Sundry Images/iStock Editorial by way of Getty Pictures

Proper now, as traders get again into risk-taking mode, the market is out of the blue re-discovering lots of downtrodden tech shares that had been buying and selling at underwater valuations far under their intrinsic worths. This group of shares has been among the many largest rebounders over the previous few weeks, and for my part, persevering with to deal with these “progress at an inexpensive value” names stays among the finest methods to beat the market on this atmosphere.

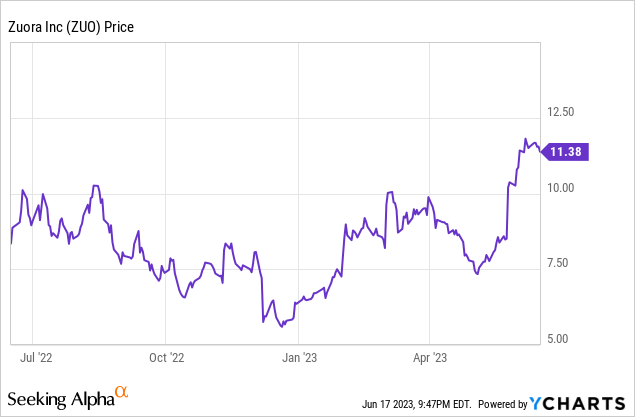

Zuora (NYSE:ZUO) is a good instance of this. This subscription revenue-management software program firm has seen its share value soar ~75% 12 months so far, with latest momentum fueled by a really sturdy Q1 earnings cycle. In my opinion, there’s nonetheless loads of upside left to go.

The bull case for Zuora resonates because it exhibits nice execution in a troublesome local weather

Earlier in April, I expressed a bullish opinion on Zuora with a $11.50 value goal on the corporate, on the time representing ~25% upside. I stay at a purchase score for Zuora inventory and am elevating my year-end value goal to $14, representing north of 20% additional upside on this inventory.

In my opinion, Zuora is a good instance of good execution in a difficult macro atmosphere. Although the corporate shouldn’t be resistant to slowing gross sales within the software program sector, it has pivoted its gross sales power in addition to its channel companions to specializing in smaller, sooner offers which have extra speedy ROI – as an alternative of chasing the multi-year, bigger offers which can be getting extra government scrutiny proper now. This strategy has allowed Zuora to publish constant progress charges that do not present a lot deceleration amid macro pressures.

Right here, for my part, is the total long-term bull case for Zuora:

- Subscription-based enterprise fashions have gotten dominant. Given the truth that an increasing number of companies are adopting any such mannequin, Zuora’s base of potential prospects has widened considerably. Zuora’s uniqueness on this regard can also be vital to level out: corporations can select an everyday ERP, however Zuora’s subscription-focused options assist to deal with frequent ache factors.

- Innovation monitor document is powerful; the product portfolio is increasing. There’s just about no different firm that markets itself as a purpose-built platform for subscription corporations. Zuora has additionally executed an excellent job at fleshing out its portfolio of options, starting from income administration to billing instruments to CPQ (configure, value and quote) purposes.

- Zuora grows together with its prospects. As Zuora’s shoppers develop their subscriber bases, so does Zuora’s alternative to monetize and develop alongside its prospects. The corporate has famous that upsells have hit a “document tempo”, and highlighted a number of key milestones like GoPro’s (GPRO) subscription-based storage and insurance coverage program (a key characteristic of the corporate’s deliberate turnaround) hitting a million subscribers.

- Offloading providers work to companions. As Zuora has scaled, it has additionally been capable of ramp up its third-party distributors and resellers to tackle extra of the unprofitable providers/onboarding work that sometimes acts as a drag on software-company margins. Zuora’s mixture of subscription versus providers income has grown over the previous a number of quarters, serving to increase gross margins and illustrating the place Zuora would favor to be at scale.

- Acquisition chance, particularly after the corporate hit breakeven. Whereas I by no means prefer to base any funding choice based mostly on excessive hopes that the inventory will get acquired, Zuora checks off lots of containers for being acquired: it is small with only a ~$1.5 billion market cap; it provides a really distinctive product that many bigger software program corporations might need to get their palms on, particularly throughout instances when natural progress is fading; and it has constructive professional forma working margins.

Valuation checkup and value goal

Even after Zuora’s latest rally, the inventory stays fairly modestly valued for my part. At present share costs north of $11, Zuora trades at a $1.56 billion market cap. Netting off the $396.9 million of money and $212.Three million of debt on Zuora’s most up-to-date steadiness sheet yields an enterprise worth of $1.38 billion.

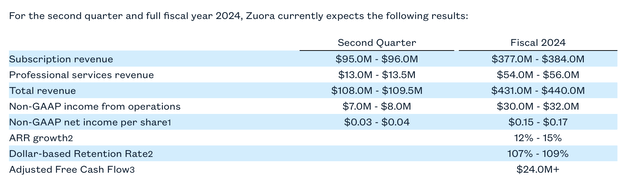

In the meantime, for the present fiscal 12 months FY24 (the 12 months for Zuora ending in January 2024), the corporate has guided to $431-$440 million in income, representing 9-11% y/y progress (contemplating the corporate’s 14% progress within the first quarter, this outlook may show mild).

Zuora outlook (Zuora Q1 earnings launch)

In opposition to the midpoint of this income outlook, Zuora trades at 3.2x EV/FY24 income. Once more, my up to date value goal on the corporate is $14, which represents a 4.0x EV/FY24 income a number of and ~22% upside from present ranges.

My advice is to proceed driving the upward momentum right here till Zuora hits that threshold.

Q1 obtain

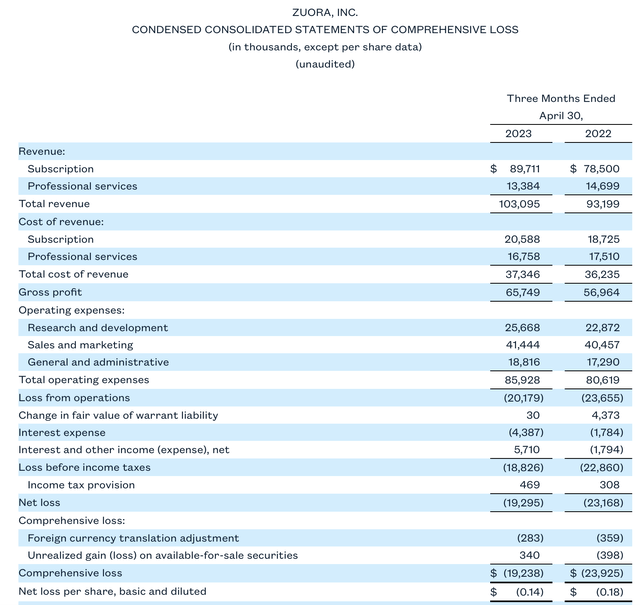

To hammer residence the purpose that Zuora has executed properly relative to expectations in addition to its personal modest valuation, we’ll now dig into the small print of Zuora’s newest quarter in additional element. The Q1 earnings abstract is proven under:

Zuora Q1 outcomes (Zuora Q1 earnings launch)

Zuora’s complete income grew 11% y/y to $103.1 million, beating Wall Road’s $102.1 million (+10% y/y) expectations. Subscription income continued to develop at a sooner tempo, up 14% y/y to $89.7 million, whereas skilled providers income declined. As a reminder to traders who’re newer to Zuora, the decline in skilled providers is each intentional and fascinating: the corporate has continued to contain extra channel companions to do integration work for shoppers, which Zuora continues to do at a loss. Opening the door for channel companions to take over this work offers Zuora entry to a wider pipeline than its personal gross sales workforce can deal with, plus helps with margin growth.

Zuora’s execution technique in Q1 was marked by an intentional shift to smaller, higher-confidence offers. Per CEO Tien Tzuo’s remarks on the Q1 earnings name:

On the similar time, patrons proceed to be cautious, realizing this in the beginning of the 12 months, we made some changes within the discipline to focus our sellers on smaller, sooner, new brand wins and these changes appear to be paying off. In actual fact, we closed extra new logos in Q1 than we did in any quarter of fiscal 12 months 2023 […]

Now, in fact, our companions proceed to be an vital a part of our technique. In actual fact, in Q1, over half of our go-lives included an SI associate. Given the macro backdrop, we’re adjusting with our companions as properly. We’re focusing with them on closing smaller, sooner lands that present a faster ROI.

In an atmosphere the place these international SIs are seeing much less demand for giant multiyear transformation offers. The excellent news is that Zuora options aren’t completely tied to such giant tasks. In actual fact, our SI companions are creating extra pipeline for us year-over-year.

So we’re seeing sooner lands, together with with our companions, however that’s solely a part of our land-and-expand technique.”

Key wins within the quarter included TELUS (TU), which is Canada’s second-largest telecom supplier, in addition to Gannett (GCI), a number one information company with greater than 2 million subscribers. The corporate nonetheless additionally maintained a excessive internet income retention price of 108%, versus 110% within the year-ago quarter: indicating that present prospects are nonetheless upselling.

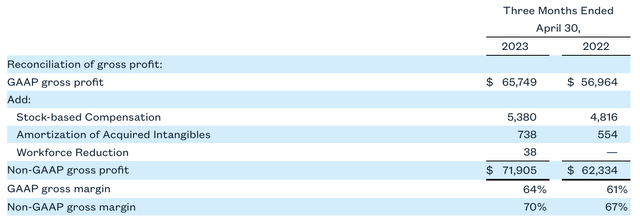

Zuora’s professional forma gross margins additionally inched upward by three factors to 70%. This was pushed each by a two-point increase in subscription gross margins to 81%, in addition to a extra favorable income combine shift away from loss-leading skilled providers and into subscriptions.

Zuora gross margins (Zuora Q1 earnings launch)

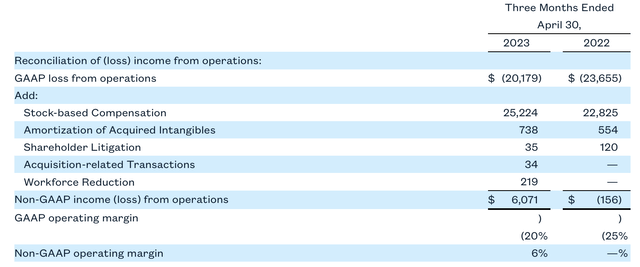

Professional forma working margins, in the meantime, expanded six factors to 6%, placing Zuora properly above breakeven when excluding inventory compensation.

Zuora working margins (Zuora Q1 earnings launch)

It is value noting as properly that FY24 free money stream is off to an excellent begin, with $13.zero million in FCF in Q1 greater than tripling the year-ago FCF of $3.7 million.

Key takeaways

After seeing the comforting success of Zuora’s gross sales execution on this difficult macro atmosphere, I am snug holding onto my Zuora inventory and increasing my value goal to $14 with ~20% further runway. Keep lengthy right here as the corporate continues to inch nearer towards its true valuation value.