Actual rates of interest are the best they’ve been in years. That’s good for U.S. bond traders, and probably good for U.S. inventory traders as nicely.

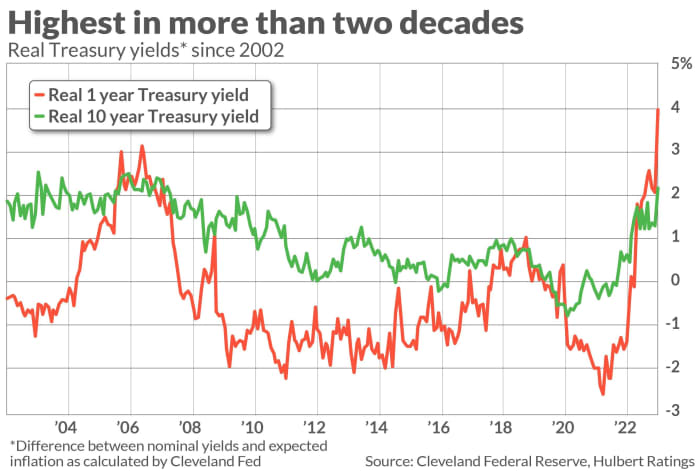

Actual rates of interest replicate the distinction between nominal yields and inflation. Actual charges had been destructive through the a few years of the Federal Reserve’s near-zero curiosity coverage, however started to shoot up a number of months in the past.

This pattern accelerated this previous week, even because the Fed determined to maintain charges regular. The desk under compares the true charges one month in the past (within the speedy wake of the Might launch of the April CPI) and at this time (following this week’s launch of the Might CPI information). Discover that nominal charges have risen during the last month as inflation expectations have declined; the distinction between the 2 subsequently has expanded considerably.

| Following the Might 10 launch of CPI information | Following the Jun 13 launch of CPI information | |

| Nominal 1-year Treasury yield | 4.70% | 5.27% |

| Inflation expectations over subsequent 12 months | 2.66% | 1.31% |

| Actual 1-year Treasury yield | 2.04% | 3.96%% |

| Nominal 10-year Treasury yield | 3.43% | 3.83% |

| Inflation expectations over subsequent decade | 2.16% | 1.66% |

| Actual 10-year Treasury yield | 1.27% | 2.17% |

A key part of those calculations is anticipated reasonably than precise inflation. That’s for 2 causes, the obvious of which is that we gained’t know the precise inflation fee over the following 12 months and 10 years till a 12 months and a decade have handed. However a extra fundamental cause to concentrate on anticipated inflation is that we wish to know what traders at the moment suppose. It’s the distinction between nominal rates of interest and traders’ present expectations that represents how a lot of a margin over inflation they’re demanding to be able to spend money on bonds.

The anticipated inflation charges used for this column come from a mannequin up to date month-to-month by the Cleveland Federal Reserve. It has a variety of inputs, together with Treasury and TIPS yields, surveys {of professional} forecasters, and inflation swaps (that are derivatives during which one get together to the transaction agrees to swap fastened funds in return for funds tied to the inflation fee).

What excessive actual charges imply for traders

Above-average actual rates of interest are excellent news for bonds, since excessive charges are extra possible than to not decline. You’ll be able to see this regression-to-the-mean tendency within the accompanying chart. The final time actual charges had been as excessive as they’re now was within the months main as much as the 2008 World Monetary Disaster (GFC). From then till the underside of that disaster, bonds skilled certainly one of their extra highly effective bull markets in U.S. historical past.

You would possibly conclude from shares’ losses within the GFC that top actual charges are unhealthy for the inventory market. However that conclusion can be untimely, based mostly on my evaluation of inventory market historical past again to 1871.

Since there’s no means of understanding what inflation expectations had been in long-ago many years, I made the simplifying assumption that traders at any given time anticipated inflation over the following 12 months to be equal to what it was over the trailing 12 months. On that assumption, I discovered a modest constructive correlation between anticipated inflation and the inventory market’s return over the following one- and five-year durations.

On condition that this correlation was so modest, nevertheless, the stronger funding implication of the at the moment excessive actual rates of interest is that the outlook for bonds is kind of good.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Scores tracks funding newsletters that pay a flat payment to be audited. He could be reached at mark@hulbertratings.com

Extra: Wealthy folks at the moment are conserving about 1/Four of their cash on this asset class, survey finds. However is it best for you?

Additionally learn: The bulls lastly management the inventory market and the indicators level larger