tadamichi

Written by Nick Ackerman, co-produced by Stanford Chemist. This text was initially revealed to members of the CEF/ETF Earnings Laboratory on June ninth, 2023.

Bancroft Fund (NYSE:BCV) continues to commerce at a deep low cost. The truth is, the low cost has expanded a bit since our prior replace. Since our prior replace, the fund’s efficiency hasn’t been doing a lot of something. On a complete return foundation, it is mainly flat, and that is additionally contemplating the low cost increasing a contact.

BCV Efficiency Since Prior Replace (Searching for Alpha)

Whereas the S&P 500 Index has offered stronger returns throughout this era, it was largely reserved for the mega-cap tech names. That is largely why the broader market, as measured by the S&P 500, reveals {that a} new bull market has began. Nonetheless, there have been slim participation, with most all the things else flat or destructive for the 12 months outdoors of that handful of tech names. Extra not too long ago, we’ve been getting a bit extra participation from different areas of the market, which is an effective improvement for a extra sustainable rally.

BCV invests largely in convertible securities and might expertise some upside as a result of convertibility characteristic of the underlying securities. Along with the potential good thing about broader participation to the upside from different market contributors, that funds low cost is engaging presently. The fund has additionally not too long ago revealed its newest semi-annual report, offering time to present the fund an up to date look.

The Fundamentals

- 1-Yr Z-score: -1.36

- Low cost: 15.28%

- Distribution Yield: 7.54%

- Expense Ratio: 1.38%

- Leverage: 20.26%

- Managed Property: $147.648 million

- Construction: Perpetual

BCV’s funding targets are “…offering earnings and the potential for capital appreciation, which targets the Fund considers to be comparatively equal over the long run.” Their method is sort of easy; they “function as a closed-end, diversified administration funding firm and make investments primarily in convertible securities…” Together with convertible securities, they’ll combine in numerous different fairness and fixed-income securities.

The fund is pretty small, even together with the fund’s leverage. This fund is best positioned by way of its leverage in comparison with another closed-end funds as a result of they’ve a locked-in fastened price. That is by way of their cumulative most well-liked shares coming in with a hard and fast 5.375% dividend price. That is publicly traded (BCV.PA), and extra conservative traders may take into account investing on this over the widespread shares. As BCV itself has mild quantity, it is most well-liked is displaying even much less quantity. That may make it tough to build up or offload a sizeable place.

Whereas this fixed-rate dividend was costly relative to credit score amenities when charges have been at zero, most funds are actually paying over 6% on their credit score amenities. With not understanding precisely when rates of interest will give up rising – regardless of alerts that we might be close to a pause part for now – certainty generally is a great point. With a fixed-rate dividend for leverage, certainty is strictly what you will get.

Efficiency – Engaging Low cost

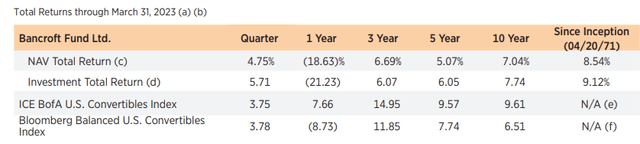

The fund’s longer-term historic outcomes had been pretty aggressive in opposition to its included benchmarks. Nonetheless, newer outcomes have left so much to be desired. With an enormous destructive 12 months over the past 12 months, that actually dragged down the outcomes. Within the first quarter of 2023, there was a glimmer of hope with issues rebounding that noticed BCV as soon as once more offering alpha over their benchmarks.

BCV Annualized Efficiency (Gabelli)

After all, being a leveraged fund with its most well-liked providing, a down 12 months will likely be felt extra sharply, and that provides to the dangers. The constructive facet of leverage is that there’s potential for outperformance, too.

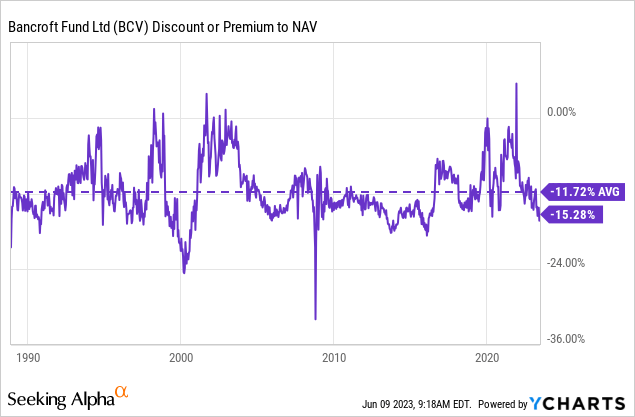

One other benefit of BCV over investing in an ETF that trades one in all these listed benchmarks is taking part in the low cost/premiums that come up in CEFs. BCV has traditionally traded at fairly a deep low cost. It was the newer historical past with the fund buying and selling the place it touched a premium stage in 2021 that was uncommon.

Ycharts

At this level, although, the fund is again buying and selling at a deep low cost. The truth is, the low cost is deeper than its longer-term historic common. Outdoors of black swan market sell-off occasions, that is about as low of a reduction because the fund usually trades.

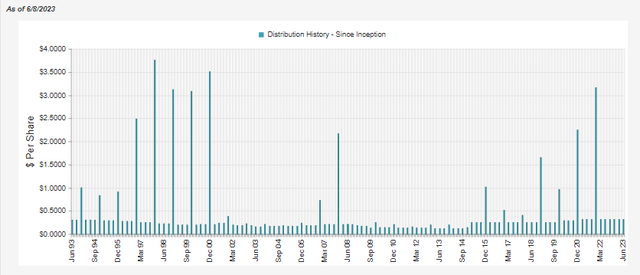

Distribution – Managed Distribution

The fund works with a managed distribution the place they intend to pay out a minimal of 5% of their NAV yearly. At this level, after final 12 months’s sharp sell-off, they’re already above the minimal. That is additionally why we did not see a particular within the prior 12 months. Nonetheless, in years the place there are ample returns, the fund will typically pay out a bigger year-end distribution to prime it off and meet the minimal.

BCV Distribution Historical past (CEFConnect)

Most traders have a tendency to not like this payout technique, nevertheless it does preserve the payout extra affordable, with flexibility for the fund to regulate as wanted. Paying out too excessive of a distribution would imply a fund supervisor might be compelled to both lower the distribution or dump belongings they’d in any other case prefer to retain for a rebound.

With rates of interest rising and seeing the value of BCV falling meant that the present distribution price has turn into extra aggressive. On a share value foundation, traders are amassing 7.54%, whereas on a NAV foundation, as a result of giant low cost, it really works out to six.39%.

For a lot of the final decade, we have been in a near-zero price atmosphere, and yields on convertibles have been very slim or nonexistent. Firms have been getting away with issuing extra zero-coupon convertibles for some time. That signifies that all or almost the entire distribution should be funded by way of capital appreciation.

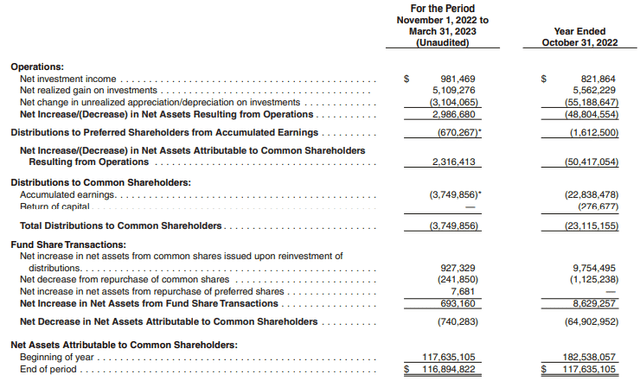

That being mentioned, BCV has actually seen its internet funding earnings ramp up year-over-year. Keep in mind, that is solely a six-month report, so if this continues, we might see an over doubling of the NII for the fund.

BCV Semi-Annual Report (Gabelli)

On a per-share foundation, the whole lot of 2022 confirmed NII of $0.18. On this newest report now, we’re at $0.17 per share in half the period of time. One motive it is not doubling on a per-share foundation is that the fund points new shares by way of its DRIP, whether or not it is at a premium or low cost.

This is not the usual for many CEFs, as when shares are buying and selling at a reduction, the reinvestment shares would truly be bought within the open market. Issuing new shares is dilutive and may help preserve the low cost vast. To offset a few of this, the fund has additionally carried out repurchases of each its widespread and most well-liked share choices. This is not the one fund that points shares at a reduction, however they’re positively within the minority.

Apart from portfolio positioning resulting in increased earnings era on the portfolio, one other issue right here might be that convertibles are actually having to be issued with a good coupon. This was famous by Calamos as one of many catalysts for making convertible securities extra engaging.

This was echoed within the BCV supervisor’s notes within the final report, too:

Throughout this era, issuance of recent convertibles has modestly improved. Within the first quarter of calendar 2023 there have been 18 new convertible securities issued with proceeds totaling $11 billion, an enchancment over 1Q 2022 however nonetheless slower than a lot of the final decade. That mentioned, the phrases of those points proceed to remain at extra engaging ranges to the customer than they have been by way of early 2022 and in 2021, with increased yields and decrease premiums. This tempo of issuance implies a fabric enchancment over the 58 points that generated $28.4B in calendar 2022.

(Notice: Writer bolded the notably noteworthy a part of the paragraph for added emphasis.)

Not solely are convertibles having to be issued with higher yields, however attributable to charges rising, it has made it a extra compelling possibility for higher-rated corporations. As corporations have their debt maturity they usually’re trying to refinance this debt, they’ll challenge convertible at comparatively decrease coupons than going the straight debt route. It comes with future dilution potential for widespread shareholders, however it could nonetheless make sense as a substitute of taking the upper rate of interest prices.

All else being equal, higher high quality corporations and better yields may result in higher returns going ahead. This is able to be as a result of BCV (and different convertibles) can begin overlaying extra of their distributions by way of earnings. Having probably extra entry to higher-rated corporations ought to imply diminished threat as nicely.

BCV’s Portfolio

Convertible company bonds comprised 87.1% of BCV’s portfolio on the finish of March 31st, 2023. In addition they listed one other 6% allotted to obligatory convertible securities and convertible most well-liked shares. They’d solely a contact of widespread shares at round 2.5%, allotted to 2 REITs that included Crown Fortress (CCI) and Modern Industrial Properties (IIPR). The rest was in U.S. Treasury Payments, which at the moment have been yielding wherever from 4.562% to 4.743% – it is nice having money pay one thing nowadays!

With all that mentioned, the fund is overwhelmingly uncovered to convertible securities. Due to this fact, that is why a rising fairness market can have a fabric affect on the fund and would profit from a broader participation in efficiency from equities along with the yields rising from newer issuances.

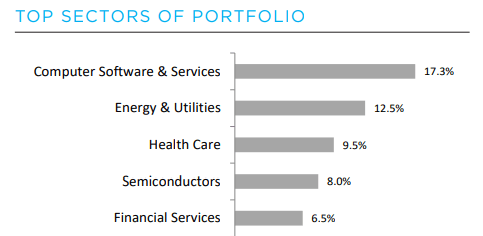

Gabelli supplies a breakdown of their prime sector allocations, however they’re arduous to match apples to apples with different fund breakdowns. It’s because they go along with a extra uncommon naming of classes that is extra like an business or sub-sector breakdown of listings.

BCV High Sector Allocation (Gabelli)

Typically, as is the case with what we have seen with different convertible funds, they’ll be tilted towards tech. Tech corporations typically embrace the decrease prices that convertibles can supply. Tech can usually obtain investor curiosity as a result of it is related to progress. Appreciation within the underlying firm from mentioned progress may result in the upside of convertible securities traders search. It is also safer, assuming that the corporate does not go bankrupt, as there’s a ground and a face worth that needs to be paid again at maturity ought to a standard inventory not run up as anticipated. So it provides a extra general balanced method to investing in progress corporations.

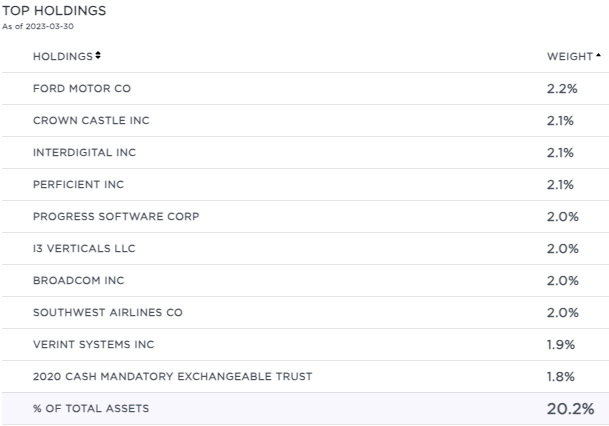

The highest ten holdings have been listed at simply over 20% of the fund’s investments. This was truly the very same on the finish of December 29th, 2022. Moreover, these prime names are additionally per the very same holdings at the very same weights.

BCV High Holdings 3/30/2023 (Gabelli)

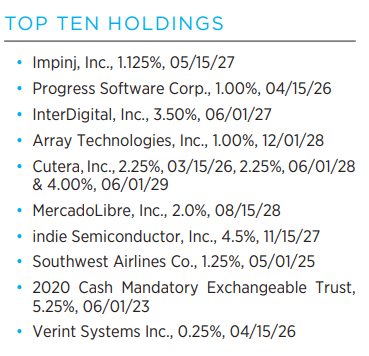

The biggest weighting of the fund is (or was) a Ford Motor (F) zero coupon convertible that matured in 2026. Nonetheless, observe that the highest holding listing above was as of March 30th, 2023. As a substitute, if we take a look at the highest ten holdings only a day later, Ford just isn’t listed, and neither are CCI and Broadcom (AVGO). AVGO was one other widespread inventory place beforehand. This prime ten listing is as of March 31st, 2023.

BCV High Ten Holdings (Gabelli)

In accordance with the most recent N-PORT that reveals listings for a similar March 31st, 2023 date, the fund holds no Ford or Broadcom place in any respect anymore. Nonetheless, they’ve retained the widespread share place in CCI, however it’s now not a prime holding.

So apparently, they saved all of their portfolio strikes for the final day of the quarter. Or, the choice rationalization is that whereas they modified the date as of when these final prime ten holdings have been offered, they really did not replace the highest ten listing however solely the “as of date.” I’ve seen unusual errors and typos happen from fund sponsors, and seeing the very same weightings of the identical names over three months is sort of suspicious. This does not appear to be a daily error to have occurred, as we are able to return to our prior replace earlier than the earlier one, and we noticed a number of adjustments at the moment between holdings.

All that mentioned, we are able to see that the highest ten holdings nonetheless comprise some pretty low-yielding convertible devices. A few of these have been earlier prime ten positions, so we do not see a completely totally different prime ten. As soon as these decrease yielders begin to get flipped into higher-yielding convertibles which can be being issued now, the NII ought to see a pleasant bump as soon as once more sooner or later, as we have seen with this earlier report.

We have seen this flip happen, too, as in our October replace, BCV listed solely Four positions with 1% yields or increased. As of this final replace, 9 out of the highest 10 holdings are actually at 1% or increased. The one exception right here is the Verint Programs Inc (VRNT) convertible with its 0.25% with 2026 maturity. This reinforces why we have seen NII enhance considerably within the newest report.

Conclusion

Convertible securities took an enormous hit in 2022, together with the broader progress area of the market. That is per what might be anticipated, given the overall focus of progress corporations issuing convertible securities. The power for convertible securities to supply higher returns going ahead with increased yields now that we’re out of the zero-rate atmosphere makes convertibles one thing that might be attention-grabbing to contemplate. A further catalyst for BCV might be the fund’s deep low cost, which may present probably additional upside ought to that low cost slim going ahead.