JJFarquitectos/iStock Editorial through Getty Photos

Be aware:

I’ve lined Star Bulk Carriers Corp. (NASDAQ:SBLK) beforehand, so traders ought to view this as an replace to my earlier article on the corporate.

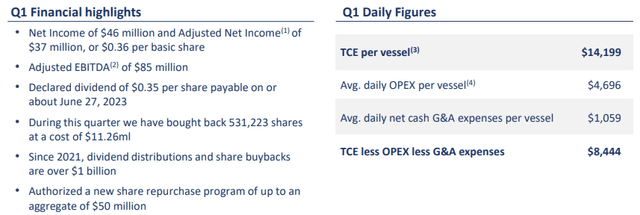

Final month, main dry bulk shipper Star Bulk Carriers Corp. or “Star Bulk” reported seasonally weak first quarter outcomes however nonetheless managed to generate $83.2 million in money movement from operations.

Firm Presentation

Primarily based on Star Bulk’s beneficiant dividend coverage, the corporate continues to return substantial quantities of capital to shareholders with mixture dividend distributions and share buybacks since 2021 eclipsing $1 billion.

Star Bulk has declared a quarterly money dividend of $0.35 which might be payable on June 27 to all shareholders of report as of June 7.

The corporate additionally continues to purchase again shares below its $50 million share repurchase program introduced in August 2021 which I would count on to be exhausted and changed with a brand new program later this 12 months.

Star Bulk Carriers stays the world’s largest U.S. exchange-listed dry bulk delivery firm, commanding a diversified fleet of 126 vessels with a median age of 11.four years.

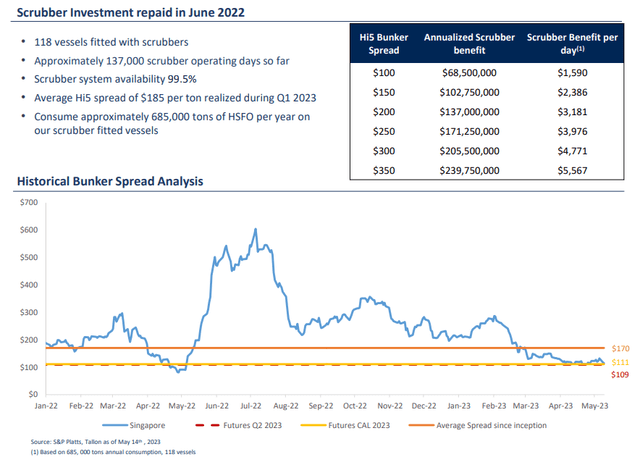

With roughly 95% of the fleet being scrubber-fitted, Star Bulk’s every day common time constitution equal (“TCE”) charge tends to outperform benchmark indices by a large margin.

Firm Presentation

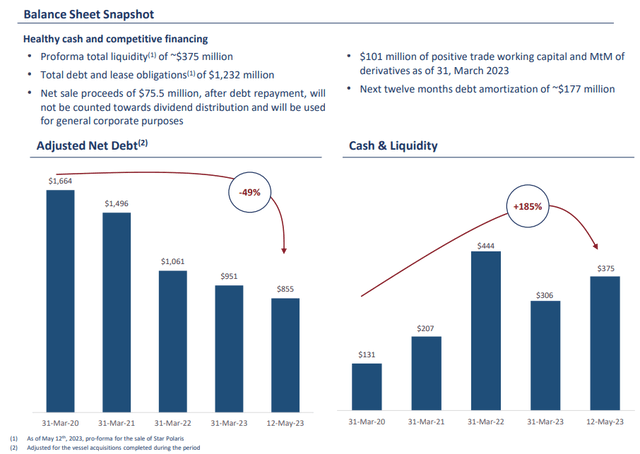

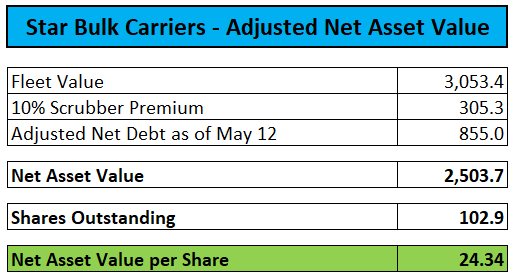

Steadiness sheet and liquidity proceed to be in fine condition with adjusted web debt of $855 million representing beneath 30% of the corporate’s fleet worth and accessible liquidity of $375 million as of Could 12:

Firm Presentation

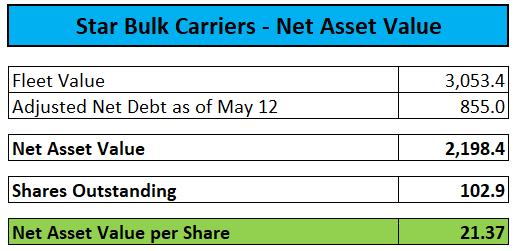

Valuation-wise, the corporate is presently buying and selling at an roughly 15% low cost to estimated web asset worth (“NAV”):

Firm Presentation / MarineTraffic.com

Please word that my fleet worth estimate is probably going on the low aspect on account of scrubber fittings not being absolutely mirrored in vessel valuations supplied by MarineTraffic.com.

In my most up-to-date dialogue of peer Eagle Bulk Transport (EGLE) or “Eagle”, the corporate’s personal fleet worth estimate exceeded the numbers supplied by MarineTraffic.com by roughly 17% probably additionally as a consequence of the truth that greater than 95% of Eagle’s vessels are scrubber-fitted.

Making use of a scrubber premium of 10% to Star Bulk’s general fleet worth would end in NAV per share leaping to effectively above $24:

Firm Presentation / MarineTraffic.com / Writer’s Estimates

Consequently, present low cost to NAV would enhance to greater than 25% which I contemplate too excessive for an business main high quality title like Star Bulk Carriers.

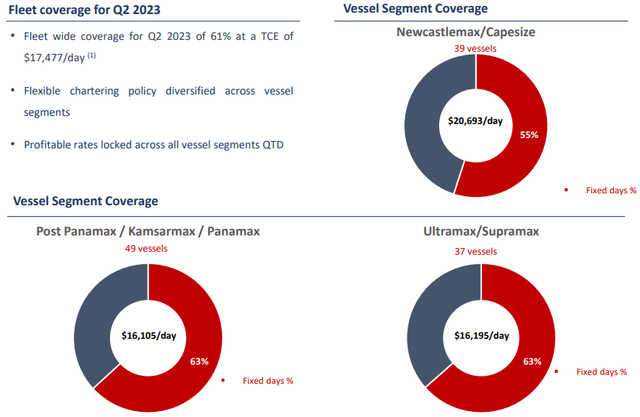

Trying ahead to the second quarter, on the time of the earnings report final month, the corporate had lined 61% of obtainable days at a median every day TCE of $17,477, roughly 23% above Q1 ranges.

Firm Presentation

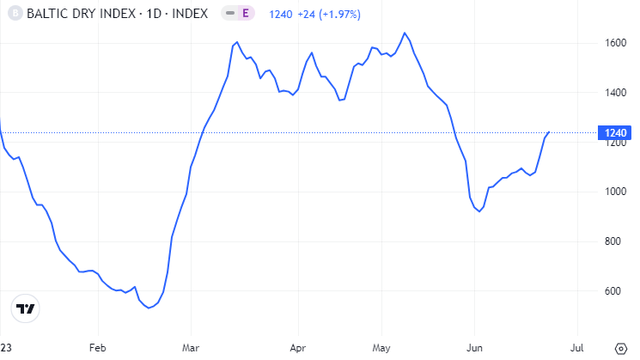

Sadly, dry bulk constitution charges have weakened considerably in current weeks which is more likely to consequence within the remaining Q2 TCE quantity coming in beneath $17,000.

TradingEconomics.com

Consequently, I might estimate a Q2 money dividend of roughly $0.40 per widespread share.

Looking forward to the second half of the 12 months, as regular, a lot will rely on Chinese language iron ore demand which is more likely to stay muted in the meanwhile.

In line with a current word by JPMorgan (JPM), extra assist for the Chinese language property sector is more likely to be localised and focused with measures being aimed toward boosting completions and gross sales fairly than stimulating new development exercise instantly.

That stated, on the Q1 convention name, Star Bulk’s administration remained constructive on demand for iron ore transportation within the second half:

Nicely, we’re seeing iron ore shares right down to 126 million tons, if I am not flawed, which is the legislation for the final at the very least two years. And we, due to this fact, count on that we’ll see extra imports within the second half of the 12 months and extra so from Brazil, which has not but carried out as much as its expectations so far as exports are involved, which can truly enhance ton miles. So, we’re constructive about iron ore commerce in the course of the second half. After which, I believe that China will enhance its efforts on — on infrastructure degree. And I’ve additionally seen that new flooring house has gone down loads. So, I might count on that as China — as the hassle to strengthen its financial system continues, I believe that we’ll see assist, each from the personal and the general public sector over there.

Backside Line

Whereas the dry bulk constitution charge atmosphere is more likely to stay unsure within the short-term, traders sharing administration’s optimism relating to Chinese language iron ore demand going ahead, ought to contemplate an funding in Star Bulk Carriers Corp. at a uncommon low cost to web asset worth.

The corporate stays a high quality title within the house with an honest stability sheet and loads of liquidity.

As well as, there aren’t any main company governance points at Star Bulk Carriers Corp. and the corporate continues to reward shareholders via a beneficiant dividend coverage in addition to an energetic share repurchase program.

Consequently, I’m reiterating my “Purchase” ranking on Star Bulk Carriers Corp.