Devrimb

The AR/VR Battle Has Solely Began

Now we have beforehand lined Meta (NASDAQ:META) in Could 2023, discussing its exemplary FQ1’23 double beats and wonderful FY2023 steerage. Mixed with the return of promoting {dollars} as soon as the macroeconomic outlook normalizes, its projected NTM EV/ EBIT of 9.42x doesn’t appear costly then.

For now, META has lastly met its match within the AR/VR competitors, in our opinion, with the long-awaited Apple (AAPL) Imaginative and prescient Professional spatial headset lastly launched by early June 2023. In simply the span of per week, the web and market analysts are already abuzz with the brand new computing platform, a hype that has sadly skipped the Quest collection.

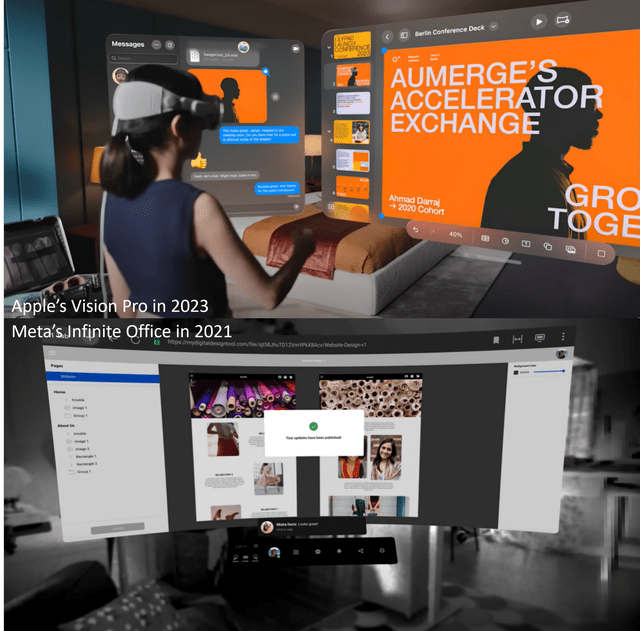

AAPL & META’s Related Choices, However Totally different Advertising and marketing Technique

AAPL & META

Most significantly, we consider Mark Zuckerberg has did not successfully convey Quest Professional’s capabilities, which supposedly already provide a comparative computing platform since 2021.

Meta 2022 & 2023 Tremendous Bowl Industrial

Youtube

As equally highlighted by different retail commentators and reviewers, many had been confused about Quest Professional’s full choices, with Meta preferring to go together with ambiguous commercials, leaving the viewers with minimal takeaways on its {hardware}/ software program Metaverse technique.

META’s Quest Advertising and marketing Movies

Youtube, Meta

Even now, the extra generally highlighted use circumstances for the Meta Quest VR headset are game-centric and, very often, e-sports on the YouTube web page. With this technique, it seems that the audience is generally retail-based as an alternative of the next-generational computing and/or skilled method that AAPL has opted for.

That is seemingly attributed to Mark Zuckerberg’s resolution to concentrate on the mass market by improved affordability and the “supposed” social interplay from the Metaverse, as just lately highlighted in Meta’s company-wide assembly after the discharge of AAPL’s Imaginative and prescient Professional spatial headset:

We innovate to guarantee that our merchandise are as accessible and inexpensive to everybody as attainable, and that could be a core a part of what we do. And we’ve offered tens of tens of millions of Quests.

Extra importantly, our imaginative and prescient for the metaverse and presence is basically social. It is about folks interacting in new methods and feeling nearer in new methods. Our machine can also be about being energetic and doing issues. In contrast, each demo that they (AAPL) confirmed was an individual sitting on a sofa by themself. I imply, that could possibly be the imaginative and prescient of the way forward for computing, however like, it is not the one which I would like. (The Verge)

Whereas some might have expressed curiosity to make do with Meta’s lower-priced choices, the Quest Professional presents a comparatively poorer show high quality of 1,800 x 1,920 pixels per eye, in comparison with AAPL Imaginative and prescient Professional’s 2,160 x 3,840 pixels per eye, or “23 million pixels-nearly thrice as many as in a 4K show.” That is on high of the previous’s 22 Pixels Per Diploma [PPD], in comparison with the latter at “round 50 to 70 PPD.”

Lengthy story brief, you’ll get the standard that you just pay for.

Moreover, Mark Zuckerberg opted to take the Quest {hardware} section as a loss chief, providing important reductions by March 2023 to supposedly enhance demand.

Nevertheless, it stays to be seen how Meta’s Quest Retailer might finally make up for the shortfall, with Actuality Labs solely reporting FQ1’23 revenues of $339M (-53.3% QoQ/ -51.2% YoY), with the deceleration principally attributed to slowing Quest gross sales. Whereas the Quest Retailer has recorded $1.5B in complete income by October 2022, the Actuality Labs stays unprofitable, with FQ1’23 working losses of $4B (-6.9% QoQ/ +33.3% YoY).

Whereas the bulls might level to Quest Retailer’s sturdy library choices, it’s no secret that AAPL customers additionally recorded greater world in-app spending at $86.8B in 2022 (+1.9% YoY). Subsequently, we consider the hole of their catalogs might finally slim, with the latter more likely to command improved in-app revenues in the long run.

Moreover, with the discharge of AAPL’s Imaginative and prescient Professional by 2024 and, seemingly, Alphabet’s (GOOG) (GOOGL) AR headset on the similar time, it’s unsure how Meta might retain its edge within the AR/VR market shifting ahead. That is on high of the market projection of 500Ok models in Imaginative and prescient Professional gross sales by 2024, doubtlessly triggering demand headwinds to the incumbent.

As well as, the gross sales for AR/VR units are anticipated to solely hit 10.35M models in 2023, minimally improved from the 8.58M reported in 2022 (-5.3% YoY). With Meta solely recording cumulative gross sales of 20M units throughout Quest 1, 2, and Professional fashions since 2019, seemingly attributed to repeat clients, we suppose the precise use circumstances have been lower than spectacular, in comparison with the worldwide put in base of AR/VR headsets at 34.7M in 2022 (+21.7% YoY).

We suppose it is a chicken-and-egg downside, since Meta’s quest for affordability has triggered a less-than-impressive show decision, triggering the extra game-centric use circumstances, in comparison with AAPL’s well-rounded options, skilled audience, and premium/ compelling expertise.

Then once more, issues might change for good from Quest Three onwards, given the administration’s declare about “Higher shows and backbone – Subsequent-gen Qualcomm chipset with 2x the graphics efficiency,” and “Excessive-fidelity colour Passthrough, modern machine studying, and spatial understanding allow you to work together with digital content material and the bodily world concurrently, creating limitless potentialities to discover.”

Assuming a drastically improved efficiency in comparison with the earlier fashions and efficient demonstration in Meta’s upcoming Join convention on September 27, 2023, we may even see Quest put up a note-worthy struggle within the AR/ VR battle forward. Solely time might inform.

So, Is META Inventory A Purchase, Promote, or Maintain?

META 2Y Inventory Worth

Buying and selling View

For now, META has solely retreated minimally post-AAPL-launch, implying that Mr. Market could also be satisfied concerning the two corporations’ completely different approaches and, seemingly, distinct finish markets.

Whereas we stay optimistic concerning the promoting/ social media firm’s execution, the rally has been optimistic certainly, giving us minimal upside potential to the worth goal of $301.74. That is primarily based on its NTM P/E valuations of 21.31x and market analysts’ FY2024 adj. EPS of $14.16.

Consequently, we favor to charge the META inventory as a Maintain right here. We may also be awaiting extra readability from the upcoming occasion in September. In the meantime, Mark Zuckerberg could also be studying just a few helpful ideas from Imaginative and prescient Professional’s advertising and marketing materials.