hjurcik/iStock by way of Getty Photos

This text was co-produced with Williams Fairness Analysis (“WER”).

Introduction

Earlier than we get into in the present day’s focus, we have to be taught the basics of part of the investing world that could be new to you. It is the similar purpose why you would not put money into ABC Drilling & Exploration should you did not know the very first thing about oil and gasoline.

You might skip to the “Technique & Property” header if you would like, however the introductory classes are vital to understanding the dangers and potential upside in my view (therefore why I took the time to write down them).

Everyone knows publicly traded corporations. Most have some familiarity with personal fairness, which is broad class encompassing investments into all sizes and forms of companies.

Angel investing is on the backside in scale. It may very well be a $100,000 funding in a 3-store franchise of native ice cream shops. The highest of personal fairness are gigantic leveraged buyouts (“LBOs”), which can contain tens of billions.

Kinder Morgan (KMI), PetSmart, Nabisco, Hilton Accommodations, and plenty of different family names have been concerned in LBOs. Between these extremes lies enterprise capital.

Enterprise capital is cash for personal corporations that aren’t giant sufficient to draw most institutional traders or the main manufacturers on Wall Road like Blackstone (BX) or KKR & Co. (KKR). However they are not start-ups both.

Enterprise capital contains corporations with $5-10 million in income to greater than $100 million. Enterprise capital is enticing as a result of it strikes a compelling steadiness between threat and reward.

Enterprise corporations typically nonetheless have 10x, 25x, and even 100x upside for traders. That is unimaginable for many publicly traded shares over a short-to-medium timeframe.

Clearly, you may hit any return determine over an extended sufficient time period by merely reinvesting dividends, however we’re speaking 15-50% inner charge of returns (“IRRs”). That issues as a result of people do not dwell perpetually, and we have now even much less time to avoid wasting and compound capital.

Then again, most high quality venture-sized corporations are previous the dangerous start-up stage. They’ve a confirmed enterprise mannequin, vital income, and identifiable expertise or different forms of aggressive benefits.

Their administration groups typically have expertise working different corporations and perceive the wants and needs of traders.

Enterprise Debt Versus Fairness

Similar to there’s personal fairness and personal debt to serve that section of the market, the identical applies to the smaller enterprise capital section.

Whereas debt to giant personal corporations could solely value 3-5% greater than a comparable publicly traded firm, enterprise debt is extra expensive for debtors. Typical yields on enterprise debt are 11-18%. It varies relying on the trade, monetary well being, and working historical past of the corporate.

Authorities laws make all of it however unimaginable for big personal corporations to borrow from banks. It is even more durable for enterprise sized corporations.

Enterprise debt had $5 billion in exercise simply previous to the Nice Recession. That a part of the capital markets was simply getting traction.

A decade later simply previous to the pandemic, it grew to $25 billion. Now, with the crash in world inventory markets and a giant transfer to “risk-off” in 2020, I would not blame anybody who thought the sector’s fast development may need met its match.

Removed from it. In 2021, it had practically doubled to $47 billion. It doubled once more in 2022.

That is clearly a profitable and rising market, so how can we take benefit? In the present day’s focus firm.

Personal Capital & BDCs

Common readers know that BDCs mortgage to non-public corporations. You may additionally recall that BDCs give attention to secure, money flowing companies. That’s a key purpose not one of the high quality BDCs minimize their dividend through the pandemic.

What allowed “dangerous” double-digit yielding BDCs to resist the pandemic with many “secure” corporations slashed their dividend?

As “difficult” as BDCs could appear, it is a easy enterprise. They largely mortgage to boring, predictable corporations. Bigger BDCs, like Ares Capital (ARCC) and Blue Owl Capital (OBDC), must work with bigger personal corporations to make the numbers work. They’ve $10+ billion gross portfolios, so that they want at the very least a $50-$100 million mortgage for it to make enterprise sense.

To be truthful, the a number of layers of the capital construction concerned (on each the BDC and borrower’s aspect) do make BDC monetary statements and working outcomes obscure for the typical investor.

That is why we spend additional time on schooling.

With out it, individuals are likely to make dangerous choices.

BDCs have a terrific and confirmed mannequin, however like all methods, it has drawbacks. Most BDCs don’t have the instruments, incentives, and or time to work with venture-sized corporations. The due diligence is simply as troublesome and time consuming as with bigger corporations, and the mortgage sizes are simply too small.

This makes it much more difficult (code for “costly” in lending) to borrow cash. So not solely will banks and typical lenders not work with venture-sized corporations, however even most BDCs are out. Now, you perceive why enterprise debt is so costly.

However that leads us to an vital query. If we have been in command of a profitable enterprise agency, why would we pay 15% or extra for debt as an alternative of elevating fairness? Enterprise corporations do not pay dividends, so is not the fairness “free?”

These of us which have had the displeasure of proudly owning an organization that continually dilutes shareholders know the place I am heading.

Imagine it or not, issuing shares is commonly costlier. Much more. And that is particularly the case as a result of most enterprise corporations are nonetheless led, at the very least partially, by founders. These are individuals with critical pores and skin (cash) within the recreation.

If an organization ultimately grows in worth by 100x, each greenback in fairness {that a} founder points is price $100 long-term. And for the reason that founders are those with many of the fairness, it is going instantly from their pockets to traders.

Then again, paying curiosity is completely different math. The corporate, not the founders, pay the ~15% curiosity. Positive, they offer up a little bit revenue within the short-term, however they do not care practically as a lot about short-term money movement as they do long-term capital features.

By borrowing costly enterprise debt, the founders aren’t diluted. The opposite traders, which frequently embody high-net price traders, household workplaces, and enterprise capital personal fairness outlets, prefer it too. They don’t need to be diluted both and their purpose is 10x+ their funding, not receiving a little bit more money movement within the present interval.

We all know Blackstone and different big Wall Road heavyweights shrink back from enterprise capital for scale causes. BDCs are extra versatile however even they like bigger personal corporations. And common banks cannot become involved even when they wished to for regulatory causes.

So who fills the hole?

That’s the place TriplePoint Enterprise Development (NYSE:TPVG) is available in. There are just a few different BDCs that play at the very least partly on this sandbox: Horizon Expertise Finance (HRZN), Hercules Capital (HTGC), Trinity Capital (TRIN), Runway Development Finance Corp. (RWAY).

Every firm’s technique has its nuances.

TriplePoint are specialists at each step of the enterprise debt course of and normally negotiate warrants into every deal.

As a reminder, warrants are like name choices in that they solely turn into invaluable if a set off is met. More often than not, that’s if the corporate is profitable and will increase in worth. This provides the BDC capital features potential at little to no value.

So what are the drawbacks of an organization concerned in enterprise debt? It might’t make the identical returns as high enterprise fairness investments. That is smart as a result of the debt is safer.

And though enterprise debt typically has a robust observe report, there are clearly dangers loaning cash to smaller, much less established corporations over giant ones with lengthy observe data. Enterprise can also be extra delicate to shifts within the broader financial system and should endure disproportionately in a extreme financial downturn. Administration’s ability in underwriting the borrower and structuring the mortgage correctly is the important thing to long-term success.

However enterprise debt definitely has its upsides. Enterprise debt generates yields among the many highest you will come throughout. And with a superb supervisor, mortgage losses are manageable.

On common, high quality enterprise debt managers (subscription required) have crushed the S&P 500 index by double-digit percentages since knowledge began being collected about 20 years in the past. Primarily based on a survey of publicly obtainable info, the typical enterprise debt fund presently yields 14.5-16.5% web to traders after bills.

And in contrast to enterprise fairness, which is normally illiquid for 5-10 years, enterprise debt offers instant money movement to traders. And through the use of a publicly traded BDCs because the funding car, liquidity is not a problem.

Technique & Property

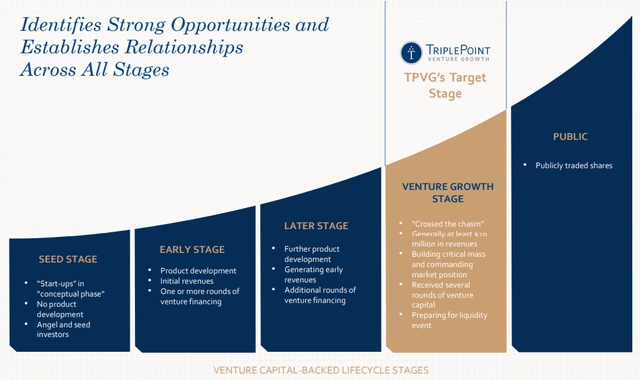

TriplePoint targets enterprise corporations with a selected profile. The primary is it must be the proper measurement the place TriplePoint has a aggressive benefit: enterprise.

TPVG Q3 2023 Investor Presentation

It additionally must be what’s referred to as the “development” stage. That is the final stage earlier than an organization graduates from enterprise sized.

Supplied the corporate stays profitable, not lengthy after the enterprise development stage it will be capable of entice capital from conventional personal fairness traders. TriplePoint will get in simply earlier than that.

I’d make a slight edit to TriplePoint’s diagram above. There are 2-Three extra columns between enterprise development and publicly traded most often.

Akin to the NBA, it is attainable to take gamers straight out of highschool (smaller personal agency goes public), however normally they go to varsity for just a few years first (the personal agency will get nearer to a $1bn market cap earlier than it tries the general public markets).

Second, it companions with corporations which have established enterprise fairness corporations with pores and skin within the recreation. For TriplePoint to lose any mortgage principal, the personal fairness agency has to lose every little thing.

The ultimate standards is trade associated. TriplePoint prefers expertise, life sciences, and some different excessive development industries which have constantly repaid enterprise loans in good instances and dangerous.

For long-term readers, you will know that I stress the trade exposures of bigger BDCs in each article. And most profitable BDCs have related exposures (enterprise software program, healthcare, et cetera). That’s no coincidence.

TriplePoint normally incorporates warrants in its mortgage phrases. There are two a lot bigger BDCs that you have heard of that take an identical strategy: Essential Road Capital (MAIN) and Ares Capital Corp (ARCC).

These a lot bigger high tier BDCs normally have 25% or extra of their portfolios in fairness/warrants. That is enabled them to develop their web asset worth (“NAV”) and pay hefty particular dividends over time.

So what is the distinction between what TriplePoint and people guys do? TriplePoint’s venture-backed corporations pay even increased rates of interest. And its fairness holdings have even larger upside potential.

Unsurprisingly, that carries increased threat in sure conditions. We focus on that within the Stability Sheet and Threat part in a while.

Let’s get a robust grasp on the engine that delivers TriplePoint’s 15%+ yield.

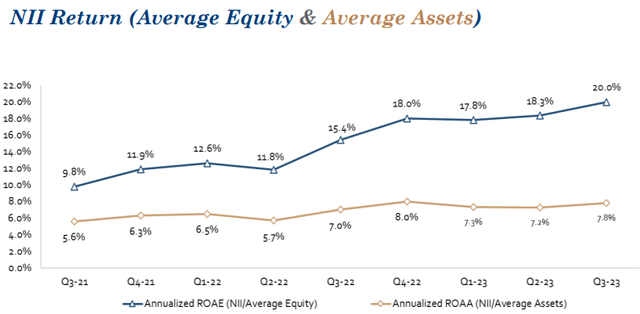

TPVG Q3 2023 Investor Presentation

You’ll be able to see that the corporate’s web funding earnings (“NII”) return on fairness just lately broke the 20% degree. In laymen’s phrases, meaning the portfolio generates roughly $0.20 in money movement for each $1 in fairness every year.

One other approach to interpret that is the utmost sustainable portfolio yield (it isn’t precisely that, however shut sufficient).

What precipitated the profitability of the portfolio to extend considerably lately? Increased rates of interest are a giant one. Like most BDCs, TriplePoint’s portfolio is primarily floating charge. The loans have “flooring” to guard from vital declines in rates of interest, however the portfolio’s profitability remains to be correlated to rates of interest.

The opposite major variable is a harder setting for enterprise capital fundraising. All of us keep in mind the insanity of tech firm valuations in 2020 and 2021. That very same irrationality flowed via to non-public fairness corporations of all sizes. That story is over.

And for the reason that trade got here again all the way down to earth, TriplePoint’s common mortgage yield has doubled since 2021.

What about these warrants? After they work, they flip into fairness investments. TriplePoint’s fairness investments have achieved effectively general.

TPVG Q3 2023 Investor Presentation

TriplePoint’s funding in Crowdstrike generated a 26x return for a $27.1 million achieve. The BDC achieved over 100x returns on Toast and Medallia.

Earlier than you get too excited, that netted shareholders about 5 million {dollars}. Bear in mind, TriplePoint’s steadiness sheet is generally debt. The warrants/fairness positions present “bonus” earnings and are not giant sufficient to trigger the inventory to double in a single day or something alongside these strains.

Money Move & Dividend

Let’s begin with the massive image and work our approach down.

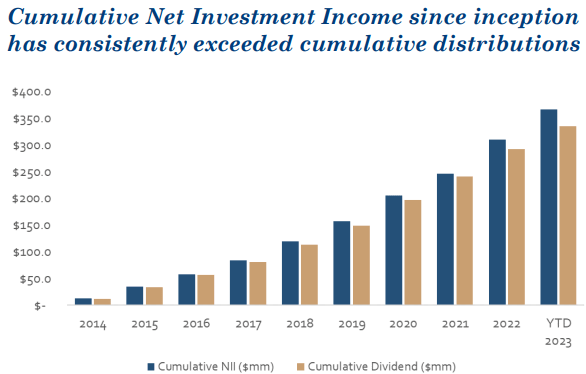

Since TriplePoint’s preliminary public providing (“IPO”) in Q1 2014, the inventory has paid $15.05 per share in distributions. That is versus the present share worth of $10.50 and IPO worth round $16.

Since I do know readers are curious in regards to the real-world returns of high-yield shares over time, I did the mathematics for an IPO investor with quarterly dividends reinvested at 12% yearly via this quarter.

It got here out to a 134% whole return (9.9% annualized) for taxable accounts and 148% return (10.4% annualized) in a retirement account. That is proper according to the S&P 500’s long-term 10-year return of 10-10.5%.

Whilst somebody cognizant of the ability of reinvesting elevated dividends, I used to be stunned an IPO investor in TriplePoint did that effectively given the inventory worth declined by a 3rd.

With the high-level view lined, let’s speak more moderen knowledge. In 2023, TriplePoint elevated its dividend by 11.1%. In the course of the troublesome 2020 calendar yr, TriplePoint paid vital bonus dividends to traders.

Spectacular little question, however what in regards to the payout ratio?

TPVG Q3 2023 Investor Presentation

TriplePoint earned $0.54 per share in NII final quarter, the commonest approach to measure a BDC’s money movement. The ensuing 74% payout ratio means TriplePoint can proceed to securely enhance the dividend for years to return (offered the financials keep on their present path).

With out getting too far within the weeds, externally managed BDCs like TriplePoint (and most others) cost a base administration and efficiency price. The phrases of those are at the very least barely completely different for each externally managed BDC, with vital deltas in how the inducement/efficiency charges are buildings.

For TriplePoint, it costs a 1.75% base administration price (increased than the trade common of 1.25-1.5%) and 20% of cumulative earnings over an 8% hurdle (about common).

Why does this matter? Efficiency charges weren’t owed to the exterior supervisor final quarter due to the 20% cumulative requirement. When these ultimately normalize, the payout ratio turns into the trade common of 80-85%.

As of the tip of final quarter, TriplePoint had $12.6 million in unrealized features on its warrants. Supplied the valuations of the enterprise corporations maintain up, traders ought to count on extra particular dividends.

To place it into context, that is $0.90 per share in undistributed earnings or ~9% of all the market capitalization of TPVG.

Stability Sheet & Dangers

All BDCs have mortgage issues, and TriplePoint isn’t any exception. I have a look at many variables, however the realized loss ratio is arguably most vital. That is when a theoretical loss turns into an actual one.

TriplePoint’s cumulative web losses are 2.6% of its mortgage commitments. Given the corporate had its IPO in 2014, that’s solely 0.27% (about one quarter of 1 %) yearly. If that sounds good, it is as a result of it’s. That is among the many greatest within the trade.

And do not forget that its friends typically mortgage to a lot bigger, extra established, and fewer dangerous corporations. Bearing in mind the borrower profile of TriplePoint, its historic mortgage losses are outstanding. Earlier than you get too excited and go purchase 1,000 shares, hold studying.

TriplePoint is small with a market cap of $377 million. This issues for a number of causes. For starters, at the very least to my data, no firm that small has been awarded an funding grade credit standing from a “first tier” issuer (Fitch, Moody’s, or S&P).

That doesn’t mechanically make it riskier, however we desire an funding grade score from a serious issuer. TriplePoint has a BBB score from DBRS. DBRS and Kroll are “second tier” score companies. In my expertise, they do a fairly good job and their scores make sense. That stated, I discover they offer one notch increased than the first-tier score companies (e.g. if BBB+ from DBRS, S&P/Fitch would award BBB).

If we apply that logic, TriplePoint would seemingly obtain a BBB- score from Fitch or S&P if it have been giant sufficient to qualify. That is nonetheless funding grade. There are many BDCs to select from with funding grade scores, so I do not blame traders preferring to pick from that group solely.

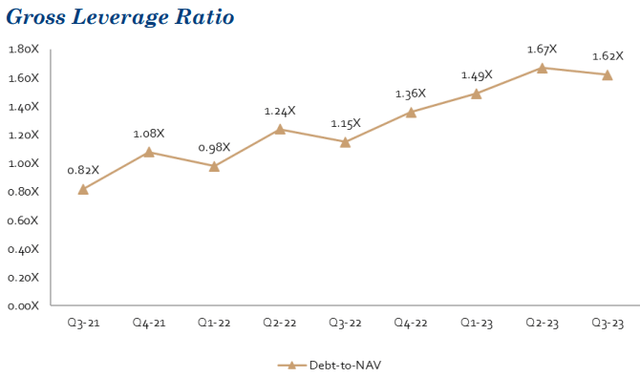

TPVG Q3 2023 Investor Presentation

Leverage is one other vital space to grasp for all corporations and particularly BDCs. TriplePoint’s leverage ratio climbed from under the trade common in 2021 to above common in 2023.

If we alter for the $105 million of money on the steadiness sheet, the ratio falls to a way more palatable 1.34x. That’s nonetheless above the peer common of 1-1.2x, however not excessively. I’d desire administration to get leverage under 1.2x. That additionally occurs to be their said purpose.

I acknowledge why leverage has elevated. Enterprise corporations have much less entry to capital, and meaning increased margins for TriplePoint. Because the firm refuses to problem shares under NAV, the one possibility is increased leverage till the share worth improves.

If I have been administration and believed these loans will largely work out, it is smart to extend leverage with the target of it bettering NAV because the monetary outcomes demand it.

The technique has largely been profitable. In my view, the present leverage profile is one purpose that the inventory trades at web asset worth (‘NAV’) as an alternative of at a premium. That gives us a lovely entry level, however it limits upside except it declines. NAV per share has additionally declined over time, one other detrimental attribute of the agency that should reverse.

Now we get to crucial threat I need you to grasp in the present day: non-accruals. These are loans or portfolio corporations with a cloth drawback. TriplePoint’s non-accrual charge was 1-2% of truthful worth in previous years.

That’s steadily elevated up to now yr to in the present day’s degree round 4.4%. In the event you mix the upper leverage with elevated non-accruals, that is not a reasonably image. 4.4% of gross belongings is about 6% of fairness (leverage adjusted for money on the steadiness sheet).

$0.72 per share was faraway from NAV because of Well being IQ’s chapter submitting and different borrower issues. After carefully analyzing its portfolio, it’s attainable that TriplePoint’s NAV takes one other 2-4% hit in This fall’s monetary launch.

The exterior supervisor is successfully subsidizing a superb portion of these mortgage losses. The exterior supervisor does not mechanically earn efficiency charges. Given the portfolio points, the BDC hasn’t been required to incentive charges for 5 consecutive quarters.

And we aren’t speaking drops in a bucket. In Q3 2023, not paying incentive charges saved the corporate $3.Eight million. This leads us to a different tailwind: administration is severely incentivized to type out the present mortgage issues.

At a macro degree, enterprise capital markets are getting again to regular after the chaos of 2020/2021. Capital dried up after the tech bubble popped, and that burdened the funds of many corporations within the BDC’s portfolio.

Valuation & Suggestion(s)

On the finish of the latest tech bubble, TPVG was flying excessive at $19 per share. Buyers over nearly any timeframe had S&P 500 crushing features.

Then the collapse in valuations expertise corporations of all measurement precipitated the share worth to dip under the 5-year common of $12-$14 per share to present ranges round $10.50.

I have been watching this inventory carefully for the reason that share worth began declining in early 2022. For these snug with the dangers I outlined above, $10.50 is a good entry level in my view.

Reinvesting the present degree of dividends alone will present a lovely return for most individuals (considerably higher than S&P 500 long-term averages).

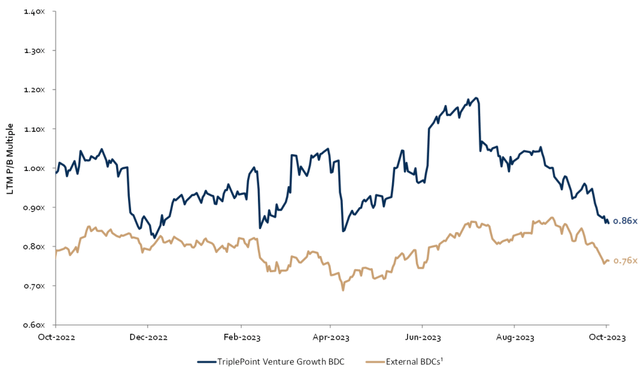

TPVG Q3 2023 Investor Presentation

The inventory trades near its newest NAV per share of $10.37. Traditionally, it is traded with a double-digit premium. It was effectively over 50% in 2021/2022.

If the present mortgage issues are resolved within the subsequent two quarters, a share worth of $14-$15 is affordable. That’s a ~40% capital achieve plus the annual distribution yield on value of 15.3%.

If it takes longer, I don’t count on the present share worth to say no materially so the return is the present yield.

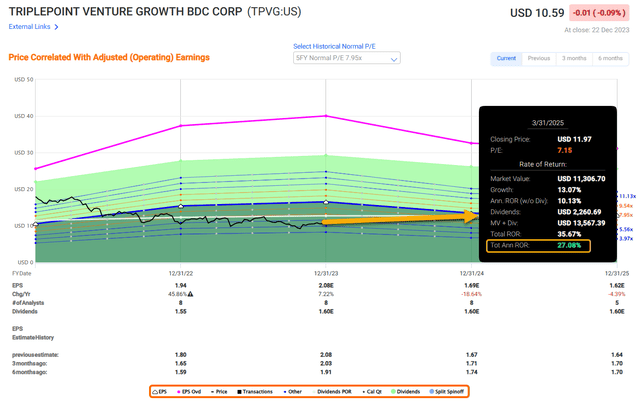

FAST Graphs

Alternate options

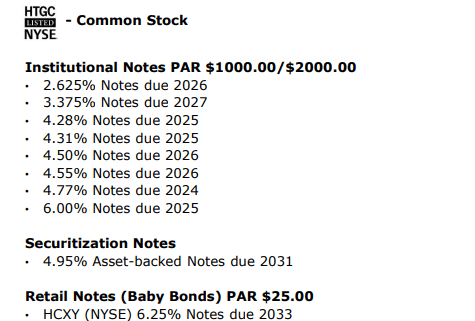

What if TPVG’s threat profile is not best for you? Hercules Capital (HTGC) is a $2.Four billion BDC with a enterprise mannequin that overlaps with TriplePoint’s. Its bigger measurement helps it earn a BBB- funding grade score from Fitch. In flip, that is allowed Hercules Capital to problem bonds at enticing charges and decrease its value of capital.

HTGC Q3 Investor Presentation

Hercules’ loss charges are additionally very enticing and it is constantly earned extra in money movement than it has paid out in dividends.

So what is the catch? Hercules’ dividend yield of 10% is 2 thirds of TPVG’s. That is primarily as a result of it is buying and selling with a steep 1.45x premium to NAV.

If it was buying and selling on the similar 1.0x to NAV ratio, it could additionally yield 15% similar to TPVG. The share worth can also be lower than $2 per share from all-time highs. Whereas not a helpful metric by itself, it reinforces that HTGC’s valuation is sort of the polar reverse of TPVG’s.

If publicity to sooner rising, smaller corporations is not enticing to you, Ares Capital (ARCC) or Blue Owl Capital (OBDC) are nice options. They’re additionally funding grade rated by main points, nice dividend and working observe data, and low mortgage losses.

However they’re additionally buying and selling close to highs and have yields under 10%. Blue Owl, for instance, considered one of our long-term favorites and high picks final yr, is up over 32% in capital features alone up to now 12 months. I just lately took earnings on Sixth Road Specialty Lending (TSLX), one other fine quality BDC that is up over 30% on a complete return foundation up to now yr.

From the lens I look via, threat is not nearly portfolio metrics or mortgage losses. These are vital, however they are often overshadowed by one other ingredient that always will get much less consideration. Margin of security and relative valuation.

That is the place TPVG shines, and it issues.

Now you perceive why TPVG, and regardless of its points, is one of many extra enticing general buys within the BDC sector in the present day.

Observe: Brad Thomas is a Wall Road author, which implies he is not at all times proper together with his predictions or suggestions. Since that additionally applies to his grammar, please excuse any typos you could discover. Additionally, this text is free: Written and distributed solely to help in analysis whereas offering a discussion board for second-level considering.