Marjan Laznik/E+ through Getty Photos

Euphoric markets are inclined to get offers achieved. We noticed one other supply just lately from the Brookfield household that got here on the footsteps of two different purchases. Brookfield Infrastructure Company (BIPC) first purchased out Triton Worldwide Restricted. (TRTN). Then Brookfield Renewable Companions (BEP) took a small renewable asset portfolio off from Duke Power (DUK). Final week we realized that Brookfield Reinsurance (BNRE) provided $55 for American Fairness Funding Life Holding Firm (NYSE:NYSE:AEL).

We have a look at this deal from each events perspective and let you know the chance of the deal getting by means of.

The Firm

AEL, by means of its wholly-owned working subsidiaries, focuses on the sale of fastened index and stuck charge annuities. Their purpose is to assist present people protect their retirement {dollars} and in addition to offer a safe, predictable revenue they can not outlive. The business is at the moment getting a tailwind from larger rates of interest, which improves the margins on newly offered insurance policies. The inventory had been by means of some turbulence previous to this supply. Prosperity Group made after which withdrew its supply as AEL didn’t give them the time of the day.

Prosperity is withdrawing its proposal to accumulate American Fairness for $45.00 per share. Given American Fairness’s refusal to have interaction and our want to proceed solely on a constructive foundation, Prosperity has no real interest in persevering with to pursue our proposed transaction at the moment.”

Supply: In search of Alpha

AEL divided 12% on that day as buyers suffered from the rug pull. The brand new supply although has some strong credentials.

Brookfield Reinsurance delivered a letter to the board of administrators of AEL setting forth a proposal to accumulate all the excellent shares of widespread inventory of AEL not already owned by Brookfield Reinsurance for mixture consideration of $55.00 per AEL share.

As consideration for every AEL share, shareholders will obtain $38.85 in money and a variety of Brookfield Asset Administration Ltd. (BAM) (BAM:CA) class A restricted voting shares (“BAM Shares”) having a price equal to $16.15 based mostly on the unaffected 90-day VWAP as of June 23, 2023, leading to complete consideration of $55.00 per AEL share.

Supply: In search of Alpha

BNRE has provided greater than 20% larger than the supply from Prosperity. One may argue that the market situations are a bit higher at this time than when the previous supply got here by means of, however there have definitely been extra stresses on the monetary sector since then. BNRE additionally owns 20% in AEL already. That is key as BNRE doubtless has a finger on the heart beat of AEL board members. AEL also can not dismiss a 20% current shareholder as simply as they might dismiss Prosperity. We give this deal a 95% plus likelihood of getting achieved.

Who Advantages From This?

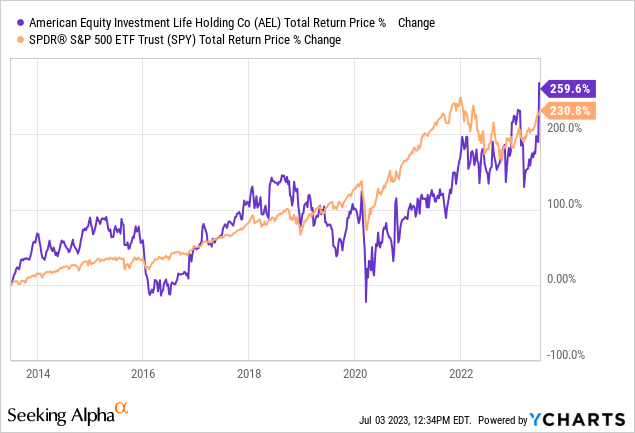

AEL exiting at $55 wouldn’t be the worst factor for the inventory holders. Only a few monetary sector shares have overwhelmed the S&P 500 during the last decade. If this deal does undergo, AEL may have achieved that.

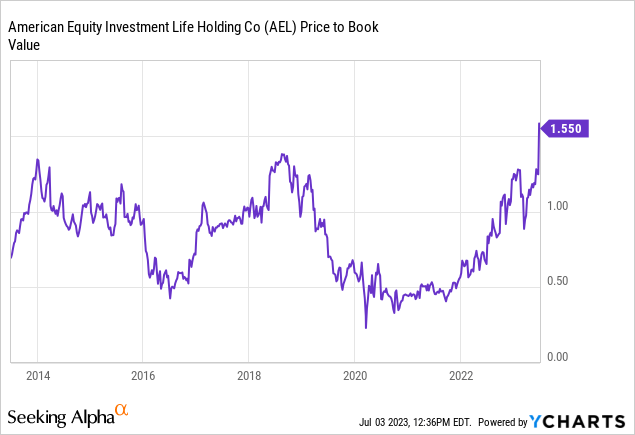

AEL can be taken out close to 1.6X on a worth to ebook worth, a quantity that may be larger than the best achieved by the corporate within the final decade. Once more, not a nasty exit from a valuation perspective.

What About The Different Facet?

BAM shares shall be issued however BAM is not going to take part within the fairness funding or have any publicity to the insurance coverage liabilities. The shares issued will come from Brookfield Company’s (NYSE:BN) holdings in BAM. BAM will get the profit right here of changing into AEL’s funding supervisor. On final examine, AEL has an enormous asset base, far in extra of its public market capitalization or shareholder fairness.

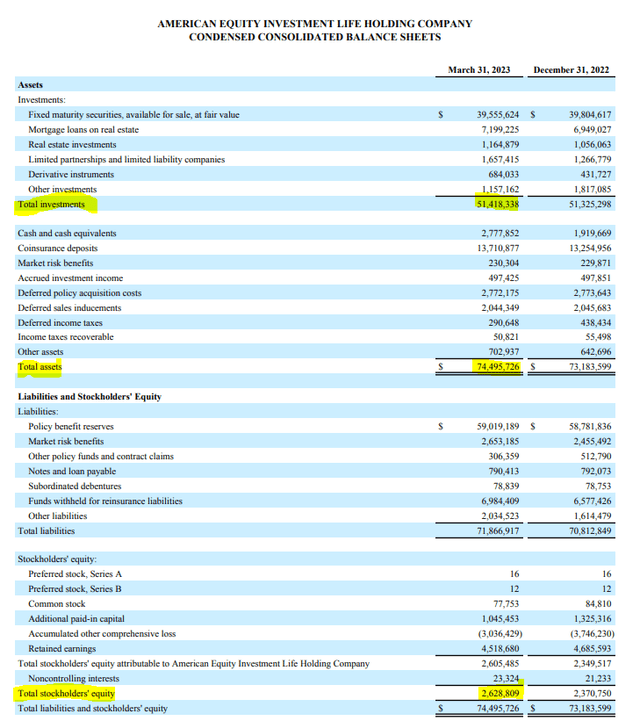

AEL Steadiness Sheet

That is customary within the case of life insurance coverage corporations and the important thing quantity right here is the $51 billion funding portfolio. BAM shall be managing that and over time it is going to turn out to be a part of its Payment-Associated-Earnings or FRE portfolio. Assuming the usual 25 foundation factors of FRE, this might add an extra $125 million to revenues and doubtlessly $115 million to earnings. Most marginal income interprets into earnings at BAM at this stage of the corporate progress.

How To Play It?

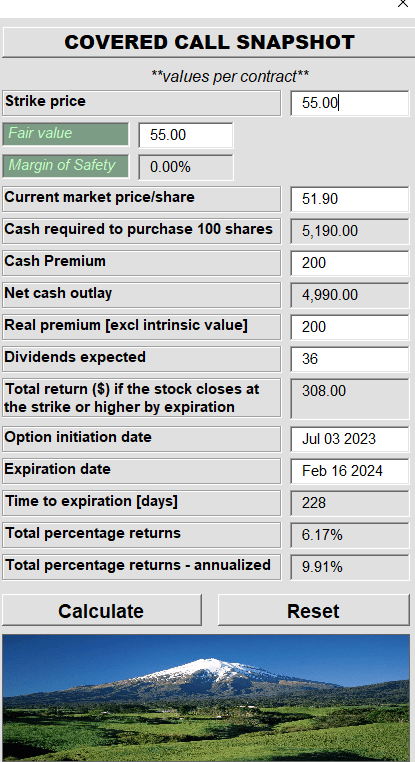

The deal doubtless goes by means of at or close to the present supply worth. If BNRE made the supply, they doubtless will not shrink back from paying somewhat further if AEL presses on it. In actual fact they may have anticipated that and made the preliminary overture with the thought they might increase it later. With AEL inventory buying and selling at $52.00 as we write this, how can one play it? Assuming it goes by means of at $55.00 inside 9 months, you do stand to make $3.00 and the small dividend. Whereas that’s good, it doesn’t beat the risk-free charge by sufficient. We choose to play this on the AEL aspect with a coated name. As proven under the “yield” is 9.91% annualized.

Creator’s Calculator

However this ignores the appreciation to $55.00 from the present strike. Your complete returns needs to be barely greater than double what’s proven from the coated name portion (assuming the deal closes by then). Additional this additionally captures a few of your upside ought to the ultimate supply be revised larger. For the reason that bulk of the supply is money, an fairness portion doesn’t current a cloth danger.

On the Brookfield aspect, we’re warming up the BN (and BNRE for that matter, the shares are equal) at or close to the $30 mark. We just lately initiated a starter place there with coated calls. We predict that may be a much better worth than BAM shares buying and selling at 24X earnings.

Please notice that this isn’t monetary recommendation. It might seem to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their aims and constraints.