jetcityimage

Headline

Recent off the presses, 3M Firm (NYSE:MMM), simply bought some constructive information concerning their PFAS case:

3M’s inventory jumped greater than 10% on Friday morning after Bloomberg Information reported the corporate agreed to a tentative settlement of at the least $10 billion with a wide range of U.S. cities and cities to resolve water air pollution claims tied to “perpetually chemical compounds.”

To be truthful, the replace from the courtroom pundits additionally goes on to level out that extra prices needs to be within the pipeline concerning this case. Additionally it is not inclusive of the earplug case, which is ongoing. 3M Firm is a dividend king and one of the vital steady cash-flowing corporations within the DJIA exterior of their unknown litigation prices. Let’s check out how low cost MMM inventory is perhaps after deducting some litigation value assumptions mixed with the exit of 3M’s PFAS enterprise come 2025.

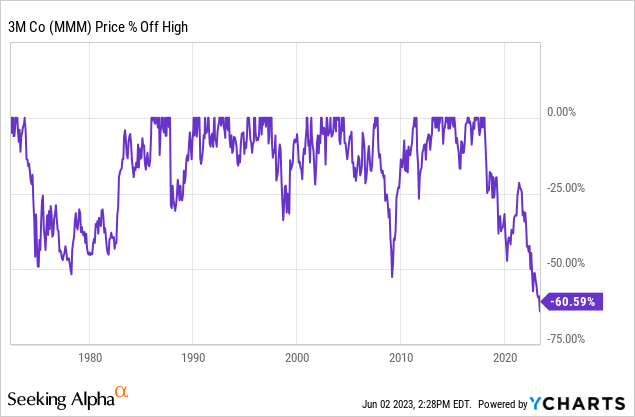

The chart

60% down might imply plenty of positive aspects forward ought to 3M resolve its litigation points. This Dow blue chip is at the moment buying and selling at a market cap of solely $52 Billion.

What they do

From the 10-Ok:

3M is a diversified expertise firm with a world presence within the following companies: Security and Industrial; Transportation and Electronics; Well being Care; and Client. 3M is among the many main producers of merchandise for lots of the markets it serves. Most 3M merchandise contain experience in product growth, manufacturing and advertising, and are topic to competitors from merchandise manufactured and offered by different technologically oriented corporations.

Valuation mannequin

I will be looking at 3M at the moment utilizing a Buffett proprietor earnings discounting mannequin. This mannequin is a novel discounting methodology that hunts for high quality shares which have an equilibrium between Depreciation and Amortization versus their CAPEX. When administration is operating effectively, the big capital outlays come to start with and it should not take tons of additional capital to take a position and maintain worthwhile thereafter.

You would be stunned what number of corporations have capital expenditures far in extra of depreciation and amortization. That is the other of a well-run enterprise. We should always say such a enterprise is extremely aggressive and has a low to no moat nature. Dividend aristocrats and kings are likely to exhibit a really shut equilibrium between the 2 aforementioned gadgets and a moat due to this.

Litigation prices

Firstly, this evaluation cannot be as easy as punching within the numbers on the guidelines. I will make a possibly not-so-conservative assumption right here and assume that there are $30 Billion in litigation prices to hold ahead. Let’s view what occurred with the latest Johnson & Johnson (JNJ) case to see how the construction of the funds is laid out:

Johnson & Johnson mentioned on Tuesday that it had agreed to pay $8.9 billion to tens of 1000’s of people that claimed the corporate’s talcum powder merchandise triggered most cancers, a proposal that attorneys for the plaintiffs referred to as a “important victory” in a authorized struggle that has lasted greater than a decade.

The proposed settlement could be paid out over 25 years by means of a subsidiary, which filed for chapter to allow the $8.9 billion belief, Johnson & Johnson mentioned in a courtroom submitting. If a chapter courtroom approves it, the settlement will resolve all present and future claims involving Johnson & Johnson merchandise that comprise talc, akin to child powder, the corporate mentioned.

Principally, a belief is about up for the payout to happen over 25 years. I’d assume one thing related right here. With that in thoughts, $30 Billion over 25 years could be a litigation value of $1.2 Billion a yr.

PFAS 2025 Exit

One other deduction we have now to place into our mannequin is the PFAS exit. The corporate plans to exit the enterprise utterly by 2025, here’s what the enterprise was bringing in in accordance with 3M Firm:

- Web gross sales of $1.three Billion

- EBITDA margin of 16%

- Equal to $208 million in EBITDA

- A $163.32 Million a yr loss in web earnings assuming an EBITDA to Web Revenue conversion of 79.7%. 79.7% is the newest EBITDA to Web Revenue conversion fee for 3M Firm.

Modified proprietor earnings

Now that we have now our deductions to penalize 3M firm for, let’s run the mannequin:

Knowledge courtesy of In search of Alpha

- TTM web earnings is $5.45 Billion

- Plus TTM depreciation and amortization of $1.838 Billion

- Minus $1.Eight Billion TTM CAPEX

- Minus $1.2 Billion litigation value/yr

- Minus $163.32 million in PFAS enterprise earnings

- Equals proprietor earnings of $4.127 Billion

- Discounted by risk-free fee of the 10-year treasury, March 2nd, 2023, of three.6% = $114.657 Billion truthful market cap

- Discounted at a brief risk-free fee of 5%, $82.55 Billion.

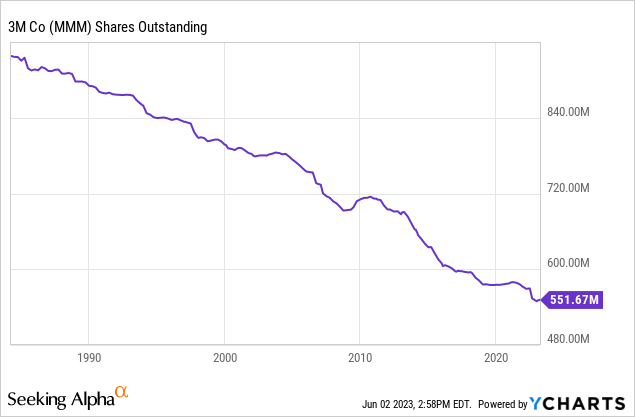

Buffett discounted stabilized companies akin to these on the 10-year treasury fee. I baked in a excessive and a low-end market cap based mostly on the lengthy and brief ends of the risk-free yield curves. Mixing the 2 will get a good market cap of $98 Billion. There are 551.672 million shares excellent as of June, 2nd 2023. This will get us to a good worth of $177.64 a share based mostly on these assumptions.

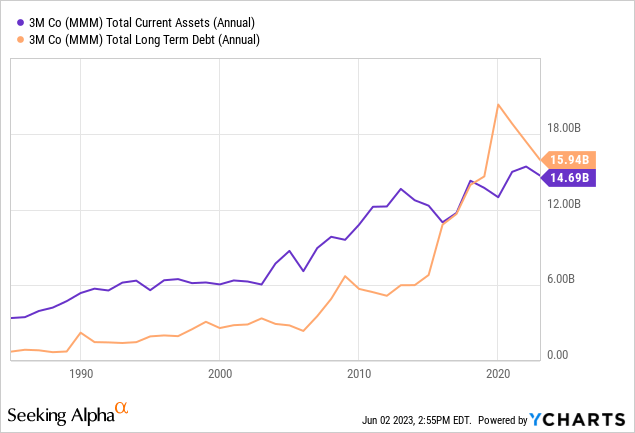

The stability sheet

Long run debt and present belongings are about in equilibrium right here. Not the very best stability sheet however not a poor one both.

The development in shares excellent is excellent. This firm is aware of give again to its shareholders and continues to take action. That is how you purchase again beneath intrinsic worth.

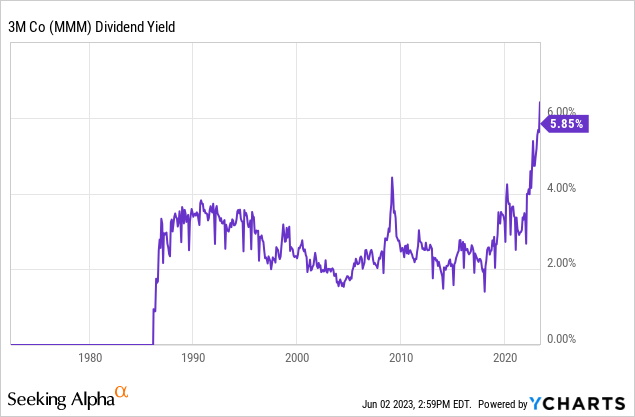

Lastly, the yield. Buyers proper now in 2023 have by no means seen a greater dividend yield on 3M Firm. The market is risk-off on them proper now, however that is historical past within the making. Is Mr. Market proper or fallacious? Even a 33% dividend minimize would go away us close to traditionally excessive ranges.

The dividend and free money stream

To be truthful, the dividend is roofed by earnings however marginally lined by free money stream.

looking for alpha

With a $6 per share dividend and a TTM free money stream of $7.23, that is a payout ratio of 82%. I am assuming buybacks should be curbed sooner or later to take care of the dividend king standing and protect capital. The dividends are extra necessary than the buybacks to protect the share worth and the moniker.

Catalysts

Extra revelations across the precise prices of litigation. Plain and easy, we’re up almost 10% after discovering out that a part of the litigation could possibly be capped at $10 Billion. I am baking in $30 Billion to my equation, some have been floating numbers above $100 Billion only for the PFAS portion alone. You by no means know the place this may wind up. Not less than the market has been ready for the worst for fairly a while.

Conclusion

I’ve began shopping for once more. I used to be merely holding my shares on DRIP for the higher a part of a yr. I, like most, have been ready to listen to any revelations within the 3M courtroom case. $10 Billion feels like lots, with extra to return, however at the least we’re getting some rational judgments. That is mixed with the truth that any payout is possible to be paid over a few years fairly than a lump sum. I am shopping for cautiously right here and my large dividend on DRIP is doing the remainder of my DCA.