aerogondo

Introduction

The Vancouver, British Columbia-based GoldMining Inc. (NYSE: NYSE:GLDG) (GOLD: CA), a junior exploration firm, introduced its second-quarter outcomes on July 13, 2023.

Observe: I’ve been overlaying GLDG recurrently since December 2020. This text updates my previous article, revealed on June 20, 2023.

1 – GoldMining Inc. belongings

As of July 2023, the corporate owns 4 distinct entities:

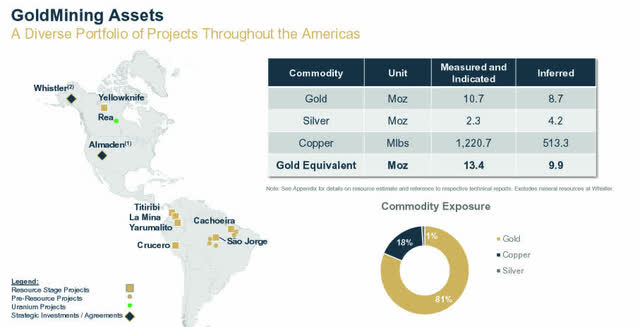

- GoldMining: a 100% owned US firm with a complete M&I useful resource of 13 Au Moz from massive gold and copper initiatives.

- Gold Royalty (GROY) with a 15% possession.

- U.S. GoldMining Inc.(USGO) with 80% possession.

- NevGold (NAU: TSX-V)

GLDG Current Snapshot (GLDG Presentation)

The corporate’s complete gold mineral assets measured and indicated are 13.Four Moz, and 9.9 Moz inferred.

GLDG Map Belongings (GLDG Presentation)

GoldMining owns 15 initiatives (phases and pre-resources) within the Americas (Au and Cu with one uranium), together with 4 in North America. A complete of 9 initiatives are on the mineral assets stage.

1.1 – The U.S. GoldMining (80% possession plus warrants)

It’s a separate public firm targeted totally on advancing the Whistler gold-copper challenge in Alaska, USA.

The Whistler Challenge is totally permitted for exploration following the receipt of an amended allow in July 2023 from the Alaska Division of Pure Sources, which is able to allow potential growth of the Program if warranted sooner or later.

On August 21, 2023, the corporate introduced that:

the graduation of the Firm’s 2023 Part 1 Drilling Program at its 100% owned Whistler gold-copper challenge in Alaska, USA… Together with core drilling of an preliminary 5,000 meters at Whistler.

…On completion, this up to date mineral useful resource estimate will underpin a proposed Preliminary Financial Evaluation (“PEA”) which is presently anticipated to start within the second half of 2024.

GLDG USGO (GLDG Presentation)

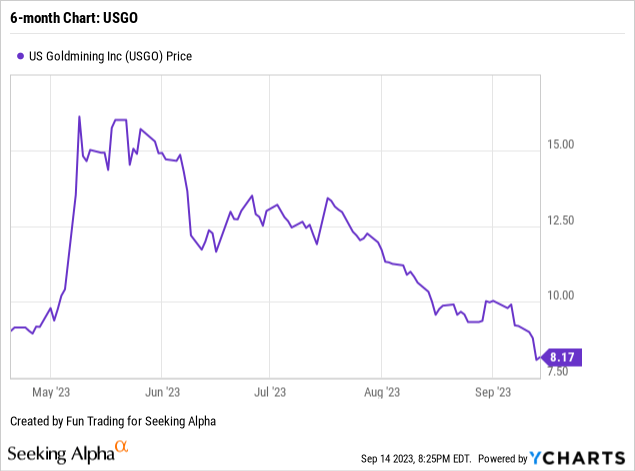

U.S. GoldMining Inc. shortly dropped from its excessive in Could and is now buying and selling at $8.17 per share after over three months.

As of Could 31, 2023, the Firm owns 9,878,261 US GoldMining Shares and 122,490 warrants to buy US GoldMining Shares. The shares owned by the Firm (excluding warrants) had a market worth of US$80.71 million on September 15, 2023.

After Could 31, 2023, US GoldMining agreed with a technical marketing consultant to handle an exploration program for the Whistler Challenge. The settlement consists of an authorized work order totaling $5.Three million, from June 1, 2023, to February 29, 2024.

1.2 – Gold Royalty Corp.

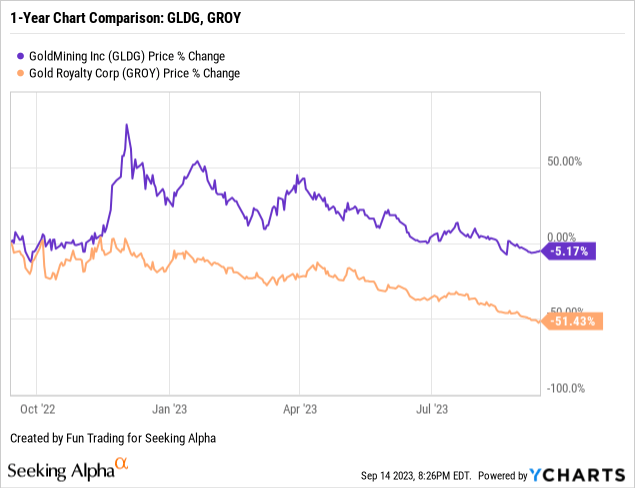

The corporate has 15% possession in Gold Royalty Corp. (GROY). GLDG and GROY have dropped considerably since November 2022 and are down 5% and 51%, respectively, on a one-year foundation.

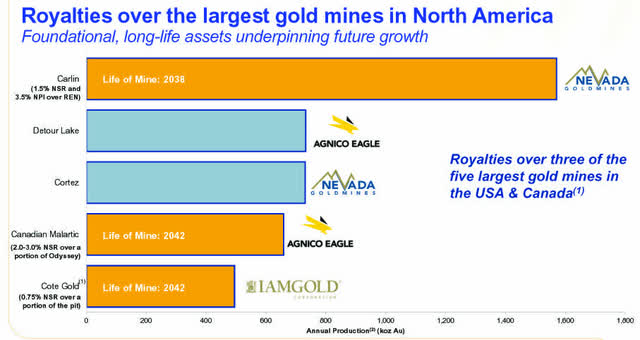

Gold Royalty has an in depth portfolio of over 200 royalties, together with these from North America’s largest gold mines.

GROY Primary Royalties Presentation (GROY Presentation)

Gold Royalty is now offering money move to GLDG by way of its royalties and streams intensive portfolio. Gold Royalty pays a yearly dividend of $0.04 with a dividend yield of 2.92%.

As of Could 31, 2023, the Firm owns 21,301,253 shares of NYSE American-listed Gold Royalty Corp. (“GRC”). The shares owned by the Firm had a good worth of C$55.Eight million on Could 31, 2023.

2 – Funding Thesis

As I’ve mentioned in my prior article, the funding thesis for GLDG and most of its subsidiaries relies largely on religion, and investing in such shares is notoriously dangerous and unpredictable.

All the enterprise mannequin contains many “potentials” that sound credible sufficient to draw funding however are removed from a sure success. Thus, I warn potential buyers about investing an excessive amount of on this firm, which can or might not repay quickly, in all probability after a painful dilution (the corporate makes use of its inventory as foreign money by way of an ATM program).

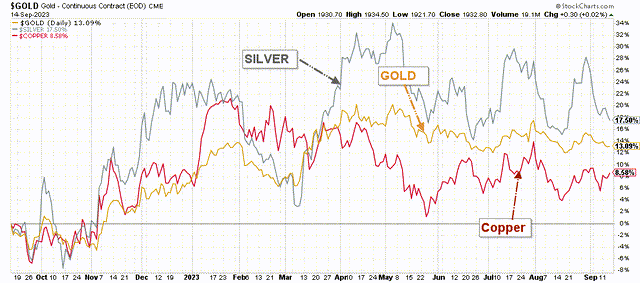

Crucial variable for the inventory worth is the value of gold and different metals. Relying on the pattern and curiosity within the metallic, GLDG will fluctuate relying on its attractiveness.

To this point, gold is holding above $1,900 and will flip bullish subsequent week, relying on the FED choice.

A bullish gold outlook might push GLDG above $1 once more. Nevertheless, nothing is assured with Jerome Powell, and he might announce a pause this month adopted by a attainable 25-point enhance the next month, which the Market won’t welcome.

Oil costs have jumped considerably previously few months, and inflation is growing once more – The CPI for August was 3.7% – one other situation for the gold worth.

GLDG 1Year Chart Gold, Silver Copper (Enjoyable Buying and selling StockCharts)

Therefore, I counsel retaining a small long-term GLDG holding as a protracted guess, however it’s essential to recurrently commerce short-term LIFO over 80% of your place.

GoldMining – Monetary Snapshot 2Q23 – The Uncooked Numbers

Observe: All numbers under are indicated in $US. Filings launched by the corporate are in C$.

| GoldMining | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Complete Revenues in $ Million | 0 | 0 | 0 | 0 | 0 |

| Web Earnings in $ Million | -2.23 | -2.23 | -3.26 | -4.54 | -5.12 |

| EBITDA $ Million | -2.38 | -1.75 | -2.89 | -2.66 | -4.18 |

| EPS diluted in $/share | -0.02 | -0.02 | -0.02 | -0.03 | -0.03 |

| Working Money Move in $ Million | -2.07 | -2.04 | -2.34 | -2.88 | -4.10 |

| Capital Expenditure in $ Million | 0.09 | 0 | 0 | 0.17 | 0.22 |

| Free Money Move in $ Million | -2.16 | -2.04 | -2.34 | -3.05 | -4.31 |

| Complete Money $ Million | 6.82 | 3.11 | 6.20 | 5.68 | 19.28 |

| Complete Long run Debt (together with present) In $ Million | 9.85 | 7.26 | 6.56 | 4.90 | 3.21 |

| Shares excellent (diluted) in Million | 152.35 | 155.11 | 158.34 | 166.88 | 168.72 |

Supply: Firm launch

The corporate has $3.21 million in debt and $19.28 million in money in 2Q23. Shares Excellent diluted jumped to 168.72 million.

The rise in money and money equivalents was primarily the results of money proceeds from the ATM program and web proceeds from US Goldmining’s IPO through the six months that ended Could 31, 2023.

For the three-month ended Could 31, 2023, the Firm incurred a complete working lack of $5.12 million, in comparison with $4.54 million on February 28, 2022.

ATM program:

In the course of the three months ended Could 31, 2023, the Firm issued 1,657,709 frequent shares beneath the ATM Program for gross proceeds of $2,403, with mixture commissions paid to brokers of $60.

Technical Evaluation and Commentary

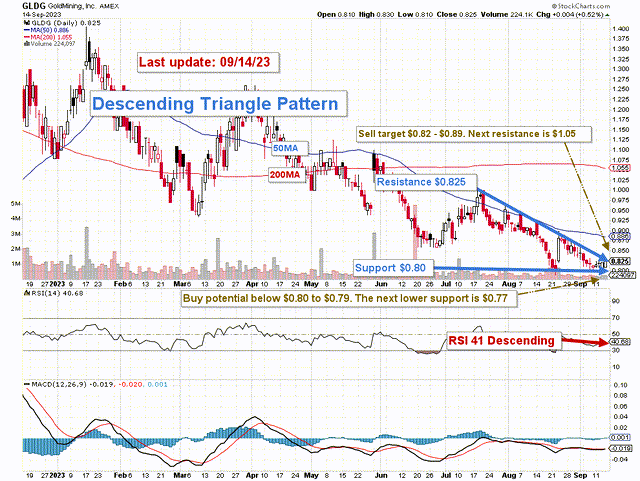

GLDG TA Chart Brief-Time period (Enjoyable Buying and selling StockCharts)

GLDG kinds a descending triangle sample with resistance at $0.825 and assist at $0.80. We’re on the finish of the sample life (Apex), and it’s maybe time to attend for a attainable breakout, which is able to rely upon the FED’s choice on curiosity.

A daily descending triangle sample is usually thought of a bearish chart sample or a continuation sample with a longtime downtrend. Nevertheless, a descending triangle sample may also be bullish, with a Breakout: Definition, Which means, Instance, and What It Tells You in the other way, and is called a reversal sample.

I counsel promoting between $0.82 to $0.89 with potential greater assist at $1.05 and accumulating a small place between $0.80 and $0.79 with attainable decrease assist at $0.77.

A warning: the inventory is topic to wild swings often and customarily is difficult to commerce, missing liquidity.

Watch the gold worth like a hawk.

Warning: The TA chart have to be up to date regularly to be related. The chart above has a attainable validity of a few week. Bear in mind, the TA chart is a device solely that can assist you undertake the correct technique. It isn’t a strategy to foresee the longer term. Nobody and nothing can.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.