BlackJack3D

Coya Therapeutics (NASDAQ:COYA) targets irritation by modulating the operate of regulatory T cells (Tregs) in neurological illnesses. The “authentic” lead asset was COYA 101, an autologous regulatory T-cell product candidate with a accomplished Part 2a trial in Amyotrophic Lateral Sclerosis underneath its belt. The trial was accomplished approach again in 2022. Nevertheless, owing to what seems to be a money downside, the corporate has determined to carry this program at bay and ahead the opposite property via early stage research first. Earlier than we test whether or not this choice is said to poor knowledge or is in any other case sound, right here’s the present pipeline:

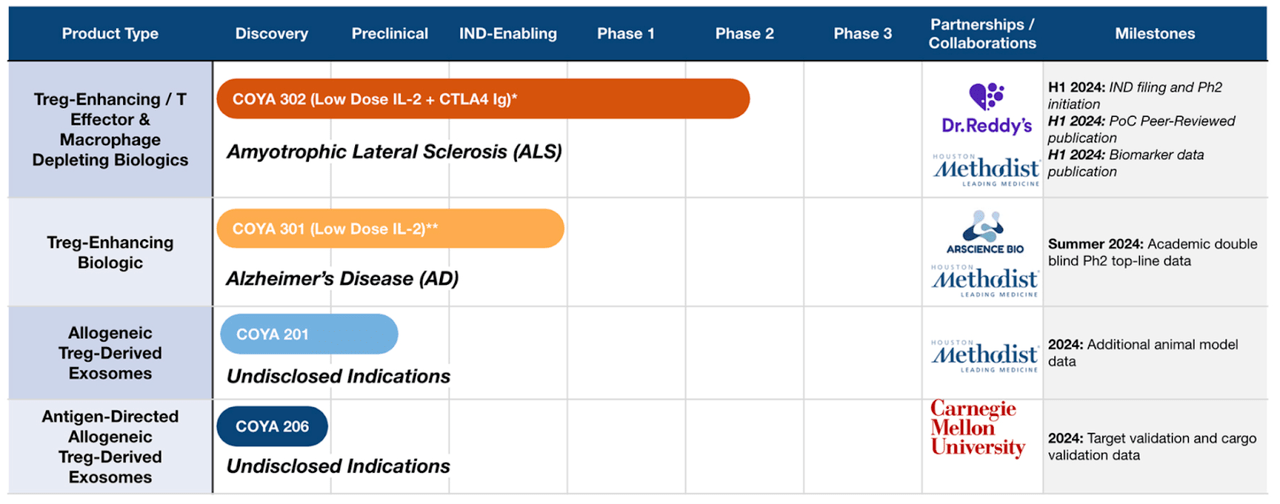

COYA PIPELINE (COYA WEBSITE)

The present lead molecule is COYA 302, a low dose IL-2 and CTLA4 Ig additionally concentrating on ALS and used as a spine remedy for different molecules. This molecule will file an IND and provoke section 2 in 2024. A second candidate is COYA 301, a low dose IL-2 concentrating on treg-enhancing biologic molecule in early stage trials concentrating on Alzheimer’s Illness, which can publish educational double-blind section 2 topline knowledge in mid-2024. Different property are preclinical.

Now, let me rapidly test that COYA 101 knowledge. Information from section 2a trial was printed in a peer-reviewed journal known as “Neurology, Neuroimmunology & Neuroinflammation” with the title “Mixed Regulatory T-Lymphocyte and IL-2 Therapy is Protected, Tolerable, and Biologically Lively for One 12 months in Individuals with Amyotrophic Lateral Sclerosis.” Key particulars from the examine:

COYA 101 was properly tolerated and elevated Treg suppressive operate

The bulk (6 out of 8) of sufferers both slowed or stopped development (imply change of -2.7 factors on ALSFRS-R rating) through the open label extension over a 24-week interval whereas 2 out of Eight sufferers didn’t profit from therapy

Evaluation of biomarkers of irritation and oxidative stress over the course of the examine correlated with ALS illness severity and should serve to prospectively consider and/or monitor therapy response

A couple of factors to notice; one, the affected person inhabitants was small resulting from covid-19 and sufficient statistical evaluation was not doable in consequence; two, the 2 sufferers that didn’t get a therapy profit had “markedly greater biomarkers of irritation (IL-17F and IL-17C) and oxidative stress (OLR1 and ox-LDL).” There have been no affected person discontinuations. As the corporate famous, knowledge appeared to indicate that sufferers with greater ranges of irritation and oxidative stress at baseline could not profit from therapy, thus offering a screening mechanism to seek out these sufferers with extra probability of therapy profit.

Thus, in addition to the small affected person inhabitants because of the pandemic and the following lack of statistical evaluation, there’s nothing destructive on this knowledge and subsequently, it doesn’t seem that the choice to progress with the remainder of the pipeline earlier than seeing this one via later trials was a strategic choice and never a defensive measure. Personally, I’m not but certain if such a choice will repay higher than if the corporate had been to keep up its give attention to COYA 101.

I might discover no additional updates on COYA 101 of their earnings calls or 10-Ks aside from the truth that they’ve moved on to 302. COYA 302 is now the brand new ALS candidate, and it additionally introduced proof of idea knowledge in March 2023. Information confirmed:

Over the medical trial’s 48-week interval, the drug was examined on 4 sufferers for security, tolerability, the operate of Tregs, sure biomarkers, and in addition for preliminary efficacy. At 24 weeks, there was important Treg enhancement, and at 48 weeks the serum biomarkers for irritation and oxidative stress had been lowered. All through the therapy, the sufferers didn’t seem to endure any severe hostile results.

COYA 302’s preliminary efficacy was measured utilizing the Revised Amyotrophic Lateral Sclerosis Practical Score Scale (ALSFRS-R), a validated ranking software that displays the incapacity development in ALS sufferers. The imply (±SD) ALSFRS-R scores had been 33.75 ±3.Three at week 24 and 32 ±7.Eight at week 48, not statistically completely different from the ALSFRS-R rating at baseline (33.5 ±5.9) earlier than COYA 302 therapy. In different phrases, the information suggests a major enchancment within the development of the illness over the 48-week therapy interval, validating Coya’s strategy with its new biologic.

Once more, this was a small trial with simply Four sufferers, and the molecule appears to have slowed down illness development after 24 weeks in addition to at 48 weeks, exhibiting no distinction in illness metrics from baseline. Later within the 12 months, the corporate introduced about 4-hydroxy-2-nonenal (4-HNE), a key biomarker for oxidative stress, and “a powerful correlation between medical response and ranges of 4-HNE and inflammatory biomarkers monocyte chemoattractant protein-1 (CCL2) and interleukin (IL-18).”

In Could, the corporate introduced knowledge from an open label examine of COYA 301 in Alzheimer’s illness. Information from Eight sufferers confirmed the next:

Therapy with COYA 301 resulted in a statistically important enchancment in cognitive operate, as measured by the Mini-Psychological State Examination check (MMSE). As well as, no cognitive decline was noticed when it was measured by the Alzheimer’s Illness Evaluation Scale–Cognitive Subscale (ADAS-Cog), and the Scientific Dementia Score-Sum of Packing containers scale (CDR-SB).

Therapy with COYA 301 gave the impression to be properly tolerated in sufferers with AD.

Over the course of the examine, COYA 301 restored peripheral Treg operate and numbers, and lowered the degrees of systemic pro-inflammatory chemokines and biomarkers in sufferers with AD.

This trial exhibits a hyperlink between biomarkers of irritation and Alzheimer’s illness. This was seen in how COYA 301 lowered each pro-inflammatory chemokines and improved cognitive operate, proving a hyperlink between the 2.

As firm knowledge confirmed once more in June, COYA 301 “resulted in a statistically important discount within the expression of three properly characterised proinflammatory cytokines — Tumor Necrosis Issue alpha (TNF-α), Interleukin 6 (IL-6), and Interleukin 1- Beta (IL-1β) — which correlated with lack of cognitive decline of the sufferers over the course of the examine.”

Apparently, PET imaging in a affected person confirmed important discount in inflammatory markers within the hippocampal area, an space of the mind strongly related to cognitive capabilities and spatial navigation, two facets of issue noticed in AD sufferers.

Financials

COYA has a market cap of $100mn and a money steadiness of $11mn. Analysis and improvement (R&D) bills had been $1.6 million for the quarter ended September 30, 2023, whereas common and administrative bills had been $2.zero million. At that fee, they’ve a money runway of 3-Four quarters, nevertheless, they actually wouldn’t have money for something dearer than preclinical trials. All or most of their trials are being funded by exterior companies or truly run in academia.

Not too long ago, Dr Reddy’s signed a cope with COYA to develop COYA 302 for ALS. The corporate paid an upfront charge of $7.5mn for the deal.

Dangers

COYA has produced some attention-grabbing knowledge, nevertheless, presumably given the preliminary nature of this knowledge, the inventory has not taken off, and valuation stays at a poor $100mn.

The corporate’s money steadiness may be very low and under no circumstances sufficient to even start occupied with later stage trials. Thus, there’s a sturdy dilution threat if a place is opened at the moment.

AD is a really tough space of remedy, and lots of molecules have failed at discovering a therapy for this devastating illness. That is true of the complete neurological illnesses area typically.

Backside line

I occur to love COYA, though, at this stage of valuation and stage of improvement, COYA stays very dangerous. I just like the inventory as a result of the information they produced – even with a horrible lack of funds – is spectacular. Aside from that, although, COYA has many miles to go earlier than it will get engaging.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.