JHVEPhoto

UGI Company (NYSE:UGI) unveiled a fancy monetary narrative in Q3 2023, marked by vital variances in its earnings. This report showcased a decline in each GAAP diluted EPS and adjusted diluted EPS when set in opposition to the backdrop of the earlier yr’s figures. Regardless of the soundness in its year-to-date EBIT, the contrasting earnings per share from the previous yr develop into discernible. Past the mere numbers, the corporate’s choice to divest from European markets indicators a vital shift in its overarching enterprise technique. This text evaluates UGI’s monetary and technical standing to establish potential funding prospects for long-term buyers. Notably, the inventory worth is presently at pivotal long-term help ranges and reveals indications of a turnaround.

UGI Company’s Monetary Efficiency

UGI launched its monetary outcomes for Q3 2023. On this quarter, UGI reported a GAAP diluted EPS of $(3.76) and an adjusted diluted EPS of $0.00. These numbers present a decline from the prior-year interval, whereby the GAAP diluted EPS was $(0.03) and adjusted diluted EPS was $0.06.

When inspecting the year-to-date efficiency, the GAAP diluted EPS was reported at $(7.78) and the adjusted diluted EPS was $2.81. That is additionally in distinction to the prior-year interval, which noticed a GAAP diluted EPS of $3.84 and an adjusted diluted EPS of $2.90. Nevertheless, the year-to-date EBIT for the corporate’s reportable segments remained nearly constant at $1,076 million, a slight drop from $1,079 million within the earlier yr. The corporate additionally highlighted its strong liquidity at roughly $1.eight billion as of June 2023. The chart under illustrates the annual revenues and internet earnings. Notably, UGI reported a lack of ($789) million in Q3 2023. Nevertheless, the overall trajectory for long-term income and internet earnings remains to be optimistic. The cumulative internet earnings for the yr ending June 30, 2023, is $1,354 million.

Strategically, UGI introduced definitive agreements to divest its pure gasoline and energy advertising enterprise in Belgium, anticipated to conclude by the tip of fiscal 2023. Moreover, UGI is ready to clear particular pure gasoline and energy advertising portfolios in France and the wind and photo voltaic portfolio within the Netherlands by the primary and second quarters of fiscal 2024, respectively.

Roger Perreault, President and CEO of UGI Company, emphasised the corporate’s dedication to strategic execution and enhancing monetary flexibility. The quarter noticed a discount in whole debt at AmeriGas and a transfer to divest a good portion of the non-core European power advertising companies. Regardless of the upper gasoline charges, buyer progress, and different optimistic elements, the adjusted earnings suffered on account of elevated operational and administrative bills throughout all reportable segments. Given the efficiency through the first 9 months and expectations for This fall, the fiscal 2023 adjusted diluted EPS is projected to lie on the decrease finish of the $2.75 to $2.90 steering vary.

Within the current segment-wise efficiency breakdown for UGI Company, AmeriGas Propane skilled a $2 million rise in EBIT, credited to higher LPG unit margins. Nevertheless, this was considerably counterbalanced by escalated operational and administrative expenditures, notably in areas like worker compensation, promoting, and vehicular prices. UGI Worldwide confronted a $four million dip in EBIT, primarily on account of a drop in margins from non-core power advertising operations and inflation-induced operational prices, mitigated partly by heightened LPG margins. The Midstream and Advertising section recorded a $Three million decrement in EBIT, linked to a decline in capability administration margin. Nevertheless, this was partly compensated by an uptick in advertising margin and the earnings from the Pennant acquisition. Lastly, the Utilities section witnessed a $6 million discount in EBIT, with elevated margins counteracted by surging operational and administrative prices.

UGI Company is actively enhancing its monetary place, specializing in sustainable value financial savings, higher earnings high quality, and strengthening the steadiness sheet to make sure long-term shareholder worth and future earnings progress.

Deciphering Technical Help Indicators for UGI Company

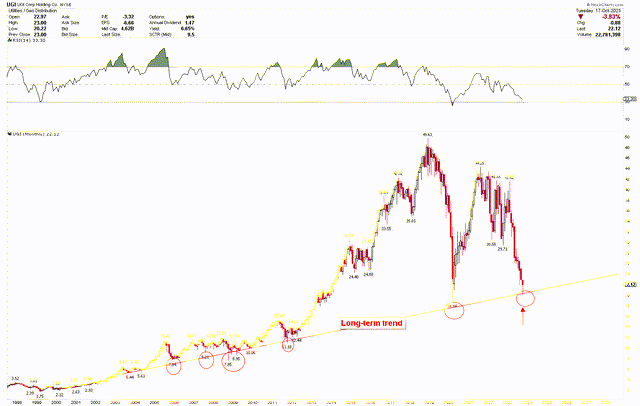

The month-to-month chart under signifies a optimistic long-term trajectory for UGI Company. This chart presents a long-term trendline spanning from the 2004 lows to its all-time peak. Costs have persistently marked their lows on this line, with a notable surge in momentum after 2011, pushing the value to an all-time excessive of $49.63. Such a pronounced rise is attributed to vital shifts within the power sector: oscillating world oil and gasoline charges, geopolitical disruptions, and legislative alterations, all impacting sector inventory values. UGI Company’s strategic strikes, together with acquisitions, divestments, and diversifying its portfolio, added layers of intricacy to its inventory efficiency. Components reminiscent of UGI’s intermittent earnings, market shifts, and broader financial indicators additional amplified these fluctuations. Moreover, UGI’s enlargement into world markets and responsiveness to altering power dynamics heightened inventory worth volatility.

UGI Month-to-month Chart (stockcharts.com)

Nonetheless, costs peaked robustly at $49.63 earlier than retreating in the direction of the foundational development set in 2004. This vital dip resembles a sturdy market, mirroring earlier corrections after the steep climbs between 2012 and 2018. At the moment, the inventory stands at a formidable help degree, hinting at a possible bounce again. The upcoming October month-to-month candle suggests an upward shift. Concurrently, the RSI is nearing an oversold state.

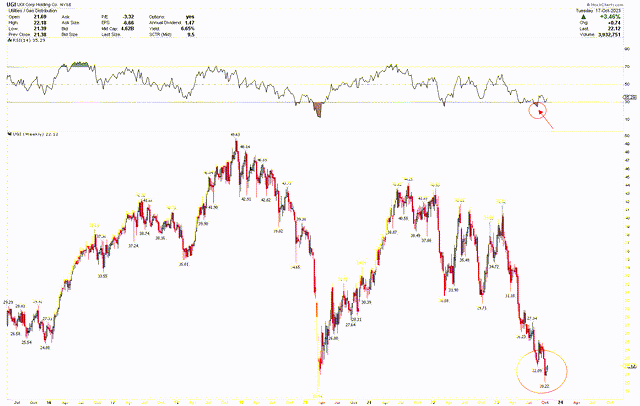

For a extra detailed perspective, the weekly chart under showcases appreciable worth volatility. A powerful restoration at these ranges produced an inside bar final week, poised to be surpassed this week. But, the weekly chart’s reversal does not firmly verify that the underside is hit, primarily on account of excessive volatility, which distorts conventional patterns, making worth forecasts trickier. It is also evident from the weekly chart that the value is nearing an oversold state, anticipating a sturdy restoration.

UGI Weekly Chart (stockcharts.com)

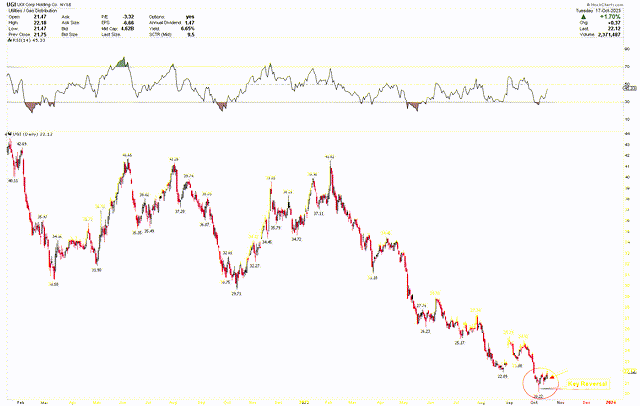

A resurgence of bullish exercise is obvious upon inspecting the every day chart intently. A reversal candle at a low of $20.22 signifies potential upward market shifts. Although the dominant development leans in the direction of a decline, this vital reversal at a well-established help degree hints at attainable upcoming rises. It is conceivable that costs could discover steadiness at this help degree earlier than embarking on a pronounced upward surge.

UGI Each day Chart (stockcharts.com)

Market Threat

There’s been a noticeable decline in earnings, each in GAAP diluted EPS and adjusted diluted EPS, yr over yr. This downturn is compounded by heightened operational and administrative prices throughout all enterprise segments, together with will increase in worker compensation, promoting, and vehicular expenditures.

Whereas UGI boasts a sturdy liquidity place at $1.eight billion, signaling monetary resilience, its choice to divest from particular European markets, though strategic, might have an effect on short-term revenues. The challenges prolong to segmental performances, with a number of of UGI’s divisions, reminiscent of UGI Worldwide and Utilities, reporting lowered EBIT.

Furthermore, the technical evaluation means that the corporate is likely to be approaching a turnaround. The long-term trajectory for UGI stays encouraging, with inventory costs indicating constant progress since 2004. Nevertheless, current volatility, primarily seen within the weekly chart, may deter short-term buyers. A month-to-month shut under $18.94 might disrupt the long-term development, doubtlessly resulting in a major worth decline.

Backside Line

UGI Company skilled a turbulent third quarter in 2023, marked by a decline in its GAAP diluted EPS and adjusted diluted EPS in comparison with the earlier yr. Though the year-to-date EBIT remained comparatively secure, vital variances in earnings paint a nuanced monetary story. UGI’s choice to divest from particular European markets signifies a pivotal change in its enterprise trajectory. Constructive indicators, reminiscent of rising gasoline costs and an increasing buyer base, are counterbalanced by elevated operational prices throughout all segments. This upward stress on bills, mixed with lower-than-expected earnings, has raised issues about UGI’s short-term monetary outlook regardless of the agency’s strong liquidity place.

Regardless of going through hurdles, the inventory worth has reached strong long-term help and is displaying indications of an upward momentum. The inventory returns from its long-term development line, and every day charts recommend worth stability. Buyers could think about shopping for on the present worth level, because it appears to be settling and has potential for future progress. Ought to the value lower additional, buyers can think about growing their holdings, supplied the value stays above $18.94 on a month-to-month closing foundation.