Maddie Meyer

Moderna (NASDAQ:MRNA) was one of many high performing biotech shares throughout the 2020 COVID-19 wave that despatched many hovering to the moon. The corporate produces vaccines that stop COVID-19 signs by releasing mRNA into the human physique to create a spike protein for optimum immune response.

In keeping with Healthline, researchers discovered that the Moderna vaccine was over 95% efficient at stopping sickness, hospitalizations, and COVID-19 associated deaths.

Sadly, specialists predict one other huge COVID-19 wave beginning in September 2023 when faculties reopen, and workers return to the office.

Which means corporations like Moderna will probably expertise a pointy enhance in income resulting from individuals dashing to get mRNA vaccines in an try to beat the upcoming COVID-19 wave.

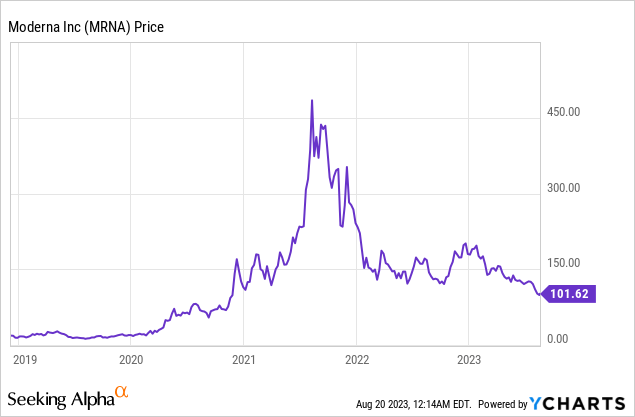

Whereas many shares received crushed throughout the 2020 COVID-19 pandemic, Moderna skilled a large enhance in share value from $20 to over $450 at its peak.

To make issues clear, I am neither for nor towards getting vaccinated as a strategy to stop the COVID-19 virus. This text is supposed for fairness evaluation solely and I am not taking a political or humanitarian stance on the jab.

Moderna Upgraded Its Steerage for Q3 & This autumn 2023

Seasonality has a serious impact on Moderna’s income and web revenue resulting from spikes and dips into COVID-19 vaccination wants. The corporate posted Q2 2023 income of $344 million with a web lack of $1.38 billion.

Within the newest Q2 2023 earnings name, Moderna CEO Stephen Hoge elevated gross sales steering to round $6-$Eight billion within the 2nd half of 2023 in anticipation of a spike in COVID-19 circumstances. Gross margins are projected to be round 60 to 65% whereas Yahoo! Finance studies revenue margins at round 11%.

Moderna additionally purchased again $600 million value of MRNA inventory throughout Q2 2023. Firms routinely carry out inventory buybacks when administration believes shares are undervalued.

The corporate held $14 billion in money on its stability sheet on the finish of Q2 2023 with $1.7 billion in long run debt.

I anticipate web revenue margins to enhance drastically heading into the tip of Q3 2023 as soon as the autumn COVID-19 wave arrives.

Have Moderna Shares Bottomed On account of a Projected COVID-19 Fall Wave?

Well being specialists are predicting a large spike in COVID-19 circumstances beginning round September 1st because the climate adjustments and everybody heads again to highschool and the office.

The most recent COVID-19 variant, Eris, has prompted a spike in COVID-19 circumstances worldwide with international locations reminiscent of the US, Canada, United Kingdom, and lots of others reporting spikes in circumstances and hospitalizations.

Moderna made a swift transfer by engaged on its most up-to-date vaccine to struggle Eris and early clinic trials reported excessive success charges in response to the most recent virus pressure.

MRNA shares crashed to a 52-week low of $95 till the information broke and despatched shares simply above $100 at present. Moderna shares look engaging at an RSI of 31 on the MRNA weekly chat.

Moderna Weekly Chart (tradingview.com)

I am predicting an inverse impact the place MRNA shares will commerce greater as we head into This autumn whereas most huge tech shares reminiscent of Tesla (TSLA) and Apple (AAPL) proceed promoting off on the worrisome information.

MRNA was one of many few shares that did not expertise the March 2023 COVID-19 crunch however quite elevated income to $20 billion and $18 billion, respectively, throughout 2021 and 2022.

Threat Elements

Moderna is arguably the most effective pure COVID-19 inventory to personal for my part however there are a number of threat elements that traders ought to play pay attention to:

- Insider Promoting: Moderna President Stephen Hoge bought 15,000 MRNA on August 17th on the value of $100. Insider promoting is a bearish sign, however the excellent news is he nonetheless owns 1.5 million MRNA shares. If insiders proceed promoting, then maybe MRNA shares might crash under $100 till they discover a backside.

- NASDAQ Panic Selloff: Hedge fund supervisor Michael Burry opened a large put place on the QQQ and SPY in late August signaling his bearish market sentiment. Whereas Moderna is not part of the QQQ, I feel most traders are turning bearish on shares basically.

- Falling COVID-19 Circumstances: COVID-19 circumstances are up practically 100% in August 2023 versus July 2023, however we aren’t positive what’s going to occur shifting ahead. If COVID-19 circumstances do not enhance, then the demand for Moderna vaccines will stay decrease than projected.

- Failure to Obtain FDA approval for Eris Vaccine: Early trials present for the Eris vaccine turned out optimistic, however Moderna should look ahead to FDA approval. If Moderna’s vaccine will get rejected, then the corporate can not fulfill its raised steering projections.

- Enticing Bond and Cash Market Yields: Wall Avenue Journal reported that Individuals moved $36 billion into cash market funds in August to benefit from 4%+ yields with very low threat.

My Gameplan for MRNA Inventory

All indicators level to an enormous enhance in MRNA’s inventory value if the autumn COVID-19 wave predictions come true. I am holding a number of MRNA name choices at numerous strike costs of round $105 to $107 over the following few weeks.

I am additionally looking at some longer-term choices across the $200 strike value expiring in January 2024 and April 2024.

If Moderna’s vaccine will get authorised in early September, then Q3 and This autumn 2023 earnings studies ought to simply beat Wall Avenue analysts’ estimates.

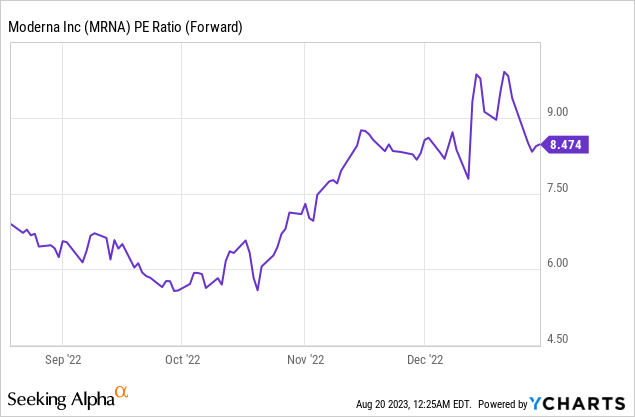

MRNA trades at a ahead P/E ratio of Eight and I feel Moderna is among the finest worth shares in the marketplace proper now.

Moderna is a money cow firm that raked in $12.2 billion in earnings for 2021 and $8.three billion in earnings for 2022. One other COVID-19 outbreak would offer substantial upside for my part contemplating how the market reacted to COVID-19 initially of 2020.