Klaus Vedfelt

I up to date Airbnb, Inc. (NASDAQ:ABNB) traders in early September, explaining that ABNB’s restoration appears strong, though the market had probably priced in its entry into the S&P 500 (SPX) (SPY). As a consequence, I urged traders to contemplate ready for a steep pullback earlier than contemplating the suitable ranges so as to add publicity.

That thesis performed out as ABNB fell along with the broad market after topping out in mid-September, declining greater than 25% earlier than forming its October 2023 lows. Accordingly, astute dip patrons returned with conviction, given ABNB’s much-improved threat/reward profile, underpinning its prevailing medium-term uptrend.

I’ve already turned extra constructive on ABNB since February 2023 once I assigned it a Promote ranking, which panned out as ABNB then fell to its Might lows. Nonetheless, I additionally indicated in my September replace that “bearish views on ABNB are not defensible, as shopping for sentiments level to an impending restoration.”

The corporate’s third-quarter or FQ3 earnings launch in early November corroborated my conviction that it’s on its technique to a long-term cyclical restoration. As well as, the trade’s cyclical tailwinds are anticipated to drive development additional after digesting the surge from its summer season journey season.

I’ve confidence that Airbnb is uniquely positioned to capitalize on its community impact moat, underpinned by the strong provide development from particular person hosts. As well as, administration underscored that it has continued to look at sturdy demand dynamics from vacationers in search of to capitalize on Airbnb’s worth proposition. Because of this, households searching for an inexpensive keep discover the corporate’s choices interesting, though it “caters to a various vary of vacationers.”

Curiously, administration highlighted that the evolution of its common day by day price or ADR is anticipated to stay “extra moderated in comparison with accommodations, that are anticipated to proceed growing costs.” Due to this fact, Airbnb ought to proceed to search out value-seeking vacationers trying to mitigate the influence of elevated macroeconomic uncertainties and excessive inflation charges. The corporate has additionally enhanced its pricing instruments to assist its hosts have extra management over their costs and probably stimulate demand. Administration indicated that “greater ADR tends to lead to decrease night time development, whereas decrease ADR results in greater night time development.” Because of this, I consider traders should not anticipate a big development inflection in its ADR as Airbnb appears towards gaining market share in its subsequent growth part.

Observant traders ought to know that Airbnb elevated its CFO, Dave Stephenson, to Chief Enterprise Officer. CEO Brian Chesky confused that Airbnb “is at an inflection level, having targeted on perfecting its core service in 2023 and now being ready to maneuver ahead.” The corporate was fairly clear about what “broaden past the core” means when it up to date traders in its Q3 shareholder letter. It highlighted its focus “on worldwide growth and constructing differentiated choices.” As well as, administration additionally indicated that Airbnb stays “under-penetrated in worldwide markets,” because it noticed strong ends in Germany, Brazil, and Korea. Notably, Airbnb accentuated that in Korea, Airbnb posted a 54% improve in gross nights booked in Q3 in comparison with the identical interval in 2019.

Airbnb is anticipated to ship an adjusted EBITDA margin of 36% for FY23. As well as, ABNB is anticipated to publish a free money movement or FCF margin of greater than 44% this 12 months. Because of this, I concur with Chesky that the corporate ought to capitalize on its strong profitability to tackle the legacy OTAs and resort operators in worldwide markets on this subsequent development part, having validated its enterprise mannequin impressively within the US.

Nonetheless, regulatory challenges would probably stay the primary hindrance over a extra aggressive international growth part. Due to this fact, resort operators may set off a extra intense pushback towards Airbnb. Stephenson’s appointment is anticipated to be pivotal as the corporate embarks on what might be a extra intense funding part, having guided Airbnb’s exceptional profitability inflection from its pandemic challenges. However the warning, administration accentuated that “80% of their high 200 markets have rules in place.” Because of this, administration is optimistic about “workable options for house sharing, supporting Airbnb’s development.” Nonetheless, I consider regulatory challenges in worldwide markets are anticipated to be a key development obstacle that traders should watch intently, as ABNB is priced at a premium.

ABNB final traded at a ahead EBITDA a number of of 20.8x, nicely above its hospitality friends’ median of 12.1x (in line with S&P Cap IQ knowledge). Because of this, the market continues to replicate a discernible development premium on ABNB to take care of its development profile.

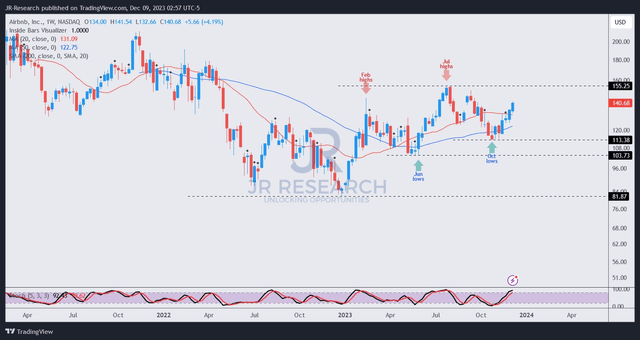

ABNB value chart (weekly) (TradingView)

ABNB’s value motion is constructive, with dip-buyers returning to defend its October low ($113 degree) aggressively. Because of this, ABNB has maintained its uptrend bias, suggesting we may break above its July 2023 excessive ($155 degree) to validate its uptrend continuation.

However my optimism, I have to spotlight that ABNB’s purchase degree is not within the optimum purchase zone if traders did not handle to capitalize on the steep selloff to mark its October low.

Regardless of that, I am more and more assured that purchasing sentiments on ABNB stay constructive, suggesting the restoration in its uptrend continues to be within the earlier levels. Because of this, ABNB holders trying so as to add extra shares ought to take into account profiting from potential near-term pullbacks to purchase extra aggressively.

Score: Upgraded to Purchase.

Necessary word: Traders are reminded to do their due diligence and never depend on the knowledge supplied as monetary recommendation. Please at all times apply unbiased considering and word that the ranking shouldn’t be meant to time a selected entry/exit on the level of writing except in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a important hole in our view? Noticed one thing vital that we didn’t? Agree or disagree? Remark beneath with the purpose of serving to everybody locally to study higher!