

Daniel Snyder: All proper. So then let me ask you this. We’re speaking concerning the gross revenue margins being within the 70% to 80%. You talked about it is much like a SaaS firm like Datadog, which we have additionally talked about earlier than. And their complete technique is land and broaden, proper? And that is form of what you are pitching right here is that they get someone shopping for one product after which they get them to purchase two, three, 4, and that is how they enhance the month-to-month income, which is smart to all people.

However how is it {that a} competitor, in the event that they’re simply promoting items, proper? Teladoc is a service firm. You must be linked with a person that you just then discuss to, and that is slightly bit totally different than simply saying, hey, this is a product I am delivery to your door each single month. Amazon (AMZN) does this. What’s – I imply, we see Amazon shifting into medical. And Amazon’s margins aren’t even that nice on that facet of the enterprise. Are you anticipating any menace from Amazon with reference to creating them have to begin chipping away at their margin right here?

Austin Hankwitz: I like this query as a result of after I was listening to the all-in podcast, which when you guys have not listened to that, I like to recommend listening into that. They made these – there’s an episode about, name it, two months in the past the place they made these 2023 predictions.

And one of many predictions for 2023 for them was that Amazon was going to swoop lean into this third leg of healthcare, which we noticed them do the $5 a month on restricted prescriptions. I overlook the title of that particularly. I believe it was a PrimeRX or one thing of that nature.

However – in order that did occur, which so kudos to them. However in addition they mentioned that they don’t seem to be ruling out the thought of Amazon buying a Hims & Hers or a Roman or certainly one of these kind corporations and simply saying, you guys have the information – you might have the patron base, proper, 10 cumulative medical consultations. 1.04, so 1,040,000 month-to-month subscribers to your service at $55 a month, proper, like, that’s insane. You will have all of those people who find themselves already prospects of you. We’re simply going to return in and purchase you, and it is $2 billion market cap that is peanuts for Amazon, proper?

So I believe that, to your level, might Amazon come up right here and be a viable competitor? They definitely might. Or they might be a purchaser? However now this is one thing attention-grabbing that I – once more, that is extra hypothesis than it’s with information.

So I simply form of, like, that is my vibe that I am getting is a variety of prospects of Hims & Hers are individuals of their 20s and 30s, perhaps even early 40s, who won’t have the posh of getting the entry to Teladoc. The corporate advantages that provide the Teladoc login and so they’re paying for it, proper?

So they do not need to pay the $150 or $200 for a session with a health care provider on Teladoc for one time. It is simply to essentially calculate. They do not really feel that. Does not resonate with them. However Hims & Hers has form of structured themselves in another way. They mentioned, we wish these individuals. We would like the people who find themselves – you won’t have these good firm advantages, however do nonetheless want entry to on a regular basis well being care like contraception, hair and pores and skin, and sexual well being, proper?

So issues of that nature is the place or individuals of that nature fairly is the place Hims & Hers, I believe personally are doubling down. They usually’re saying, we’ve these million subscribers. How do we’ve to take to 2 million, Three million, Four million by 2025, 2027, 2030. And those self same individuals, proper, the people who find themselves form of pushing again towards the corporate advantages within the Teladocs, I believe do not need to do the amazons, proper?

I made a TikTok video about Amazon’s $5 factor, how a lot cash it’ll save lots of people, how nice of a service that is, and the remark part was flooded with individuals saying, I do not need Amazon having my well being care information. I do not belief Amazon. I do not need Amazon, proper?

So I am by no means saying that that is going to have any materials influence on Amazon’s skill to recruit individuals and HIMS’ skill to retain no matter, proper? However simply form of feeling out the vibe right here with the purchasers that I believe that HIMS are going after and the identical prospects that Amazon desires. I do not assume Amazon – let me say this. I do not assume HIMS will lose market share.

Daniel Snyder: So Amazon simply closed the $3.9 billion acquisition of One Medical. And we all know Walmart has been coming into the house making an attempt to compete with Amazon. Any ideas on Walmart being the acquirer of HIMS and shifting into that form of issues?

Austin Hankwitz: That might make a variety of sense. Nonetheless, the one purpose that I am leaning extra in the direction of Amazon is as a result of about 12 months in the past, perhaps it was near a 9, HIMS and I might be misspeaking right here because it pertains to how I am describing this. However Hims & Hers has an precise storefront on Amazon’s web site the place you may identical to store all of their merchandise, proper? So about 12 or 18 months in the past, Hims & Hers launched an app.

So primarily, earlier than this, it was only a web site that you could possibly, like, make a session, do the entire, like subscribe to your particular prescription, issues that nature. Then they got here out with the app, tons of training, which was their storefront, however that they had this bizarre, like, nine-month interval the place they did not have an app and it was nonetheless an internet site, however they wished to promote some extra. So Amazon helped them launch their very own storefront on Amazon’s web site.

So I believe and I have never logged into it shortly, and it appears to be like such as you could be taking a look at it proper now. So please appropriate me if I am improper right here. However I believe they do have this storefront on Amazon the place you may store all their merchandise and get the prescription from a health care provider and issues of that nature.

Daniel Snyder: The one factor that I’d take into consideration is how Amazon has taken the lower of them whether or not they’re simply fulfilling the logistics of it as Amazon likes to do. However is there a method for them to streamline or promote throughout a number of channels to broaden their attain as their viewers. Do you need to undergo the underlying metrics of what was simply introduced financially on the [call? I haven’t] [ph] performed that but. Let’s go forward and undergo these.

Austin Hankwitz: So really, earlier than we do this although, I am really going to provide slightly bit extra shade as to what the unique projections have been for this 12 months because it pertains to every time they made their public debut in in 2020, proper? So when the corporate hit public markets in 2020, that they had a number of issues going for them. That they had about 2 million telehealth consultations. That they had 250,000 month-to-month subscribers. And since they have been vertically built-in, that they had, like 70% gross margins, okay?

So now if we take a look at their 2020 investor deck, they have been projecting for 2022 to have income of $233 million, gross revenue of $175 million, and damaging $9 million in adjusted EBITDA loss. Nonetheless, that was clearly not the case for this 12 months. This 12 months, we noticed income of $527 million, proper, so that’s far more than twice as a lot as what they have been initially projecting.

Daniel Snyder: Like quadruple, proper?

Austin Hankwitz: Quadruple. Yeah. It is insane. From a gross revenue, I imply, their margins have been 77% this 12 months. I did not do the mathematics on that, however name it $440 million or so, which is far more than the $175 million. After which from an adjusted EBITDA perspective, they have been saying for the 12 months that was going to be damaging 9%. It was definitely damaging for the 12 months. Nonetheless, they’ve flipped constructive from the adjusted EBITDA perspective.

However particularly now need to speak about their working loss and the web loss and the way that has narrowed considerably year-over-year. So if we take a look at the working loss for the 12 months of 2022, we see a damaging $68.7 million evaluate that to the damaging $115 million of final 12 months, proper? After which from a internet loss perspective, we noticed it damaging $66 million or so and evaluate that to the damaging $108 million final 12 months.

So we’re seeing that solely an organization who’s rising income by 94% year-over-year, however we’re – in flipping, adjusted EBITDA constructive for the very first time. However they’re additionally narrowing their working loss considerably, narrowing their internet loss considerably. And I learn right here earlier this morning on their transcript for his or her earnings name that their advertising as a % of income is down for the 12 months, I consider it is like 5% or 6%, proper?

In order that they’re rising considerably. They’re spending much less as a % of income. And all the things’s shifting in the suitable route from an economies of scale perspective.

Daniel Snyder: Yeah. That is actually attention-grabbing an organization general. I imply, it is one thing that I did not precisely consider in final 12 months once we first talked about it. However, I imply, the corporate is performing So I’ve bought to ask you, is that this firm part of the $2 million portfolio mission? After which why do not we simply take a second as effectively? Simply inform the individuals that do not know what that’s, what do you might have happening with that?

Austin Hankwitz: Yeah, 100%. So usually talking right here, proper, I am 26, and I am younger. And so I form of have this luxurious of having the ability to be aggressive with my cash in addition to I am good sufficient to not be too aggressive, proper? I noticed what 2021 did. I noticed all of the loopy stuff that occurred.

So usually talking right here, the $2 million portfolio is me saying, hear, I need to have a $2 million portfolio invested within the markets by over the following 10 years, proper? Give myself a 10-year shot clock to realize this. And the aim of this portfolio and once more, that is extra of a dividend development portfolio per se, so greater than 50%, we’ll discuss by means of the particular metrics right here. However greater than 50% of this portfolio is invested into dividend development shares.

However my aim right here is I need as a lot of this portfolio to be invested into high quality, long-term, secular development pattern, dividend paying corporations at discounted costs given the volatility we have seen within the markets over the past 12 months to 18 months, and we’ll possible proceed to see over the following 6 months to maybe 12 months, who is aware of.

However I need to be investing whereas these high quality corporations are seeing all this volatility. And so I need to simply pile as a lot cash into corporations who will not be solely flipping free money circulation constructive, however these which can be already free money circulation constructive, proper? I need to obtain these dividends as a result of certified dividends are taxed far more favorably than bizarre earnings, and I need this $2 million within the subsequent decade to be the Austin Basis that units me up for monetary independence by the point I am 40 years older or so.

Daniel Snyder: Proper on. So with this portfolio, you began originally of this 12 months. You have been allocating funds to it. Do you might have a few shares in right here that you just may be capable to share with our viewers at this time as to what you’ve got been shopping for and why you see this paying off within the subsequent 10 years, why these corporations?

Austin Hankwitz: Yeah, 100%. So simply to form of undergo the highest right here and name out a number of. So the primary one which I used to be simply tremendous stoked to have form of the phrase or the phrase, like beat like, beat somebody to the punch line there’s not precisely it, however I used to be in a position to get a good-looking little bit of Taiwan Semiconductor, TSM proper earlier than Warren Buffett introduced his place. So I used to be actually enthusiastic about that.

However yeah, I imply, it is corporations like that, proper? Firms who’re rising their dividends like loopy. I can positively say that the typical five-year compounded annual development fee for a holding inside this portfolio is over 12%, proper? So the aim is to be investing in these dividend development shares, proper? So we have Taiwan Semiconductor (TSM). We’re seeing Visa (V). We have got slightly little bit of Dwelling Depot (HD).

Now this is one which I believe is attention-grabbing or two fairly. The primary one which I believe is attention-grabbing and this isn’t but a dividend development inventory in a way that you just assume that the dividend is rising, however it’s really extra of identical to the expansion inventory facet of this. And we really talked concerning the inventory, Daniel, in certainly one of our early episodes, Academy Sports activities and Outside (ASO), proper?

So Academy Sports activities and Outside is a holding within the portfolio. If anybody listening proper now desires to go take a look at their inventory value over the past, name it, two years, it has been going up into the suitable. Like, all this volatility we have seen is…

Daniel Snyder: We crushed that episode. I simply bought to provide props to us, like [Multiple Speakers]

Austin Hankwitz: We did so effectively, man. We did so effectively. In order that one – that is a holding in right here. And once more, they only began paying a dividend. It isn’t a loopy development dividend inventory simply but very new to the markets. However from a development inventory perspective, I need entry to that, proper?

And one other one right here is Williams Sonoma (WSM), proper? Rising dividend like loopy. However then we even have REITs. So we’ve a few REITs in right here, and it is quite common that REITs aren’t precisely rising the dividends at a loopy quantity. So, we’ve VICI Properties (VICI), various to gaming and issues of that nature.

We have now Realty Revenue Company within the firm. Everybody listening proper now, I am certain has heard of. Ticker image, O. In the event you rewind, I believe, on their web site, it says since like 2002 or for the reason that final 20 one thing years on their Investor Relations web sites, they’ve carried out some 14.5% or 15% compounded yearly, which of their information has outperformed the S&P. I just like the consistency. I just like the dividend. In order that’s form of the place that got here from.

And once more, we have the W. P. Carey (WPC), the VICI, AMT, O. After which additionally there might be particular circumstance ETFs that I believe are extra form of there to supply range of earnings. So we have corporations like JEPI, JEPI. We have got QQQX), proper? We have now these corporations who’re writing coated calls towards their underlying positions within the S&P and within the Nasdaq and producing extra of an earnings, proper? In order it pertains to dividend earnings, it is coming from a bunch of various methods.

Now as we take into consideration the $2 million portfolio as a complete, it is arduous to realize true development, simply betting on dividend shares generally, proper? So – and once more, I am younger, so I need to have publicity to know-how. Each on the tried and true facet if you consider like Apple (AAPL) and Salesforce (CRM) and Microsoft (MSFT) and Google (GOOG,GOOGL) and Amazon; however then additionally on the extra riskier facet, corporations like Hims & Hers, Monday.com.

So from my allocation, we have 50% now in these dividend corporations as a result of I do need to personal a variety of fairness in corporations who’re paying and rising dividends that may proceed to be these certified dividends for me over the following decade. However I additionally need to see the upside from investing in one thing that I consider in wholeheartedly, which is know-how over the following 10 years.

And so from an extended know-how perspective, it is about 25% allocation proper at these large tech corporations. After which from a dangerous know-how perspective, it is about 20% allocation, leaving us about 5% left to be parked in SCHD.

Daniel Snyder: So let’s begin with this. Predominant query I’ve for you is, are any of those shares arrange on a dividend reinvestment program, or are you taking the earnings and taking that tax hit after which reinvesting?

Austin Hankwitz: Good query. In order of at this time, they’re all arrange on the dividend reinvestment program. Nonetheless, they – I don’t have them set as much as be reinvested in themselves. As an alternative, they’re reinvesting within the technique as a complete, proper? In order that they’re reinvesting into the, like, all the cash that I am going to make. I believe my dealer right here is telling me I am going to make, as of proper now, about $18 in dividends this quarter. And so these $18 won’t be reinvested into the particular names, however as an alternative again into this normal technique of 50% and the dividend development 25% in know-how, 20% in riskier know-how, and 5% in SCHD.

Daniel Snyder: And if individuals need to see this portfolio that you just put collectively, can they discover that on Money Circulate Freaks? Is it up there prepared for them?

Austin Hankwitz: It’s. It is all up there prepared for them. It is all built-in into the again finish because it pertains to Searching for Alpha’s Market Service. You may get entry clearly to the portfolio with a bunch of tabs inside. So I understand how I defined that may have been a bit complicated. So I break it down by form of attribute, proper?

So I break it down. It is a REIT. I bought a complete REIT tab and I bought my REIT analysis on the enjoyable stuff because it pertains to these or if it is perhaps these lengthy dangerous shares that I am enthusiastic about. We have now a complete tab for that. Analysis for each single a kind of because it pertains to the holding and my funding thesis.

Daniel Snyder: Yeah. I used to be going to say you might have the analysis library tab right here and also you even put within the Searching for Alpha Quant Ranking. Simply so it is there…

Austin Hankwitz: That is proper. That is proper, man.

Daniel Snyder: Superior. There’s one other query I wished to ask you. Particularly, you identified Taiwan Semi, proper? And we noticed lately in the newest Berkshire (BRK.A, BRK.B) 13F Type that they’ve began promoting a good portion of that firm. I discussed it on a earlier episode as effectively with Bertrand. Are you continue to absolutely invested full cam TSM for the long term?

Austin Hankwitz: I’m, proper? As a result of if you concentrate on, like, simply the final secular development pattern, semiconductors, like, as a $440 billion firm, like, they match completely inside that. And a variety of that all the things because it pertains to the place the trade goes. They’ll experience that tailwind simply superb.

To me and I really had a query from somebody that was like, hey, hear, like, the precise share value of those names could be down slightly bit. Like, are you apprehensive, like, what is going on on? We have seen volatility over the past couple of weeks now. It is like, on the finish of the day, no, proper? As a result of there is a lengthy 10-year time horizon that I am – that I give myself to put money into these corporations. But it surely’s additionally this dividend development that I am so enthusiastic about, proper?

So if we glance right here into Taiwan Semiconductors from a dividend development perspective, that is 10% compounded yearly for the final 5 years. And who is aware of the place it should go sooner or later. Typically talking, there might be situations that, oh, this is an amazing occasion, this is an exquisite occasion of me saying that I used to be improper and bought out of it.

3M, I solely do not forget that episode that we had. Oh my gosh. What occurred to that inventory? So I, as of like, I believe it was yesterday, traded in my 3M place, which I used to be down 25% or 30% on, which on the – at its core isn’t a dividend development inventory, however again to this concept of corporations who’re paying and rising their dividends for the long-term actually certainly one of that diversification. Handled that firm in for W. W. Grainger, GWW is the ticker. They’re anticipated to do superior EPS over the following a number of years right here.

However yeah, in order that’s the place it is like, hey, palms up. I bought it improper. I – I am shifting out. We’re doing one thing totally different, proper?

Daniel Snyder: I like if you say that although. Lots of people need to come on and speak about all their winners and so they by no means speak about their losers. And it is like, the entire thing is all of us have losers, proper? It is simply managing their danger facet of issues. And 3M (MMM), I imply, that episode that we did concerning the lawsuit and all the things else happening there, I imply, it is a large overhang for the inventory, so it form of is smart. However bravo to you for proudly owning it. I do know our viewers at all times appreciates after they hear the actual, actual on the episode as effectively.

So I need to transfer it away from the portfolio right here. And let’s begin speaking concerning the general markets, proper? Individuals are taking a look at these general market ranges whereas we’re recording this, the S&P 500 has been balancing round this 4,000 psychological stage for – looks like a fairly a number of days now. General market, not simply particular person shares, though I am certain someone take into accout and say it is a inventory file market, as we all know. However general market ranges, are you a purchaser at these ranges? Otherwise you assume it is nonetheless time to promote?

Austin Hankwitz: Gosh. That is such a black and white query. I adore it. General market…

Daniel Snyder: I need to make you are taking, too. You guys simply know…

Austin Hankwitz: Yeah, I do know I’ll. General market at 39.93 [ph] for the S&P 500. All proper. So this is the sport play, proper? I am an enormous believer that as a result of charges are going to be larger for longer. As a result of what we have seen with the ISM manufacturing guarantee companies bounce again and however who is aware of if that is now form of a brand new pattern? Inflation jumped up in January, proper?

We’re not seeing issues go completely to plan as they have been three months in the past, proper? With this new information, I believe as charges keep excessive for longer, all of the issues I simply talked about, we will see continued volatility within the markets in 2023. And I am undecided if that is going to go away by the top of the 12 months, by subsequent summer time. I do not know what that timeline is.

However what I do know is historical past, proper? And historical past tells us that the final 5 occasions that the patron value index has been above, I believe, it was 6%, perhaps it is 8%. I can discover the statistics right here for you. It was like 1953, 19 – two occasions the 1970s, as soon as the 1980s, and actually simply final 12 months.

The unemployment fee needed to spike above 6%, and we needed to have a recession earlier than inflation would come again all the way down to precise, the shop [ph] 2%, proper, 2.5%. We have but seen that. The labor market could be very robust. However then when you take a look at the housing begins and the permits which have been granted, these are plummeting proper now. Nonetheless, development employment remains to be up and nonetheless regular. However when you look again on the final 4 occasions that it did plummet, development employment additionally plummeted, proper? So perhaps that is a forecast the place it might be occurring with the or it might be coming later this 12 months with unemployment.

I simply – I don’t assume that we’re out of the woods simply but. I’m promoting. I am going to say it. I am promoting. I do not assume although that, like, I am not – see, that is the factor. You made it so black and white by your self. I am sitting on my palms. I am greenback value averaging slightly bit, proper? However I am not saying, all proper, we’re out of the weeds. Bull markets right here. Let’s load the boat. That is not how I really feel.

How I really feel is, I’ll proceed to do that complete inventory pickers market factor, proper? I am going to discover the HIMS. I am going to discover the businesses who’re paying and rising their dividends. I am going to proceed to try this and wager large on these corporations whereas additionally being a internet purchaser of belongings, usually talking, because it pertains to the markets, however not in a really aggressive method.

Daniel Snyder: I am going to provide you with that reply. That is wrap up on the finish there. As a result of, actually, it is all about, like, first half, second half, story, perhaps it is quarter-by-quarter. I imply, we have been speaking with Eric on final week’s episode about him trying six months forward and what he is seen as effectively from the housing information and repair information after which sticky inflation and all that stuff, like, anyone that is listening proper now, it is best to go hearken to that episode that Eric had. I imply, he laid it out.

Austin Hankwitz: Yeah. Eric is superb.

Daniel Snyder: He is an amazing man. And his analysis is phenomenal.

Austin Hankwitz: 10 occasions higher than mine. He’s superior. Everybody, go hearken to him, for certain.

Daniel Snyder: However what about this PE a number of? Are we – when you’re saying that you just’re – you’d be a speller proper now. Is it a a number of story happening within the general market if rates of interest are larger for longer?

Austin Hankwitz: Yeah. I believe it’s a number of, proper? As a result of, like, when you assume again to the final couple of bear markets we had and I haven’t got the information in entrance of me. However I keep in mind form of seeing the numbers of how the PE a number of has contracted from, like, name it, I do not know, 17 occasions all the way down to, like, 13 occasions or, like, 18 occasions all the way down to, like, 14 occasions. Like, each single time that we have had a bear market earlier than we have seen a backside, it actually contract down this 13 occasions, 14 occasions vary.

And I believe the bottom we ever bought was in October, and it was like 16.5 occasions or 17 occasions, proper? And to me, as we hear to those earnings calls from corporations like Walmart or Dwelling Depot or Goal right here, I believe, most likely simply got here out. I have never listened to it but, however I am certain it should be the identical story within the sense that we’re seeing continued inflation.

Our earnings are going to be down. Issues of that nature trying ahead. It is like, okay. So we’re – I do not know the PE ratio proper now. I am assuming with the S&P, it is round, name it, perhaps 18.5, 19, perhaps I’ve the quantity in entrance of you. However why are we buying and selling at some form of premium if the businesses who’re embodying, I’d argue Walmart could be very a lot what retail is and Dwelling Depot could be very a lot on what retail is, proper?

These corporations which can be embodying what retail goes to appear to be and what the patron mindset and extra particularly what firms are going to be reporting and are taking a look at and guiding to over the following, name it, 9 months. If these will not be nice, then why are we placing a frothy valuation on prime of one thing that’s not nice. I do not perceive that, proper?

So I believe that the PE a number of wants to return all the way down to this, name it, 14 occasions, 15 occasions earlier than we actually see a bear market backside. However because it pertains to discovering that backside, would I – one thing I am extra taking a look at is the financial indicators, proper? I need to see the ISM Manufacturing information rotated, proper?

We’re nonetheless nosediving. Positive the companies has moved from, I believe, it was, like, 49, up now to 55, however that was one month. Like, what the pattern, proper? I need to see these very particular – I need to see the ISM information flip round as a result of if you concentrate on it, I noticed a chart from a man named David Marlin who was in a position to form of pull collectively what’s traditionally talking, over the past, name it, three many years of how the S&P 500 has carried out in bear markets to seek out these bear market bottoms in relation to the ISM information.

And the chart that he shared, I do not know if it was one which he created or one thing that Financial institution of America (BAC) when these banks had created, however primarily it was saying that the ISM information has been one of the best predictor of the place the inventory market bottoms are as a result of as soon as that form of trough has been created and we’re shifting again up in the suitable route, then it is protected to imagine that both if we noticed a backside, that was the underside or there can be – there’s going to be a backside right here fairly quickly.

So I am – I do care about valuations. I do care about PE multiples and issues of that nature for the S&P 500. However to me, it actually simply comes down to love what is the economic system doing? As a result of to be fairly trustworthy, like and we have heard this quote a 100 occasions on the market.

The market could be loopy for much longer than you could be solvent, proper? The market was loopy in 2020, 2021. 2022 is form of like a snap again to actuality, however even we noticed this loopy bear market rally to begin the 12 months, proper? Like, there’s going to be some occasions the place the market goes completely not if you form of go searching within the economic system and the information comes out, it is like, wait, inflation is larger than we thought. Individuals are unemployed. However that is occurring at housing begins, A, B, C, X, Y, and Z.

So which means after I’m extra targeted on versus just like the PE a number of. However as somebody who’s a internet purchaser of belongings, clearly, I do need to maintain it excessive on the PE a number of of the market.

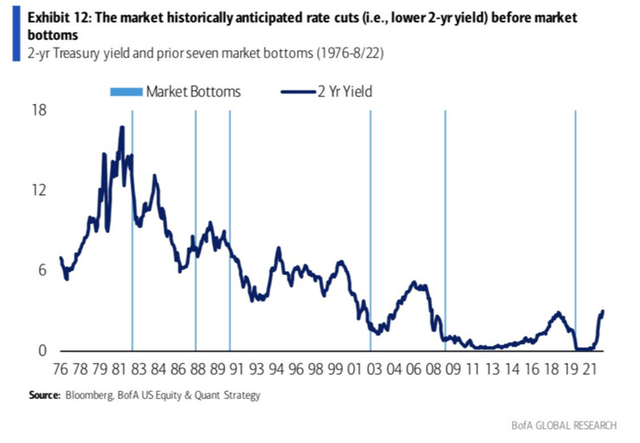

Daniel Snyder: Some individuals on the market are saying, “Properly, the a number of remains to be frothy as a result of the bond market is predicting the cuts additional down the street, and due to this fact, they’re assessing the chance in that standpoint. And also you guys despatched over these charts concerning the two-year yield. Why do not you form of simply break down for us what we’re taking a look at inside these charts?

Austin Hankwitz: All proper. So, primarily, when you take a look at these two charts.

So the primary chart is the two-year word bond yield. And now we’re taking a look at virtually 4.8% yield on the two-year. And traditionally talking, we’ve this superior chart by Financial institution of America. And what they’ve performed is that they’ve form of overlaid the S&P 500 market bottoms on prime of the two-year yield. And a pattern that you just may see that I believe could be very obvious in that is earlier than the market has bottomed and really seen a backside after which we rotated or again as much as the races, the two-year yield has peaked and fallen by at the very least 50 foundation factors, proper?

We have – you could possibly argue that we’d have seen that peak in November, proper, when it was buying and selling round this, name it, 4.75, after which it got here all the way down to virtually 4, proper? That might have been the 50 foundation level mark, however now we’re even seeing larger highs within the two years.

So I’d argue that that’s most likely invalid at this level. So usually talking, the bond market is telling us that the market hasn’t bottomed but. There is a ton of housing information that is telling us unemployment goes to be skyrocketing because it pertains to development. I imply, there’s a lot information that’s pointing to ISM information. There’s a lot information that is pointing to.

We’re not out of the woods simply but, which is holding me on the sidelines, usually talking, proper? I am nonetheless nibbling right here. I am investing in that purchaser of belongings, however I am not saying, “All proper, guys, I am in. I am doing all the things I can to purchase dangerous corporations. I am doing all the things I can to purchase this and purchase that. I am simply – I am affected person. I am greenback value averaging appropriately. I’ve a big money place that’s greater than the fairness place I’ve in my portfolio proper now.”

So simply be very clear right here with individuals listening, proper? I’m majority money at this second. However I simply do not see us out of the weeds simply but.

Daniel Snyder: Gotcha. Thanks for breaking that down. I bought one query left earlier than – effectively, really, two questions left earlier than we allow you to go. First query is, regarding the portfolio that you just maintain speaking about, is {that a} month-to-month allotment that your greenback value averaging it in? In the event you’re promoting one thing, do you do this quarterly, month-to-month? How are you dealing with that?

Austin Hankwitz: Yeah. It is a good query. So I am going to reply the second first because it pertains to promoting one thing. I do not need to form of choose my winners and losers on, like, a month-to-month and even two-month foundation. However on a quarterly foundation, proper, after I opened up this portfolio in October, so I am a six months in at this level referred to as 5 months, 4 months. And taking a look at this 3M place, it was a transparent loser. And clearly, if anybody listening proper now, hearken to the episode we did about 3M.

Daniel and I each know concerning the loss, so we learn about a variety of headwinds that this firm is dealing with. And at that time, it simply to me made much more sense to say, hear, I’ll lower this final phrase as occupied with the attitude of the bond marketplace for a second, proper? The six-month is yielding 5.1-plus %. It is like, would I fairly simply take that cash and put it into one thing risk-free like bonds? Like, that is a no brainer. I would a lot fairly do this than try to roll the cube right here with 3M.

In order that’s form of how I form of method that. And from the attitude of a time horizon form of rebalancing, I believe quarterly is truthful. I believe each quarter, it is a good theme to form of go searching and say, okay. What’s performing finest? What’s performing worse? Why is that occuring? I do that extra on a weekly foundation as a result of I am form of hyper obsessed about it, proper?

So when you comply with and are subscribed to the Money Circulate Freaks, you may see a portfolio replace each Sunday saying your method. The place I did an replace on Adobe (ADBE), and I did an replace on Dwelling Depot in addition to Union Pacific Company (UNP), and I talked about clearly what had occurred with the derailment in Ohio. After which the day after I revealed that the CEO stepped down and the inventory went up 12% or one thing, proper? However lengthy story quick right here, I would say, is a quarterly foundation is fairly wholesome because it pertains to rebalancing.

Daniel Snyder: The final query earlier than I allow you to go, get on and out of right here is the place can individuals sustain with you? The place can they contact you? The place can they chat with you if they’ve extra questions?

Austin Hankwitz: So if you’re all in any respect focused on studying extra concerning the money flowing or quickly to be money flowing corporations that I am investing into particularly, you should definitely try the Money Circulate Freaks. It’s a Market Service on Searching for Alpha, this is what you may count on.

So each Monday morning, what my crew does is we publish one thing referred to as the Week Forward. And what that is, it is a normal replace on what to anticipate within the markets that week. If it is particular names for earnings, if it is particular financial information that is supposed to return out or investor relations, we bought the Tesla (TSLA) factor popping out. I believe that is tomorrow, proper?

In order it pertains to the markets, what to anticipate from a high-level going ahead? And my scorching takes us to what I believe goes to occur, proper? So I gave some scorching takes on Hims & Hers earlier than the earnings got here out. I gave some scorching takes on Snowflake (SNOW) earlier than their earnings and in addition to Goal. In order that’s what to anticipate on a Monday foundation.

After which on Sundays, what to anticipate is an efficient recap of all the things that really moved the markets. If it was particular earnings is the place we dive deep, we present the charts, we present the place sizes, all that enjoyable stuff. Because it pertains to the financial experiences, we dive deep on these, we get good quotes from different economists who’ve far more expertise than myself to hopefully add some further shade. Then we additionally provide you with guys the play by performs on these investor shows and investor days. So I am excited to tune into Teslas after which give the play by play on that.

After which on a couple of month-to-month, perhaps biweekly foundation, it actually relies on how as a result of this is the factor. I am not a believer in posting content material simply to put up content material. Like, I do not need to pitch a inventory to you guys with out having a full understanding of what that firm is and why I am enthusiastic about it.

However usually, each two to 4 weeks, you may count on a brand new inventory pitch breakdown evaluation, Hims & Hers and Academy Sports activities and Outside was November’s. And clearly, we see how that did. And in order that’s additionally what to anticipate.

After which lastly, on Monday nights, we’ve some livestreams. So for about an hour, 45 minutes to an hour relying on the group and the way lengthy Q&A lasts. I am going to sit down and I stroll by means of some ready remarks because it pertains to updates on the economic system, slightly bit about perhaps earnings that had occurred final week or provide you with guys, perhaps a preview as to what I am engaged on because it pertains to a inventory pitch. And, yeah, it is only a enjoyable time to attach with a couple of dozen or two different people who find themselves subscribers.

So actually fortuitously, you guys are right here to hearken to what I’ve to say and so open-minded about my concepts and searching ahead to anybody and everybody’s views in a scorching takes within the Searching for Alpha’s Market of Money Circulate Freaks.

Daniel Snyder: Properly, I bought to say I imply, you’ve got amassed an enormous viewers. I believe all of us recognize the evaluation and the information and you have taken the time to place all this content material collectively. We at all times love speaking to you right here as effectively, getting the updates from you out of your portfolio and elsewhere. And we will do it once more right here in a number of months as a result of that is what we do.

We wish to check-in with you. We’ll see in case your minds has modified what you are recommending to individuals at this second in time. I do know…

Austin Hankwitz: Can I simply drop in simply so I can say in three months from now that that I mentioned this on the file button right here, Perion Community. Perion Community, PERI, is an organization that I am very diving deep into proper now. Primarily, an extended story quick is that they have a strategic partnership with Microsoft Bing to just about be their unique advertiser community.

So if anybody desires to promote on Microsoft Bing, I ChatGPT, all of the enjoyable stuff that they’ll see over the following six to 9 months. You need to promote on Bing, you bought to undergo Perion Community. In order that they have a four-year $800 million strategic partnership with them. And I am doing a variety of analysis within the firm proper now, however very enthusiastic about that.

So hopefully, in three months once we test again in, I’ll have some updates.

Daniel Snyder: So that you’re saying that analysis goes to drop quickly. So individuals ought to test it out.

Austin Hankwitz: That analysis is dropping tomorrow.

Daniel Snyder: Oh, however there you go. While you’re listening to this podcast episode, it most likely will already be out. So we will go forward and be sure that we hyperlink within the present notes web page in addition to put these graphs up and all the things else that you just despatched, so that individuals can simply discover that.

Austin, thanks a lot in your time. Lot of nice info on this episode. I like what you are doing the $2 million portfolio.

And everybody, in case you have any feedback concerning the episode, drop them on the present notes web page. I am going to bounce in, I reply questions, Austin does as effectively, and we sit up for speaking to you.

Only a reminder, everybody, when you loved this episode, depart a ranking or a evaluation in your favourite podcasting app. And we’ll see you once more subsequent week with a brand new episode and a brand new visitor.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.