cyano66/iStock through Getty Photos

Above: Sports activities advert gaming is in a double-digit CAGR development cycle.

- New Flutter Leisure plc (PDYPF, PDYPY) ticker FLUT will start buying and selling on the NYSE on January 29th.

- ADR holders must contact brokers or sponsoring banks for professional rata funds as a part of the compelled promote course of.

- The itemizing for the primary time will give readability to buyers in evaluating, in {dollars}, FLUT to different sector leaders.

We’re guiding the NYSE debut as a powerful purchase.

Premise: On November 12, we reiterated a powerful BUY suggestion on the shares of Flutter Leisure, the UK/Eire-based largest on-line wagering operator on the globe. We targeted on the US-traded ADR (OTCPK:PDYPY) with a worth goal (“PT”) of $117. That decision assumed a seamless buying and selling profile of the inventory, because it was not but clear when the UK dad or mum would affirm a date for its plan to commerce the inventory on the NYSE and drop its Dublin itemizing.

The underlying propulsion for the ADR has all the time been the efficiency of FLTR’s U.S. enterprise flagship, FanDuel, which holds the largest share of market with DraftKings Inc. (DKNG). The 2 high websites trade the #1 share of market place nearly month-to-month. At this writing, FanDuel sits at #1 with 39.3% vs. DKNG at 34.1%. DKNG has been #1 as many occasions as has PDYPY. What’s most essential right here is that, mixed, they produce over 73% of the month-to-month wins within the U.S.

The one double-figured peer among the many 15 lively websites available in the market is BetMGM (50% owned MGM Resorts Worldwide (MGM) and the UK’s Entain Plc (OTCPK:GMVHF), (OTCPK:GMVHY), who declare an 18% share. When you add MGM to the 2 leaders, you might have 91% of all U.S. sports activities betting motion within the arms of three opponents at this level. That leaves ~13 websites battling for the crumbs, because it have been.

WSW

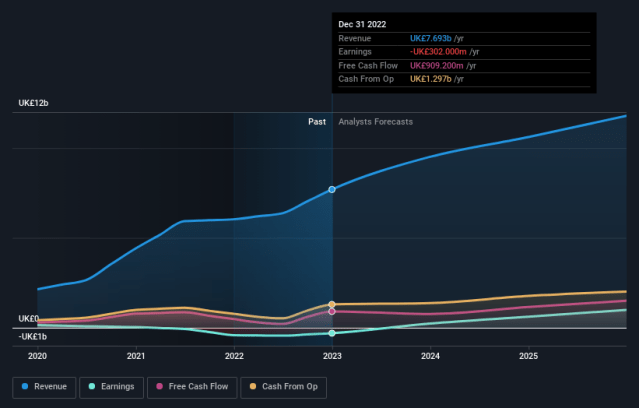

Above: The trajectory of FLUT must be robust going ahead to 2025 a minimum of.

DKNG shares have had a terrific run this 12 months, transferring up a hefty 240%. Shares of dad or mum Flutter in London are up 28%. But, primarily based on occasions since our name, we are actually ready to information the brand new NYSE arrival in USD going ahead.

What’s modified

Prospects are that PDYPY’s FanDuel will transfer into revenue in This fall primarily based on Q3 2023 outcomes. DKNG might take a bit longer, however shut.

DKNG faces a category motion lawsuit in Massachusetts over what claimants assert as deceptive bonusing. This motion has a protracted tail legally, however may very well be pesky.

Two deep-pocketed arrivals into the already overcrowded sports activities betting sectors are BetESPN and privately held (inevitably public) Fanatics. They launched their websites final month. It’s far too early to inform whether or not both or each could make even a small dent within the estimated $7.62b in income the sector is predicted to ship this 12 months.

DKNG is guiding 2023 income to achieve $3.7b

Flutter is guiding 2023 income to achieve US$4.7b (EBITDA $180M).

Each SITES anticipate to be close to or over optimistic EBITDA by a minimum of Q1 2024 or earlier. However each proceed to spend closely on promotions, so we consider the expansion in optimistic EBITDA could also be slower than their vibrant, double-digit CAGR features.

Flutter: Welcome to the NYSE January 29th Flutter! Fast steering for PDYPY holders, FLTR holders, and potential consumers

Of all of the directional pivots now we have seen since our final Searching for Alpha submit, the strongest catalyst we see is the NYSE itemizing. At first look, it could emit little greater than shrugs from some buyers. In spite of everything, there will likely be no change in efficiency in consequence. However real-world expertise suggests to us that the change within the main buying and selling submit is a serviceable analogy to that very outdated and really true outdated noticed for actual property: It is all about location, location, location.

There is no such thing as a higher location to commerce a inventory with a attainable triple-digit opening worth than the NYSE

The transfer means an exponential enhance in visibility. Buying and selling in USD offers buyers an ideal apples-to-apples comparative with all U.S. sports activities betting platforms. FLTR administration has seen sufficient of a possible upside on a NYSE transfer to have pursued it for over 2 years a minimum of.

Proper now, the London-traded dad or mum is 13% institutionally owned. By U.S. requirements, that is nearly non-existent within the institutional universe. Our expectation is that, as soon as analyst protection arrives quickly thereafter calibrated in USD, we’ll see that proportion a minimum of triple to ~35% to 40%. Retail exercise, which supplies a lot of the propulsive quantity on DKNG, is semi-quiescent for FanDuel’s dad or mum by comparability.

The endgame information for present and future holders

PDYPY ADR, London-traded holders

- The sponsors of the U.S.-traded ADRs are Financial institution of NY, Citi, J.P. Morgan, and Deutsche Financial institution. Holders should contact them or their brokers to take part within the compelled sale of their shares at market. Proceeds will likely be doled out professional rata to holders.

- Holders of the UK-traded dad or mum will primarily be switching London shares to NYSE shares on a one-for-one foundation. Ex: You maintain 200 shares of Flutter Leisure in London, you’ll obtain 200 shares of the NYSE FLUT inventory.

Betting on a US-traded FanDuel

NYSE ticker: FLUT

Value: The U.S. entity is predicted to start out buying and selling in USD linked considerably to the final transaction in GBX in London.

London’s worth at writing ~13,000GBX.

This is the same as (in the intervening time): $163.42 (this displays the worldwide enterprise, not simply FanDuel).

PDYPY worth at writing: $82.73.

The apples-to-apples idea of DKNG to Flutter forward fails as a result of whereas FLUT is the income chief with working websites unfold throughout 12 international locations, DKNG is a U.S.-only website per se.

However a price-only comparability supplies an alternate prism:

DKNG at writing: $36.60 with robust gross sales development momentum.

Flutter London shares at writing: the equal in USD of $163, or 4.5X the DKNG worth. So, in idea, if you happen to view each market leaders with equal shares of the U.S. income, assume that Mr. Market would worth a freestanding FanDuel inventory ~ the identical as DKNG, i.e., ~$36 a share, you’d be valuing FLTR’s world enterprise alone at $132 a share primarily based on this morning’s London quote.

Our alternate supposition is that U.S. buyers have already got seen analysts forecasting FTLR PTs anyplace between $100 to $120 going ahead.

Think about additionally that the U.S. market will proceed to require appreciable promotional spend going ahead. Common month-to-month gamers final quarter: DKNG 2.2m, Flutter: 2.56m. Each websites confirmed double-digit features in AMP in Q3 2023.

We anticipate the primary days of buying and selling quantity on FLUT to be heavy, presumably bidding up the shares to close its equal UK closing worth ~$160 USD. By then, we should always have analyst calls as to what the ultimate Flutter numbers will likely be in income features and precise worthwhile EBITDA.

For now, now we have appeared on the long-term buying and selling histories of each shares in an effort to put a PT on the place we predict the brand new FLUT shares would open and get bid to throughout the first weeks.

Our sense now’s that holders of PDYPY ADRs are properly guided to place the proceeds of the compelled sale to open an preliminary place within the NYSE situation. We additionally consider the U.S. shares have a very good probability of debuting and buying and selling to $120, which is able to worth it at ~4X DKNG, with a lot worth assigned to the worldwide verticals going ahead.

One other helpful analogy could be for buyers to think about the scenario just like U.S. on line casino giants like Wynn Resorts, Restricted (WYNN). Its Vegas and Boston properties are appreciable contributors to total EBITDA for sure. However everyone knows the inventory principally trades on good or unhealthy information out of Asia (Macau). On this case, we may see the reverse. U.S. buyers will comply with the FanDuel portion because the make-or-break valuation producer reasonably than the worldwide enterprise, which continues formidable.

Both approach, look ahead to the debut, Flutter Leisure plc shares on the NYSE goes to be a purchase.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.